10 July 2017 Weekly Analysis

GCMAsia Weekly Report: July 10 – 14

Market Review (Forex): July 3 – 7

U.S. Dollar

Greenback rose against other major peers on Friday after data showed that US economy has generated jobs at a robust pace last month, supporting the expectation for a third rate hike by Federal Reserve later this year. The dollar index was up 0.21% to 95.78 during late Friday trading.

According to the US Labor Department, the economy added 222,000 jobs for the month of June, higher than expected reading of 179,000. Likewise, figures for April and May was revised to show an additional of 47,000 jobs were created than previously reported.

However, unemployment rate ticked up to 4.4% from a 16-year low of 4.3% in May as more people looked for work, a sign of confidence in the labor market. Likewise, wage growth remained tepid, with annual wage inflation rate of only 2.5% as compared to forecast of 2.6%.

Overall, the rapid pace of jobs growth reassured investors that the economy is on a strong note to justify the Fed’s plan to raise interest rates once more by year end.

US Nonfarm Payrolls

—– Forecast

US economy generated 222,000 jobs last month, further underpinning investors’ sentiment for another rate hike by year end.

US Unemployment Rate

—– Forecast

Overall unemployment rate ticked up 0.1% to 4.4% last month, a tad higher than previous 16-years low of 4.3%.

USD/JPY

Pair of USD/JPY touched session low of 113.11 before rebounding to 113.90 in late trade.

EUR/USD

Euro was a tad lower against the dollar, slipping off 0.21% to $1.1398.

GBP/USD

Sterling slumped to a one-week low, with pairing of GBP/USD depreciating more than 0.61% to $1.2890.

Market Review (Commodities): July 3 – 7

GOLD

Gold prices slumped to almost four-months low on Friday following a stronger-than-expected Nonfarm Payrolls reading which boosted the demand of dollar against other major currencies. Its prices were down 0.93% to $1,211.98, its lowest close since March 15th. Typically, gold prices and dollar move in opposite fashion as stronger dollar makes the appeal of gold as alternative asset for other currency bearers more expensive to be bought. Likewise, optimistic US jobs report has increased overall sentiment for another rate hike in the United States which has further dampen gold’s appeal.

Crude Oil

Oil prices fell sharply on Friday while logging in its sixth-weekly losses for the past seven weeks due to ongoing concern over supply glut in the market. Crude oil price tumbled $1.29 or 2.9% on Friday while ended the week at around $44.23 a barrel. According to oilfield service provider Baker Hughes, US drillers has added seven oil rigs in the week to July 7th, which brings the total count up to 763.

The report came after US government data showed that total domestic crude production rose by 88,000 barrels to around 9.34 million barrels last week, underlining more concern that rising US production may derail other major producer’s effort to rebalance the market. Per se, oil ministers from five countries monitoring the production cut deal will be meeting on July 24th in Russia to discuss possibility of adjusting the deal.

Previously, OPEC and some non-OPEC members had extended a deal to cut 1.8 million barrels per day until March 2018. However, the production-cut agreement has yet to yield any impact on global inventory levels due to rising supply from non-participating countries such as Libya, Nigeria and United States.

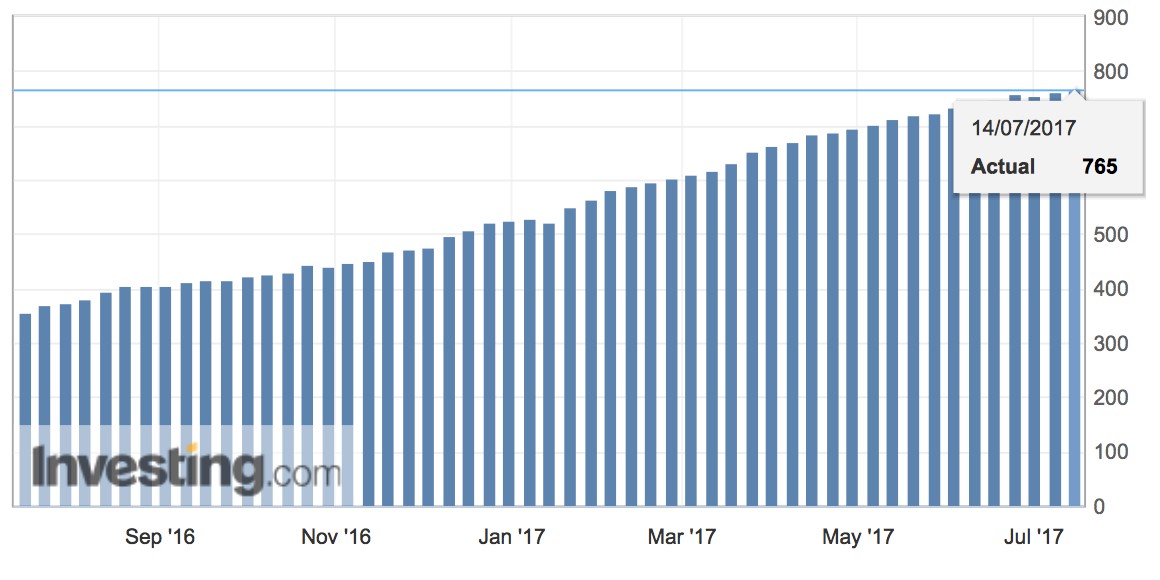

U.S. Baker Hughes Oil Rig Count

US drillers has added 7 oil rigs last week to 763 thus far.

Weekly Outlook: July 10 – 14

For the week ahead, main focus of market participants will be Fed Chair Janet Yellen’s testimony on monetary policy as well as US data on inflation and retail sales. Likewise, investors will be closely monitoring UK jobs report and Bank of Canada’s policy meeting which will be set for Wednesday.

As for oil traders, investors will keep an eye for monthly reports from Organization of the Petroleum Exporting Countries and International Energy Agency to assess global supply and demand levels. Otherwise, they will also keep an eye on fresh weekly information regarding US stockpiles of crude and refined products due this Wednesday and Thursday.

Highlighted economy data and events for the week: July 10 – 14

| Monday, July 10 |

Data CNY – CPI (YoY) (Jun) CNY – PPI (YoY) (Jun) EUR – German Trade Balance (May)

Events N/A

|

| Tuesday, July 11 |

Data AUD – NAB Business Confidence (Jun) CAD – Housing Starts (Jun) USD – JOLTs Job Openings (May)

Events GBP – BoE MPC Member Broadbent Speaks

|

| Wednesday, July 12 |

Data Crude Oil – API Weekly Crude Oil Stock GBP – Average Earnings Index +Bonus (May) GBP – Claimant Count Change (Jun) CAD – BoC Interest Rate Decision Crude Oil – Crude Oil Inventories

Events Crude Oil – OPEC Monthly Report USD – Fed Chair Yellen Testifies CAD – BoC Monetary Policy Report CAD – BoC Gov Poloz Speaks

|

| Thursday, July 13 |

Data CNY – Trade Balance (USD) (Jun) USD – Initial Jobless Claims USD – PPI (MoM) (Jun)

Events Crude Oil – IEA Monthly Report USD – Fed Chair Yellen Testifies

|

|

Friday, July 14

|

Data USD – Core CPI (MoM) (Jun) USD – Core Retail Sales (MoM) (Jun) USD – Retail Sales (MoM) (Jun) USD – Industrial Production (MoM) (Jun) USD – Michigan Consumer Sentiment (Jul) Crude Oil – U.S. Baker Hughes Oil Rig Count

Events N/A

|

Technical weekly outlook: July 10 – 14

Dollar Index

DOLLAR_INDX, Daily: Dollar index remained traded within a downward channel while recently retraced from the resistance level of 96.20. Stochastic Oscillator which begins to form a retracement signa suggests dollar index to extend its losses towards the support level of 95.15.

Resistance level: 96.20, 97.50

Support level: 95.15, 94.00

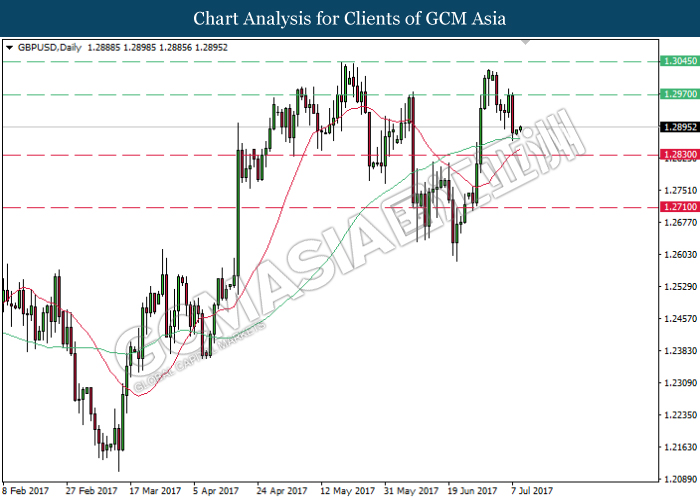

GBPUSD

GBPUSD, Daily: GBPUSD were traded higher following prior rebound from the 60-moving average line (green). Both MA lines which continues to narrow upwards suggests GBPUSD to extend its gains towards the target of resistance level at 1.2970.

Resistance level: 1.2970, 1.3045

Support level: 1.2830, 1.2710

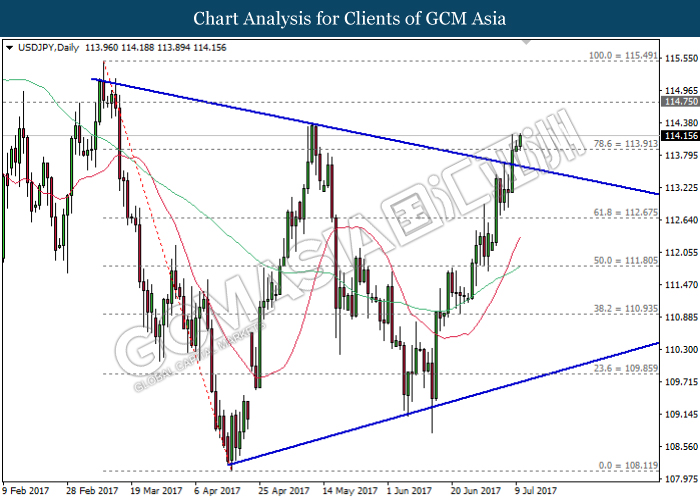

USDJPY

USDJPY, Daily: USDJPY has recently broke out from the top level of narrowing triangle, signaling a change in trend direction to move further upwards. Both MA line which continues to expand further up suggest USDJPY to advance towards the next target at 114.75.

Resistance level: 114.75, 115.50

Support level: 113.90, 112.70

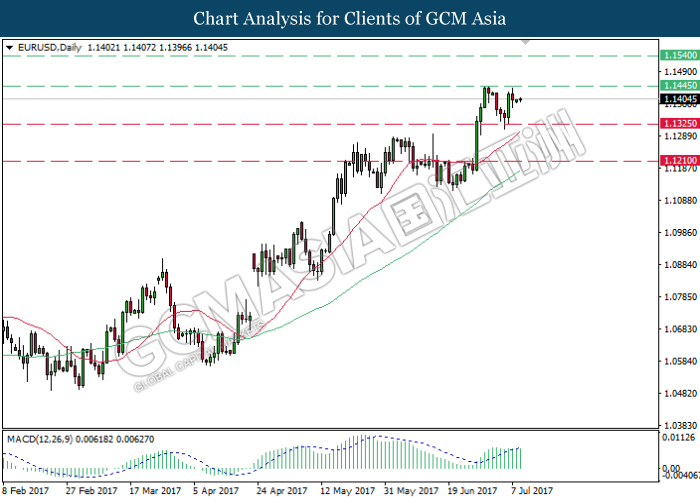

EURUSD

EURUSD, Daily: EURUSD remained traded within a range of 1.1325 and 1.1445 following prior retrace from the top level. MACD which continues to drift outside of upward momentum suggests EURUSD to oscillate within the trading range in short-term. Long-term trend direction could only be determined after a successful breakout from either side of the trading range.

Resistance level: 1.1445, 1.1540

Support level: 1.1325, 1.1210

GOLD

GOLD_, Daily: Gold price has extended its losses following prior breakout from the bottom level of ascending triangle. Both MA lines which continues to expand downwards suggests further downward bias for gold price to extend its losses towards the target of support level at 1200.00.

Resistance level: 1217.00, 1232.00

Support level: 1200.00, 1180.00

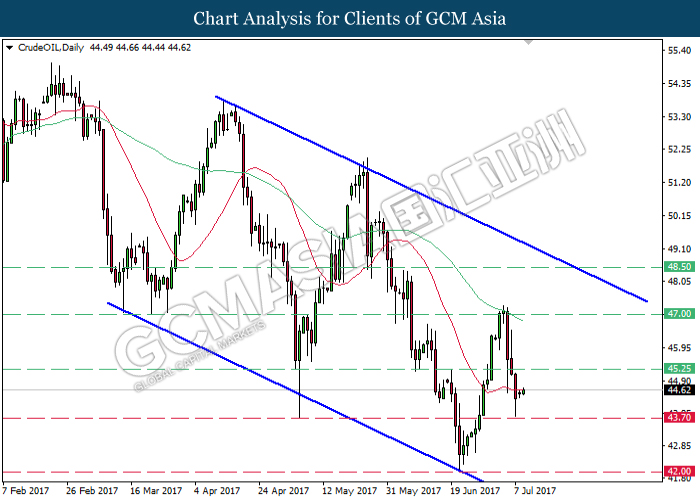

Crude Oil

CrudeOIL, Daily: Crude oil price remained traded within a downward channel while recently rebounded from the support level of 43.70. A closure above the 20-moving average line (red) would suggest crude oil price to extend its retracement towards the resistance level of 45.25.

Resistance level: 45.25, 47.00, 48.50

Support level: 43.70, 42.00