06 August 2020 Morning Session Analysis

US Dollar slumped amid the negative job data.

The dollar index which gauge against a basket of six major currency pair slumped over the backdrop of the negative job data on yesterday. According to Automatic Data Processing (ADP), the U.S. ADP Nonfarm Employment Change had notched down significantly from the previous reading of 4,314K to 167K, missing the economist forecast at 1,500K, which show a slowdown momentum in hiring as the second wave of the coronavirus resulted in various states rolling back on their reopening plans while providing negative prospect for the Non-Farm Payrolls data which would be released on tomorrow. Nonetheless, the losses experienced by the US Dollar was limited amid upbeat U.S. ISM Non-Manufacturing Purchasing Manager Index (PMI) economic data. The Institute of Supply Management reported that such data had increased from the previous reading of 57.1 to 58.1, confounding market forecast for a reading of up to 55.0. Nonetheless, at this time investors would be eyeing on the negotiations between the White House and Congressional Democrats with regards of the coronavirus relief package and also the NFP and unemployment data which will be released tomorrow in order to gauge the likelihood movement for the US Dollar. As of writing, the dollar index slumped 0.62% to 92.76.

In the commodities market, the crude oil price surged 0.40% to $42.29 per barrel as of writing following the Energy Information Administration (EIA) showed that the U.S. Crude oil inventories came in at -7.373M, fared better than the market forecast at -3.001M. On the other hand, the gold price surged 0.03% to 2038.55 per troy ounces amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:00 GBP BoE Inflation Report

14:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – BoE Interest Rate Decision (Jul) | 0.10% | 0.10% | – |

| 16:30 | GBP – Construction PMI (Jul) | 55.3 | 57.0 | – |

| 20:30 | USD – Initial Jobless Claims | 1,434K | 1,400K | – |

Technical Analysis

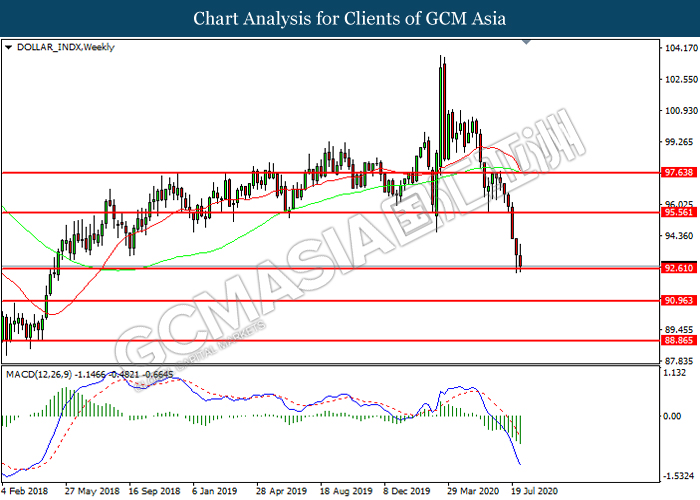

DOLLAR_INDX, Weekly: Dollar index was traded lower while currently testing the support level at 92.60. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 95.55, 97.65

Support level: 92.60, 90.95

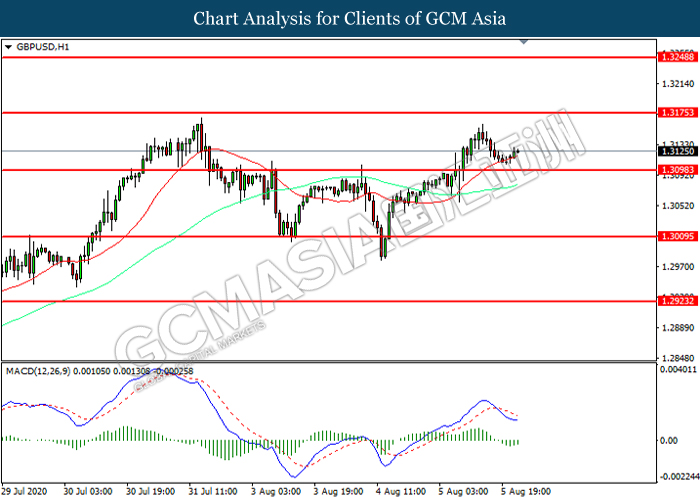

GBPUSD, H1: GBPUSD was traded higher following prior rebound from the support level at 1.3095. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.3175.

Resistance level: 1.3175, 1.3250

Support level: 1.3095, 1.3010

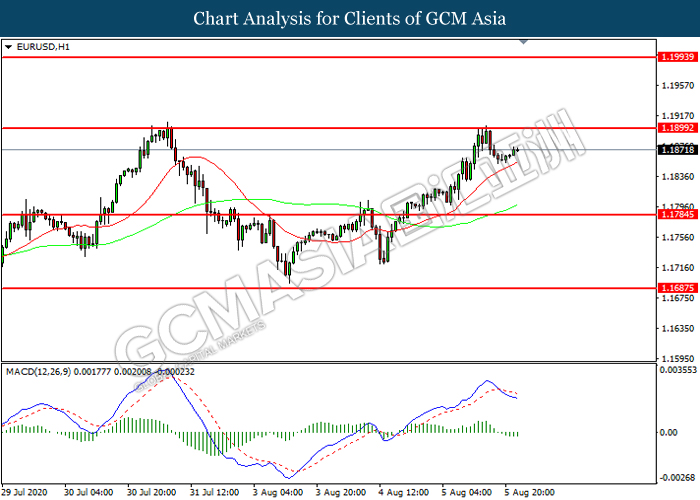

EURUSD, H1: EURUSD was traded lower following prior retracement from the resistance level at 1.1900. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1900, 1.1995

Support level: 1.1780, 1.1685

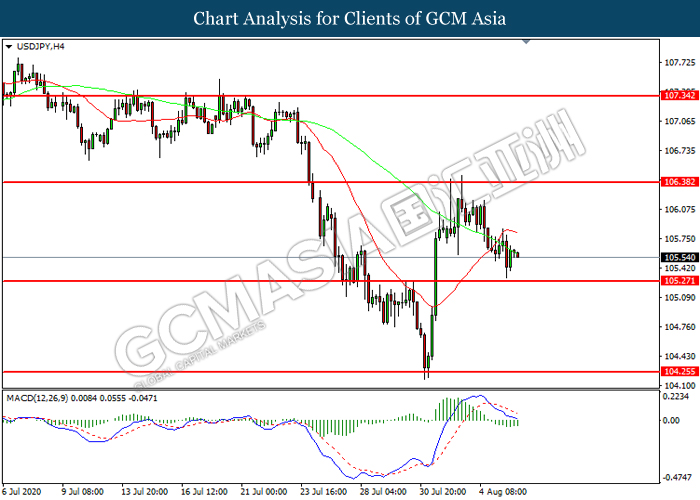

USDJPY, H4: USDJPY was traded lower while currently near the support level at 105.25. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 106.40, 107.35

Support level: 105.25, 104.25

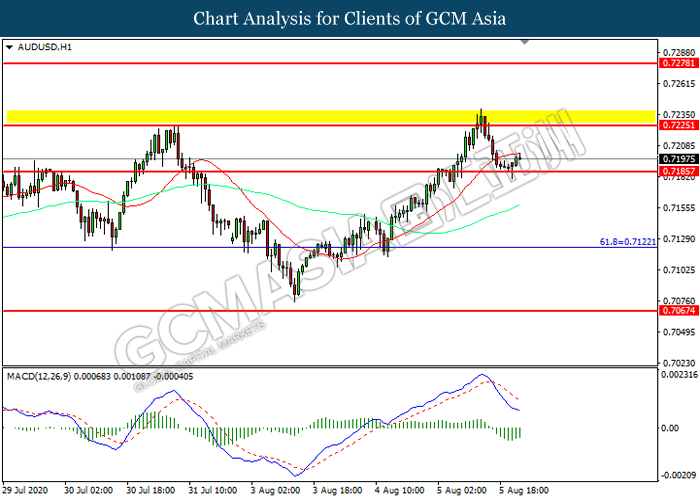

AUDUSD, H1: AUDUSD was higher following prior rebound from the support level at 0.7185. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.7225.

Resistance level: 0.7225, 0.7280

Support level: 0.7185, 0.7120

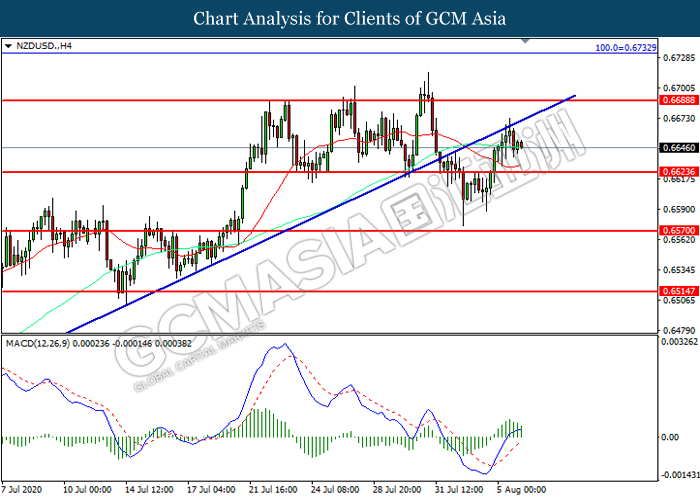

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the upward trend line. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6625.

Resistance level: 0.6690, 0.6735

Support level: 0.6625, 0.6570

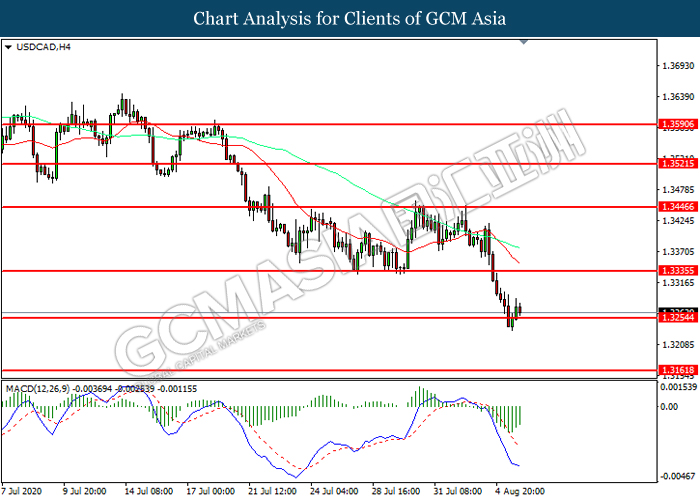

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3255. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.3335.

Resistance level: 1.3335, 1.3445

Support level: 1.3255, 1.3160

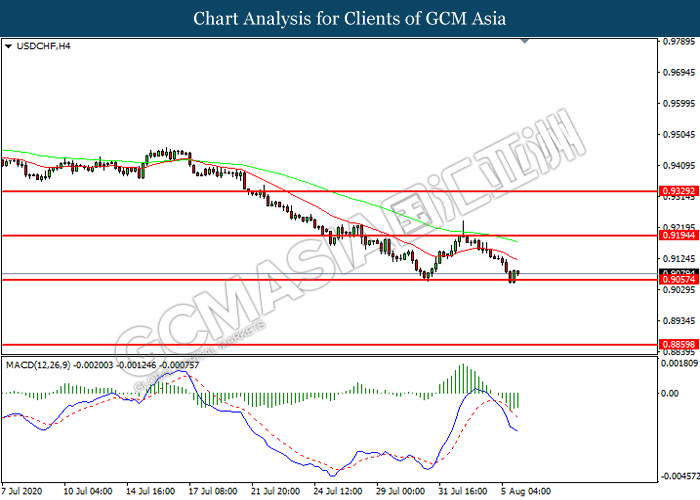

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9055. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9195, 0.9330

Support level: 0.9055, 0.8860

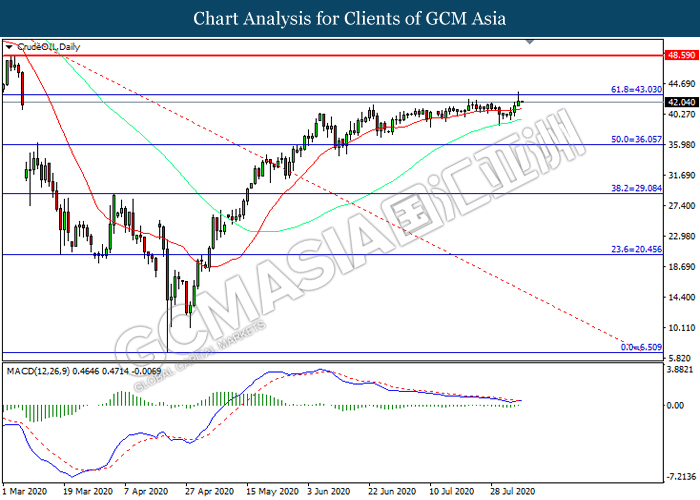

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 43.05. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 43.05, 48.60

Support level: 36.05, 29.10

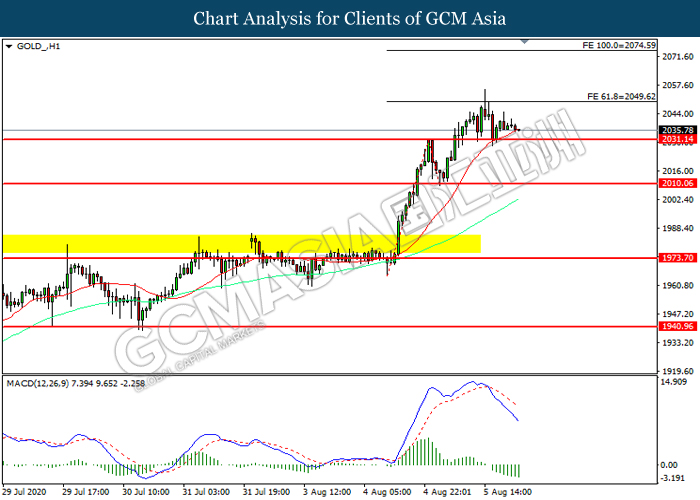

GOLD_, H1: Gold price was traded lower while currently near the support level at 2031.15. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2049.60, 2074.60

Support level: 2031.15, 2010.05