8 December 2021 Afternoon Session Analysis

Dollar retreat amid upbeat market mood.

The dollar index which traded against a basket of six major currency pairs have retreat from its high following positive news of Omicron variant and China rate cut fueled market optimism and prompt investors to seek for riskier assets. Following latest development on Omicron variant, a top WHO official stated that the Omicron does not appear to cause more severe disease than the previous Covid variants. He also state that the preliminary data from South Africa suggest that while the existing vaccine may prove less effective against the Omicron, but vaccine is still holding up in protection and very highly unlikely to able vaccine protection. On the other hand, risk sentiment was also lifted by announcement from PboC to cut banks reserve requirement by 50 basis points next week. The move will Chinese banks to release $188 billion worth of liquidity into the economy, helping ease the pressure on a number of property companies as well as supporting growth in the world’s second largest economy. At the time of writing, dollar index fell 0.22% to 96.15.

In the commodities market, crude oil price rose 0.07% to $71.84 as of writing following renewed optimism towards demand outlook. Recent positive comments from various officials that hinted that the symptom associated with the Omicron is not as severe as they expect have helped eased investors’ concern over demand outlook and lifted the commodity price. On the other hand, gold price rose $1789.69 a troy ounce at the time of writing amid dollar retracement.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:15 EUR ECB President Lagarde Speaks

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – JOLTs Job Openings (Oct) | 10.438M | – | – |

| 23:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.25% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -0.910M | – | – |

Technical Analysis

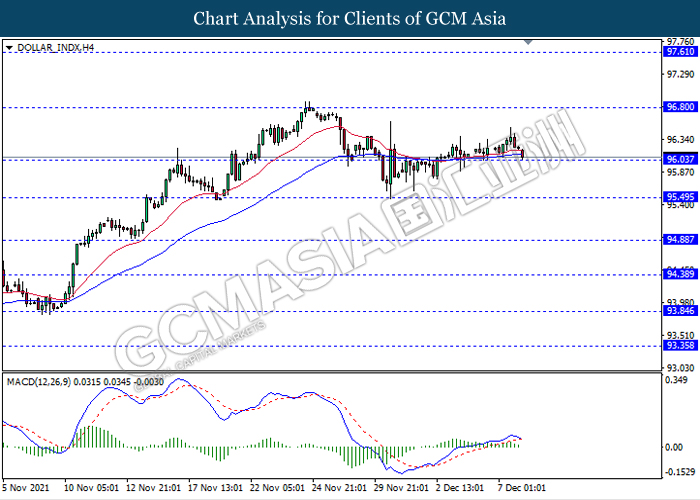

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 96.05. MACD which illustrate diminishing bullish momentum signal with the formation of death cross suggest the dollar to extend its losses after it breaks below the support level.

Resistance level: 96.80, 97.60

Support level: 96.05, 95.50

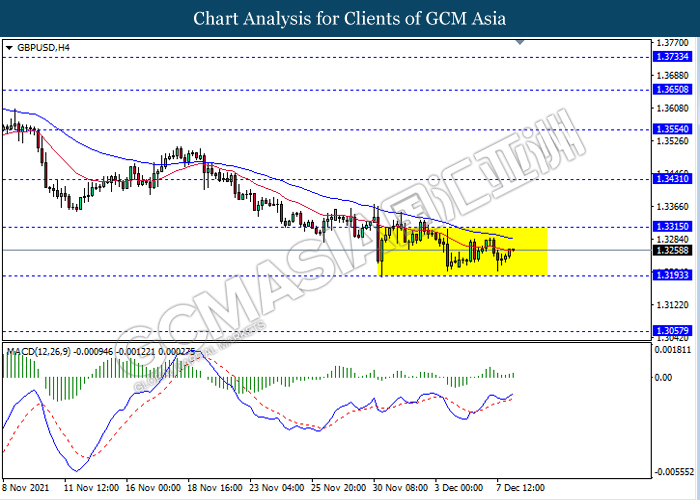

GBPUSD, H4: GBPUSD remain traded in a sideway channel. However, MACD which illustrate bullish momentum signal suggest the pair to be traded higher in short term towards the resistance level 1.3315.

Resistance level: 1.3315, 1.3430

Support level: 1.3195, 1.3055

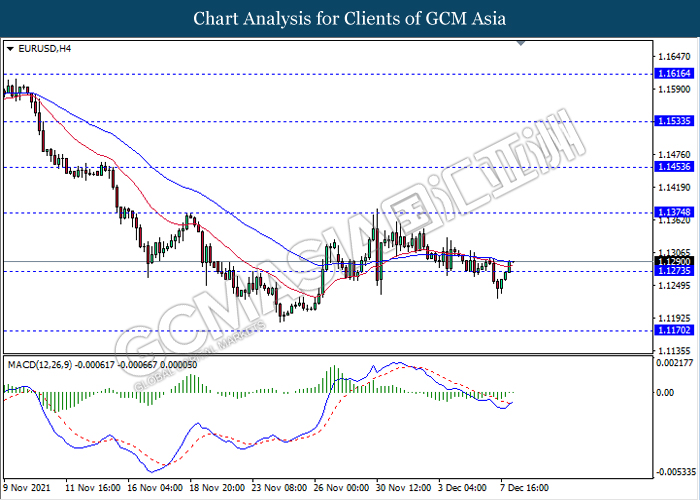

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.1275. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 1.1375.

Resistance level: 1.1375, 1.1455

Support level: 1.1275, 1.1170

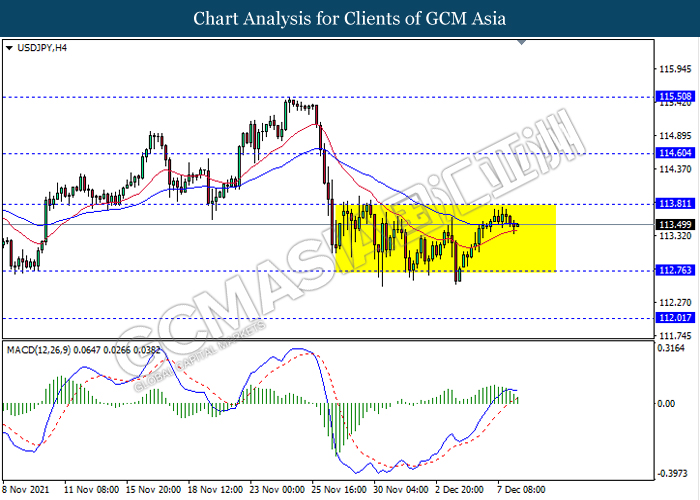

USDJPY, H4: USDJPY remain traded in a sideway channel following recent retracement from the resistance level 113.80. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to extend it retracement in short term towards the support level 112.75.

Resistance level: 113.80, 114.60

Support level: 112.75, 112.00

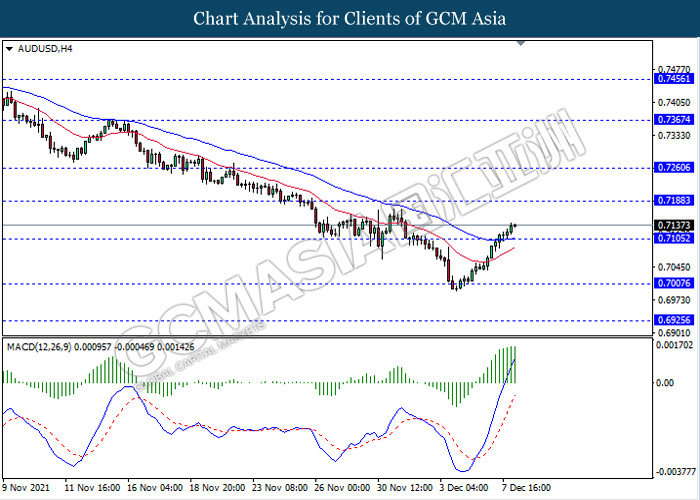

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level 0.7105. MACD which illustrate ongoing bullish momentum signal suggest the pair to extend its gains towards the resistance level 0.7190.

Resistance level: 0.7190, 0.7260

Support level: 0.7105, 0.7005

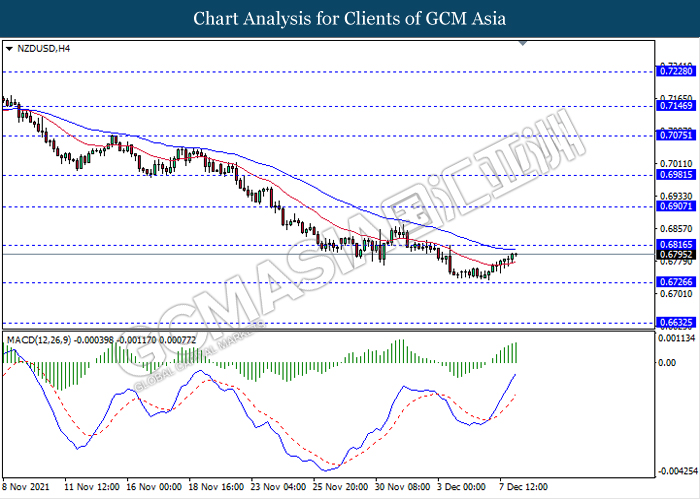

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6815. MACD which illustrate bullish bias signal suggest the pair to extend its gains after it breaks above the resistance level 0.6815.

Resistance level: 0.6815, 0.6905

Support level: 0.6725, 0.6630

USDCAD, H4: USDCAD was traded lower while currently testing the support level 1.2615. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to experience a technical correction towards the resistance level 1.2735.

Resistance level: 1.2735, 1.2865

Support level: 1.2615, 1.2505

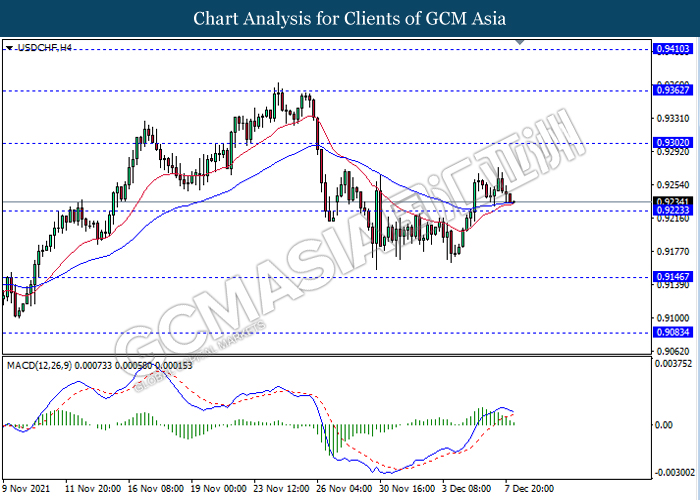

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.9225. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.9300, 0.9360

Support level: 0.9225, 0.9145

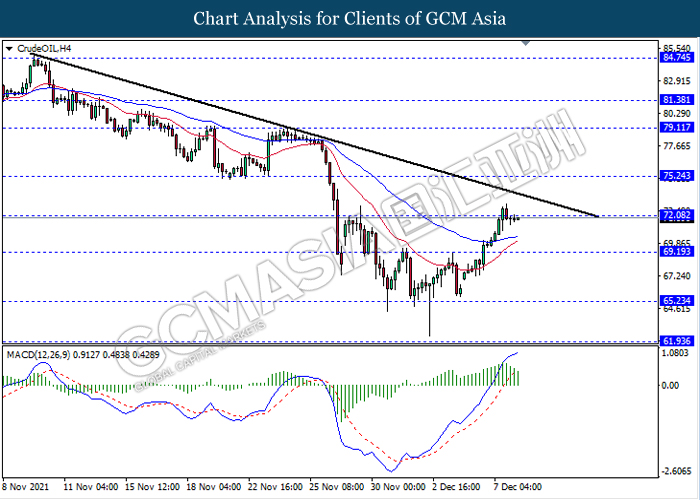

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 72.10. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower as a technical correction towards the support level 69.20.

Resistance level: 72.10, 75.25

Support level: 69.20, 65.25

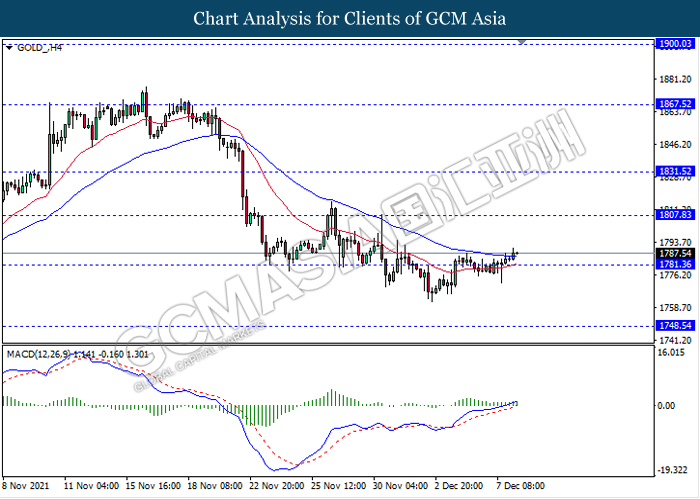

GOLD_, H4: Gold price was traded higher following prior rebound from the support level 1781.35. MACD which illustrate bullish momentum signal suggest the commodity to extend its rebound towards the resistance level 1807.85.

Resistance level: 1807.85, 1831.50

Support level: 1781.35, 1748.55