7 April 2017 Daily Analysis

US launches missiles, investors scavenge safe-haven.

Greenback edges lower during Asian trading hours following news report of US missile strikes in Syria which boosted the demand for traditional safe haven assets such as gold and Japanese yen. The dollar index was down 0.11% and was last quoted at 100.48. US President Donald Trump addresses that the strike on Syria is vital national security interests of the United States in order to prevent the spread and use of chemical weapons. Market participants remain cautious today as they await the outcome of talks between US and China president, which would be focusing on trade deals and North Korea’s nuclear programs. “I think the dollar will move flatly today ahead of US jobs data as the situation with North Korea and Syria contributes to higher risk-off sentiment,” said Masashi Murata, senior currency strategist in Tokyo. Later in the evenings, US will release the highly anticipated Nonfarm Payrolls report which is expected to show an addition of 180,000 jobs during March, while a positive reading could reinforce overall expectation towards Federal Reserve who will be delivering two more rate hikes this year.

Glancing through the commodities, crude oil price settled higher amid higher expectation for OPEC-led cut to be extended beyond June, offsetting bearish US inventories data. Otherwise, gold price was up 0.79% to $1,260.20 following reports of US launching dozens of missiles against various targets near the Syrian airfield.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 GBP BoE Gov Carney Speaks

22:00 CAD BoC Gov Poloz Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | GBP – Halifax House Price Index (MoM) (Mar) | 0.1% | 0.3% | – |

| 16:30 | GBP – Manufacturing Production (MoM) (Feb) | -0.9% | 0.3% | – |

| 16:30 | GBP – Trade Balance (Feb) | -10.83B | 10.90B | – |

| 20:30 | USD – Nonfarm Payrolls (Mar) | 235K | 180K | – |

| 20:30 | USD – Unemployment Rate (Mar) | 4.7% | 4.7% | – |

| 20:30 | CAD – Employment Change (Mar) | 15.3K | 5.0K | – |

| 22:00 | CAD – Ivey PMI (Mar) | 55.0 | 56.3 | – |

| 01:00 | Crude Oil – US Baker Hughes Oil Rig Count | 662 | – | – |

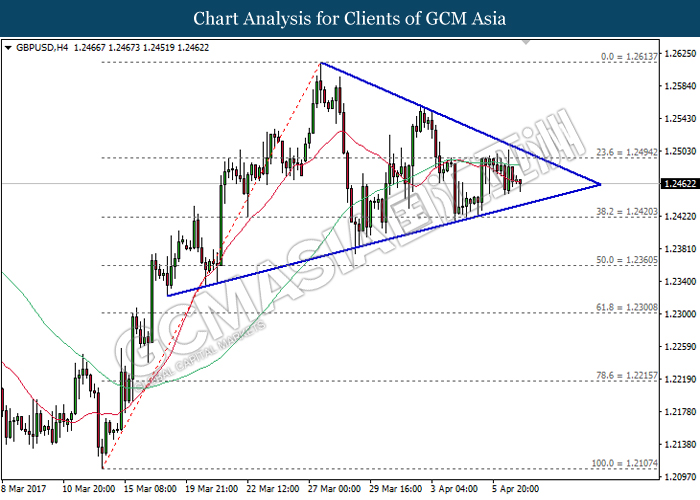

GBPUSD

GBPUSD, H4: GBPUSD was traded lower following prior retrace from the resistance level of 1.2495 while currently trading near the 20-moving average line (red). A successful closure below this line would suggest GBPUSD to advance further down, towards the lower level of the narrowing triangle.

Resistance level: 1.2495, 1.2615

Support level: 1.2420, 1.2360

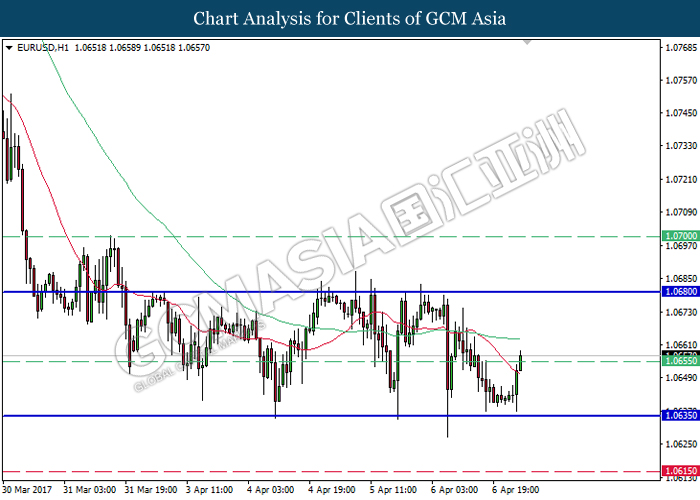

EURUSD

EURUSD, H1: EURUSD remains traded within the sideways channel following prior rebound from the bottom level of the channel. It is expected to be traded higher in short-term, towards the upper level of the channel after breaking the resistance level of 1.0655. Otherwise, long-term trend direction could only be determined following a successful breakout from either side of the channel.

Resistance level: 1.0655, 1.0680, 1.0700

Support level: 1.0635, 1.0615

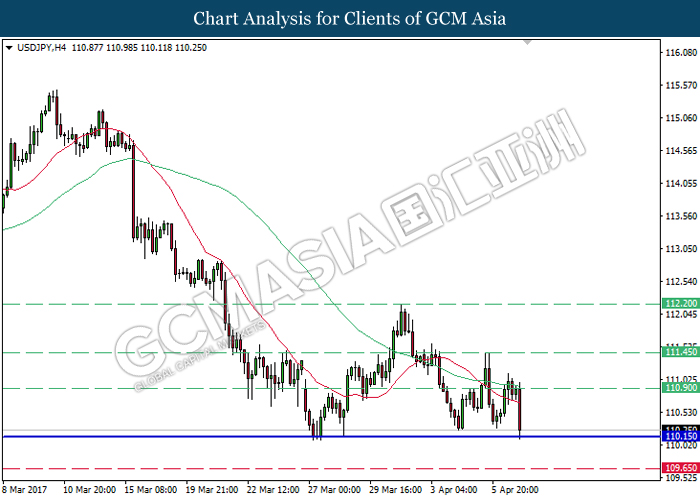

USDJPY

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level of 110.90 while currently testing near the strong support level of 110.15. A successful closure below this level would suggest USDJPY to extend its downward momentum towards the subsequent target of support level at 109.65.

Resistance level: 110.90, 111.45, 112.20

Support level: 110.15, 109.65

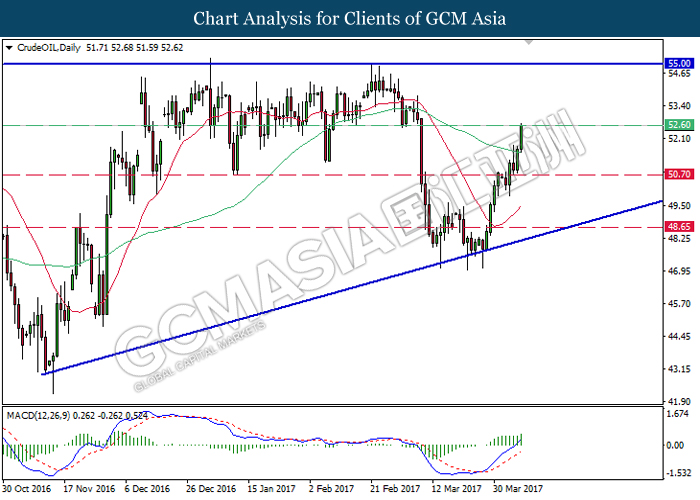

CrudeOIL

CrudeOIL, Daily: Crude oil price remains traded within an ascending triangle following prior rebound from the bottom level of the triangle. Currently, as the MACD histogram continues to illustrate upward signal and momentum while coupled within recent closure above the 60-moving average line (green), crude oil price is expected to extend its upward momentum after breaking the resistance level of 52.60.

Resistance level: 52.60, 55.00

Support level: 50.70, 48.65

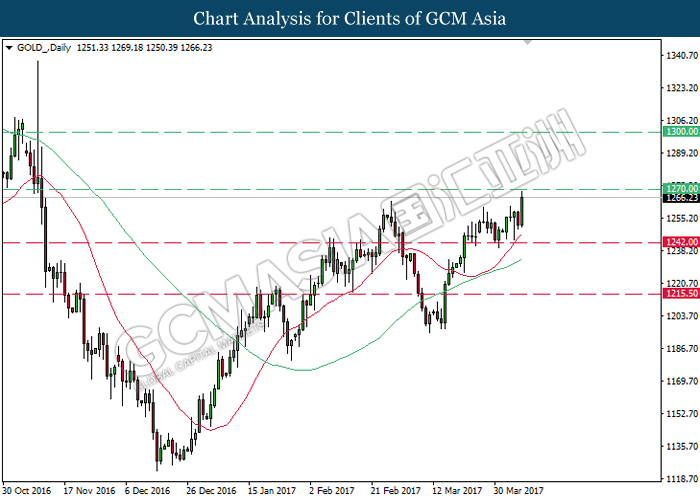

GOLD

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level of 1242.00. With regards to both moving average line which continues to expand further upwards, gold price is expected to extend its upward momentum after breaking the resistance level of 1270.00.

Resistance level: 1270.00, 1300.00

Support level: 1242.00, 1215.50