3 July 2017 Weekly Analysis

GCMAsia Weekly Report: July 3 – 7

Market Review (Forex): June 26 – 30

U.S. Dollar

Greenback was steadied on Friday but ended the week close to nine-months low amid expectations that several major central banks around the world are getting ready to tighten their monetary policy. The dollar index was last quoted at 95.39 during late Friday trading while ended the second quarter with 4.8% of losses, its largest quarterly loss since third quarter of 2010.

Investors’ expectations for tighter monetary policy was catalyzed after governor from European Central Bank, Bank of England and Bank of Canada gives hawkish view on their future monetary policy stance. The hawkish signals contrasted with doubts over US Federal Reserves’ ability to hike interest rates again this year due to recent slowdown in US economic performance and growing skepticism over Trump’s administration ability to deliver his pro-growth policies.

USD/JPY

Greenback remained resilient against the Japanese counterpart with USD/JPY rising 0.2% to 112.40 and ended with gains of 1.05%.

EUR/USD

Euro dipped 0.13% to $1.1425 due to profit seeking effort after touching one-year high.

GBP/USD

Pound sterling rose 0.16% to $1.3027 and ended the week with 2.22% of gains.

Market Review (Commodities): June 26 – 30

GOLD

Gold prices edges lower on Friday while posting its first weekly decline since March due to rising global bond yields which reduces the demand for the precious metal. Its prices were down 0.27% and closed the week at $1,242.48 while recording a loss of 1.27% for the week. However, price of the yellow metal still ended first half of the year with 8% of gains due to weaker dollar. Gold prices came under pressure amid hawkish signals given by several major central banks around the world with regards to tighten their monetary policy in the future. In the event of rising interest rates, opportunity cost for holding non-yielding asset such as gold would increase, thus placing further pressure on its prices.

Crude Oil

Crude oil price extended its gains for seventh consecutive session on Friday while logging in its biggest weekly recovery since mid-May as investors were encouraged by fresh signals of diminishing US crude production.

The report came after US government data showed that total domestic crude production fell by 100,000 barrels a day to 9.25 million barrels for the week of June 23rd. Its prices rallied $1.11 or 2.5% on Friday and ended the week at $46.04 a barrel. For the week, it has gained $3.03 or 7%. However, its prices still ended the first quarter with a loss of 9% thus far.

On Friday, US energy services company Baker Hughes reported that the number of active US rigs drilling for oil was declined by two to 756 rigs. This has marked the second time where its weekly oil rig count fell during this year after increasing for 23 weeks in a row.

U.S. Baker Hughes Oil Rig Count

The number of active oil drilling rig was declined by 2 to 756.

Weekly Outlook: July 3 – 7

For the week, investors will be focusing on Wednesday’s US Federal Reserve meeting minutes for fresh cues on the timing of next interest rate hikes. Likewise, Friday’s US jobs report will also be closely watched. Employment data from Canada will be within investor’s radar amid higher speculation that BoC may raise interest rates as soon as this month.

As for oil traders, they will keep an eye on fresh weekly information regarding US stockpiles of crude and refined products due this Wednesday and Thursday. Meanwhile, traders will also pay close attention to comments from global oil producers for further evidence on complying with their agreement to reduce output this year.

Highlighted economy data and events for the week: July 3 – 7

| Monday, July 3 |

Data JPY – Tankan Large Manufacturers Index (Q2) JPY – Tankan Large Non-Manufacturers Index (Q2) CNY – Caixin Manufacturing PMI (Jun) GBP – Manufacturing PMI (Jun) USD – ISM Manufacturing PMI (Jun)

Events GBP – BoE Gov Carney Speaks

|

| Tuesday, July 4 |

Data AUD – Retail Sales (MoM) (May) AUD – RBA Interest Rate Decision (Jul) GBP – Construction PMI (Jun)

Events AUD – RBA Rate Statement

|

| Wednesday, July 5 |

Data Crude Oil – API Weekly Crude Oil Stock GBP – Services PMI (Jun) USD – Factory Orders (MoM) (May)

Events USD – FOMC Meeting Minutes

|

| Thursday, July 6 |

Data AUD – Trade Balance (May) CHF – CPI (MoM) (Jun) USD – ADP Nonfarm Employment Change (Jun) USD – Initial Jobless Claims CAD – Building Permits (MoM) (May) USD – ISM Non-Manufacturing PMI (Jun) Crude Oil – Crude Oil Inventories

Events N/A

|

|

Friday, July 7

|

Data GBP – Halifax House Price Index (MoM) (Jun) GBP – Manufacturing Production (MoM) (May) USD – Nonfarm Payrolls (Jun) USD – Unemployment Rate (Jun) CAD – Employment Change (Jun) CAD – Ivey PMI (Jun) Crude Oil – U.S. Baker Hughes Oil Rig Count

Events GBP – BoE Gov Carney Speaks

|

Technical weekly outlook: July 3 – 7

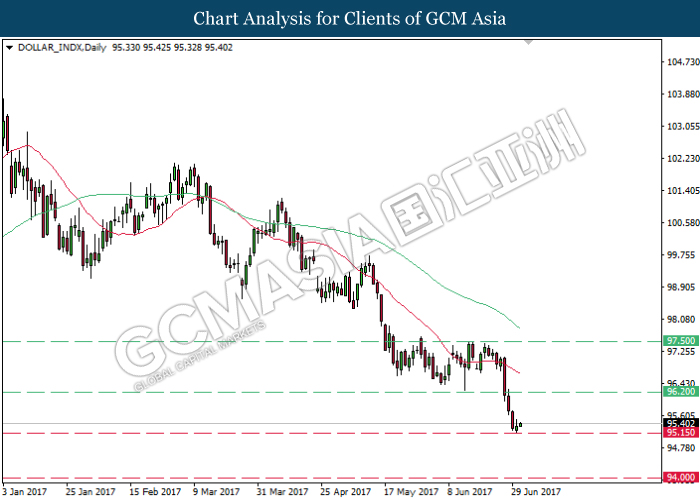

Dollar Index

DOLLAR_INDX, Daily: Dollar index extended its losses following prior formation of death cross by both moving average line. However, recent rebound from the support level of 95.15 suggests dollar index to be traded higher in short-term as technical correction. Long-term trend directions still suggest dollar index to extend its losses.

Resistance level: 96.20, 97.50

Support level: 95.15, 94.00

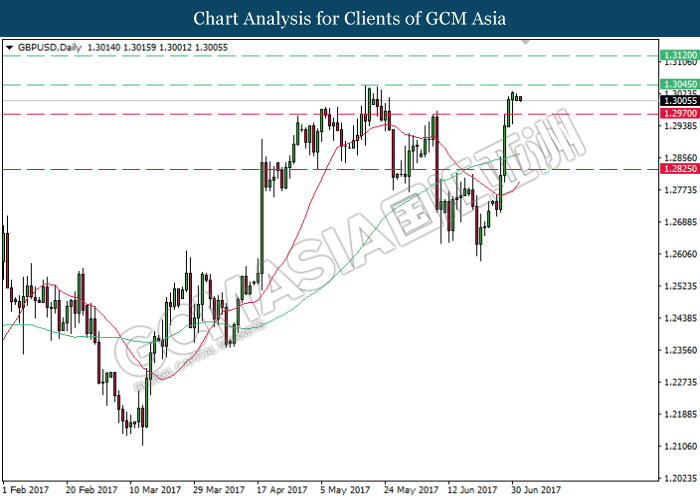

GBPUSD

GBPUSD, Daily: GBPUSD remained hovered near the previous high at 1.3045 following prior closure above the 60-moving average line (green). As both MA line continues to narrow upwards, GBPUSD is expected to extend its gains after successfully closing above the resistance level of 1.3045.

Resistance level: 1.3045, 1.3120

Support level: 1.2970, 1.2825

USDJPY

USDJPY, Daily: USDJPY remained traded within a narrowing triangle while recently rebounded from the support level of 111.80. Both moving average line which continue to narrow upwards suggests USDJPY to advance further up towards the upper level of the triangle after breaking the resistance level of 112.70.

Resistance level: 112.70, 113.90

Support level: 111.80, 110.95

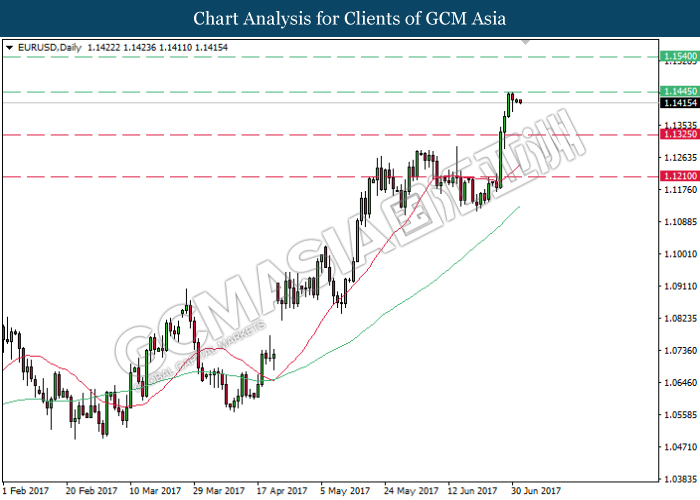

EURUSD

EURUSD, Daily: EURUSD was traded lower following a retracement from the previous high at 1.1445. It signals EURUSD to be traded lower in short-term as technical correction. Otherwise, long-term trend directions still suggest EURUSD to move further up as both moving average line continues to expand upwards.

Resistance level: 1.1445, 1.1540

Support level: 1.1325, 1.1210

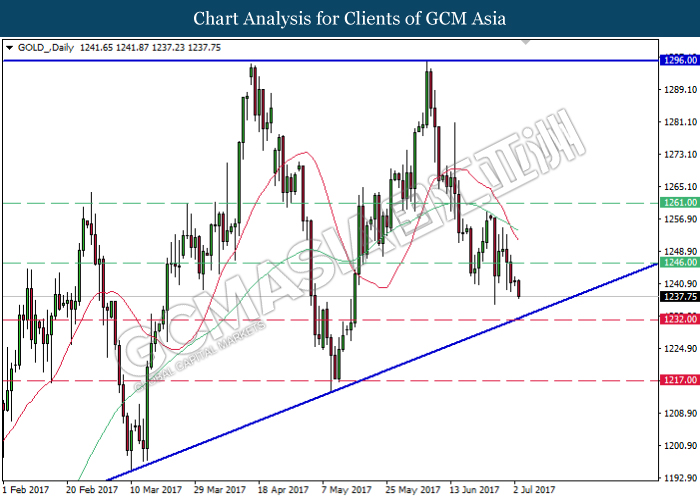

GOLD

GOLD_, Daily: Gold price extended its losses following the formation of death cross by both MA lines. Its prices are expected to advance further down, towards the bottom level of ascending triangle. Any breakout from the bottom level would signal a change in trend direction to move further downwards.

Resistance level: 1246.00, 1261.00

Support level: 1232.00, 1217.00

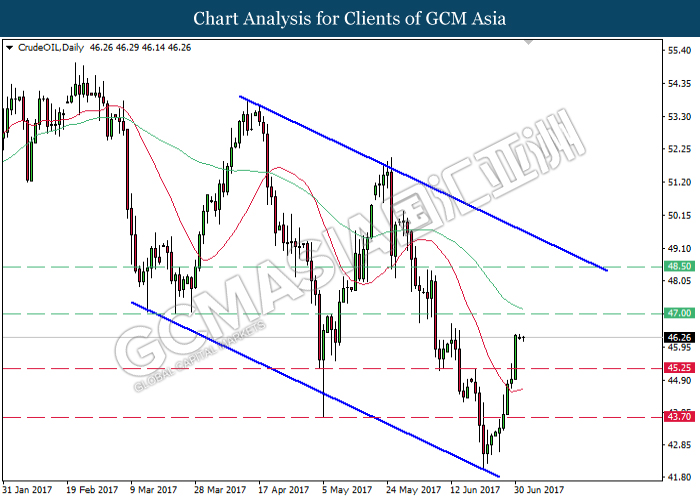

Crude Oil

CrudeOIL, Daily: Crude oil price remained traded within a downward channel following prior rebound from the bottom level. Recent closure above the 20-moving average line (red) suggests crude oil price to extend its gains towards the resistance level at 47.00.

Resistance level: 47.00, 48.50

Support level: 45.25, 43.70