14 August 2017 Weekly Analysis

GCMAsia Weekly Report: August 14 – 18

Market Review (Forex): August 7 – 11

U.S. Dollar

Greenback slipped against other major peers on Friday following a weaker-than-expected US inflation data that has dial down market’s expectations for a third interest rate hike by the Federal Reserve this year. The dollar index sheds 0.33% to 92.99 as of late Friday while recording weekly loss of 0.49%.

According to the Labor Department, US consumer prices edged up 0.1% in July, below economist forecast of 0.2%. Consumer prices were up 1.7% on a year-over-year basis from 1.6% in June. The softer inflationary pressure may force the Fed to adopt a more cautious stance before raising their interest rates by year end. According to the Fed Rate Monitor Tool, futures traders are pricing in at 35% chance for a rate hike in December.

US Inflation Rate (MoM)

—– Forecast

US inflation rate for July came in at 0.1%, underscored expected reading of 0.2%.

US Inflation Rate

—– Forecast

As for year-over-year comparison, US inflation was a tad higher with 1.7% for the month of July as compared to previous with only 1.6%.

USD/JPY

Pair of USD/JPY ended flat at 109.19, not far from 16-weeks low following heightened tension between the US and North Korea.

EUR/USD

Euro rose 0.42% to $1.1821 against the greenback after Morgan Stanley raised its forecast for the currency to reach 1.25 threshold by early next year.

GBP/USD

Great British Pound appreciates by 0.24% to $1.3008 during late Friday trading.

Market Review (Commodities): August 7 – 11

GOLD

Gold price peaks at two-months high on Friday following a weaker-than-expected US inflation report while coupled with rising tensions between United States and North Korea. Price of the yellow metal settled up 0.38% while ended the week at $1,295.00, its highest close since June 6th.

Investors flock to safe-haven assets such as Yen, Swiss Franc and gold earlier this week after Pyongyang stated that they will develop a plan by mid-August to launch an intermediate-range missile towards US territory in Guam. In retaliation, US President Donald Trump warned North Korea that any threat towards the United States would be met with “fire and fury”. Meanwhile, the demand for precious metal was further supported following Friday’s depreciation on the greenback.

Crude Oil

Oil prices inches further up on Friday albeit recording a weekly loss due to lingering concerns over a global supply glut. Apart from that, investors are also closely monitoring the developments between the US and North Korea which may hinder investor’s appeal for risky assets over higher perceived risk in the financial market. Crude oil price ended the week with 23 cents or 0.5% lower at $48.82, not far from two-and-a-half weeks’ low of $47.98.

According to a report released by the International Energy Agency, OPEC compliance with the daily output cut deal has fallen to 75% last month, its lowest since the deal was initiated in January. The bearish compliance report came a day after OPEC released its monthly report, showing a rise in production from the cartel during the month of July with gains lead by both Libya and Nigeria whom are exempted from the deal.

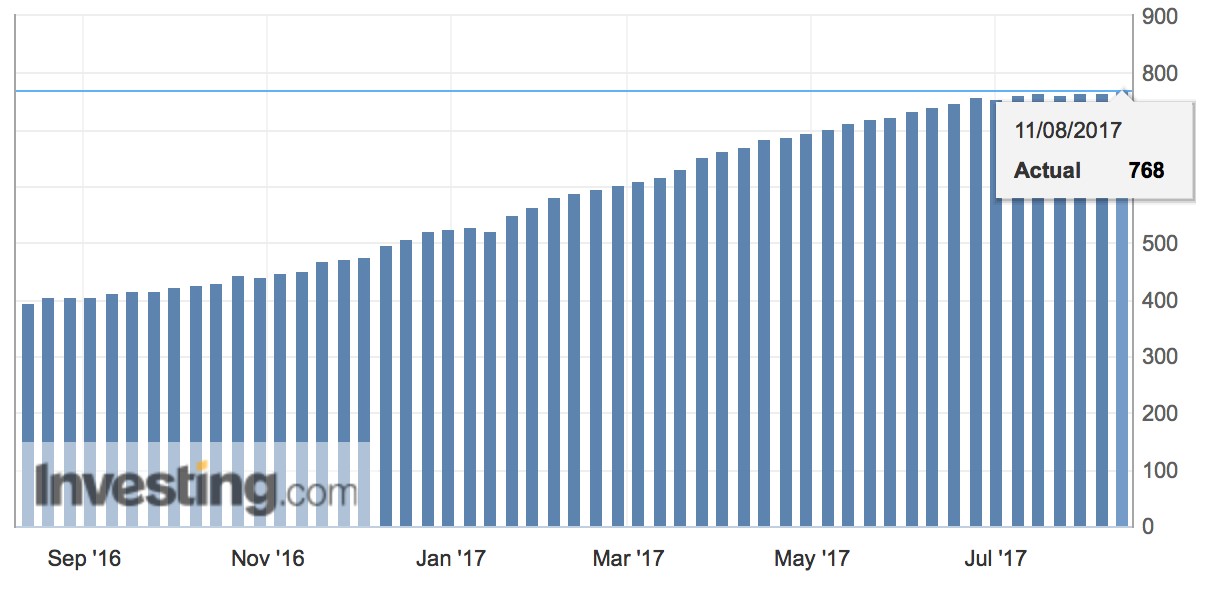

Otherwise, US oilfield services firm Baker Hughes reported on Friday that weekly count of oil rigs was up by 3 and the total count ticked up to 768 last week. A rebound in oil drilling activity in the US added further pressure over the oil price amid rising output from the United States.

U.S. Baker Hughes Oil Rig Count

Active drilling rigs in the United States was up by 3 and the total count is currently at 768.

Weekly Outlook: August 14 – 18

For the week, investors will be focusing on Wednesday’s Federal Reserve meeting minutes for further hints regarding the next interest rate hike. Sidelined are a report on US retail sales which could gauge consumer spending level as inflationary pressure remained subdued. Elsewhere, UK data on inflation and employment will be in focus as well amid ongoing concerns over the possible economic fallout due to Brexit.

In the oil market, investors will be eyeing fresh information on US crude stockpiles on Tuesday and Wednesday to gauge the strength of demand in the world’s largest oil consumer. Likewise, traders will also pay close attention to comments from global oil producers over their compliance towards the oil cut deal.

Highlighted economy data and events for the week: August 14 – 18

| Monday, August 14 |

Data NZD – Core Retail Sales (QoQ) NZD – Retail Sales (QoQ) (Q2) JPY – GDP (QoQ) (Q2) CNY – Fixed Asset Investment (YoY) (Jul) CNY – Industrial Production (YoY) (Jul)

Events N/A

|

| Tuesday, August 15 |

Data EUR – German GDP (QoQ) (Q2) CHF – PPI (MoM) (Jul) GBP – CPI (YoY) (Jul) USD – Core Retail Sales (MoM) (Jul) USD – Retail Sales (MoM) (Jul) USD – NY Empire State Manufacturing Index (Aug)

Events AUD – RBA Meeting Minutes

|

| Wednesday, August 16 |

Data CrudeOIL – API Weekly Crude Oil Stock GBP – Average Earnings Index +Bonus (Jun) GBP – Claimant Count Change (Jul) EUR – GDP (QoQ) (Q2) USD – Building Permits (Jul) USD – Housing Starts (Jul) CrudeOIL – Crude Oil Inventories

Events USD – FOMC Meeting Minutes

|

| Thursday, August 17 |

Data AUD – Employment Change (Jul) GBP – Retail Sales (MoM) (Jul) EUR – CPI (YoY) (Jul) USD – Initial Jobless Claims USD – Philadelphia Fed Manufacturing Index (Aug)

Events EUR – ECB Publishes Account of Monetary Policy Meeting USD – FOMC Member Kaplan Speaks

|

|

Friday, August 18

|

Data CAD – Core CPI (MoM) (Jul) USD – Michigan Consumer Sentiment (Aug) CrudeOIL – US Baker Hughes Oil Rig Count

Events N/A

|

Technical weekly outlook: August 14 – 18

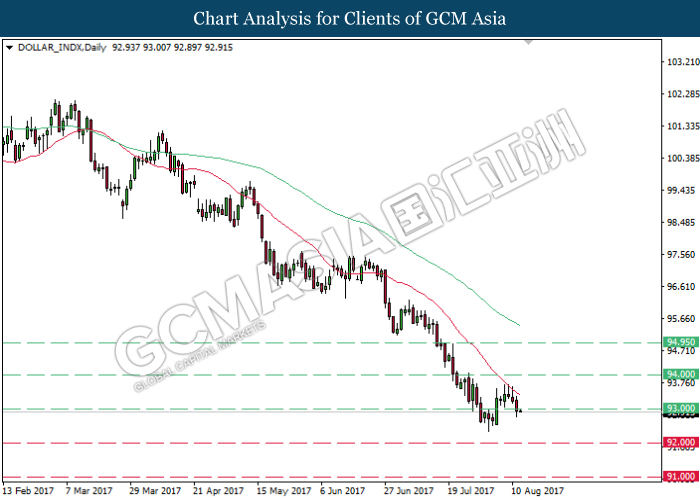

Dollar Index

DOLLAR_INDX, Daily: Dollar index extended its back leg following prior retracement from the 20-MA (red). Recent closure below the threshold of 93.00 suggests the dollar index to advance further down, towards the target of support level 92.00.

Resistance level: 93.00, 94.00, 94.95

Support level: 92.00, 91.00

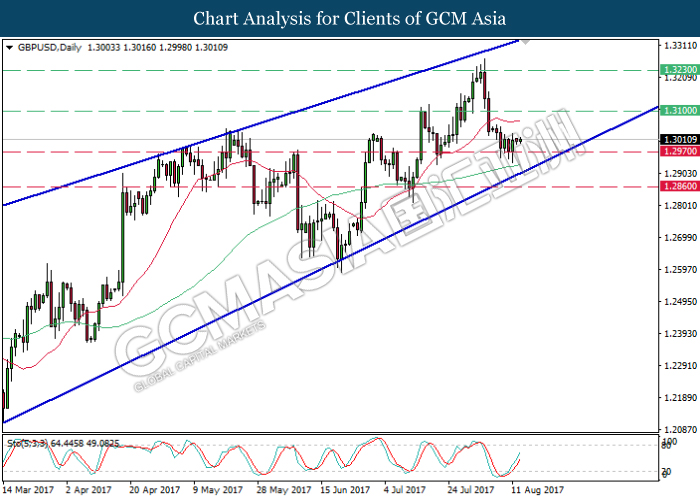

GBPUSD

GBPUSD, Daily: GBPUSD continues to be traded within a rising wedge while recently rebounded from the support level of 1.2970. Stochastic Oscillator which illustrates rebound signal from the oversold region suggests further upward bias for GBPUSD, towards the target of resistance level at 1.3100.

Resistance level: 1.3100, 1.3230

Support level: 1.2970, 1.2860

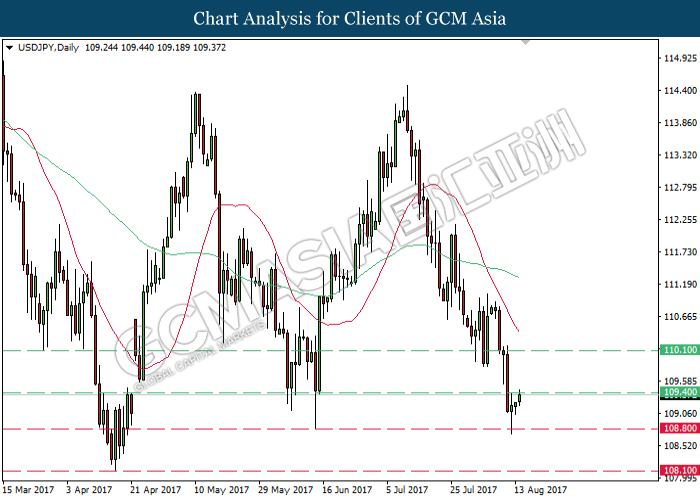

USDJPY

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level of 108.80. Such price movement suggests short-term upward bias for USDJPY and its first target is at 109.40. Otherwise, long-term trend direction suggests USDJPY to extend its downward momentum as both MA line continues to expand downwards.

Resistance level: 109.40, 110.10

Support level: 108.80, 108.10

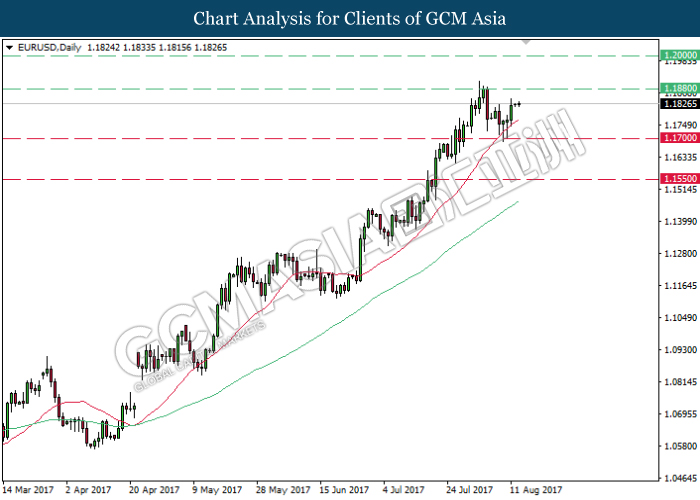

EURUSD

EURUSD, Daily: EURUSD pared its prior losses following a rebound from the 20-MA line (red). Both lines which continues to expand upwards suggest EURUSD to advance further up and retest at the strong resistance level of 1.1880.

Resistance level: 1.1880, 1.2000

Support level: 1.1700, 1.1550

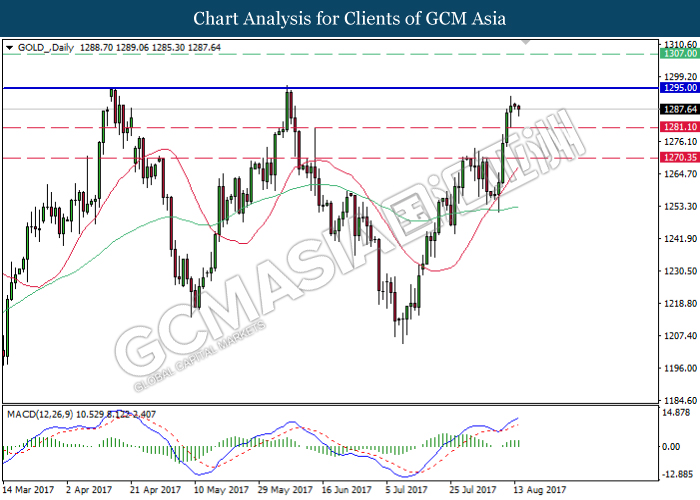

GOLD

GOLD_, Daily: Gold price halts its ascend following prior retracement before the resistance level of 1295.00. The price movement suggests gold price to be traded lower in short-term as technical correction towards the direction of support level at 1281.10. Otherwise, long-term trend direction still remains as upside bias while both MA lines continues to expand further up.

Resistance level: 1295.00, 1307.00

Support level: 1281.10, 1270.35

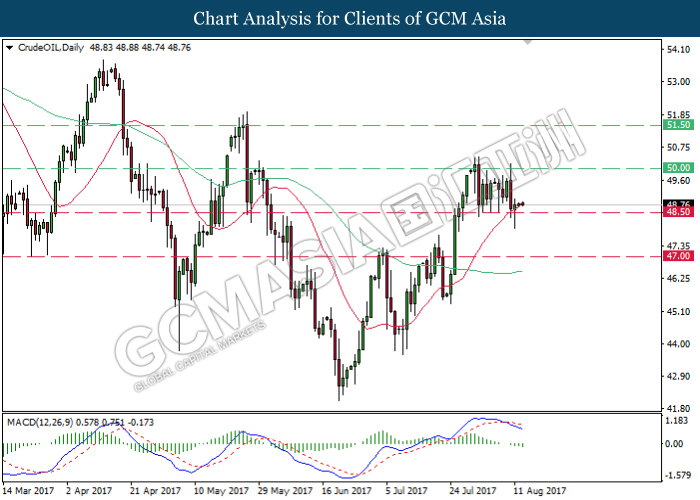

Crude Oil

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the strong resistance level of 50.00. MACD histogram which begins to illustrate negative divergence signal suggests crude oil price to extend its losses after closing below the support level of 48.50.

Resistance level: 50.00, 51.50

Support level: 48.50, 47.00