23 November 2021 Afternoon Session Analysis

Euro fell amid Covid fears.

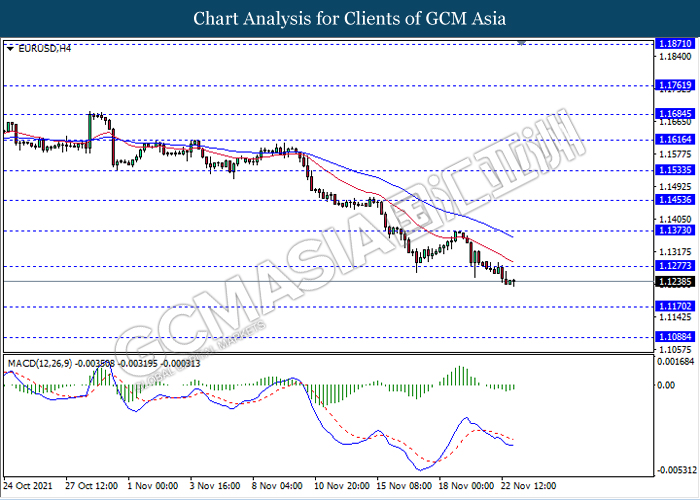

The Euro which traded against the dollar and other currency pairs remain pressured and plunge as the pandemic continue to worsen in the Eurozone especially in Germany. Following latest data from Robert Koch health agency, Germany added another 30,643 cases on Monday. According to reports from Reuters, Germany Chancellor Angela Merkel stated that the coronavirus situation in Germany is worse than anything they have seen so far. She added that tougher restrictions are required. The move could add more reason for ECB to remain dovish and continue to loosen its policy in order to support the economy. Some members are calling for the PEPP QE program to be extended in March, given that the emergency phase of the pandemic will not yet be deemed over. At the time of writing, EUR/USD fell 0.06% to 1.1235.

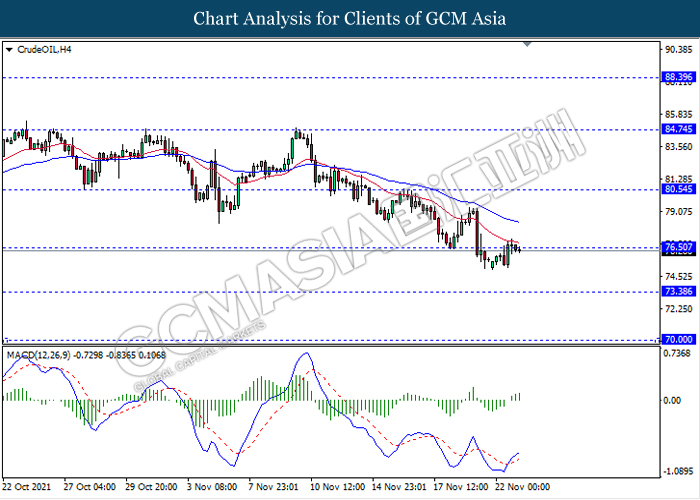

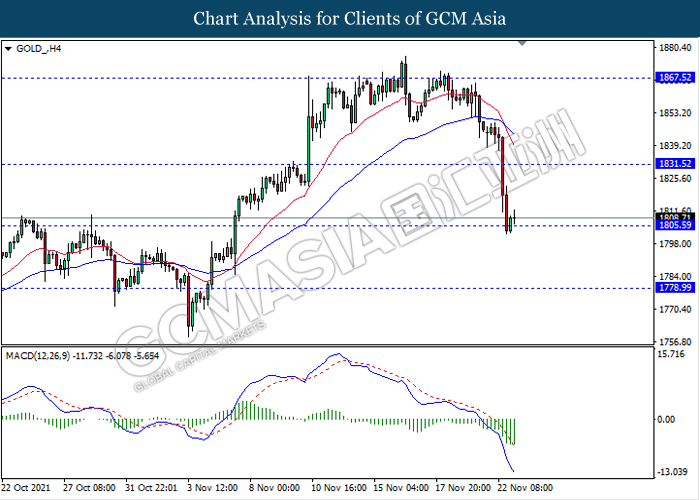

In the commodities market, crude oil price rebound 0.07% to $76.29 per barrel as of writing following reports of OPEC could alter output plans. According to reports from Bloomberg, OPEC+ adjust plans to raise oil production if large consuming countries release crude from their reserves or if the coronavirus pandemic dampens demand. On the other hand, gold price fell 0.16% to $1808.96 a troy ounce at the time of writing amid dollar strength.

Today’s Holiday Market Close

Time Market Event

All Day JPY Public Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q3) | 1.90% | 2.2% | – |

| 16:30 | EUR – German Manufacturing PMI (Nov) | 57.8 | 56.9 | – |

| 17:30 | GBP – Composite PMI (Oct) | 54.1 | 54.1 | – |

| 17:30 | GBP – Manufacturing PMI (Oct) | 56.3 | 56.3 | – |

| 17:30 | GBP – Services PMI (Oct) | 54.6 | 54.6 | – |

Technical Analysis

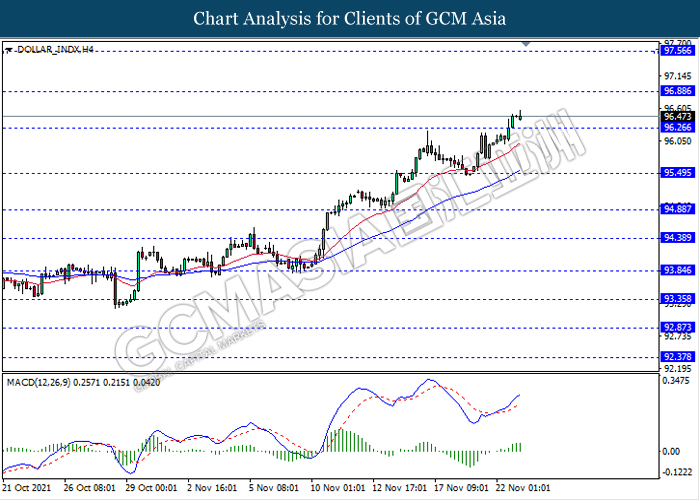

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level 96.25. MACD which illustrate bullish momentum signal suggest the dollar to extend its gains towards the resistance level 96.90.

Resistance level: 96.90, 97.55

Support level: 96.25, 95.50

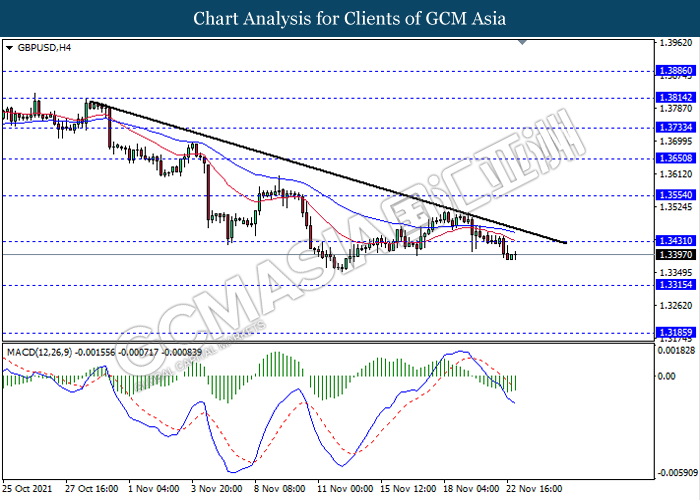

GBPUSD, H4: GBPUSD was traded lower following recent breakout below the previous support level 1.3430. MACD which illustrate bearish bias signal suggest the pair to extend its losses towards the support level 1.3315.

Resistance level: 1.3430, 1.3555

Support level: 1.3315, 1.3185

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level 1.1275. MACD which illustrate bearish bias signal suggest the pair to extend its losses towards the support level 1.1170.

Resistance level: 1.1275, 1.1375

Support level: 1.1170, 1.1010

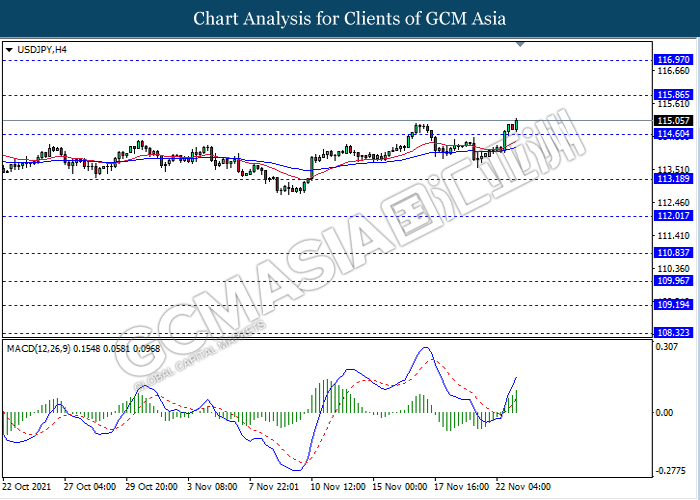

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level 114.60. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 115.85.

Resistance level: 115.85, 116.95

Support level: 114.60, 113.20

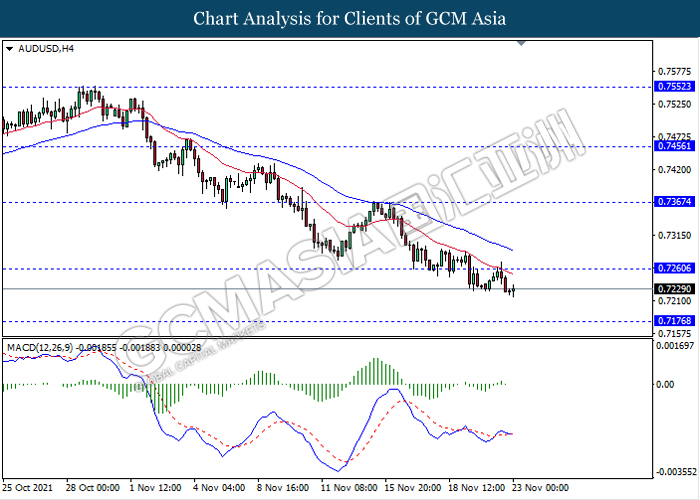

AUDUSD, H4: AUDUSD was traded lower following recent retracement from the resistance level 0.7260. MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 0.7175.

Resistance level: 0.7260, 0.7365

Support level: 0.7175, 0.7105

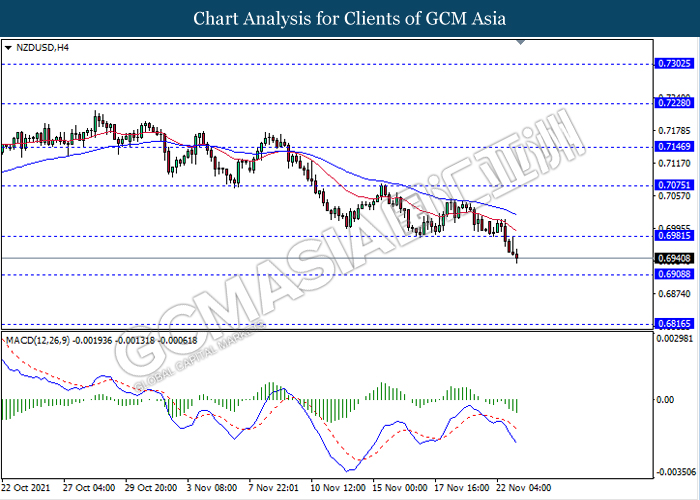

NZDUSD, H4: NZDUSD was traded lower while currently testing near the support level 0.6910. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6980, 0.7075

Support level: 0.6910, 0.6815

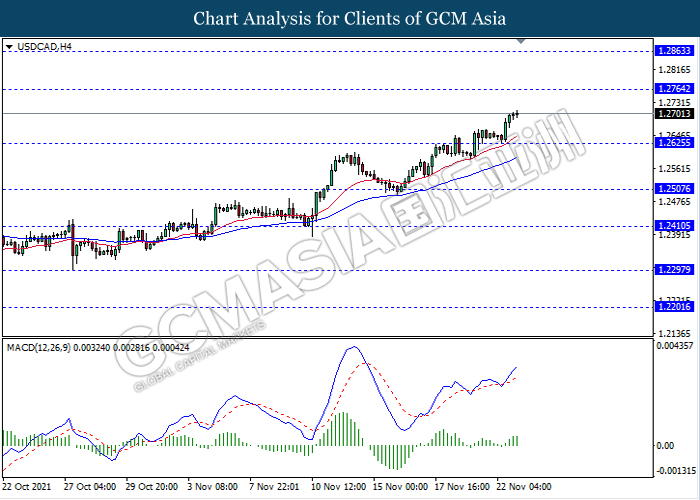

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level 1.2625. MACD which illustrate bullish bias signal suggest the pair to extend its gains towards the resistance level 1.2765.

Resistance level: 1.2765, 1.2865

Support level: 1.2625, 1.2505

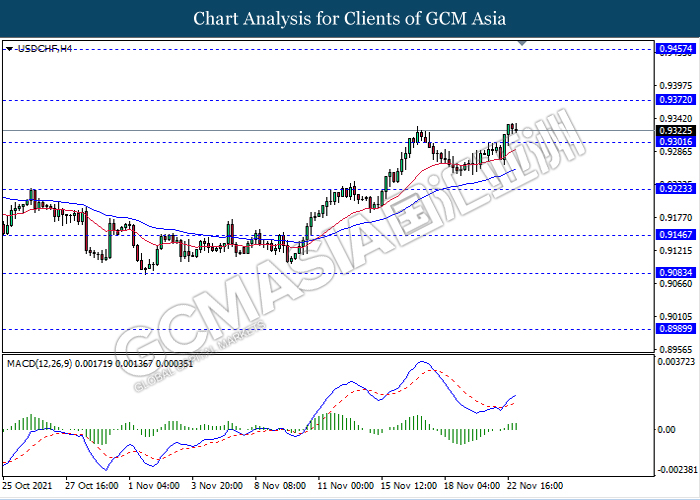

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level 0.9300. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.9370.

Resistance level: 0.9370, 0.9455

Support level: 0.9300, 0.9225

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 76.50. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the commodity to extend its rebound towards the resistance level 80.55.

Resistance level: 76.50, 80.55

Support level: 73.40, 70.00

GOLD_, H4: Gold price was traded lower while currently testing the support level 1805.60. MACD which illustrate persistent bearish momentum signal suggest the commodity to extend its losses after it breaks below the support level 1805.60.

Resistance level: 1831.50, 1867.50

Support level: 1805.60, 1779.00