28 January 2022 Morning Session Analysis

US GDP delivers, will greenback extend its gains?

US dollar hovers at 19 months high after US economic growth notched in its fastest pace in more than 4 decades. According to US Bureau of Economic Analysis, Gross Domestic Product came in at 6.9% for the 4th quarter, significantly higher than forecast of 5.5%. US economic activity accelerated during end of last year due to strong spending among consumers and businesses. Likewise, the data also shows robustness in terms of both public and private sector by adjusting their business towards the new norm after pandemic began in 2020. Additionally, the data has also cemented the course for a faster rate hike pace from Federal Reserve. Higher growth in the economy which are largely driven by strong consumption and demand may propel inflation in the near-term. As such, Fed may need to act quickly via interest rate hike in order to control the stability of consumer goods prices. As of writing, the dollar index was up 0.01% to 97.18.

As for commodities, crude oil price rose 0.47% to $87.44 per barrel while investors speculate geopolitical tension in between Russia and Ukraine may led to oil supply deficit in the event of war. Otherwise, gold price was down by 0.01% to $1,797.56 a troy ounce due to stronger greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German GDP (QoQ) (Q4) | 1.70% | -0.20% | – |

Technical Analysis

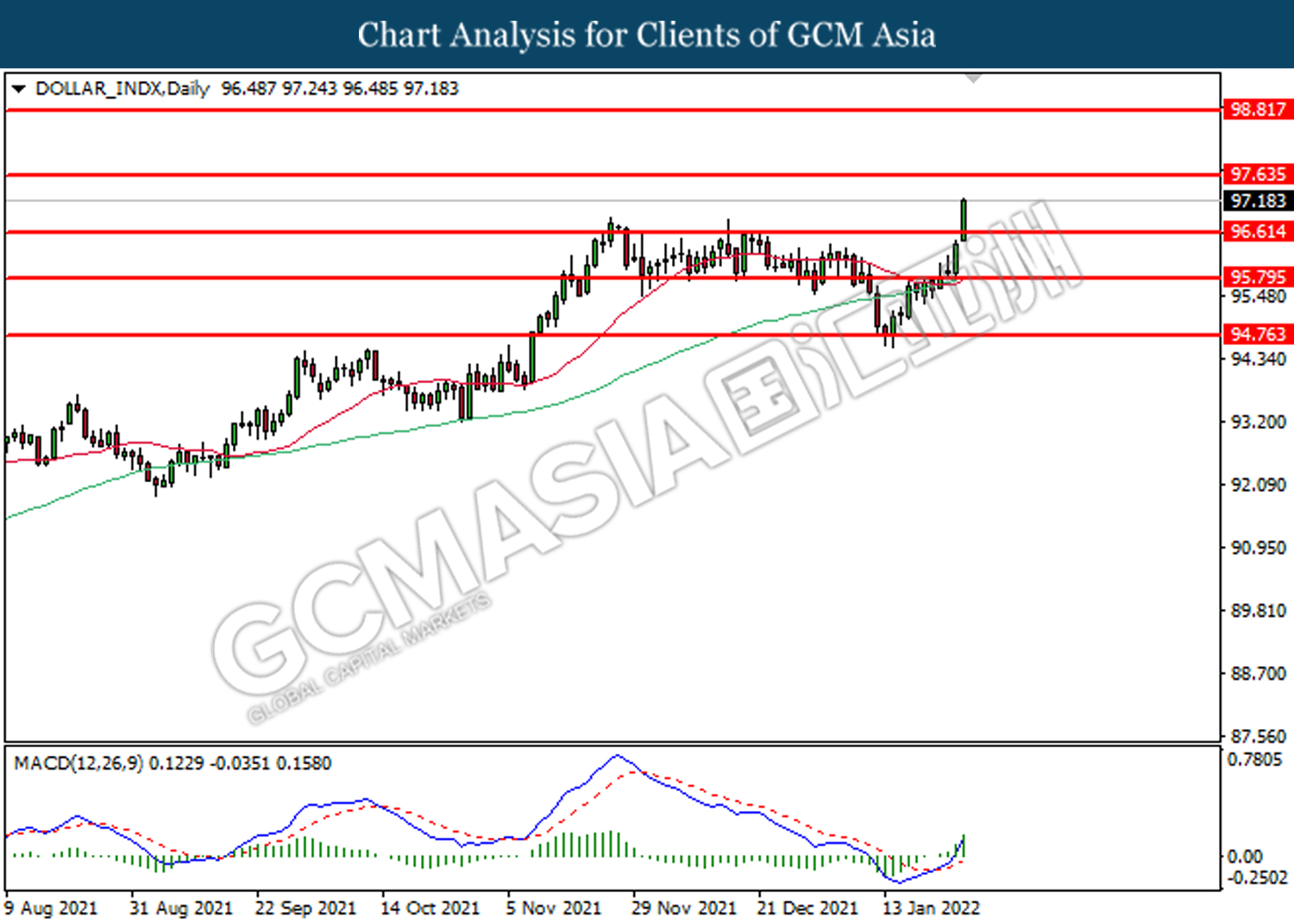

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3410, 1.3470

Support level: 1.3355, 1.3290

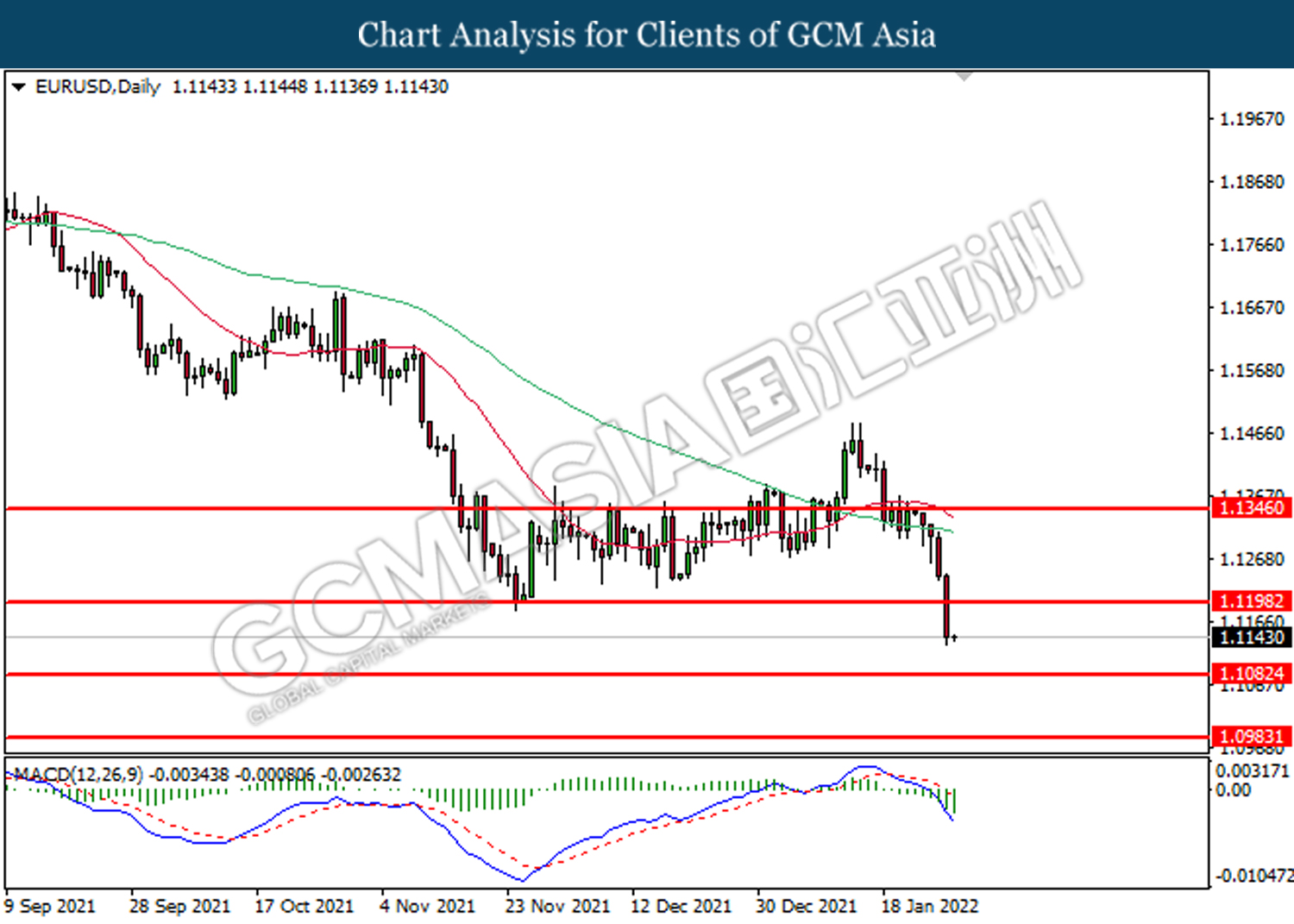

EURUSD, Daily: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1200, 1.1345

Support level: 1.1080, 1.0985

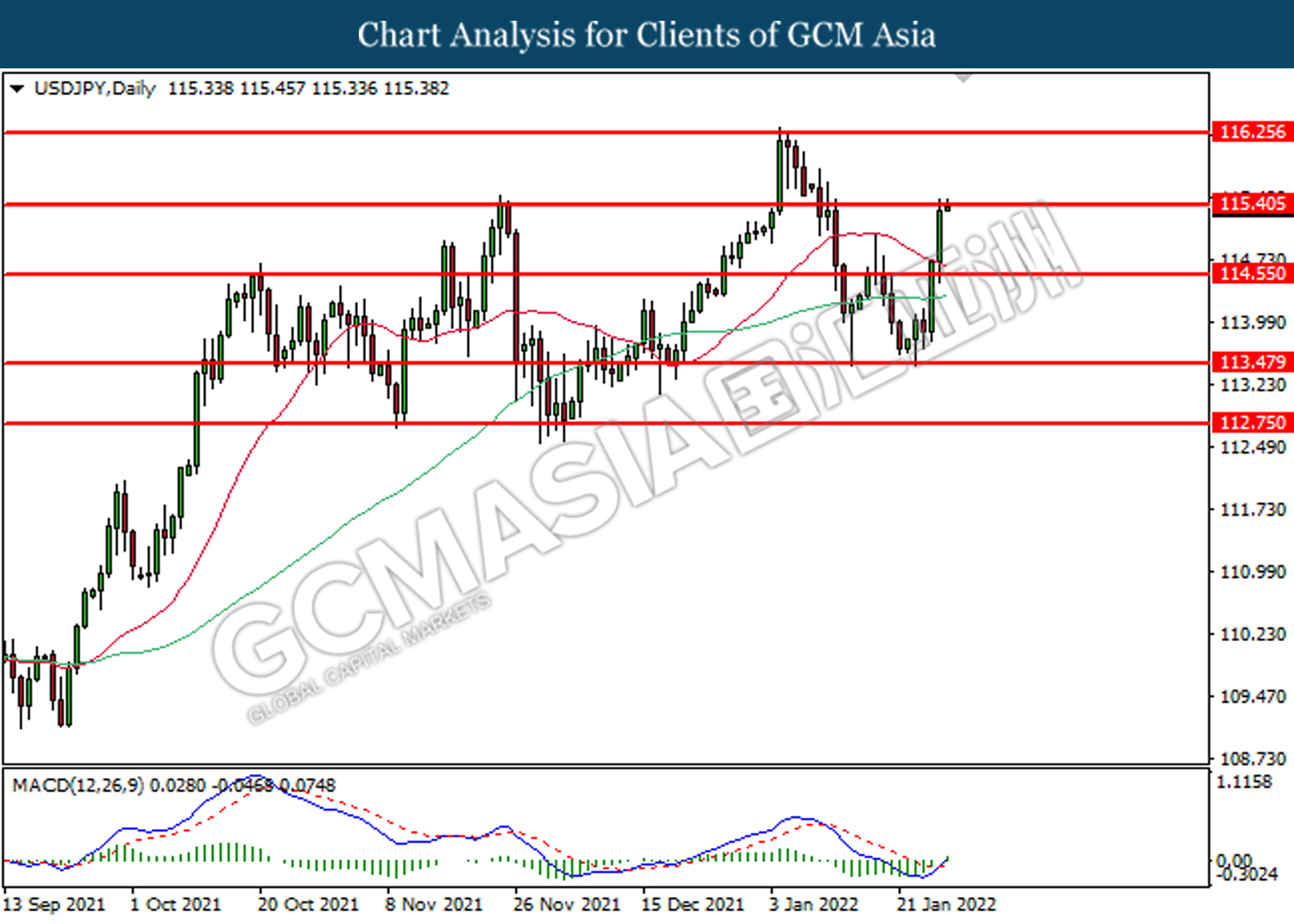

USDJPY, Daily: USDJPY was traded higher following rebound from 113.50. MACD which illustrate diminished bearish signal suggests the pair to be traded higher after it breaks the resistance level.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

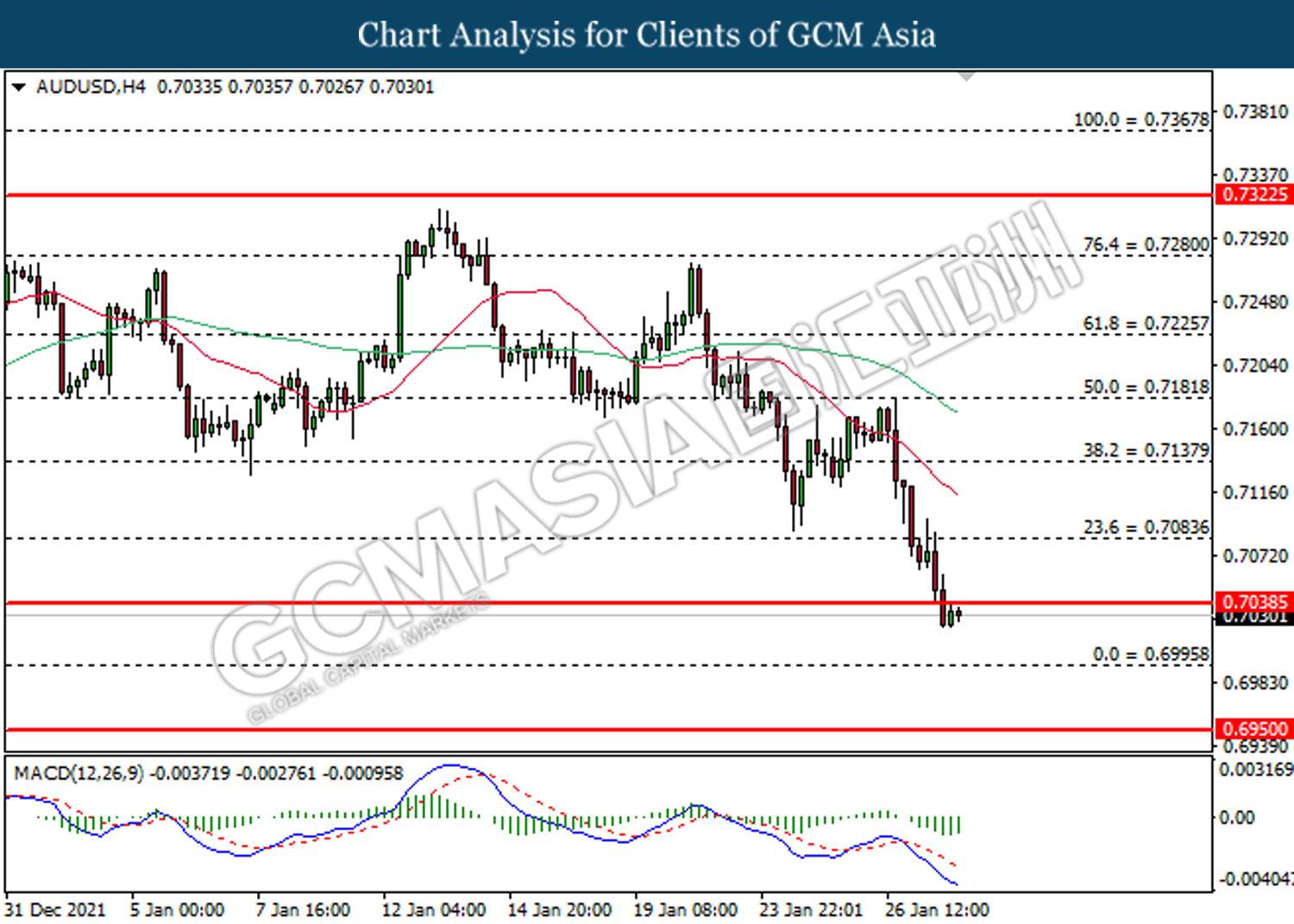

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7040, 0.7085

Support level: 0.6995, 0.6950

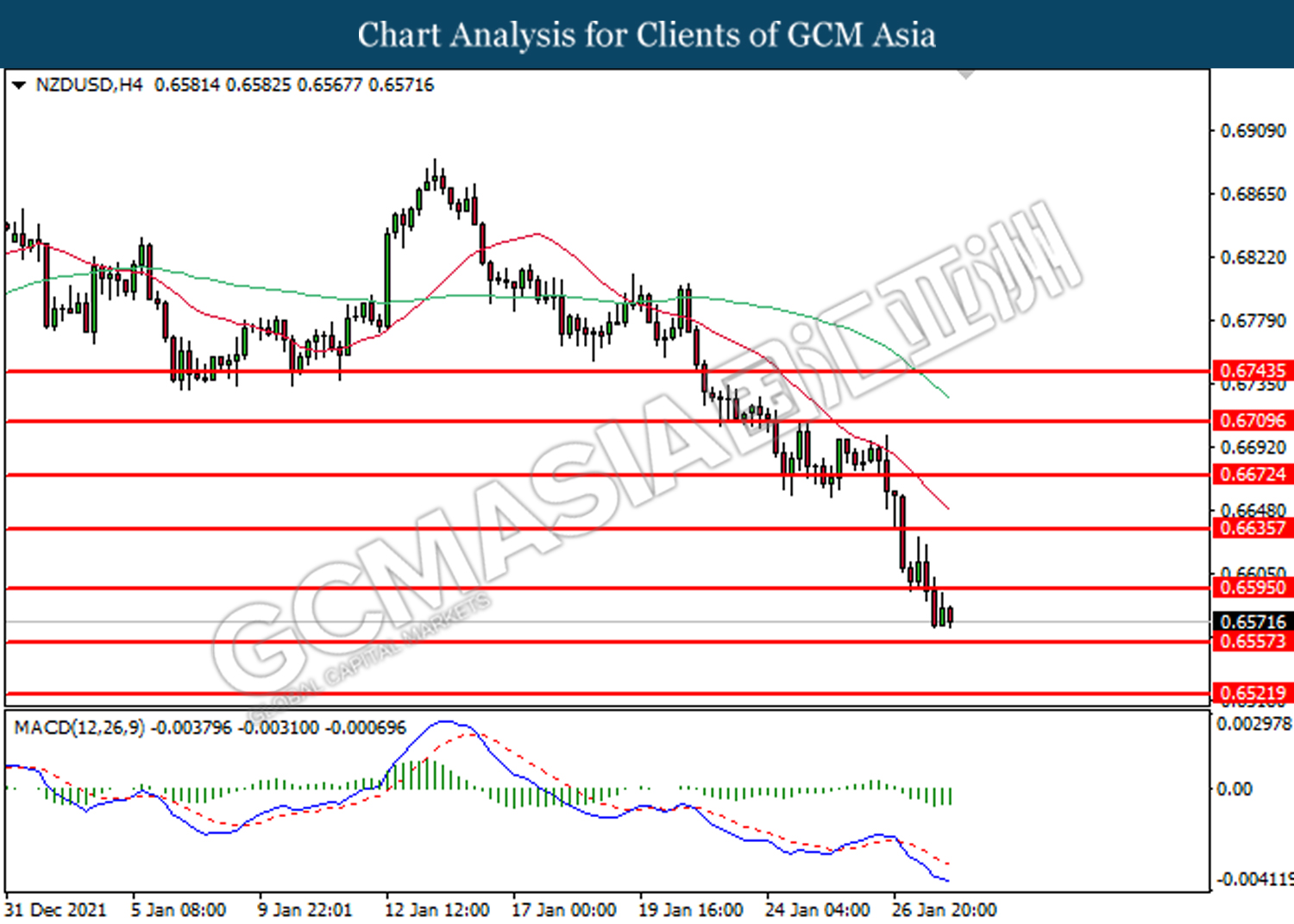

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6595, 0.6635

Support level: 0.6560, 0.6520

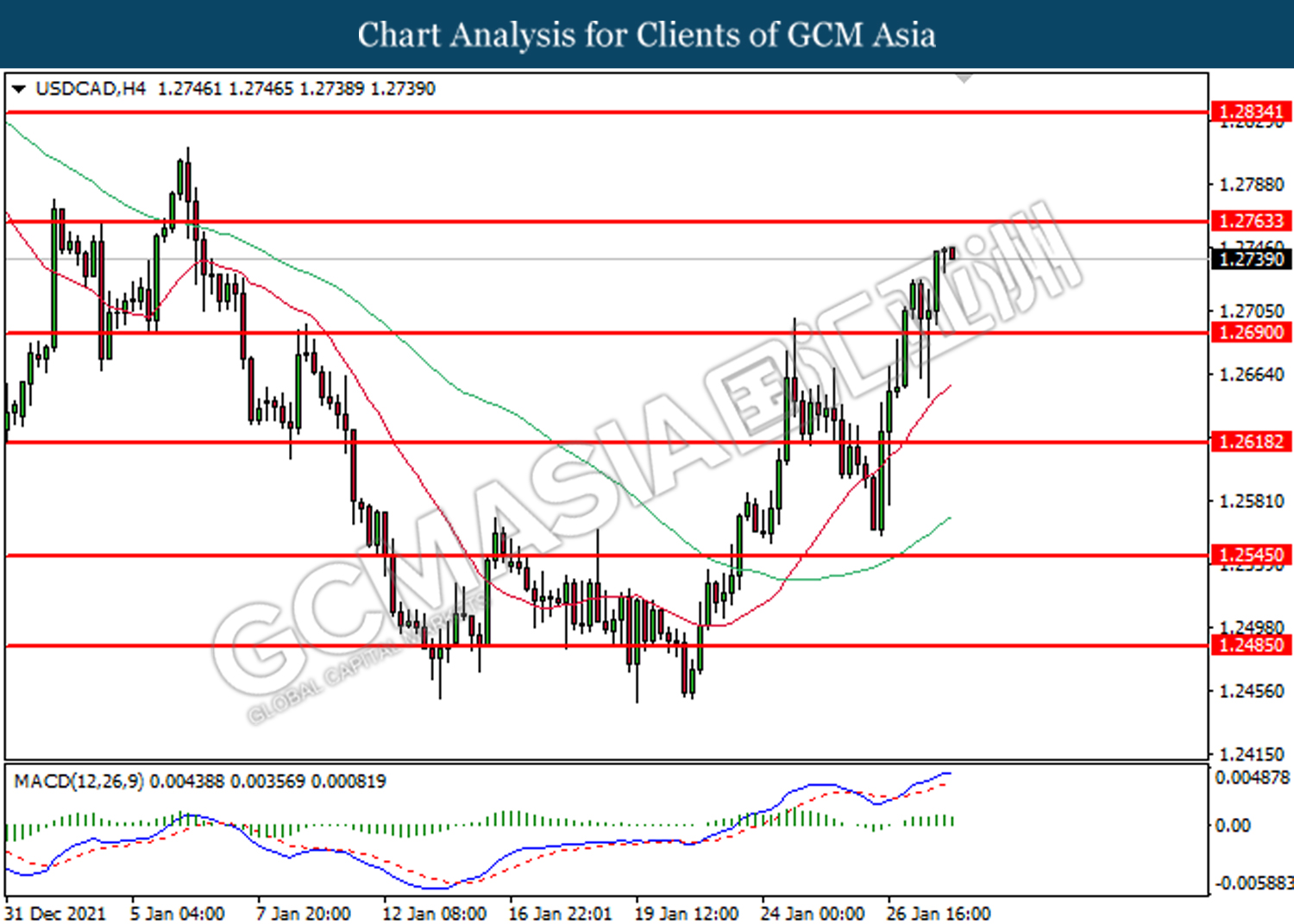

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.2765, 1.2835

Support level: 1.2690, 1.2620

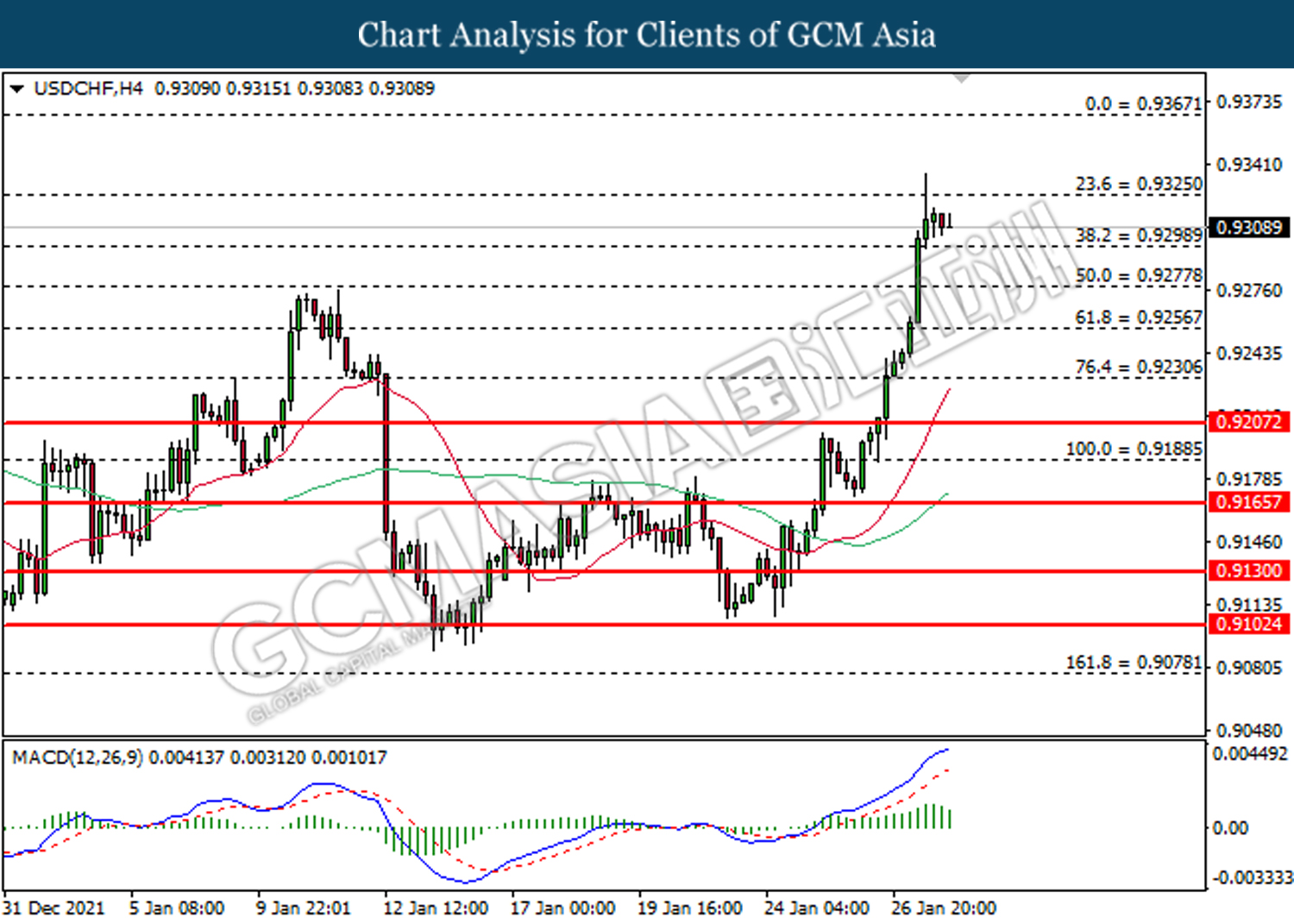

USDCHF, H4: USDCHF was traded higher following prior breakout at 0.9280. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9325, 0.9370

Support level: 0.9300, 0.9280

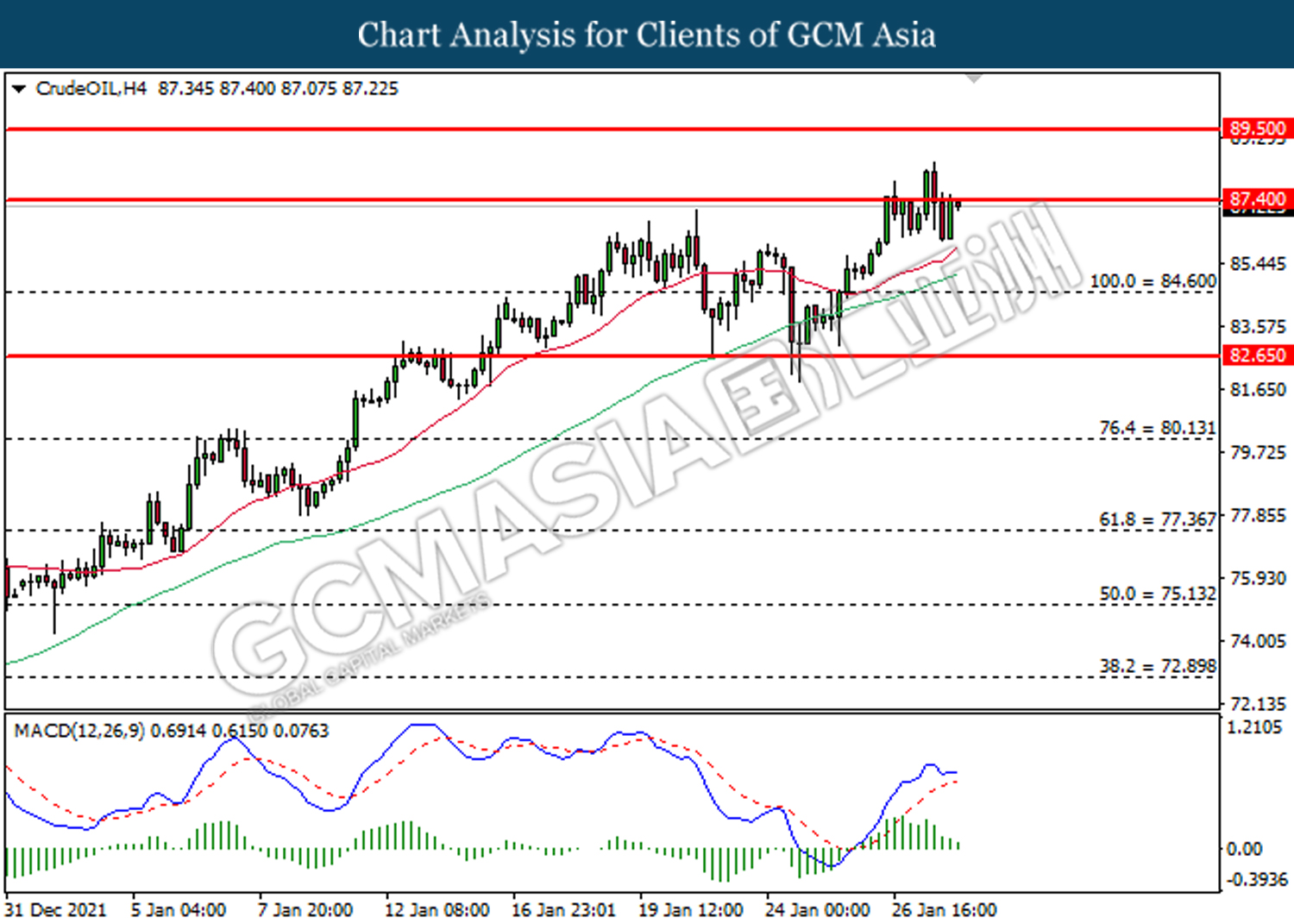

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 87.40, 89.50

Support level: 84.60, 82.65

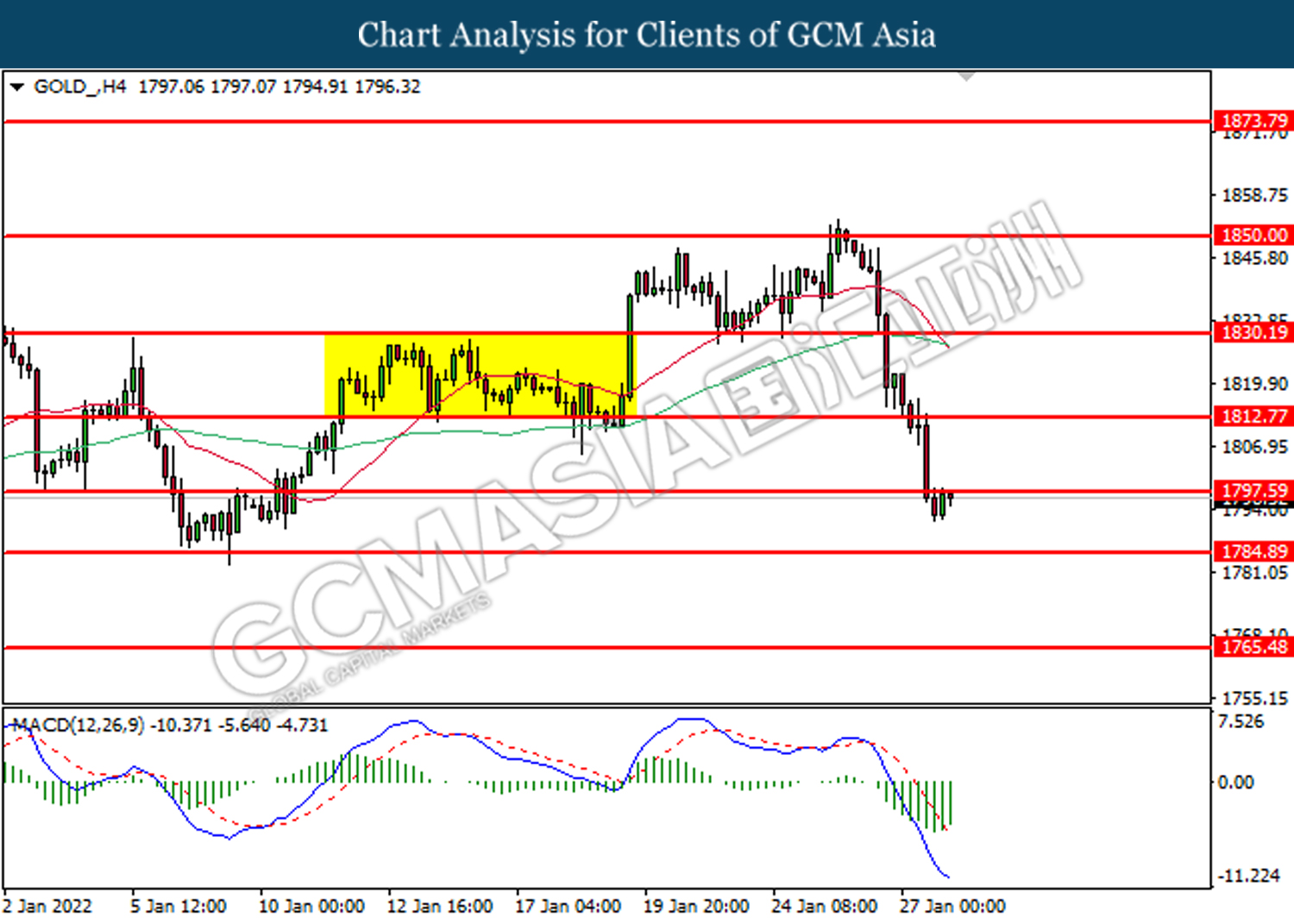

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 1797.60, 1812.80

Support level: 1784.90, 1765.50