1 Julai 2020 Afternoon Session Analysis

Aussie gains after China & Australia data.

During late Asian session, the Aussie dollar which traded against the greenback and other currency pairs have rose following the release of data from China and Australia. On Australia, the Building Permits have fell by 16.4%, weaker than market expectation of 10% decline. However, positive release from China managed to overshadow the downbeat data. China’s Caixin PMI which surveys small and medium-sized exports and business have increased to 51.2m surpassed economist expectation of 50.5 and also up from May’s reading of 50.7. The positive release which signalled an expansion have manage to provide some bid on the Aussie. However, its potential gains may be capped by the increasing concerns of coronavirus in the country. In terms of coronavirus latest update in Australia, the country have record a spike of new 85 cases which its total coronavirus cases tops 7920 while the deaths from coronavirus at 104. As of writing, AUD/USD edge higher 0.11% to 0.6907.

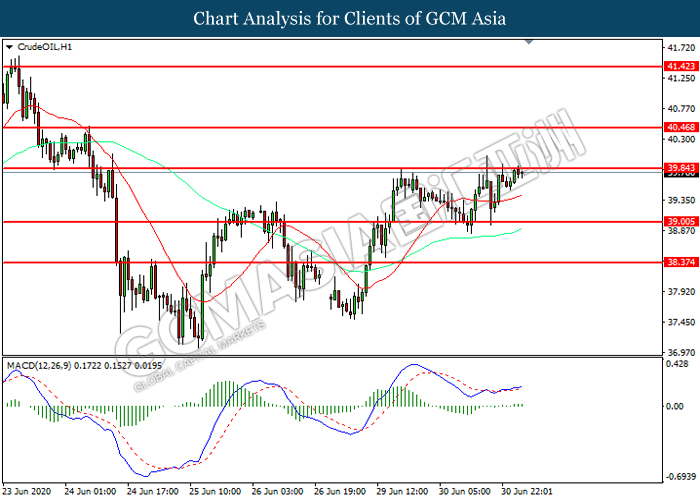

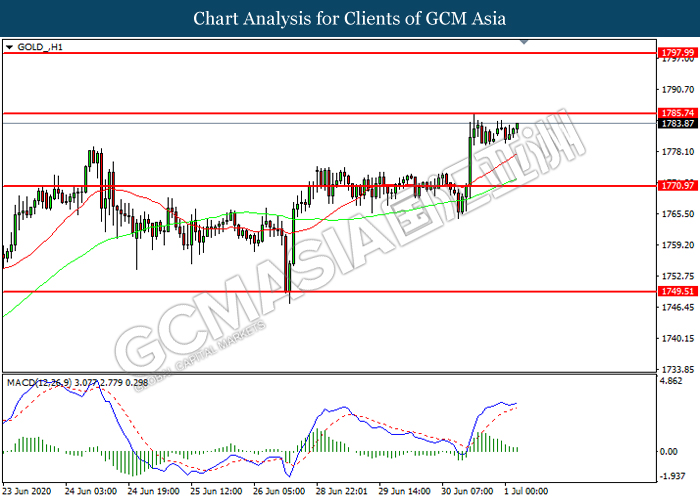

In the commodities market, crude oil price rose 1.08% to $39.78 per barrel at the time of writing following dwindling supply level continue to provide optimism for the market. Market continues to cheer on the surprising decrease in inventory build from API. On top of that, high compliance rate from Saudi Arabia and the rest of OPEC nation also boosted further the sentiment. The output from OPEC have fell to the lowest point in two decades. On the other hand, gold price appreciates 0.05% to $1781.49 a troy ounce as of writing following COVID-19 concerns continue to increase risk-aversion sentiment.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Meeting Minutes

(2nd)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI | 44.6 | 44.6 | – |

| 15:55 | EUR – German Unemployment Rate | 6.3% | 6.6% | – |

| 16:30 | GBP – Manufacturing PMI (Jun) | 50.1 | 50.1 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Jun) | -2,760K | 3,000K | – |

| 22:00 | USD – ISM Manufacturing PMI (Jun) | 43.1 | 49.5 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.442M | -0.710M | – |

Technical Analysis

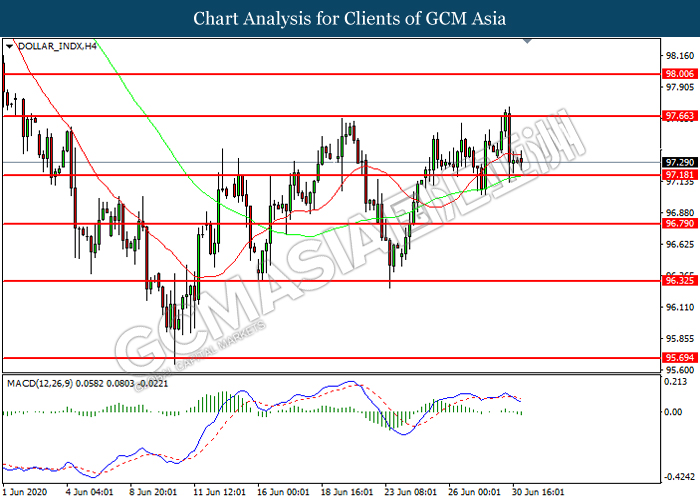

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 97.20. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 97.65, 98.00

Support level: 97.20, 96.80

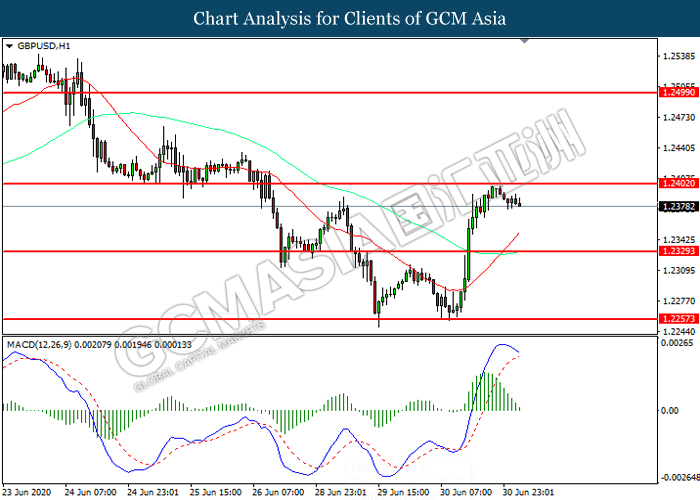

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level at 1.2400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.2330.

Resistance level: 1.2400, 1.2500

Support level: 1.2330, 1.2255

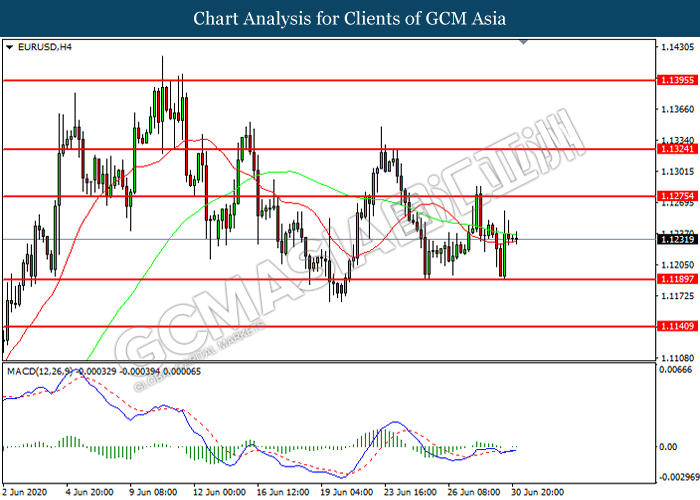

EURUSD, H4: EURUSD was higher following prior rebound from the support level at 1.1190. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1275, 1.1325

Support level: 1.1190, 1.1140

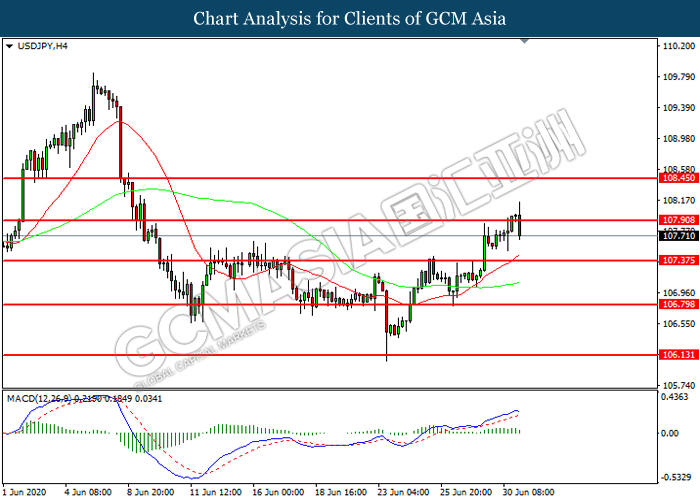

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 107.90. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 107.35.

Resistance level: 107.90, 108.45

Support level: 107.35, 106.80

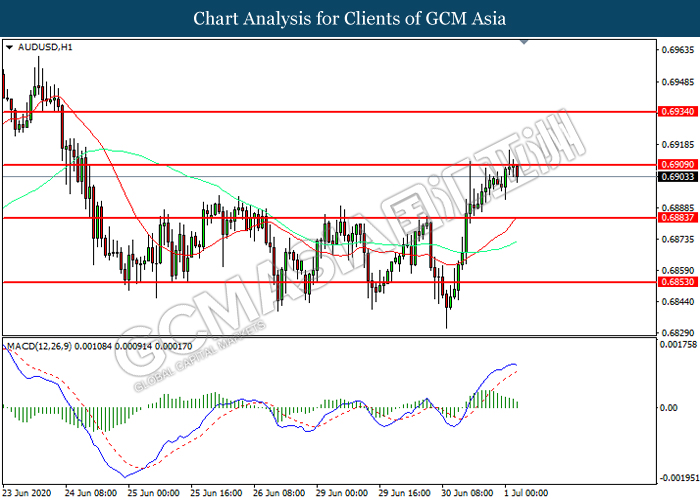

AUDUSD, H1: AUDUSD was traded lower following prior retracement from the resistance level at 0.6910. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6885.

Resistance level: 0.6910, 0.6935

Support level: 0.6885, 0.6855

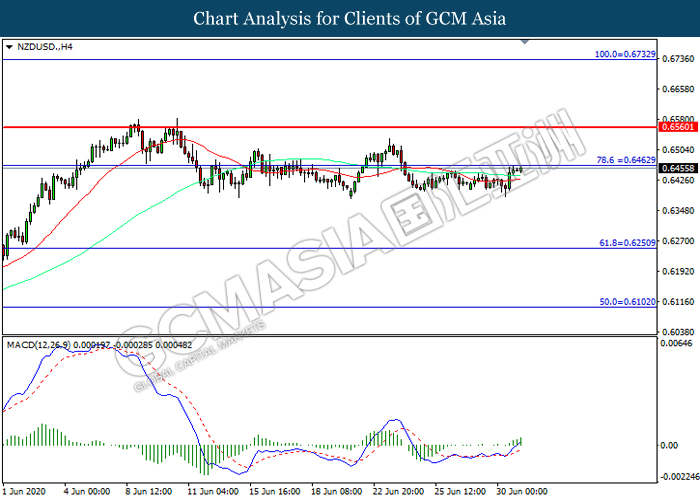

NZDUSD, H4: NZDUSD was traded within a range while currently testing the resistance level at 0.6465. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher after it successfully breakout above the resistance level.

Resistance level: 0.6465, 0.6560

Support level: 0.6250, 0.6100

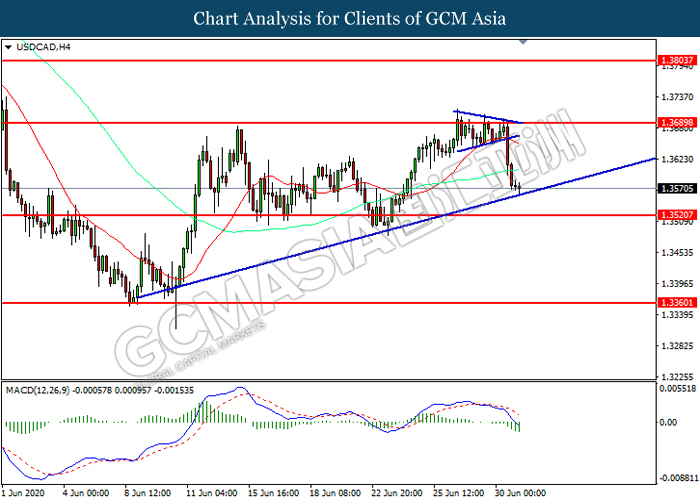

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3690. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.3520.

Resistance level: 1.3690, 1.3805

Support level: 1.3520, 1.3360

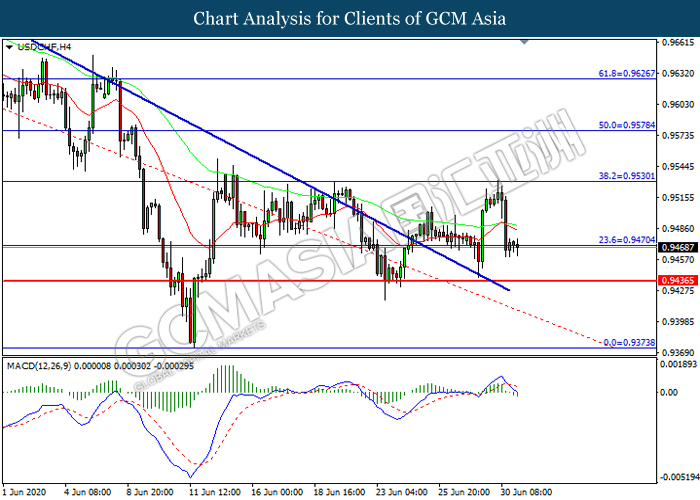

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9470. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9580

Support level: 0.9470, 0.9435

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level at 39.85. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 39.85, 40.45

Support level: 39.00, 38.35

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1785.75. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1785.75, 1798.00

Support level: 1770.95, 1749.50