31 July 2017 Weekly Analysis

GCMAsia Weekly Report: July 31 – August 4

Market Review (Forex): July 24 – 28

U.S. Dollar

Greenback extended its losses against other major peers on Friday following the release of economic data which portrays mixed signals to investors. The dollar index was down 0.61% to 93.20, its lowest close since June 22nd, 2016. The index has pared its gains around 2.3% for the month and was down for 9% for the year thus far.

According to the US Commerce Department, gross domestic product for second quarter increased within an expected reading of 2.6%. However, previous quarter reading was readjusted to show only a mild growth of 1.2% from 1.6%. In a separate report, wage growth and inflation remained tepid in the second quarter, doubling down investor’s sentiment towards US economy.

The US Labor Department reported that wages and salaries increased at a rate of 0.5% for the second quarter, after accelerating 0.8% in the first quarter. Likewise, Personal Consumption Expenditures (PCE) which is the Fed’s preferred inflation gauge increased only at 0.9%. It was the slowest pace over the course of two years. Subdued inflation outlook has raised doubts over the ability of the US Federal Reserve to following through its plan for a third rate hike by the end of the year.

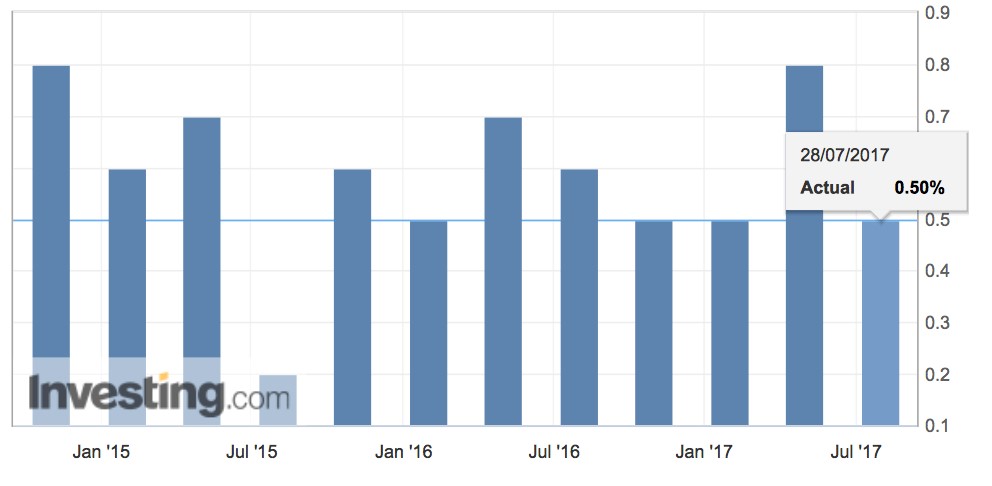

US Gross Domestic Product

—– Forecast

US Gross Domestic Product was well within economist expectation of 2.6% for the second quarter.

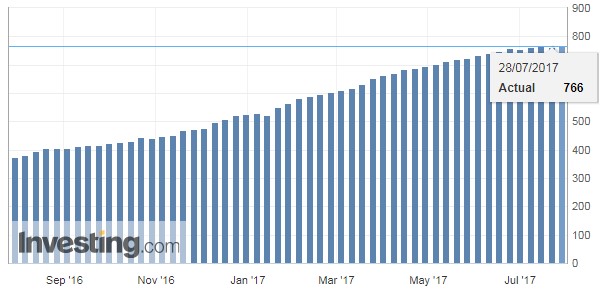

US Employment Wages

US employment wages rose at a mild rate of 0.5% for the second quarter, as compared to 0.8% during the first quarter.

USD/JPY

USD/JPY sheds its prior gains and was down by 0.5% to six-weeks low of 110.68.

EUR/USD

Euro rose 0.63% to $1.1749, not far from two and a half years high of $1.1755 against the greenback. The single common currency has risen 2.84% within this month while recording an appreciation of 11% for the year, deeming it as the best performing major currency against the dollar.

GBP/USD

Pound sterling rose 0.54% to $1.3135 against the US dollar during late Friday trading.

Market Review (Commodities): July 24 – 28

GOLD

Gold prices rose on Friday following sluggish inflation data which has tempered investors sentiment for US Federal Reserve in raising its interest rates again this year, further supporting the demand for the metal. Price of the yellow metal closed at 0.74% higher at $1,269.34 while recording its third consecutive weekly gain of 1.08%. The dollar was broadly weakened by data which shows signs of sluggishness in both wage and inflation growth, which has triggered a sell-off on the currency. A weaker dollar will boost the appeal of gold which are denominated in the US currency. Likewise, the metal has received additional boost following rising tension between United States and North Korea.

Crude Oil

Crude oil price settled higher for its fifth consecutive session on Friday while logging in its biggest weekly gain following signs of rising demand that could offset excess supply in the market. Its prices rose 67 cents or 1.4% while ended the week at $49.71 a barrel. For the week, it has gained $3.94 or around 8.5%, seemingly large gain since last December as Saudi Arabia and Nigeria pledged to potentially reduce their crude exports and outputs.

Data from American Petroleum Institute and Energy Information Administration shows a fourth consecutive decline in US crude inventories which signals a possible slowdown in US shale production has added further optimism towards the rebalancing of oil market. On the other hand, energy services company Baker Hughes reported that the number of active drilling rig was increased by 2 to 766 last week, suggesting early signs of slowdown in domestic production growth.

Previously, OPEC and some non-OPEC members had extended a deal to cut 1.8 million barrels per day until March 2018. However, the production-cut agreement has yet to yield any impact on global inventory levels due to rising supply from non-participating countries such as Libya, Nigeria and United States.

U.S. Baker Hughes Oil Rig Count

Active drilling rigs was up by 2 and total count thus far remains at three-years high of 766.

Weekly Outlook: July 31 – August 4

For the week ahead, investors will be focusing on Friday’s highly anticipated US jobs report for further indication on the possible policy direction that would be adopted by US Federal Reserve. Central bank meetings in the UK and Australia will also be focused while euro zone is set to release their preliminary data on inflation and second quarter growth.

Otherwise, oil traders will be eyeing fresh information regarding US stockpiles to gauge the strength of demand in the world’s largest oil consumer. Sidelined are the comments from global oil producers which may hint their compliance with prior agreement to reduce or freeze their production levels.

Highlighted economy data and events for the week: July 31 – August 4

| Monday, July 31 |

Data CNY – Manufacturing PMI (Jul) NZD – ANZ Business Confidence (Jul) EUR – German Retail Sales (YoY) (Jun) EUR – CPI (YoY) (Jul) GBP – Net Lending to Individuals USD – Chicago PMI (Jul) USD – Pending Home Sales (MoM) (Jun)

Events N/A

|

| Tuesday, August 1 |

Data CNY – Caixin Manufacturing PMI (Jul) AUD – RBA Interest Rate Decision (Aug) EUR – German Manufacturing PMI (Jul) EUR – German Unemployment Change (Jul) GBP – Manufacturing PMI (Jul) USD – ISM Manufacturing PMI (Jul)

Events AUD – RBA Rate Statement

|

| Wednesday, August 2 |

Data Crude Oil – API Weekly Crude Oil Stock NZD – Employment Change (QoQ) (Q2) AUD – Building Approvals (MoM) (Jun) GBP – Construction PMI (Jul) USD – ADP Nonfarm Employment Change (Jul) Crude Oil – Crude Oil Inventories

Events N/A

|

| Thursday, August 3 |

Data AUD – Trade Balance (Jun) GBP – Services PMI (Jul) GBP – BoE Interest Rate Decision (Jul) USD – Initial Jobless Claims USD – Factory Orders (MoM) (Jun) USD – ISM Non-Manufacturing PMI (Jul)

Events GBP – BoE Inflation Report GBP – BoE MPC Meeting Minutes GBP – BoE Gov Carney Speaks

|

|

Friday, August 4

|

Data AUD – Retail Sales (MoM) (Jun) USD – Average Hourly Earnings (MoM) (Jul) USD – Nonfarm Payrolls (Jul) USD – Unemployment Rate (Jul) CAD – Employment Change (Jul) CAD – Ivey PMI (Jul) Crude Oil – U.S. Baker Hughes Oil Rig Count

Events AUD – RBA Monetary Policy Statement

|

Technical weekly outlook: July 31 – August 4

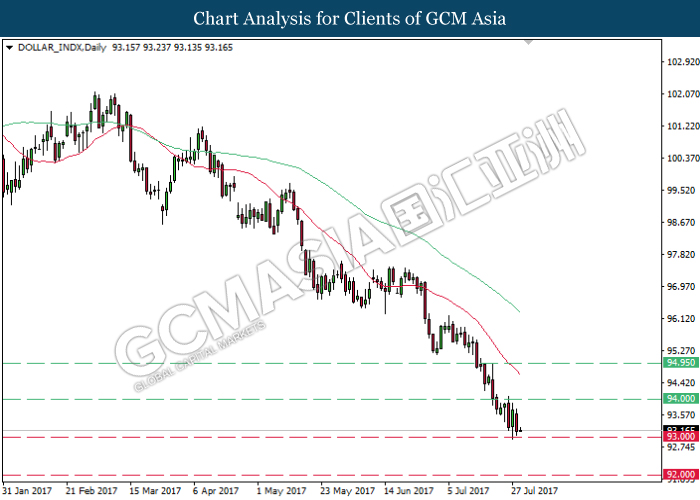

Dollar Index

DOLLAR_INDX, Daily: Dollar index extended its losses following prior retracement from the resistance level near 94.00. Both MA lines which continues to expand downwards suggests dollar index to advance further down after successfully closing below the support level of 93.00.

Resistance level: 94.00, 94.95

Support level: 93.00, 92.00

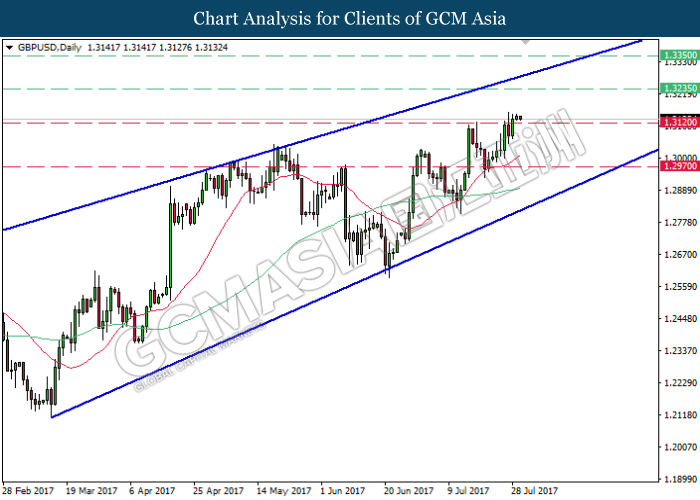

GBPUSD

GBPUSD, Daily: GBPUSD was traded within a rising wedge following prior rebound from the 20-MA line (red). Recent closure above the resistance level of 1.3120 suggests further upside bias to advance towards the next target at 1.3235.

Resistance level: 1.3235, 1.3350

Support level: 1.3120, 1.2970

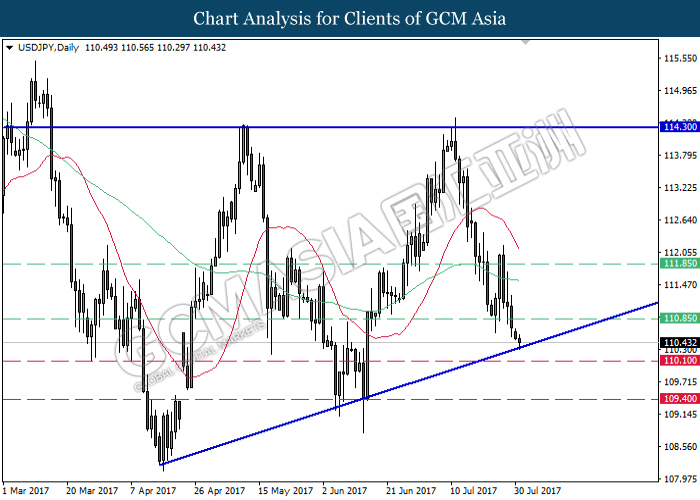

USDJPY

USDJPY, Daily: USDJPY was traded lower following prior closure below the strong support level of 110.85. Both MA lines which continues to narrow downwards suggests possibility for a breakout to occur at the bottom level of ascending triangle and signal a change in trend direction. Next target will be at 110.10.

Resistance level: 110.85, 111.85, 114.30

Support level: 110.10, 109.40

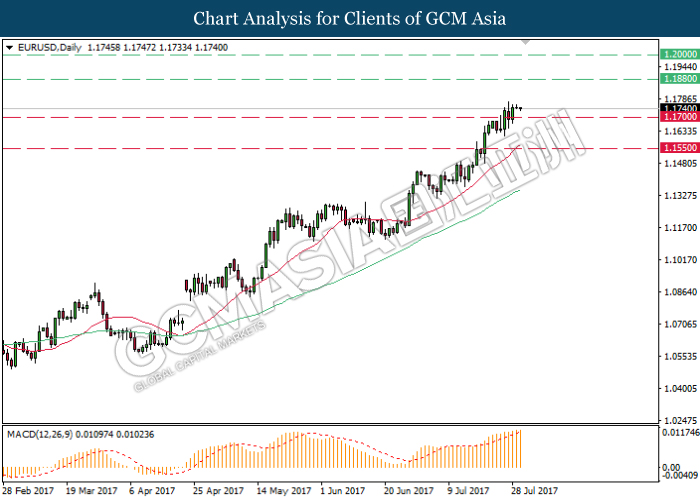

EURUSD

EURUSD, Daily: EURUSD extended its uptrend following prior closure above the strong resistance level at 1.1700. MACD which illustrates a substantial increase in upward momentum suggests further upside bias for EURUSD to extend towards 1.1880.

Resistance level: 1.1880, 1.2000

Support level: 1.1700, 1.1550

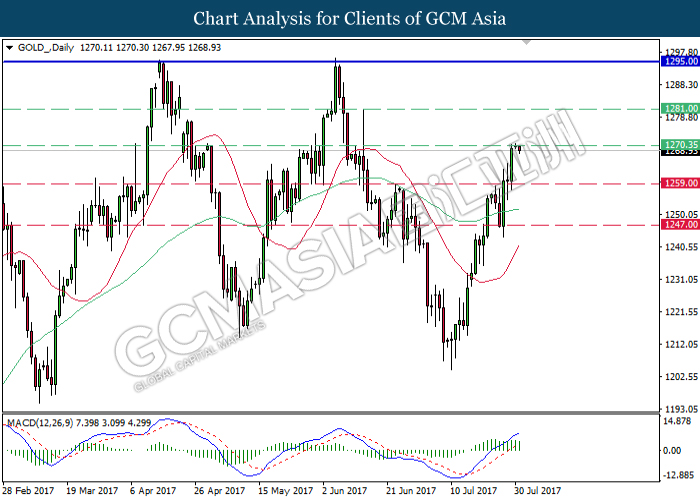

GOLD

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level of 1247.00. MACD histogram which illustrates substantial upward signal suggests gold price to extend its uptrend after closing above the resistance level of 1270.35.

Resistance level: 1270.35, 1281.00, 1295.00

Support level: 1259.00, 1247.00

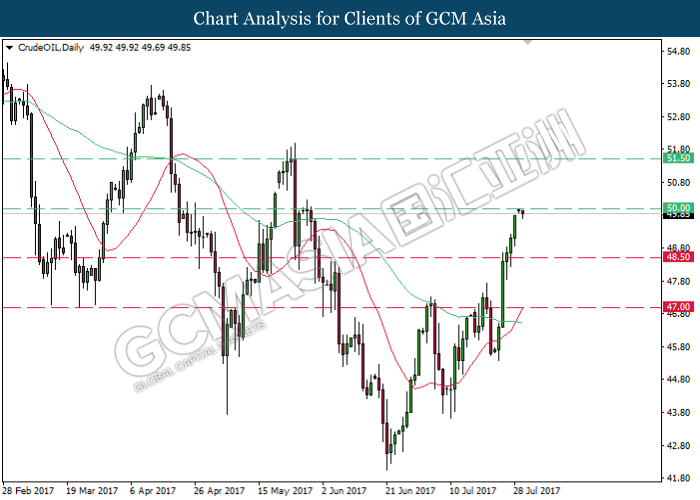

Crude Oil

CrudeOIL, Daily: Crude oil price advanced further upwards following prior formation of golden cross by both MA lines. A successful closure above the psychological level of 50.00 would suggest an extension of upward momentum towards the next target at 51.50.

Resistance level: 50.00, 51.50

Support level: 48.50, 47.00