01 June 2021 Morning Session Analysis

Dollar slumped on inflation fears.

The Dollar Index which traded against a basket of six major currency pairs extend its losses yesterday amid investors remained their concern over the impact of a surge in U.S. inflation rate, which diminishing the appeal of US Dollar. According to Bureau of Economic Analysis, U.S. Core PCE Price Index vaulted 3.1% on last week, the largest annual increase since July 1992 due to economic recovery from the Covid-19 pandemic and various supply disruptions. A high reading of core inflation data would likely lower the value for US Dollar while prompting investors to shift their portfolio toward other currencies. Nonetheless, investors would continue to scrutinize the crucial U.S. Nonfarm Payroll data which will be released on Friday to gauge the likelihood movement for the currency. As of writing, the Dollar Index depreciated by 0.22% to 89.85.

In the commodities market, the crude oil price surged 0.15% to $66.95 per barrel as of writing. The oil market edged higher on positive hopes upon the crude oil demand will grow significantly in next quarter, while investors would focus on OPEC+’s meeting today to receive further trading signal. On the other hand, the gold price surged 0.05% to $1907.90 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

23:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Jun) | 0.10% | 0.10% | – |

| 15:55 | EUR – German Manufacturing PMI (May) | 64.0 | 64.0 | – |

| 15:55 | EUR – German Unemployment Change (May) | 9K | -9K | – |

| 16:30 | GBP – Manufacturing PMI (May) | 66.1 | 66.1 | – |

| 17:00 | EUR – CPI (YoY) (May) | 1.6% | 1.9% | – |

| 20:30 | CAD – GDP (MoM) (Mar) | 0.4% | 1.0% | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 60.7 | 60.7 | – |

Technical Analysis

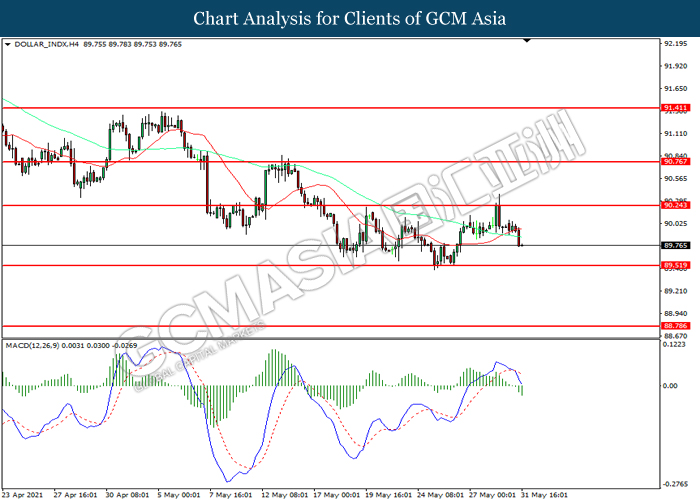

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 90.25. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 89.50.

Resistance level: 90.25, 90.75

Support level: 89.50, 88.80

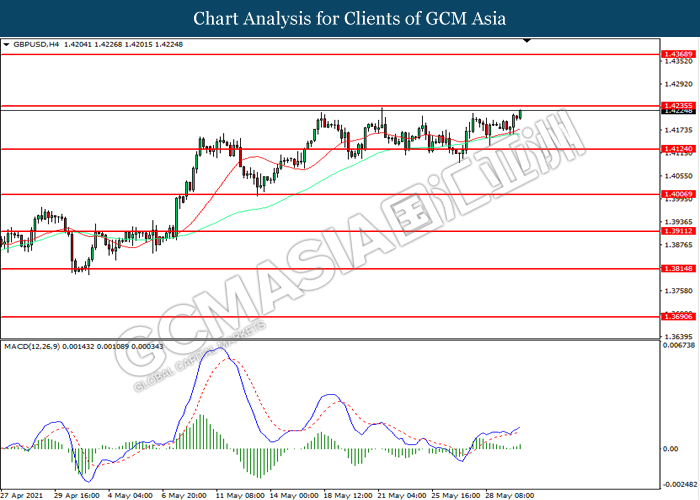

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.4235. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.4235, 1.4370

Support level: 1.4125, 1.4005

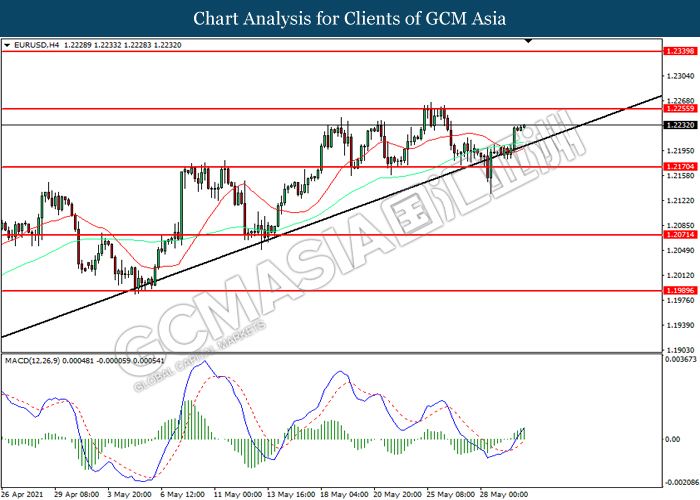

EURUSD, H4: EURUSD was traded higher while currently near the resistance level at 1.2255. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2255, 1.2340

Support level: 1.2170, 1.2070

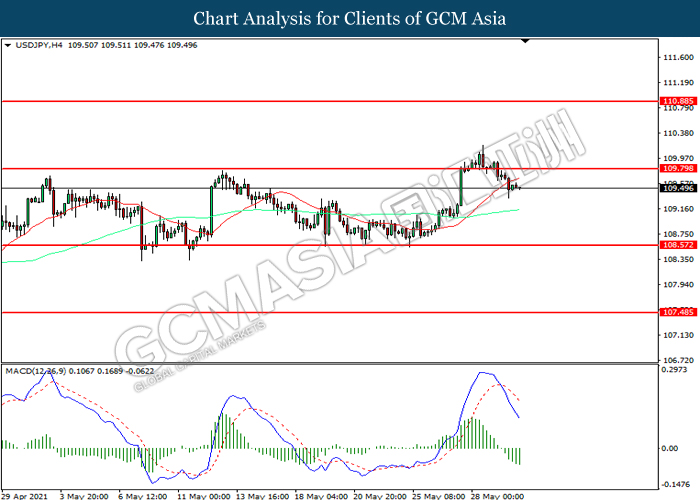

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 109.80. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 108.55.

Resistance level: 109.80, 110.90

Support level: 108.55, 107.50

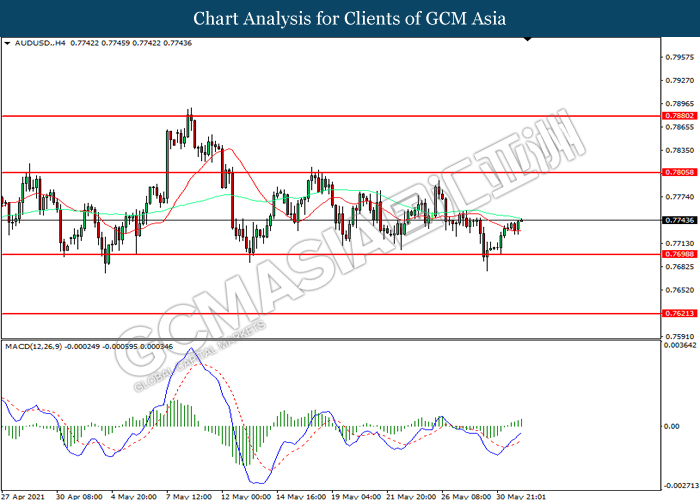

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7700. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7805.

Resistance level: 0.7805, 0.7880

Support level: 0.7700, 0.7620

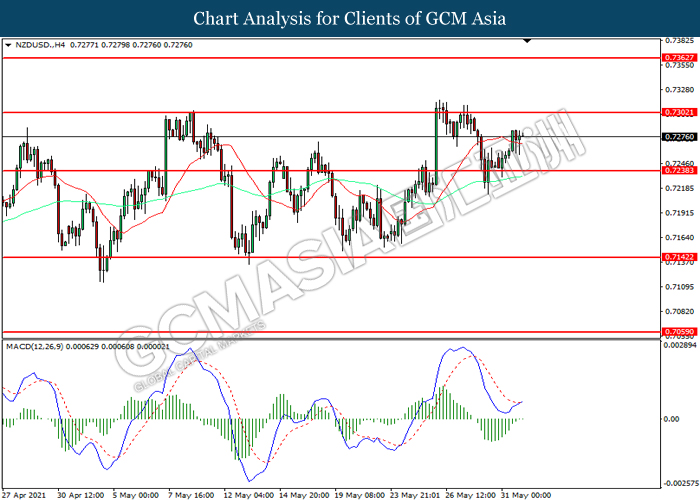

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.7240. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.7300.

Resistance level: 0.7300, 0.7360

Support level: 0.7240, 0.7140

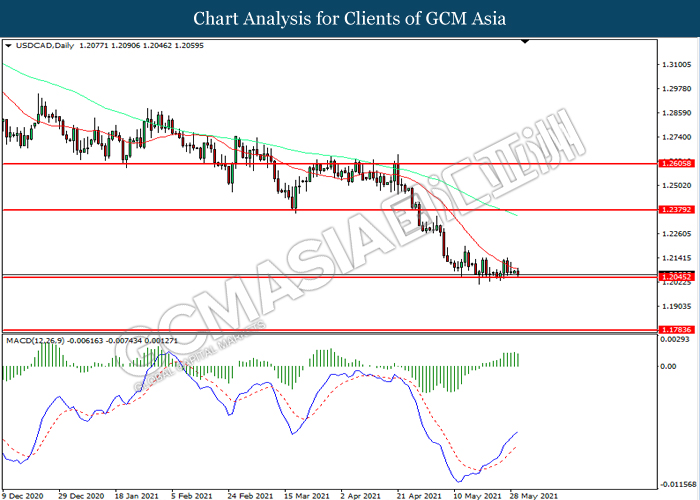

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2045. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2380, 1.2605

Support level: 1.2045, 1.1785

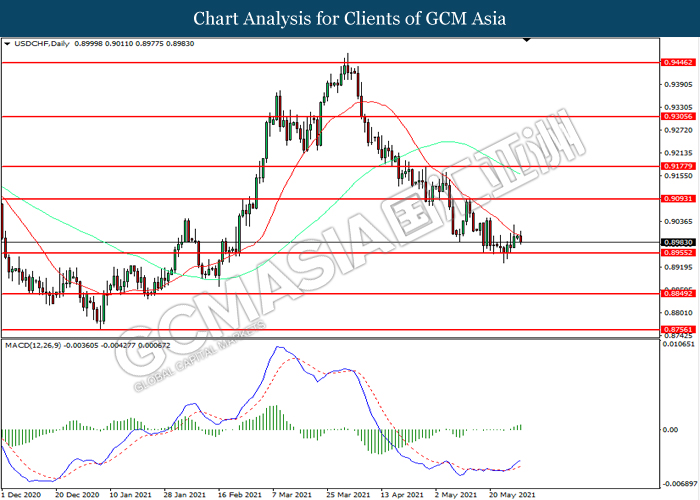

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8955. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9095, 0.9175

Support level: 0.8955, 0.8850

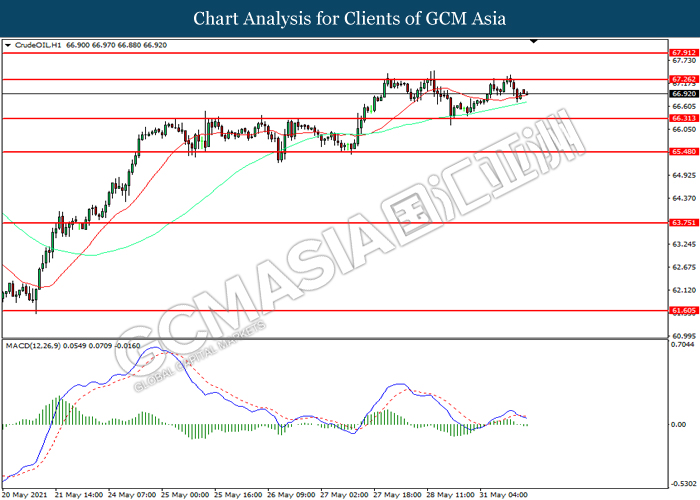

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 67.25. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 66.30.

Resistance level: 67.25, 67.90

Support level: 66.30, 65.50

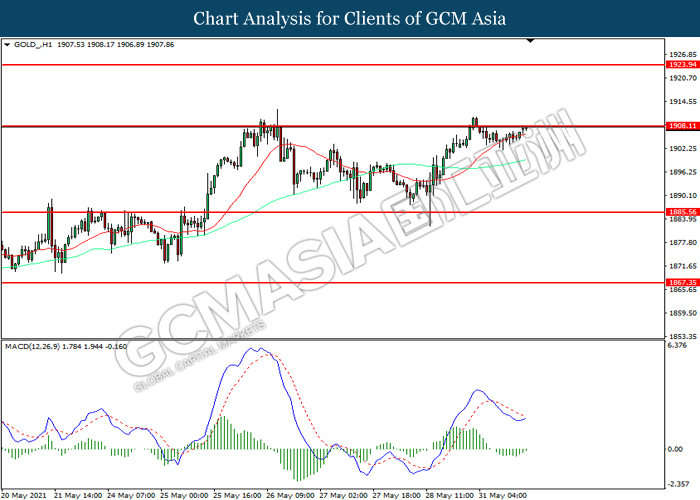

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1908.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1908.10, 1923.95

Support level: 1885.55, 1867.35