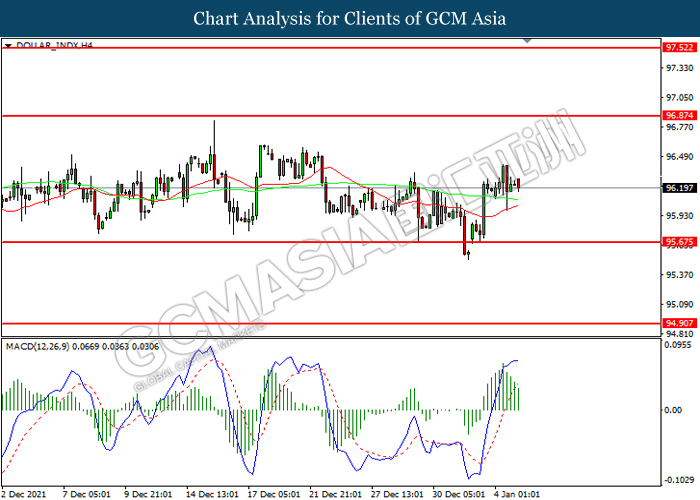

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 95.65. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 96.85, 97.50

Support level: 95.65, 94.90