13 December 2021 Afternoon Session Analysis

Euro remains weak on dovish stance from ECB.

The euro which traded against the dollar and other currency pairs remains pressured and fell following news of ECB plan to extend its loose monetary policy. According to sources from Bloomberg, ECB policymakers are leaning towards a temporary increase in the regular bond purchase scheme that would still significantly reduce overall debt buys once a much larger pandemic-fighting scheme ends in March. While the details of this boost are still open, the sources said that the ECB could do one of two things. It could approve a purchase envelope until the end of the year, with the caveat that not all of it must be spent. The plan is expected to be discussed at a meeting of the Governing Council on Dec. 16. On top of that, some ECB members also make clear that the purchases will remain until at least the end of 2022 and suggest that the rate hike is highly unlikely as long as bond purchase continues. At the time of writing, EUR/USD fell 0.12% to 1.1296.

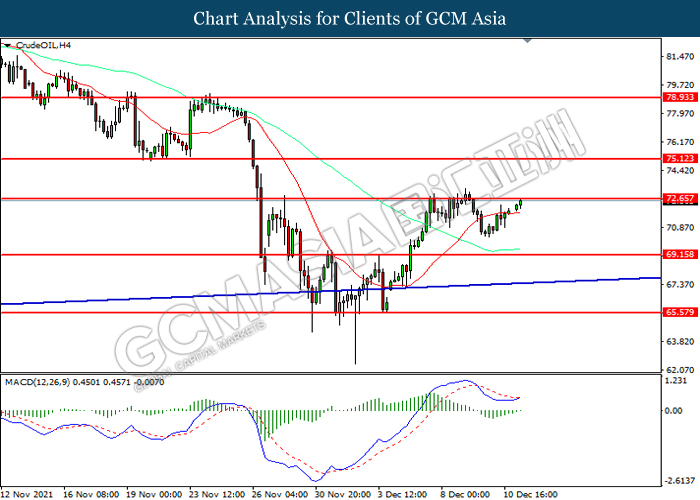

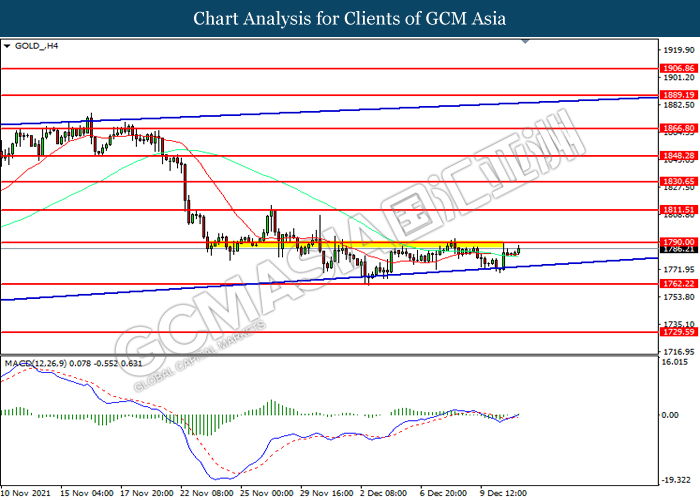

In the commodities market, crude oil price rose 1.04% to $72.60 per barrel as of writing amid rising prospect of fuel demand. Market sentiment continue to improve with growing optimism that the Omicron variant’s impact will be limited on global economic growth and fuel demand. South African scientists see no sign that the Omicron variant is causing more severe illness. On the other hand, gold price rose 0.19% to $1786.05 a troy ounce at the time of writing following dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

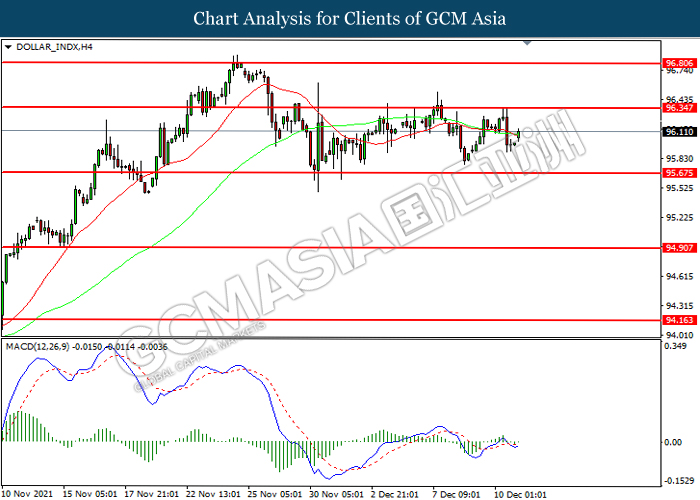

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 96.35. MACD which illustrate increasing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 96.35, 96.80

Support level: 95.65, 94.90

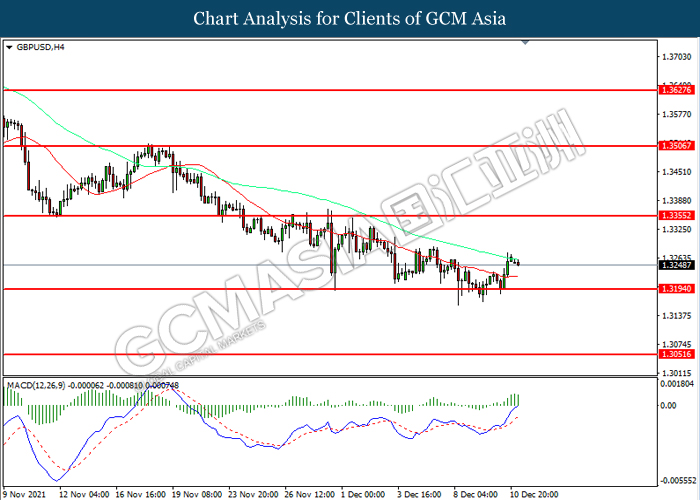

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3195. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3355, 1.3505

Support level: 1.3195, 1.3050

EURUSD, H4: EURUSD was traded within a range while currently near the resistance level at 1.1370. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1370, 1.1530

Support level: 1.1175, 1.1010

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 112.80. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 114.40.

Resistance level: 114.40, 115.40

Support level: 112.80, 112.05

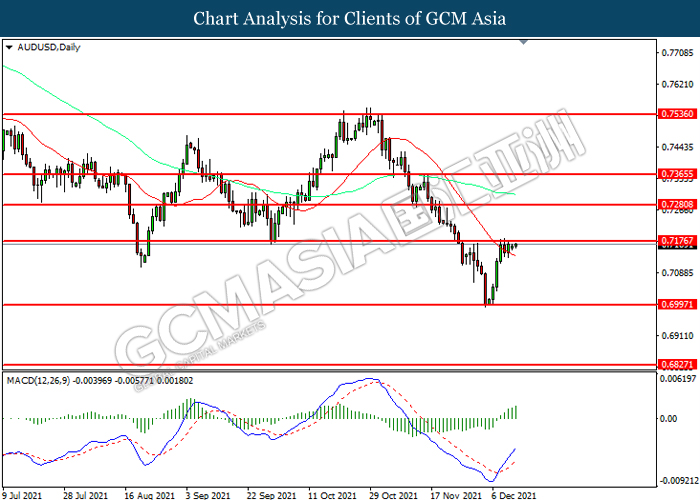

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7175. MACD which illustrate increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7175, 0.7280

Support level: 0.6995, 0.6825

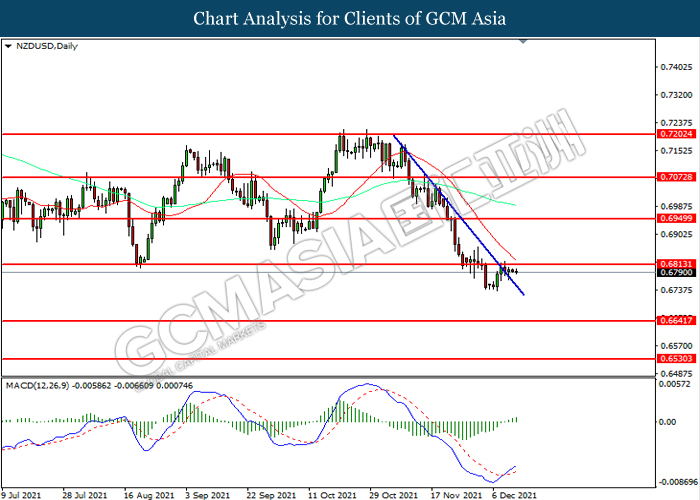

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6815. MACD which illustrate bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6815, 0.6950

Support level: 0.6640, 0.6530

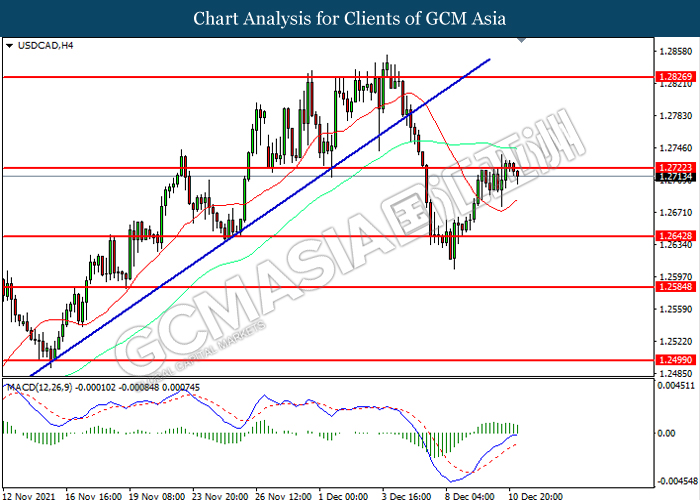

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2720. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2720, 1.2825

Support level: 1.2645, 1.2585

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9200. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.9260.

Resistance level: 0.9260, 0.9315

Support level: 0.9200, 0.9155

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 72.65. MACD which illustrate diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 72.65, 75.10

Support level: 69.15, 65.60

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1790.00. MACD which illustrate increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1790.00, 1811.50

Support level: 1762.20, 1729.60