23 September 2020 Afternoon Session Analysis

Pound slumped following new Covid-19 restriction imposed.

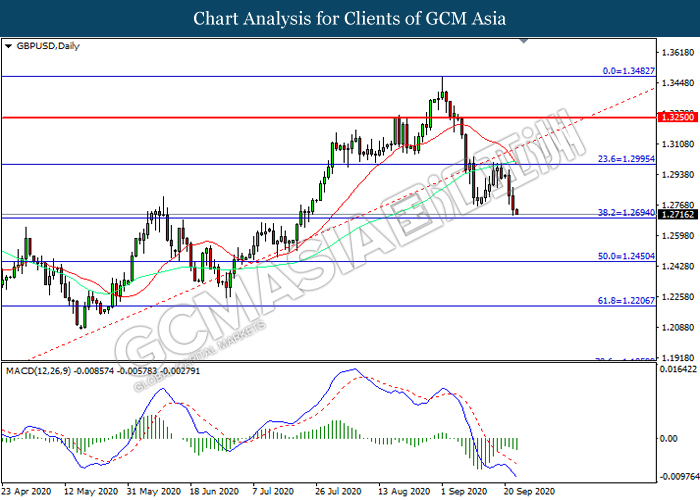

Pound Sterling which acting as one of the major currencies in the FX market plunged significantly after UK Prime Minister announced to unveil a new Covid restriction measure in order to curb the virus’s spread. According to the Worldometers, UK has recorded a number of confirmed cases near to 5K yesterday while indicating an obvious upward sloping in the infections. In the new restriction plan, it is included the extending use of face coverings, curfews on bars, pubs and restaurants and also increased the fines on rule breakers. Besides, Boris Johnson also warned the public to adhere the new Covid restrictions, or else lockdown measure would be re-imposed to contain the resurgence of pandemic. On the other side, the unbreakable Brexit deadlock still haunting the sentiment of pound market. As of now, both parties are still figuring out the best deal for each sides while in a hopes of breaking the impasses before the due date which is the mid of October. As of writing, the pair of GBP/USD dropped 0.09% to 1.2720.

In the commodities market, the crude oil price depreciated by 0.88% to $39.45 per barrel amid heightening of market worries over the prospect of oil demand. According to the latest statistics, a resurgence of Covid-19 has been detected in most of the countries such as France and UK, which eventually caused the oil market outlook clouded. Besides, gold price slumped 0.50% to $1890.10 a troy ounce as market risk avoidance behaviour reduced.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22.30 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22.00 | USD – Existing Home Sales (Aug) | 5.86M | 6.00M | – |

Technical Analysis

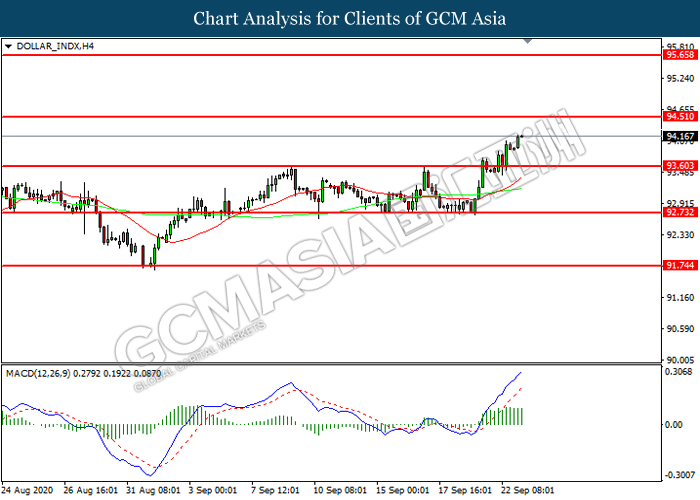

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 93.60. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 94.50.

Resistance level: 94.50, 95.65

Support level: 93.60, 92.75

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2695. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2995, 1.3250

Support level: 1.2695, 1.2450

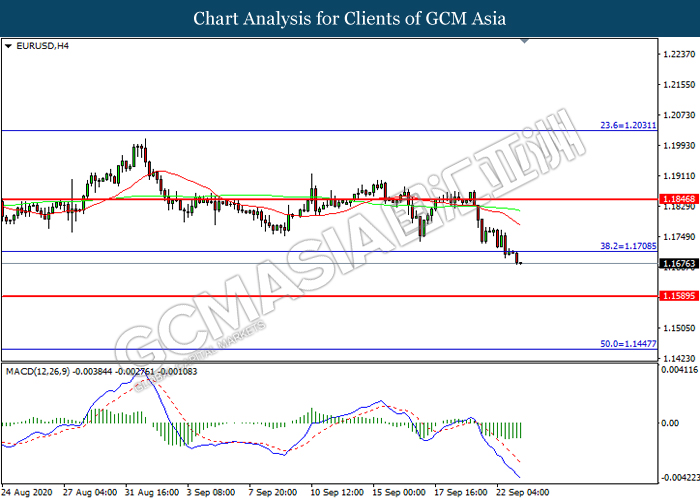

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1590.

Resistance level: 1.1710, 1.1845

Support level: 1.1590, 1.1445

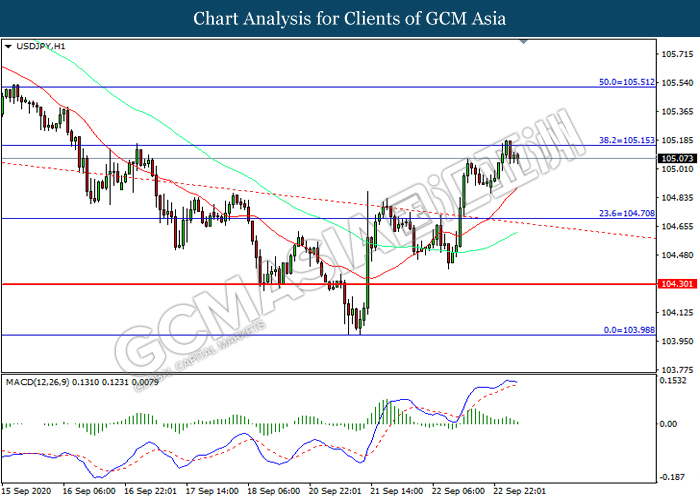

USDJPY, H1: USDJPY was traded higher while currently testing the resistance level at 105.15. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 105.15, 105.50

Support level: 104.70, 104.30

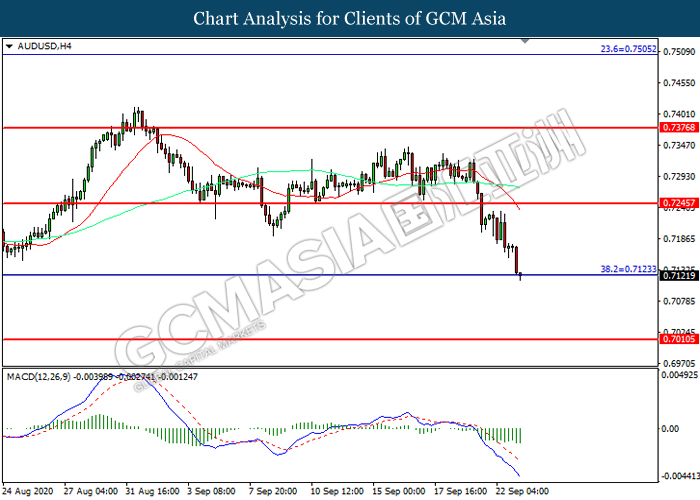

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7125. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7245, 0.7375

Support level: 0.7120, 0.7010

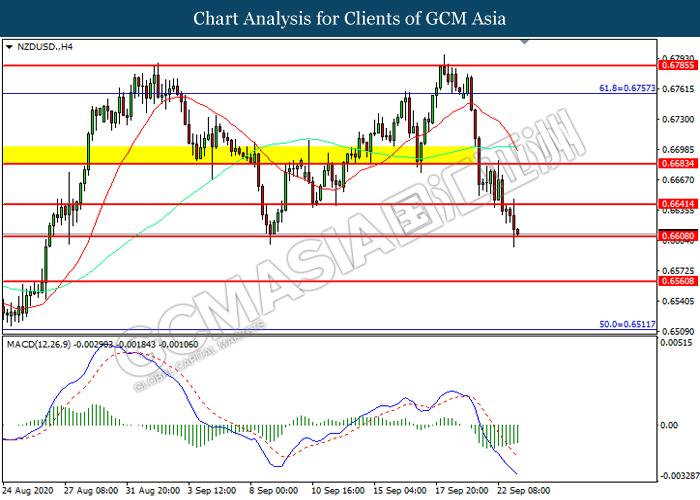

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6610. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6640, 0.6685

Support level: 0.6610, 0.6560

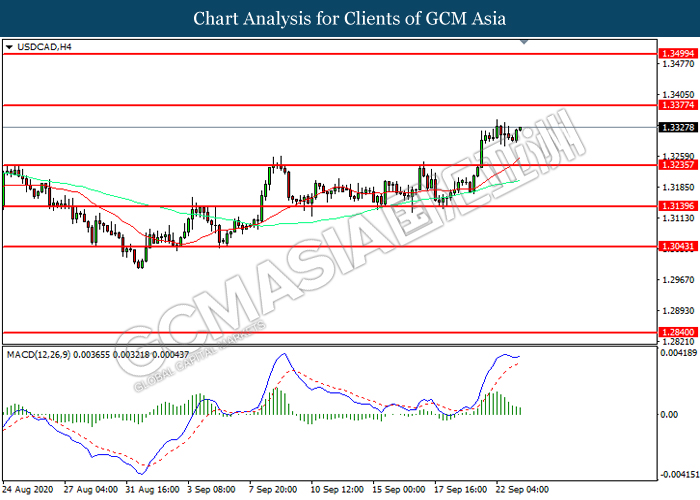

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3235. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3375, 1.3500

Support level: 1.3235, 1.3140

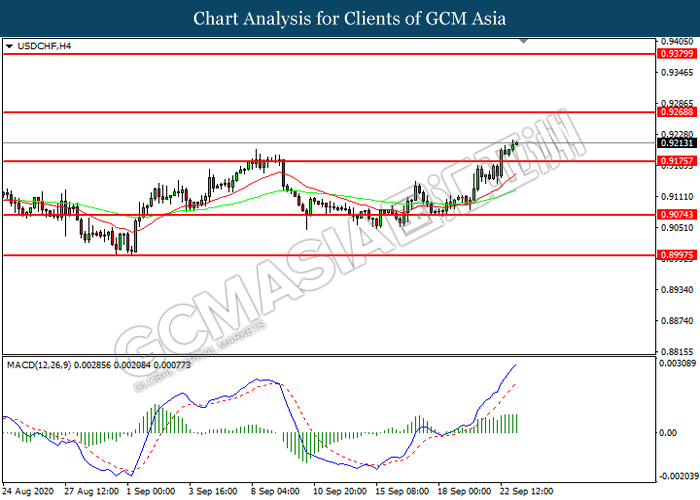

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9175. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9270.

Resistance level: 0.9270, 0.9380

Support level: 0.9175, 0.9075

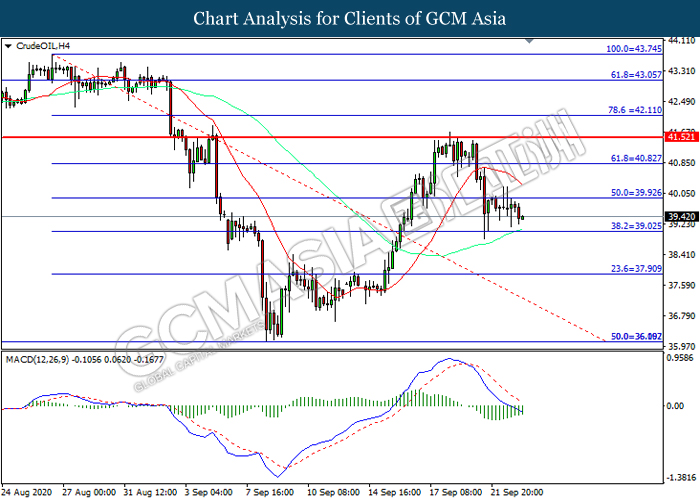

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 39.95. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 39.95, 40.85

Support level: 39.05, 37.90

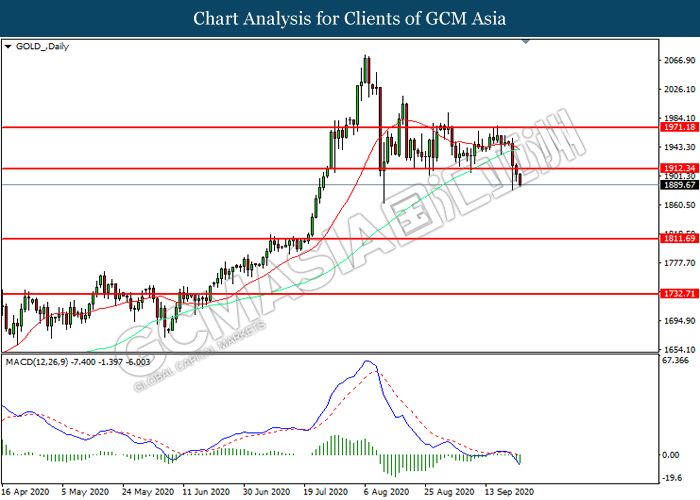

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1912.35. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1811.70.

Resistance level: 1912.35, 1971.20

Support level: 1811.70, 1732.70