10 December 2021 Afternoon Session Analysis

Dollar rose following upbeat data, rising Omicron cases.

The dollar index which traded against a basket of six major currency pairs have rose following recent positive jobs data from the U.S and also rising Covid-19 cases that increase the appeal for safe-haven market. On data front, U.S Initial Jobless Claims rose only just 184K, lower than market forecast of 215K. The number of unemployed individuals continue to show declining trend since last year and now hits the lowest level in 52 years. On the other hand, the dollar also receive further support amid risk aversion sentiment in the market due to Omicron cases. U.K Prime Minister Boris Johnson have announced to imposed tougher COVID-19 restrictions in England, ordering people to work from home, wear masks in public places and use vaccine passes to slow the spread of the new variant. At the time of writing, dollar index rose 0.08% to 96.11.

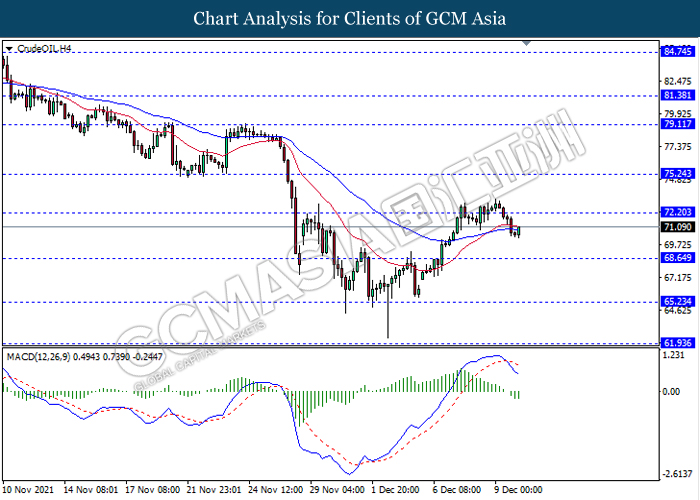

In the commodities market, crude oil price fell 0.08% to $71.01 a troy ounce as of writing amid weaker prospect of crude demand. On Thursday, ratings agency Fitch downgraded property developers China Evergrande Group and Kaisa Group to “restricted default” status, saying they had defaulted on offshore bonds. The news exacerbates the Chinese GDP growth fears and ultimately could impact the oil-buying appetite of the world’s biggest crude customer. On top of that, rising Omicron cases also weigh on the commodity. On the other hand, gold price fell 0.04% to $1778.78 a troy ounce at the time of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:05 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) | 0.60% | – | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Oct) | 0.10% | 0.10% | – |

| 21:30 | USD – Core CPI (MoM) (Nov) | 0.60% | 0.50% | – |

Technical Analysis

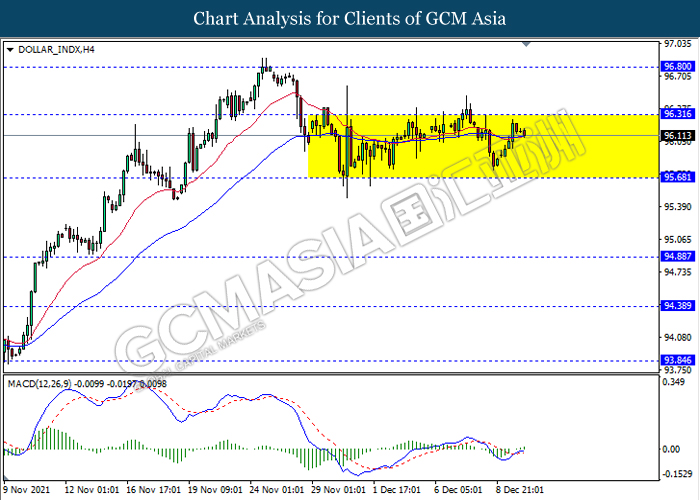

DOLLAR_INDX, H4: Dollar index remain traded in a sideway channel while currently testing the near the resistance level 96.30. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the dollar to extend its gains after it breaks above the resistance level.

Resistance level: 96.30, 96.80

Support level: 95.70, 94.90

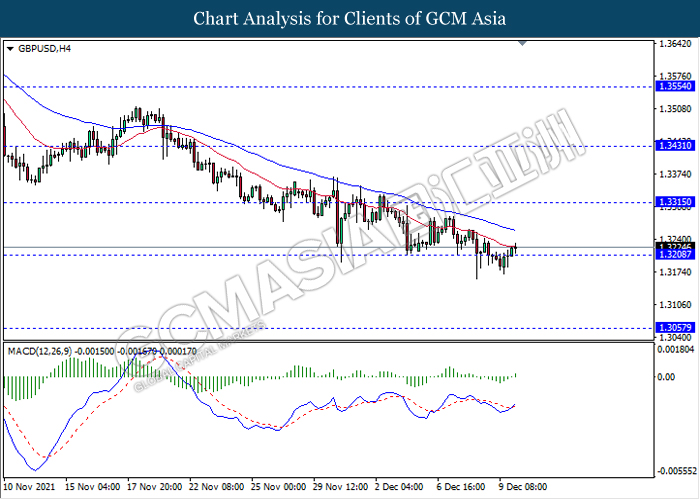

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level 1.3210. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 1.3315.

Resistance level: 1.3315, 1.3430

Support level: 1.3210, 1.3055

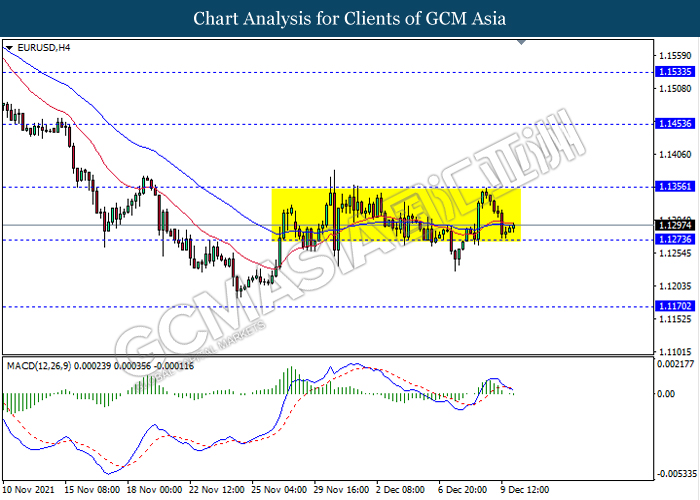

EURUSD, H4: EURUSD remain traded in a sideway channel while currently testing near the support level 1.1275. However, MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1355, 1.1455

Support level: 1.1275, 1.1170

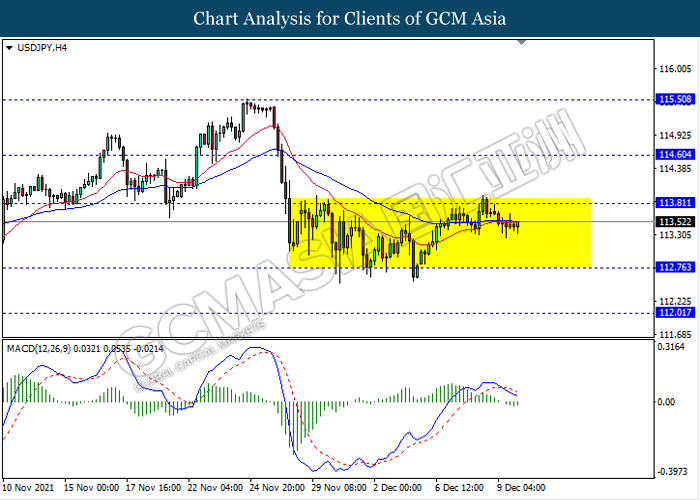

USDJPY, H4: USDJPY remain traded in a sideway channel following prior retracement from the resistance level 113.80. However, MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its retracement towards the support level 112.25.

Resistance level: 113.80, 114.60

Support level: 112.75, 112.00

AUDUSD, H4: AUDUSD was traded lower following recent retracement from the resistance level 0.7190. However, MACD which illustrate diminishing bullish momentum signal with the starting formation of death cross suggest the pair to extend its retracement towards the support level 0.7105.

Resistance level: 0.7190, 0.7260

Support level: 0.7105, 0.7005

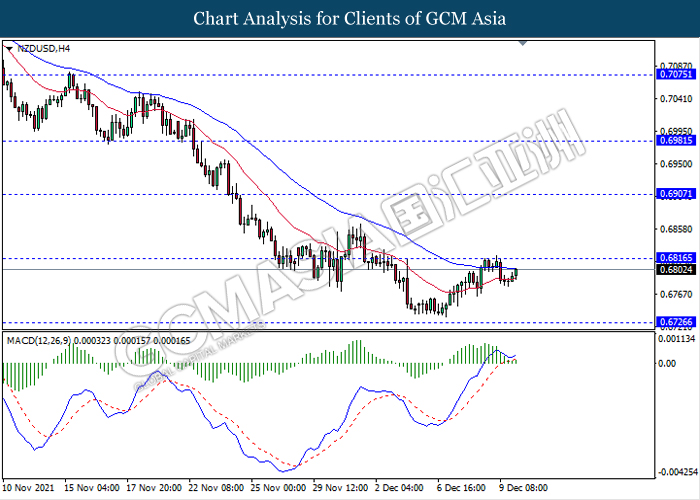

NZDUSD, H4: NZDUSD was traded higher while currently testing near the resistance level 0.6815. MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level 0.6815.

Resistance level: 0.6815, 0.6905

Support level: 0.6725, 0.6630

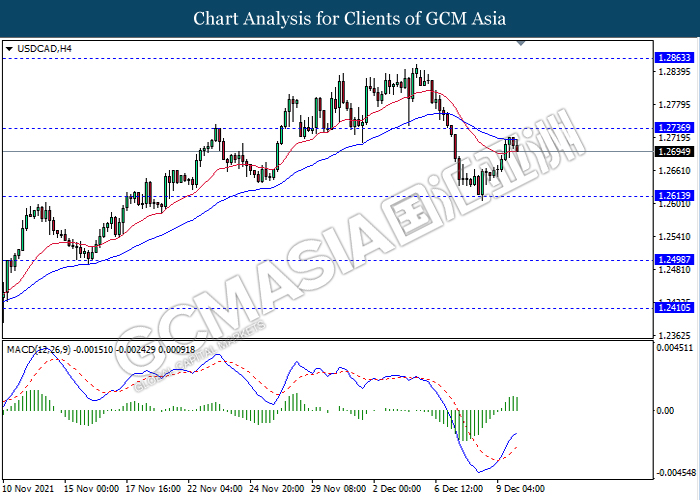

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.2735. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses towards the support level 1.2615.

Resistance level: 1.2735, 1.2865

Support level: 1.2615, 1.2500

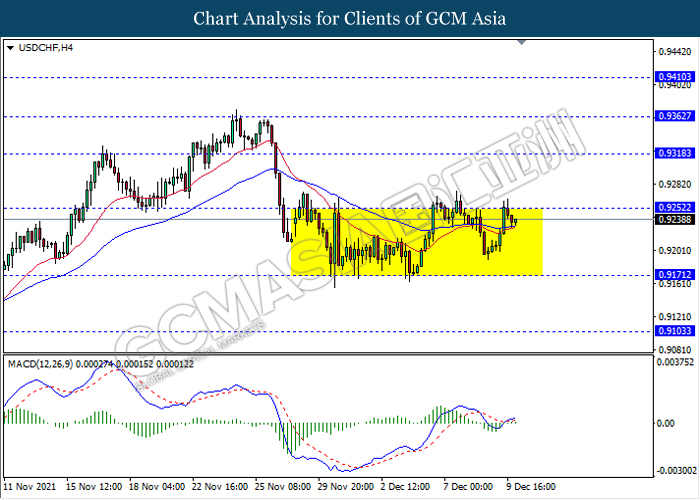

USDCHF, H4: USDCHF remain traded in a sideway channel while currently testing the resistance level 0.9250. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.9250, 0.9320

Support level: 0.9170, 0.9105

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level 72.30. MACD which illustrate bearish momentum signal with the formation of death cross suggest the commodity to extend its retracement towards the support level 68.65.

Resistance level: 72.20, 75.25

Support level: 68.65, 65.25

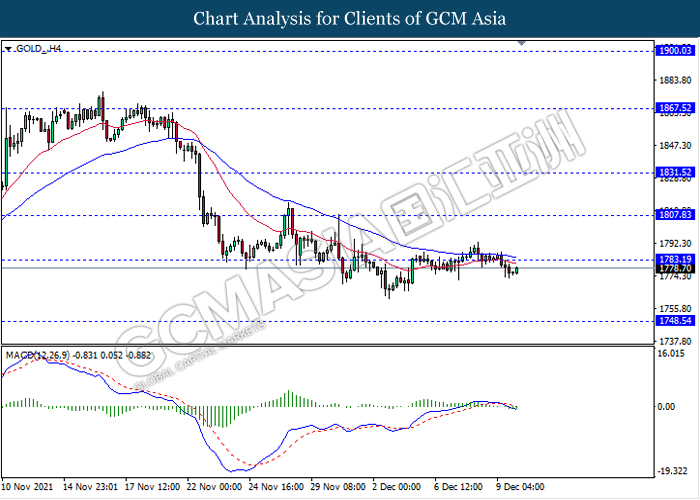

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level 1783.20. MACD which illustrate bearish bias signal suggest the commodity to extend its losses towards the support level 1748.55.

Resistance level: 1783.20, 1807.85

Support level: 1748.55, 1725.70.