17 November 2020 Morning Session Analysis

Yen retreats over risk-on sentiment.

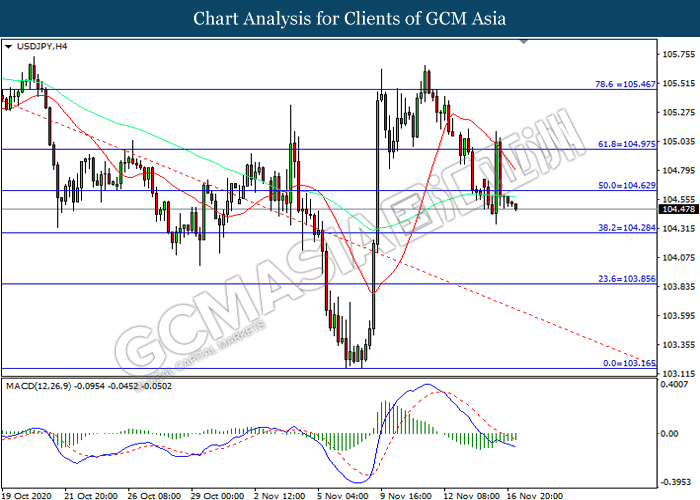

The safe-haven currency such as Japanese Yen slumped amid the positive prospect for the Covid-19 vaccine development on yesterday, which spurring risk-on sentiment in the FX market while sapping the market demand on the safe-haven currency. According to Reuters, Moderna on Monday claimed that its coronavirus vaccine candidate was 94.5% effective at protecting people from the disease. Though, the company reiterated that detailed of the data from the study was expected to be delivered in late November, and added that it planned to request emergency use of its vaccine by early December. The news had added further optimism toward the vaccine development after Pfizer Inc last week said its candidate was proven to 90% effective in a clinical trial. Nonetheless, the losses experienced by the Japanese Yen was limited over the backdrop of the upbeats economic data on yesterday. According to Cabinet Office, Japan Gross Domestic Product (GDP) for last quarter had notched up significantly from the previous reading of -8.2% to 5.0%, exceeding the market forecast at 4.4%. As of writing, USD/JPY depreciated by 0.01% to 104.55.

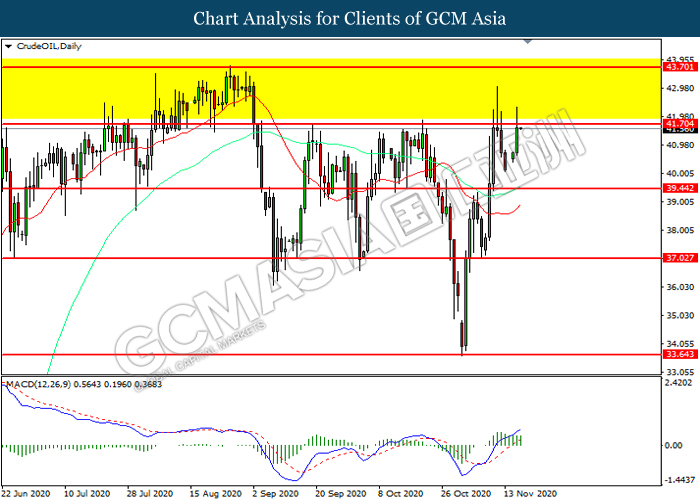

In the commodities market, the crude oil price surged 0.17% to $41.70 per barrel as of writing. The oil market edged higher amid investors expected a speedier end to the coronavirus pandemic could provide positive prospect toward the market demand on this black-commodity. On the other hand, the gold price slumped 0.02% to $1888.75 per troy ounces amid the positive Covid-19 vaccine news had improved the risk appetite in the FX market while diminishing market demand on the safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Retail Sales (MoM) (Oct) | 1.5% | 0.6% | – |

| 21:30 | USD – Retail Sales (MoM) (Oct) | 1.9% | 0.5% |

Technical Analysis

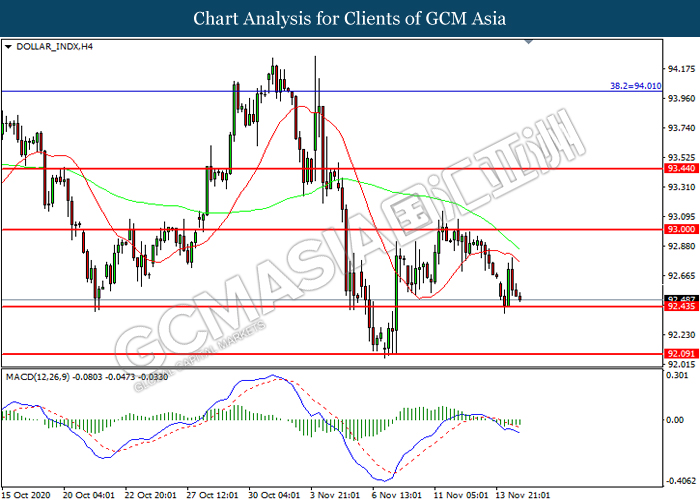

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 92.45. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 93.00, 93.45

Support level: 92.45, 92.10

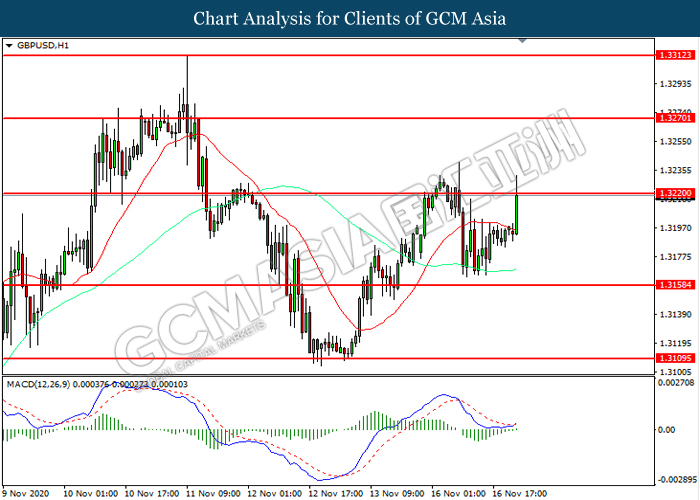

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level at 1.3220. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.32200, 1.3270

Support level: 1.3160, 1.3110

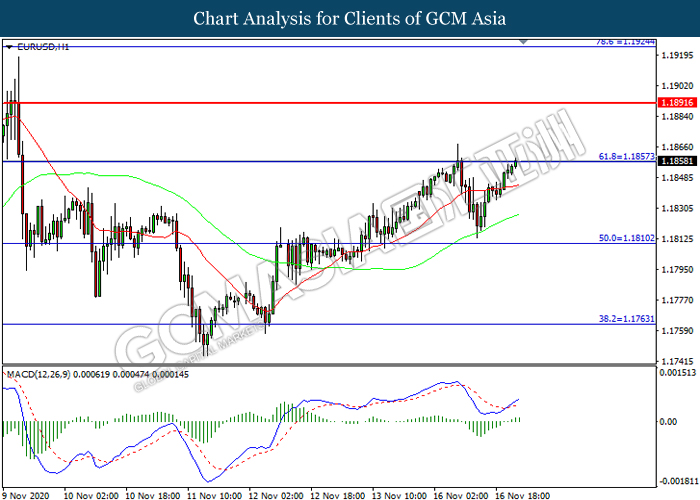

EURUSD, H1: EURUSD was traded higher while currently testing the resistance level at 1.1855. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1855, 1.1890

Support level: 1.1810, 1.1765

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 104.65. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 104.65, 104.95

Support level: 104.30, 103.85

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7325. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7320, 0.7430

Support level: 0.7220, 0.7100

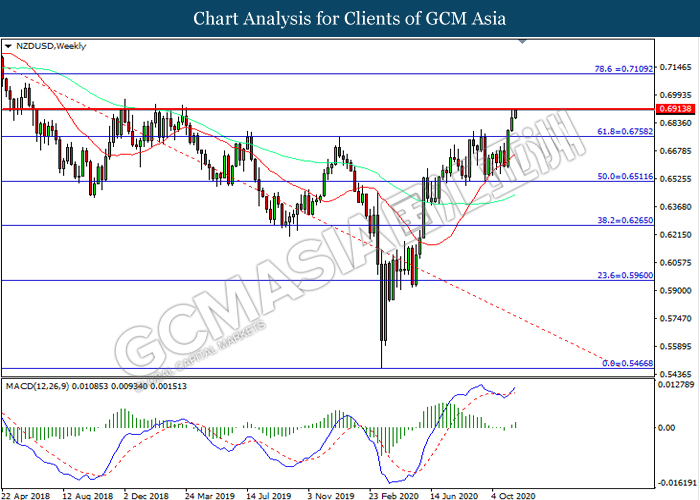

NZDUSD, Weekly: NZDUSD was traded higher while currently testing the resistance level at 0.6915. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6915, 0.7110

Support level: 0.6760, 0.6510

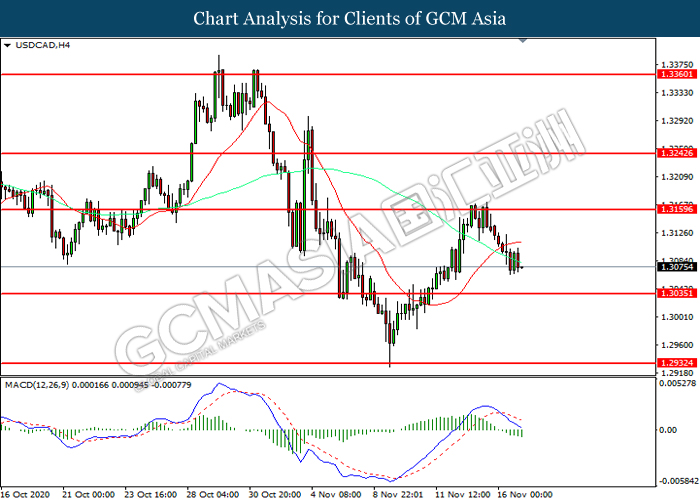

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3160. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3035.

Resistance level: 1.3160, 1.3245

Support level: 1.3035, 1.2930

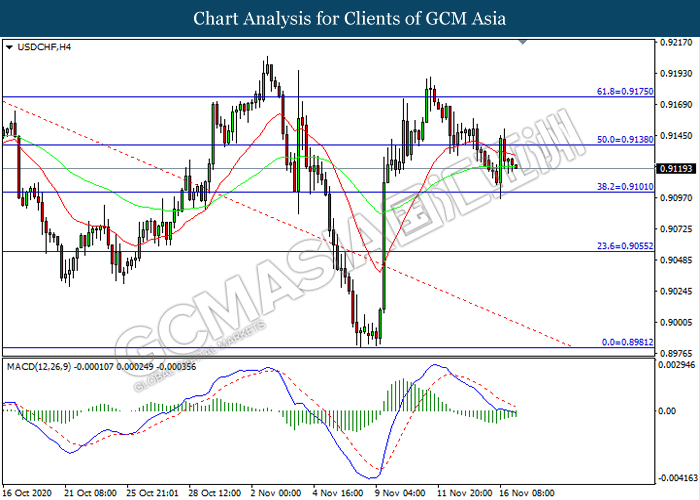

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9140. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9140, 0.9175

Support level: 0.9100, 0.9055

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 41.70. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 41.70, 43.70

Support level: 39.45, 37.05

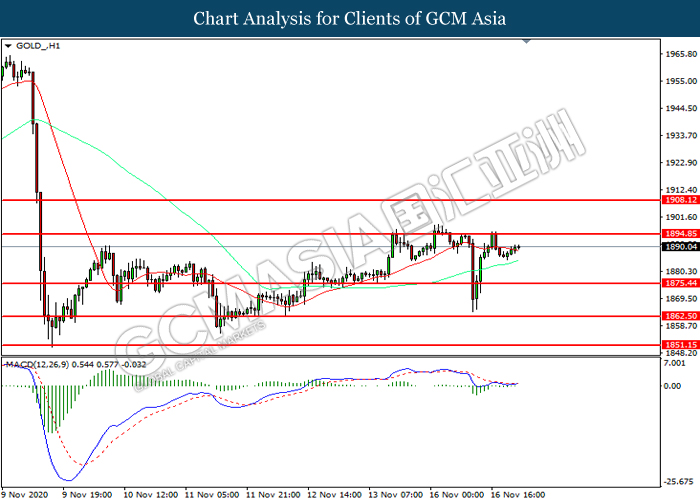

GOLD_, H1: Gold price was traded higher while currently nearby the resistance level at 1894.85. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1894.85, 1908.10

Support level: 1875.45, 1862.50