16 November 2020 Morning Session Analysis

Yen rebound on Covid-19 uncertainty.

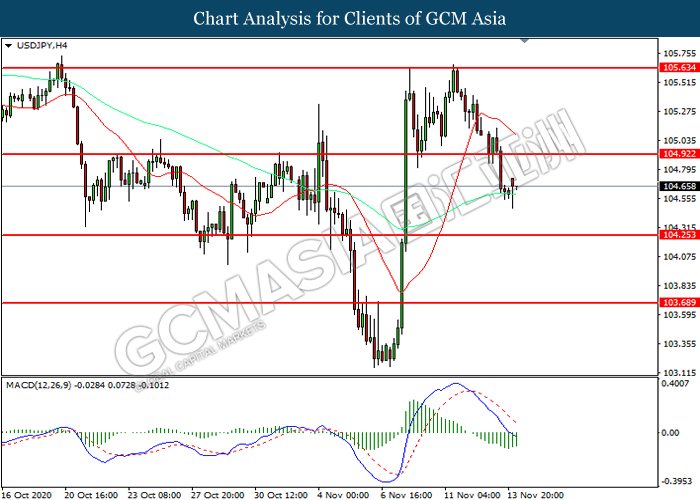

The safe-haven currency Japanese Yen rebound on last Friday, amid the fears upon the resurgence of the coronavirus in the United States and Europe had outweighed the earlier positive vaccine news, which diminishing the risk appetite in the FX market while prompting investors to shift their portfolio toward the safe-haven currency. Besides, both heads of the Federal Reserve and the European Central Bank (ECB) stressed that the economic outlook remains uncertain amid the lock-down measures from the U.S. and European region had dialled down the market optimism toward the economic progression in global financial market. According to Reuters, the Germany’s health minister claimed on last Friday that it was too early to say how long the latest lockdown would last, while the French Prime Minister said France’s lockdown measures would not be eased for at least two weeks. According to latest data, as for yesterday the global coronavirus infections cases had notched up more than 450,000 people while more than 6000 people were killed by these infections. As of writing, USD/JPY depreciated by 0.05% to 104.65.

In the commodities market, the crude oil price surged 0.67% to $40.65 per barrel as of writing. Nonetheless, the crude oil commodity was traded lower on last week amid the spiking numbers of the coronavirus had continue to weigh the market demand on this black-commodity. Though, investors would continue to scrutinize the latest updates with regards of the Coronavirus vaccine in order to receive further trading signal. On the other hand, the gold price appreciated by 0.06% to $1891.05 per troy ounces as of writing amid the risk-off sentiment in the FX market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

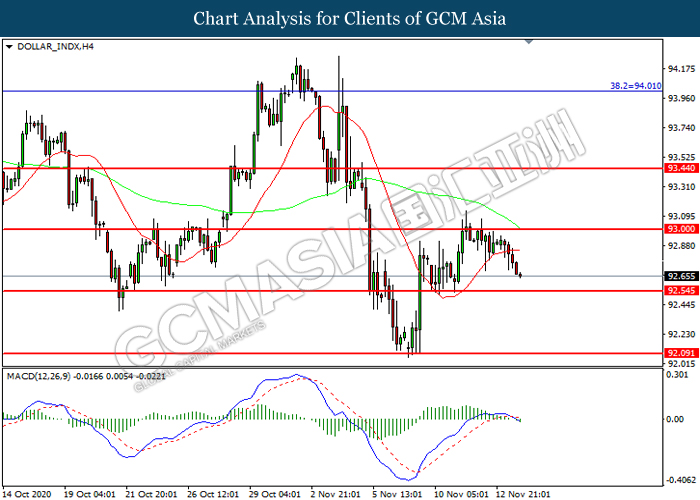

DOLLAR_INDX, H1: Dollar index was traded lower while currently nearby the support level at 92.55. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 93.00, 93.45

Support level: 92.55, 92.10

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3225. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3225, 1.3270

Support level: 1.3160, 1.3100

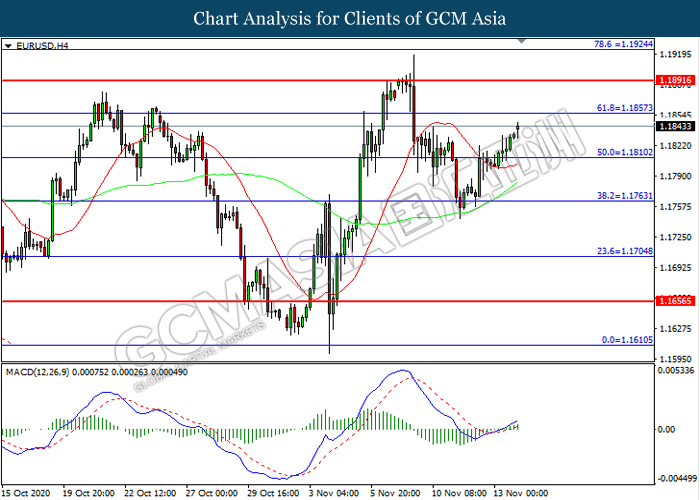

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1810. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.1855.

Resistance level: 1.1855, 1.1890

Support level: 1.1810, 1.1765

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 104.90. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 104.90, 105.65

Support level: 104.25, 103.70

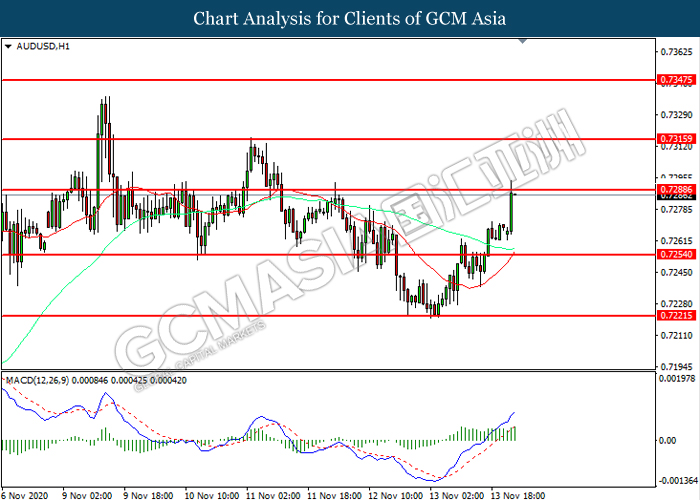

AUDUSD, H1: AUDUSD was traded higher while currently testing the resistance level at 0.7290. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7290, 0.7315

Support level: 0.7255, 0.7220

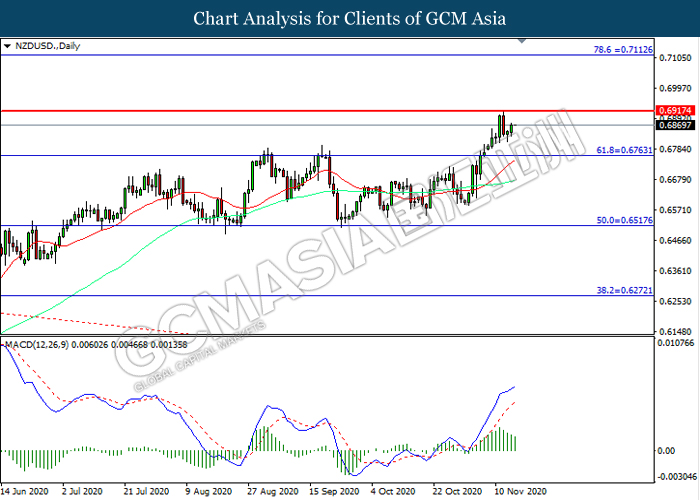

NZDUSD, Daily: NZDUSD was traded higher while current nearby the resistance level at 0.6915. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6915, 0.7115

Support level: 0.6765, 0.6515

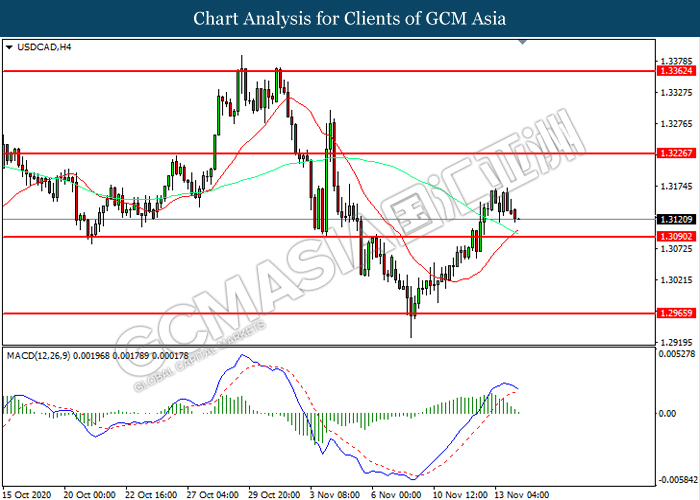

USDCAD, H4: USDCAD was traded lower while currently nearby the support level at 1.3090. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3225, 1.3360

Support level: 1.3090, 1.2965

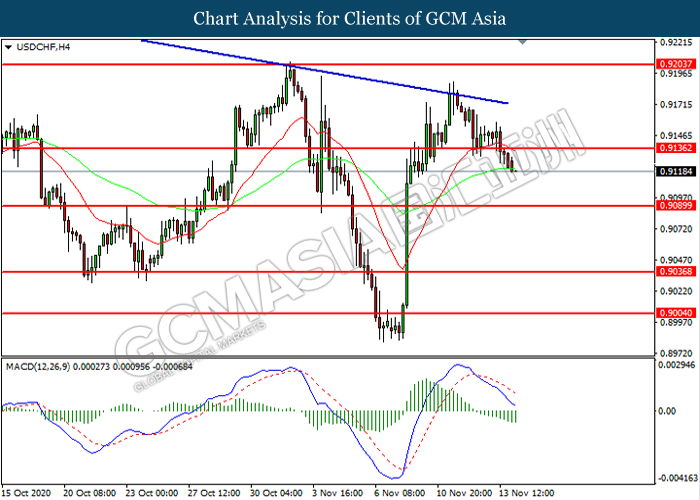

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9135. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9090.

Resistance level: 0.9135, 0.9205

Support level: 0.9090, 0.9035

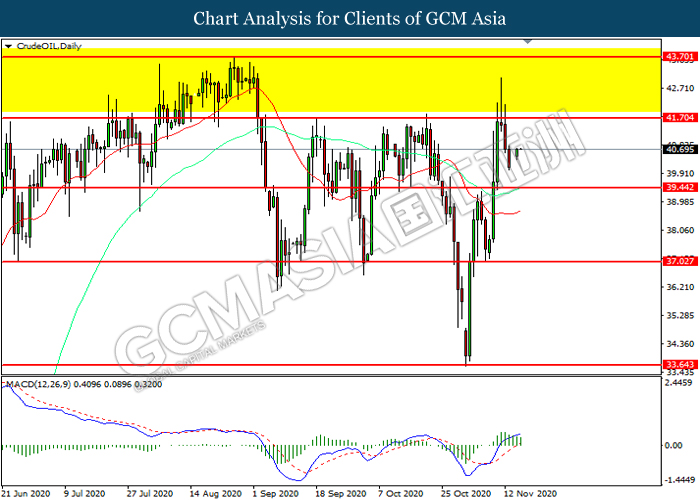

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 41.70. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 39.45.

Resistance level: 41.70, 43.70

Support level: 39.45, 37.05

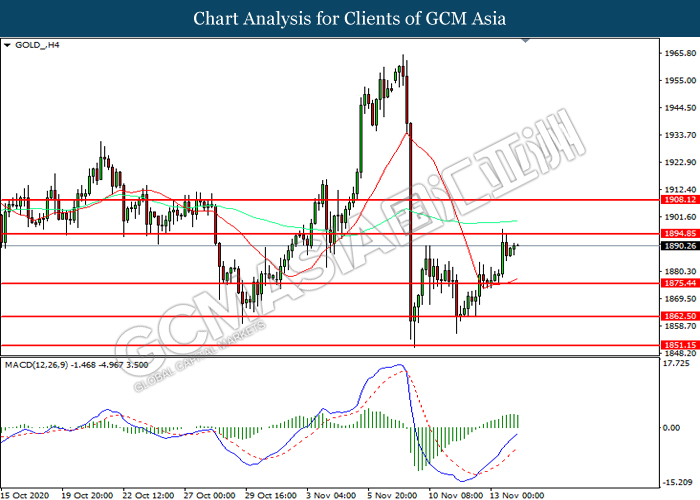

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1894.85. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1894.85, 1908.10

Support level: 1875.45, 1862.50