25 January 2022 Afternoon Session Analysis

Pound slumped following downbeat data were released.

The Pound Sterling dipped over the backdrop of a string of bearish economic data from UK region yesterday. According to Markit Economics, UK Composite Purchasing Managers’ Index (PMI) notched down from the previous reading of 53.6 to 53.4, missing the market forecast at 55.0. Meanwhile, UK Manufacturing PMI and UK Services PMI came in at 56.9 and 53.3, which both fared worse-than-expectation at 57.7 and 53.9 respectively. The UK business activity cooled unexpectedly amid spiking numbers of Omicron cases in UK last month continue to jeopardize the economic recovery momentum for the United Kingdom. However, UK consumer price inflation hit a nearly 30-year high of 5.4% for last year, sparkling hope for the Bank of England to increase the interest rate in future to combat the inflation risk. As of writing, GBP/USD depreciated by 0.12% to 1.3470.

In the commodities market, the crude oil price depreciated by 0.64% to $84.10 per barrel as of writing. The oil market edged lower amid technical correction. Nonetheless, the overall prospect for this black-commodity remained bullish on the concerns over possible supply disruption following rising geopolitical tensions in both Russia and Ukraine. On the other hand, the gold price surged 0.05% to $1840.75 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Jan) | 94.7 | 94.7 | – |

| 23:00 | USD – CB Consumer Confidence (Jan) | 115.8 | 111.8 | – |

Technical Analysis

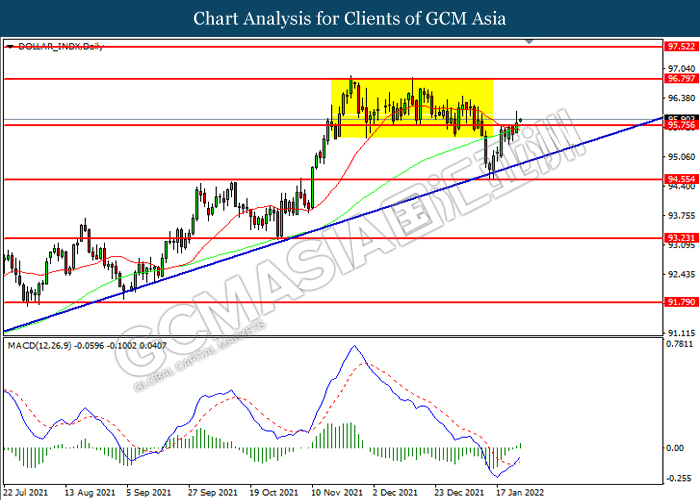

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.75. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.75, 96.80

Support level: 94.55, 93.25

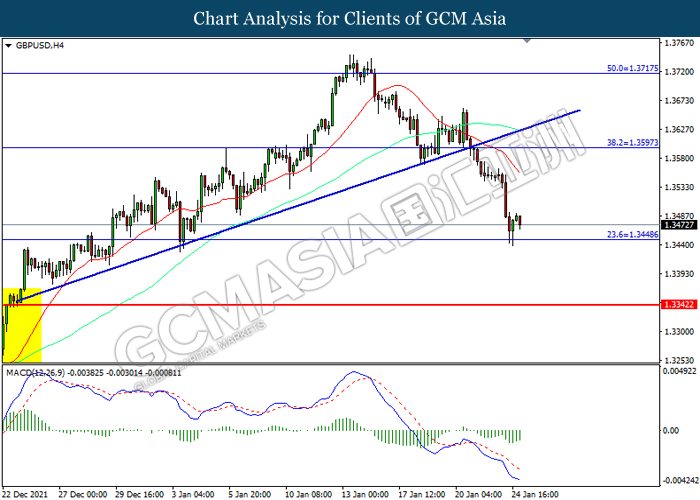

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

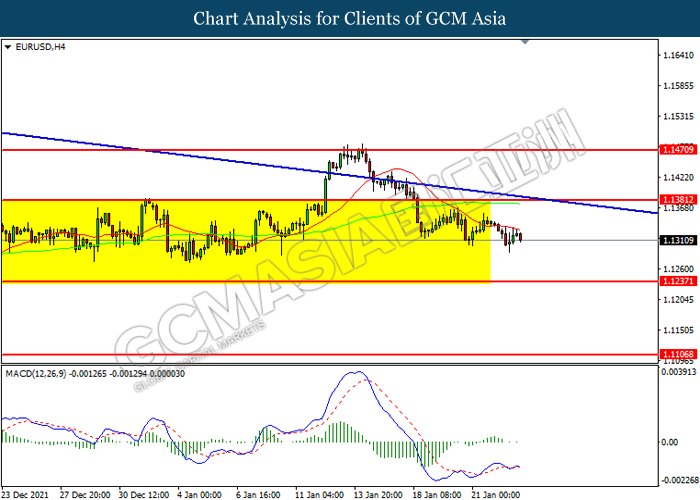

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

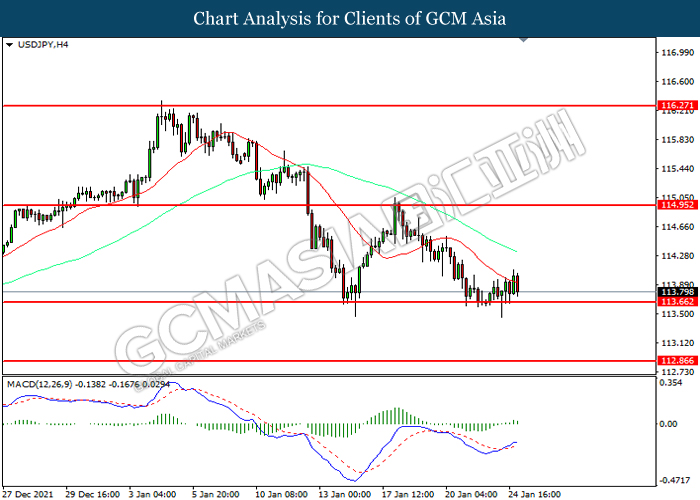

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 114.95, 116.25

Support level: 113.65, 112.85

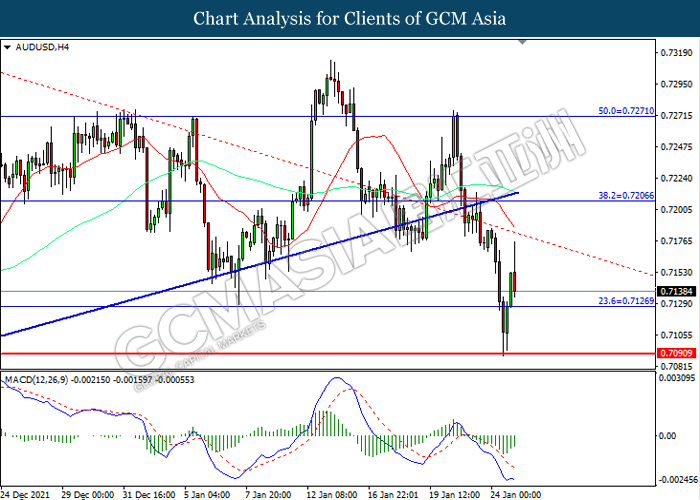

AUDUSD, H4: AUDUSD was traded lower while currently near the support level at 0.7125. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7090

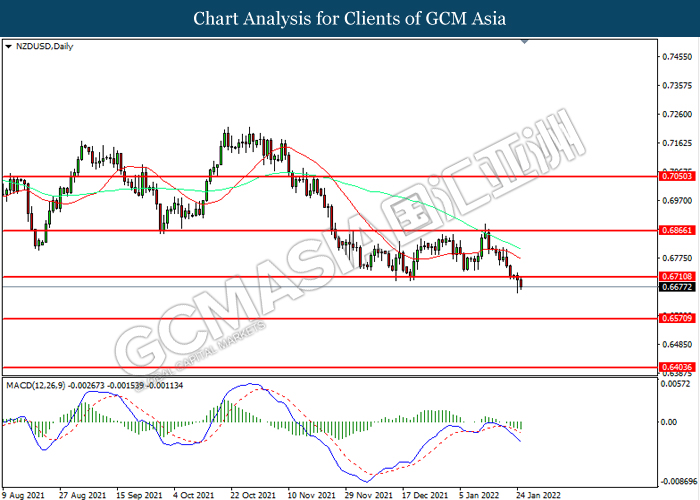

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6570.

Resistance level: 0.6710, 0.6865

Support level: 0.6570, 0.6405

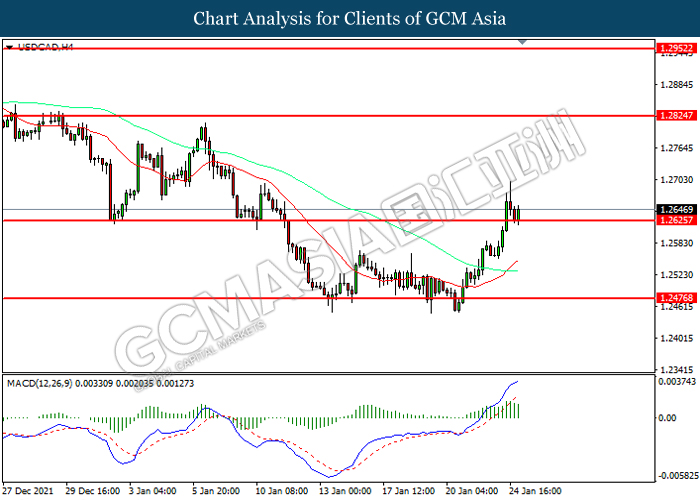

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2425. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2825

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

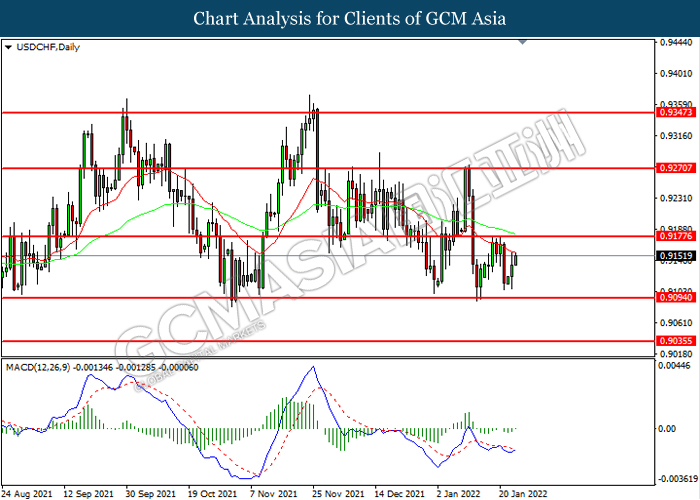

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9175. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 83.15. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 86.60, 88.60

Support level: 83.15, 80.15

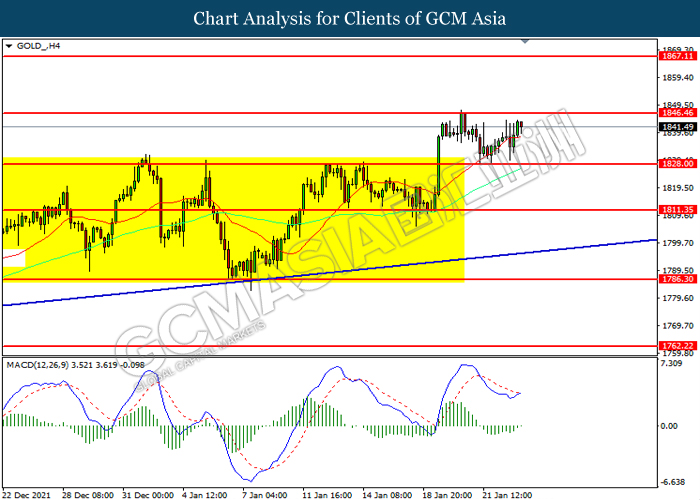

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1846.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1846.45, 1867.10

Support level: 1828.00, 1811.35