24 June 2021 Afternoon Session Analysis

Pound remains resilient ahead of BoE.

The pound sterling which traded against the dollar and other currency pairs continue to hold its ground while investors await key monetary policy meeting from Bank of England (BoE). The U.K. economy continues to gather pace with inflation – at 2.1% on an annualized basis. The result is running ahead of the central bank’s target, but BoE is likely to point to temporary factors boosting inflation and ongoing uncertainty in its outlook for the economy as reasons to keep monetary policy on autopilot. On the other hand, U.K Prime Minister Boris Johnson stated that the U.K will ease social restriction on July 19 as planned due to high vaccination levels from U.K citizens and the number of deaths remain at low level. At the time of writing, GBP/USD rose 0.03% to 1.3958.

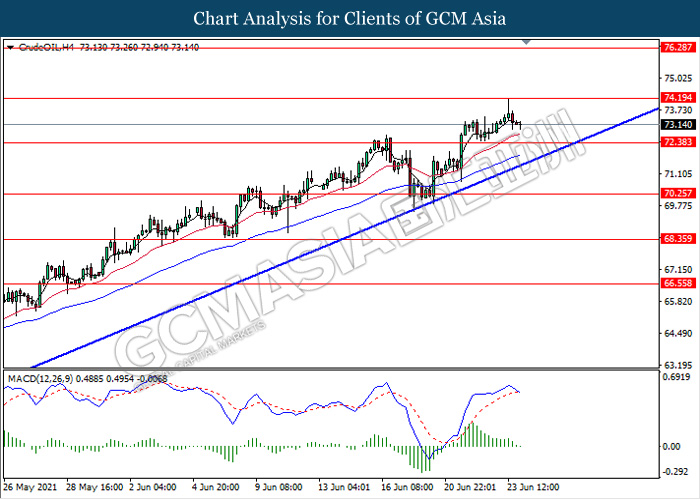

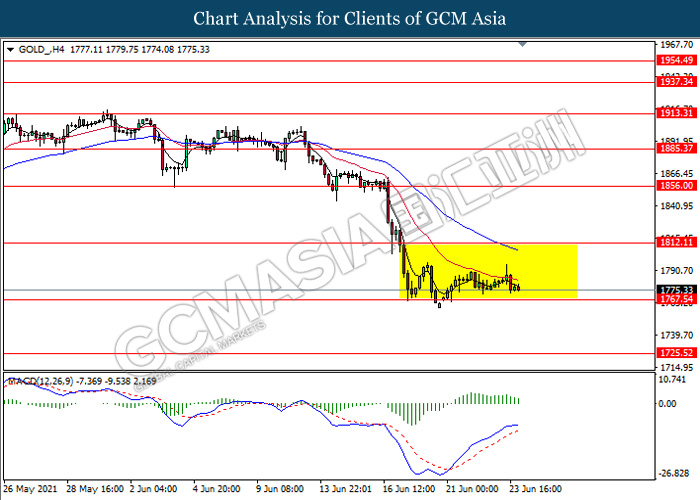

In the commodities market, crude oil price rose 0.11% to $73.12 per barrel at the time of writing following prospect of solid oil demand. Following latest development, demand recovery has accelerated as vaccination are rolled out worldwide, boosting fuel consumption and helping to drain stockpiles that were built up during the height of the pandemic. On the other hand, gold price slips 0.20% to 1775.15 a troy ounce at the of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Jun) | 99.2 | 100.1 | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 0.10% | 0.10% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (May) | 1.00% | 0.70% | – |

| 20:30 | USD – GDP (QoQ) (Q1) | 6.40% | 6.40% | – |

| 20:30 | USD – Initial Jobless Claims | 412K | 380K | – |

Technical Analysis

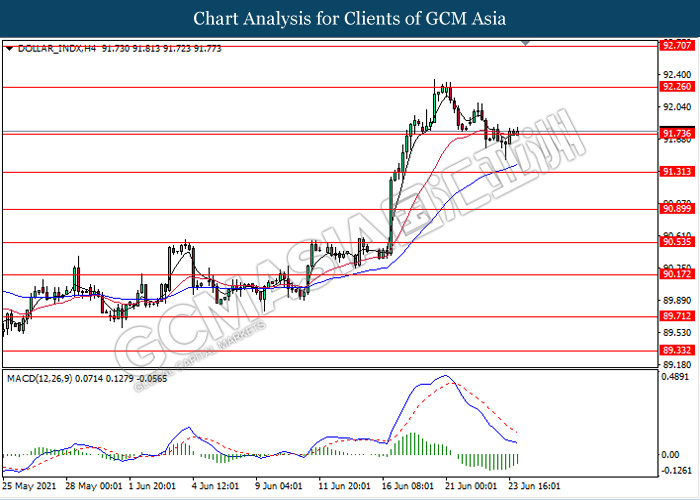

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level 91.75. MACD which display diminishing bearish momentum signal suggest the dollar to extend its gains after it breaks above the resistance level.

Resistance level: 91.75, 92.25

Support level: 91.30, 90.90

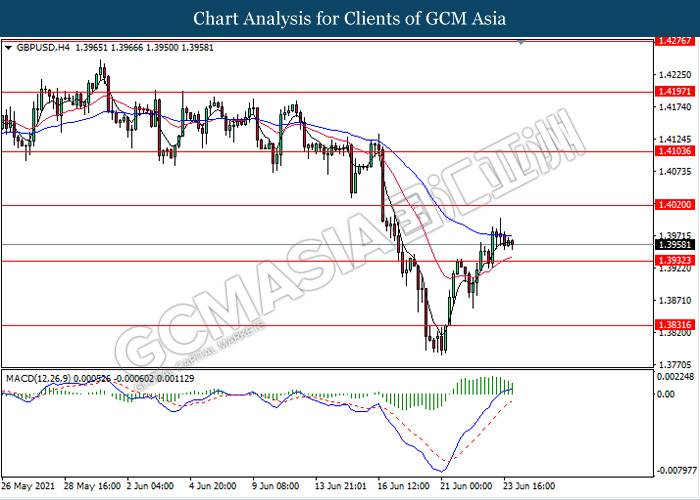

GBPUSD, H4: GBPUSD was traded lower following prior retracement from its high level. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 1.3930.

Resistance level: 1.4020, 1.4105

Support level: 1.3930, 1.3830

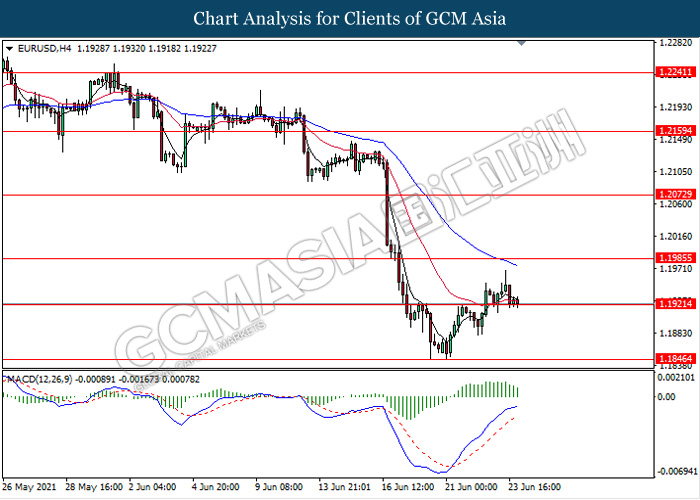

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.1920. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1985, 1.2070

Support level: 1.1920, 1.1845

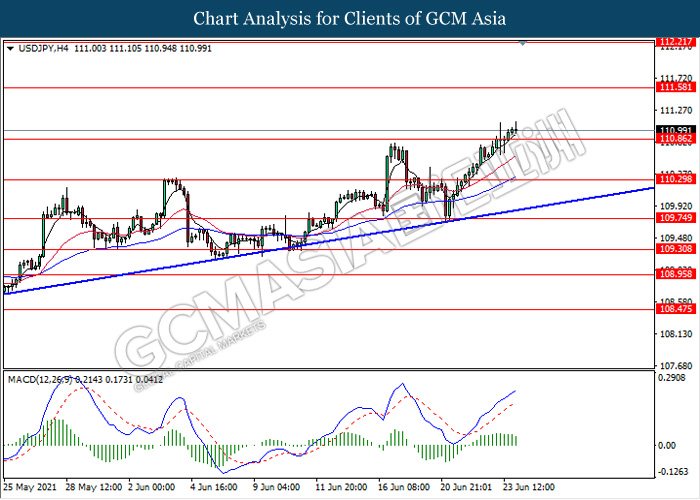

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level 110.85. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a short-term technical correction back towards the level 110.85.

Resistance level: 111.60, 112.20

Support level: 110.85, 110.30

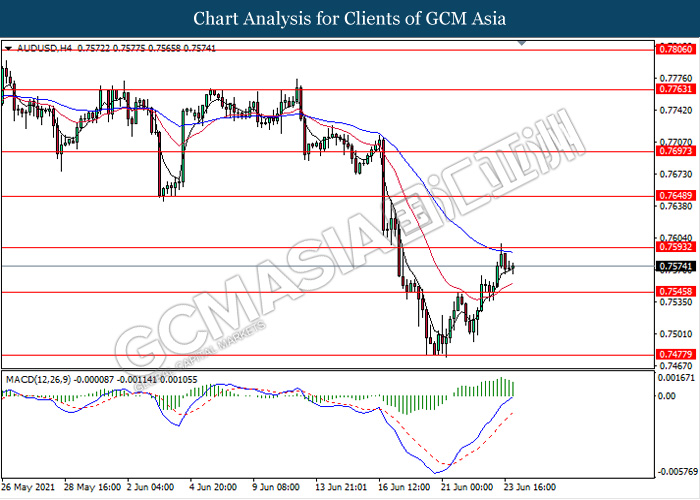

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7595. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 0.7545.

Resistance level: 0.7595, 0.7650

Support level: 0.7545, 0.7475

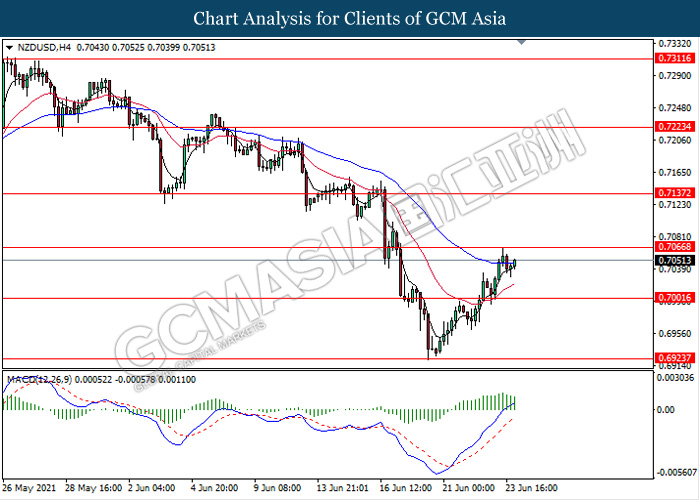

NZDUSD, H4: NZDUSD was traded higher while currently testing near the resistance level 0.7065. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction towards the support level 0.7000.

Resistance level: 0.7065, 0.7135

Support level: 0.7000, 0.6925

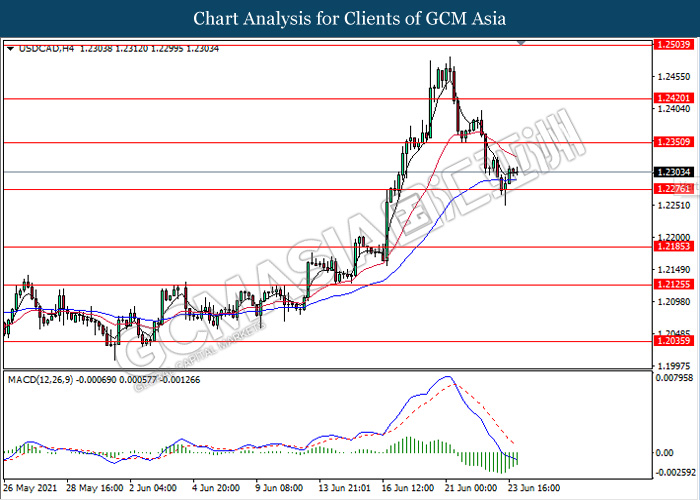

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level 1.2275. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 1.2350.

Resistance level: 1.2350, 1.2420

Support level: 1.2275, 1.2185

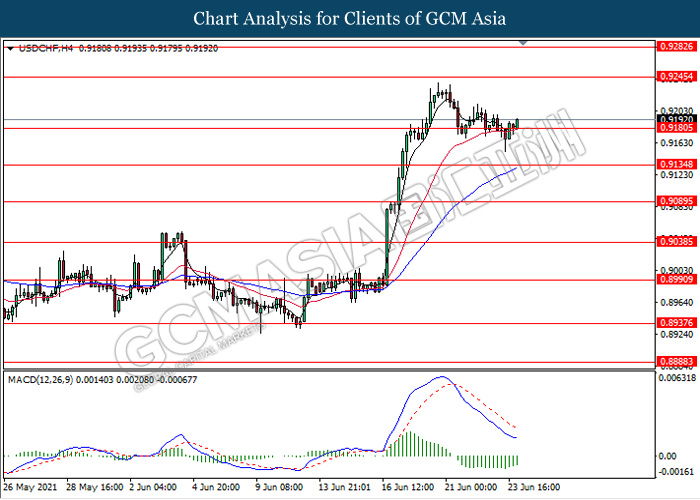

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level 0.9180. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 0.9245.

Resistance level: 0.9245, 0.9280

Support level: 0.9180, 0.9135

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level 74.20. MACD which illustrate diminishing bullish momentum signal suggest the commodity to extend its retracement towards the support level 72.40.

Resistance level: 74.20, 76.30

Support level: 72.40, 70.25

GOLD_, H4: Gold price remain traded flat in a sideway channel while currently testing near the support level 1767.55. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to be traded lower after it breaks below the support level.

Resistance level: 1812.10, 1856.00

Support level: 1767.55, 1725.50