6 August 2018 Weekly Analysis

GCMAsia Weekly Report: August 6 – 11

Market Review (Forex): July 30 – August 3

US Dollar

The US dollar price was overall traded higher despite the weaker than expected Non-Farm Payroll readings last Friday. The dollar index has jumped 0.11% while closing last week price at 94.99.

According to the US Department of Labor, the number of jobs generated for the month of July has dropped significantly by 157K, weaker than the economic forecast with a reading of 190K. Despite the weak NFP data that triggered the selling of dollar after data release, the dollar’s price drop has been limited by the other readings of positive economic data released on the same day. The Average Hourly Earnings, which is the also one of the indicators for inflation from measuring wage-based hourly wages, have given a positive reading with an increase of 0.3%, in line with economic expectation while for unemployment data, the data also meets economist expectations with reading of 3.9.

Overall, the dollar appears to remain firm against its basket competition of its six major currency pairs and the risk sentiment for the dollar remains strong following with most of encouraging economic data for last month and boost confidence for the possibility of the U.S. central bank to continue its plans for interest rate hikes.

USD/JPY

USDJPY pair dropped 0.33% to 111.22 during late Friday trading session.

EUR/USD

EURUSD has slip 0.15% to 1.1563 against the US Dollar.

GBP/USD

GBPUSD has dropped 0.12% to 1.3000 during the Friday trading session. The pair remained under pressure following the tensions in the Brexit plan agreement between the UK and the EU that were still unachievable and the resume of the talks that would be scheduled this month.

Market Review (Commodities): July 23 – 27

GOLD

Gold prices have retreated from it temporary bullish spike on Friday after a strong dollar has weakened investors’ sentiment against the safe assets. The metal price record losses and closed the market last week by 0.13% to $ 1,213.10 a troy ounce.

The gold price has retreated and is likely to extend its losses following the latest saga in the trade war and most of the positive economic data from US. Trade war between the US and China remains ongoing where the US has planned to slap a higher tariff of 25% on China’s $ 200 billion worth of goods and China vows to counter attack. But because US imports are lesser than China, investors expect the US to have a high advantage in the trade war, thus boosting the risk sentiment against the dollar. In addition, despite the NFP reading that was weaker from expectation last week, investors were confident that the data did not cause any significant impact on interest rates hike for upcoming month following with the health of a strong US economy from multiple positive economic data.

Crude Oil

The price of crude oil closed lower on Friday as followed with the missed data expectations on Baker Hughes Oil Rig Count economic data. The commodity price has plunged by 0.53% to $ 68.56 a barrel during last Friday’s session.

Last week, the price of crude oil has recorded a significant loss following with a negative risk sentiment from various events related to the commodity. In terms of economic data, the oil rig number of Bakers Hughes platforms have given the reading of 861, lower than the previous data with the reading of 863 by 2, hinting US tightening output.

Also, crude oil inventory stockpiles also surprise the market by an unexpected increase of 3.803 million barrels on Wednesday, further boosting negative sentiment to the commodity.

In addition, with rising tensions in the ongoing US-China trade war, investors have expressed their concern that the conflict may hurt the demand for the black oil.

Overall, last week’s sentiment was more likely towards bearish after a series of weak crude oil economic data and events that happen in the world that caused negative impact to the black oil.

Weekly Outlook: July 23 – 27

For the week ahead, investors will focus on the release of major US economic data where the Consumer Price Index (CPI) data which measures inflation and spending levels for domestic goods and services will be released on Friday this week to monitor their stance towards future monetary policy and economic outlook.

For crude oil traders, they will place their attention over OPEC meeting which is scheduled to commence on Wednesday to obtain further signals with regards to their approach taken to tackle imminent supply shortage.

Highlighted economy data and events for the week: July 30 – August 3

| Monday, August 6 |

Data EUR – German Factory Orders (MoM) (Jun) JPY – Japan Household Spendings (MoM)(Jun)

Events N/A

|

| Tuesday, August 7 |

Data AUD – RBA Interest Rate Decision (Aug) EUR – German Industrial Production (MoM)(Jun) EUR – German Trade Balance (Jun) GBP – Halifax House Price Index (YoY) USD – JOLTs Job Openings (Jun) CAD – Ivey PMI (Jul)

Events AUD – RBA Rate Statement

|

| Wednesday, August 8 |

Data CNY – Trade Balance (USD)(Jul) CAD – Building Permits (MoM)(Jun) USD – Crude Oil Inventories

Events AUD – RBA Governor Lowe Speaks

|

| Thursday, August 9 |

Data NZD – RBNZ Interest Rate Decision CNY – CPI (MoM)(Jul) CNY – PPI (YoY)(Jul) CHF – Unemployment Rate s.a (Jul) USD – Initial Jobless Claims USD – PPI(MoM)(Jul)

Events NZD – Monetary Policy Statement NZD – Rate Statement NZD – Press Conference EUR – ECB Economic Bulletin

|

|

Friday, August 10

|

Data JPY – GDP (QoQ)(Q2) GBP – GDP (YoY)(Q2) GBP – Manufacturing Production (MoM)(Jun) GBP – Trade Balance (Jun) USD – CPI (MoM)(Jul) CAD – Employment Change (Jul) CAD – Unemployment Rate (Jul)

Events AUD – RBA Monetary Policy Statement

|

Technical Weekly Outlook: July 30 – August 3

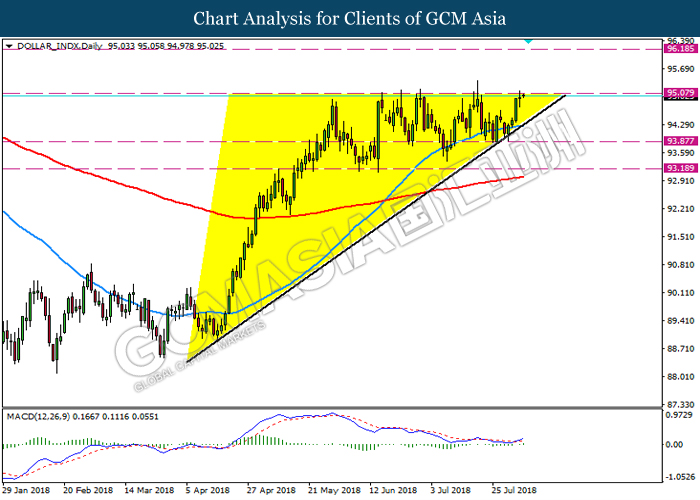

Dollar Index

DOLLAR_INDX, Daily: Dollar index remain traded in a ascending symmetrical triangle while currently testing the top level of the triangle. Although MACD which started to display bullish momentum signal, a breakout above the resistance level 95.05 is required for further confirmation.

Resistance level: 95.05, 96.20

Support level: 93.85, 93.20

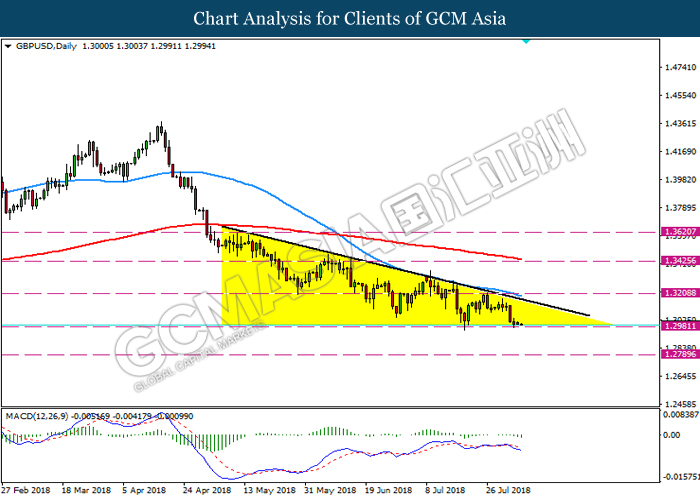

GBPUSD

GBPUSD, Daily: GBPUSD remain traded in a descending symmetrical triangle while currently testing the support level 1.2980. MACD which now indicating bearish signal suggest the pair may be traded lower if it breaks below the support level 1.2980.

Resistance level: 1.3010, 1.3425

Support level: 1.2980, 1.2790

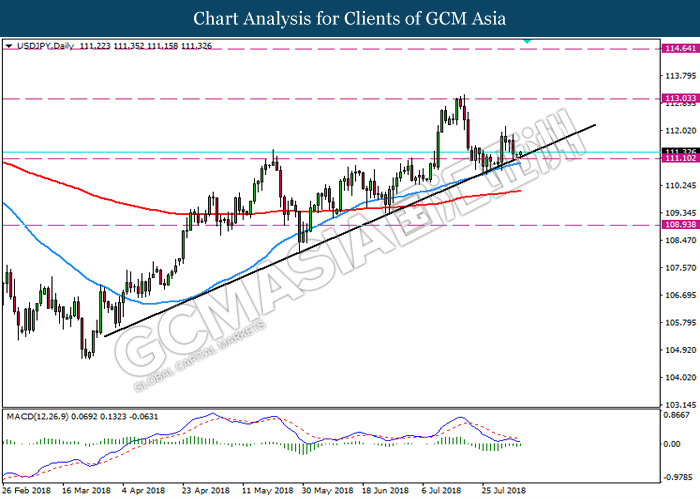

USDJPY

USDJPY, Daily: USDJPY was traded lower while currently testing the support level 111.10 and trend line. Although MACD illustrate bearish signal, a breakout below the support level 110.10 and also trend line is required to attain further confirmation.

Resistance level: 113.00, 114.65

Support level: 111.10, 108.95

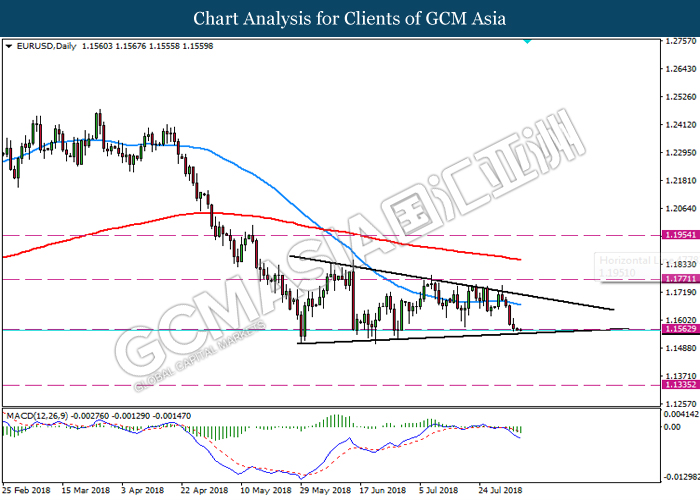

EURUSD

EURUSD, Daily: EURUSD remain traded in a falling wedge channel while currently testing the lower level of the channel and support level 1.1560. Although MACD display bearish momentum signal, a breakout below the support level 1.1560 is required for further confirmation.

Resistance level: 1.1770, 1.1955

Support level: 1.1560, 1.1335

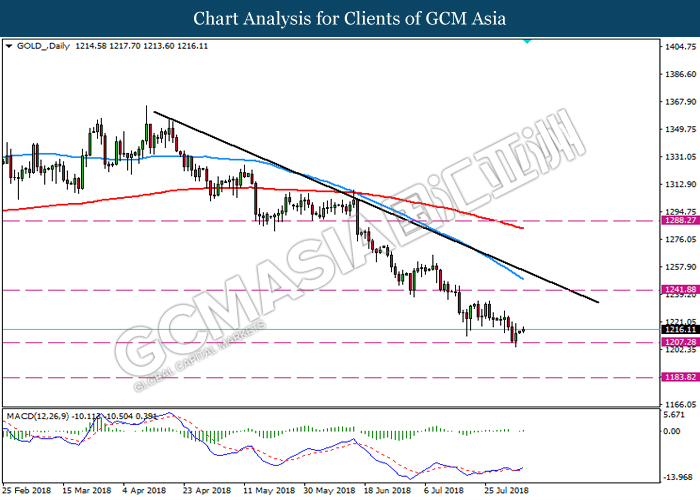

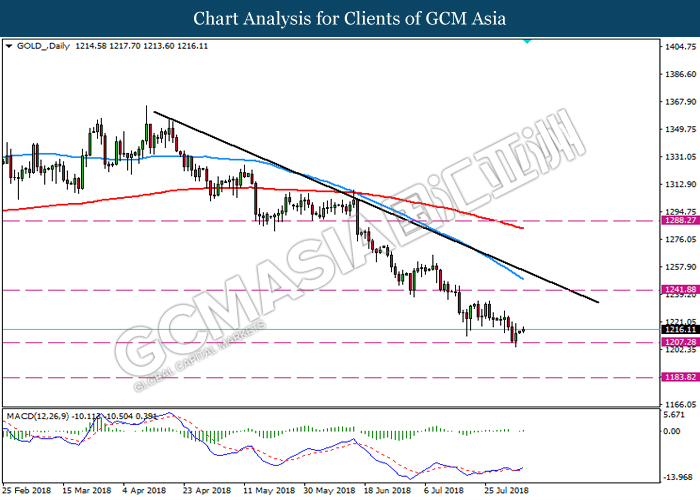

GOLD

GOLD_, Daily: The price of gold has been traded higher following recent rebound from the support level 1207.00. MACD which display bullish signal with the positive divergence pattern suggest the yellow metal to experience a short term technical correction towards the resistance level 1242.00 and trend line.

Resistance level: 1242.00, 1288.00

Support level: 1207.00, 1184.00

Crude Oil

CrudeOIL, Daily: The price of crude has traded higher following prior rebound from the trend line. Although recent price action indicating momentum bullish for the black oil, lack of signal from MACD suggest the commodity to wait for further clear signal appear before entering the market.

Resistance level: 70.15, 72.65

Support level: 66.75, 64.15