2 July 2020 Afternoon Session Analysis

Dollar wobbles amid pessimistic labor data.

Dollar index which gauge its value against a basket of six major currencies dipped following the release of downbeat ADP Nonfarm Employment Change data yesterday. According to the Automatic Data Processing (ADP), US Nonfarm Employment Change data came in at 2,369K, weaker than the economist forecast at 3,000K, indicating the weakness and vulnerable of US labour market during the fallout of pandemic. A series of weak labour data which released recently has provide a clearer sign of tonight NonFarm Payroll data results, hence market participants chose to escape from dollar market while remained cautious at the moment. Additionally, a dovish bias meeting minutes from Federal Reserve has also further urged the investors to sell off their dollar’s holding. In the FOMC meeting minutes, board of members unanimously agreed with low interest rate to remain unchanged for a certain time of period due to pandemic of covid-19. Besides, FOMC meeting also noted that a highly accommodative monetary policy should be implemented amid US current weak economy health. As of now, dollar index dropped 0.12% to $97.10.

In the commodities market, crude oil price rose 0.02% to $39.80 per barrel as recent surprise drop in crude oil inventory level continued provide strong bullish momentum toward this black commodity market. Besides, global supply glut has also started to shrink after IHS Markit data showed a significant drop in crude oil floating storage by roughly 150 million barrels last month. Besides, gold price depreciated by 0.09% to $1768.75 a troy ounce as market are still awaiting for tonight’s NFP data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20.30 | USD – Initial Jobless Claims | 1480K | 1355K | – |

| 20.30 | USD – Nonfarm Payrolls (Jun) | 2509K | 3000K | – |

| 20.30 | USD – Unemployment Rate (Jun) | 13.3% | 12.3% | – |

Technical Analysis

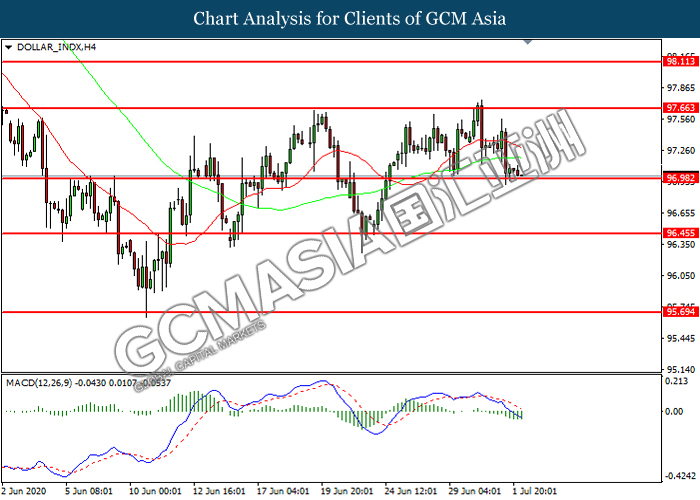

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 96.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 97.65, 98.10

Support level: 96.95, 96.45

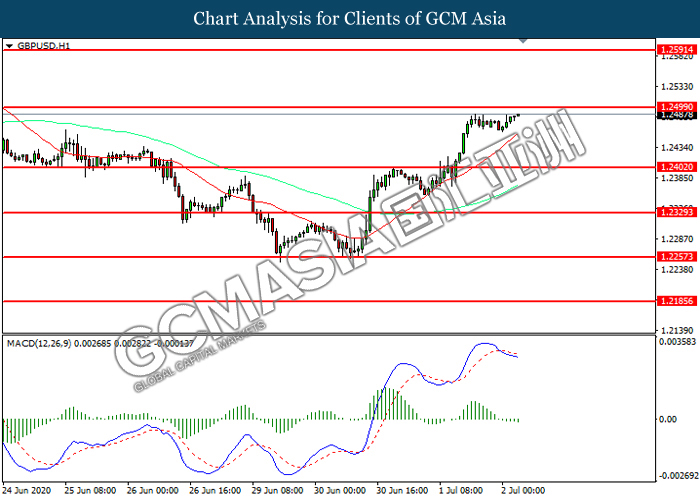

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level at 1.2500. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2500, 1.2590

Support level: 1.2400, 1.2330

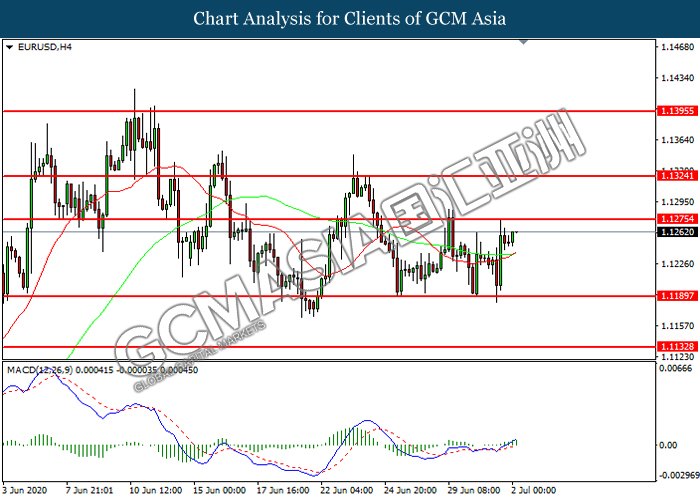

EURUSD, H4: EURUSD was higher following prior rebound from the support level at 1.1190. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.1275.

Resistance level: 1.1275, 1.1325

Support level: 1.1190, 1.1135

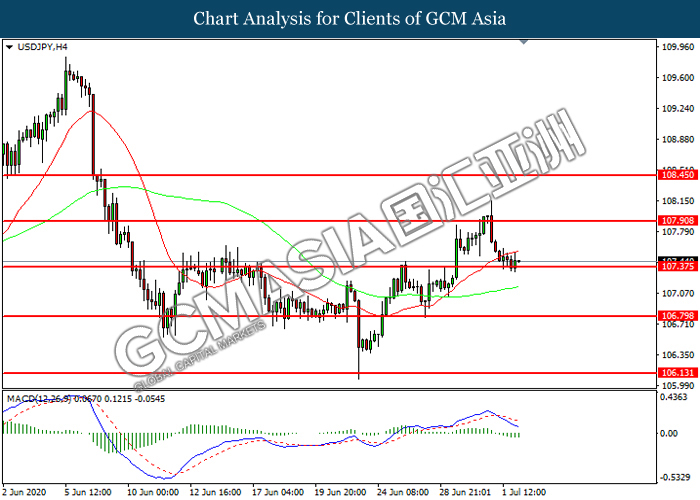

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 107.35. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 107.90, 108.45

Support level: 107.35, 106.80

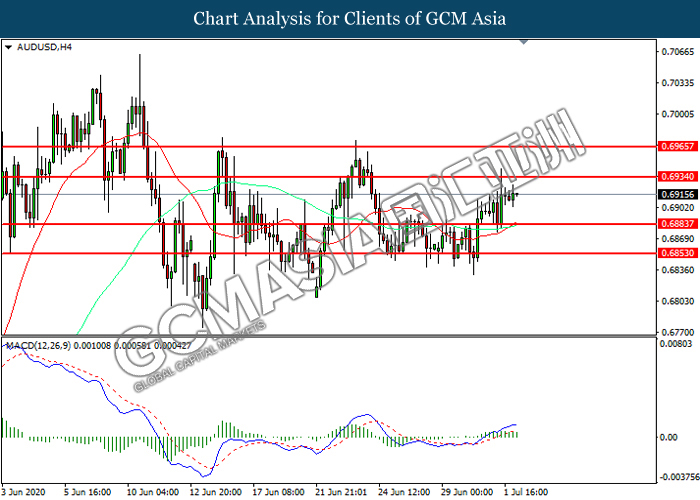

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.6885. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6935, 0.6965

Support level: 0.6885, 0.6855

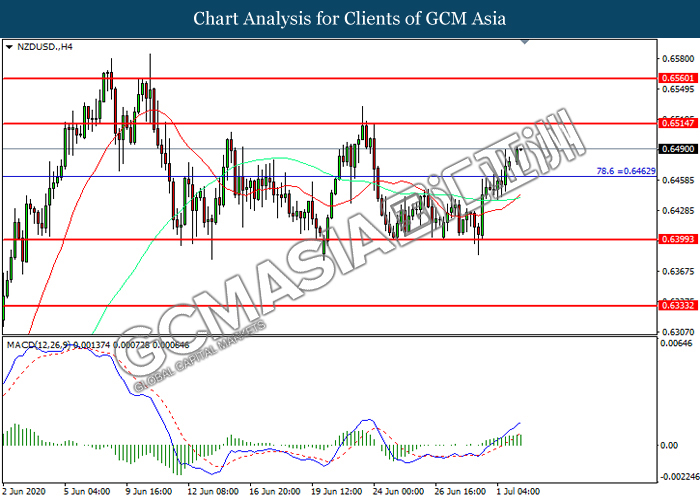

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6465. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6515.

Resistance level: 0.6515, 0.6560

Support level: 0.6465, 0.6400

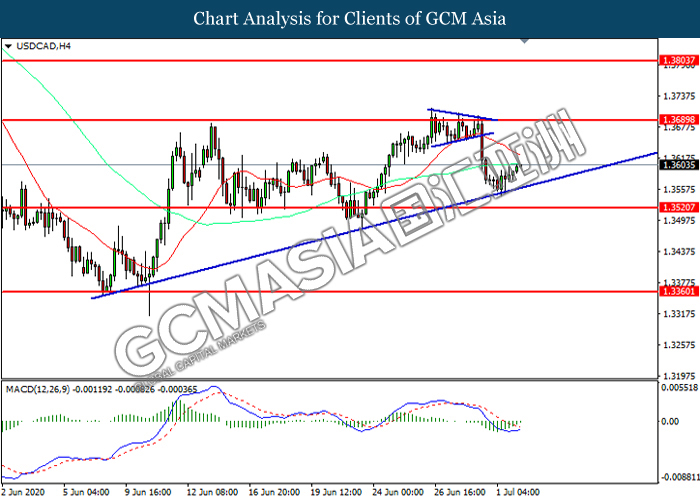

USDCAD, H4: USDCAD was traded higher following prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.3690.

Resistance level: 1.3690, 1.3805

Support level: 1.3520, 1.3360

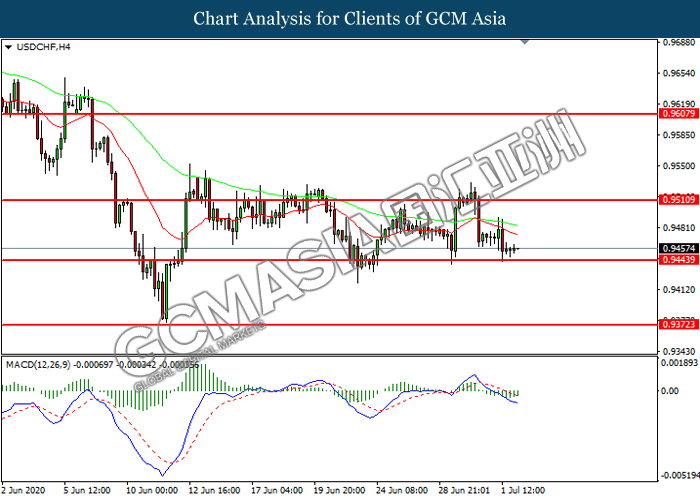

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9445. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9510, 0.9610

Support level: 0.9445, 0.9370

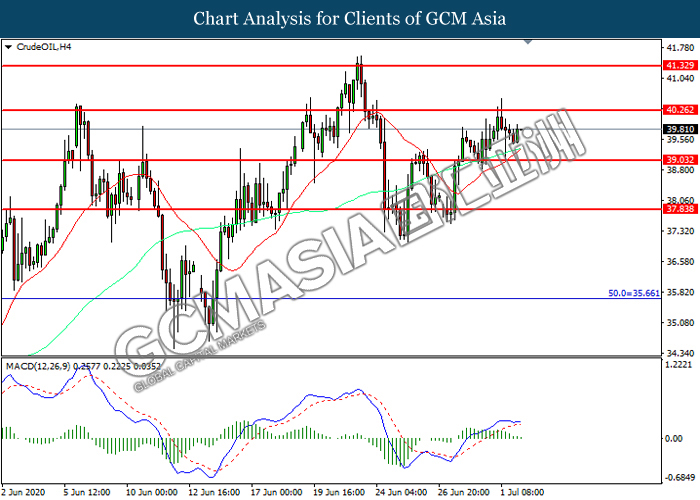

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 40.25. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 39.05.

Resistance level: 40.25, 41.35

Support level: 39.05, 37.85

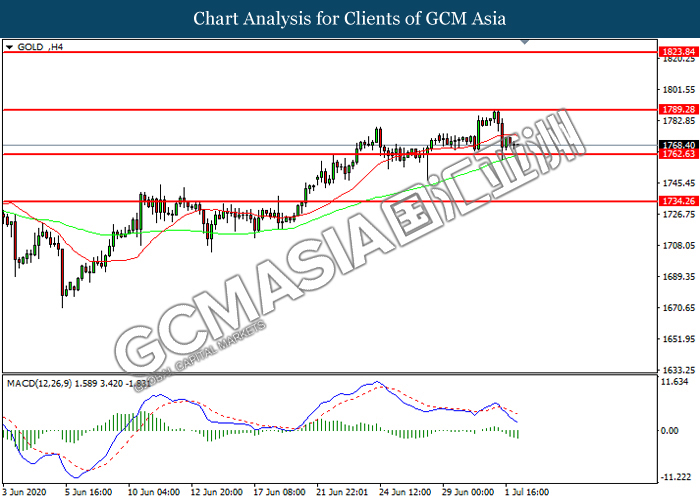

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1762.65. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1789.30, 1823.85

Support level: 1762.65, 1734.25