28 January 2022 Afternoon Session Analysis

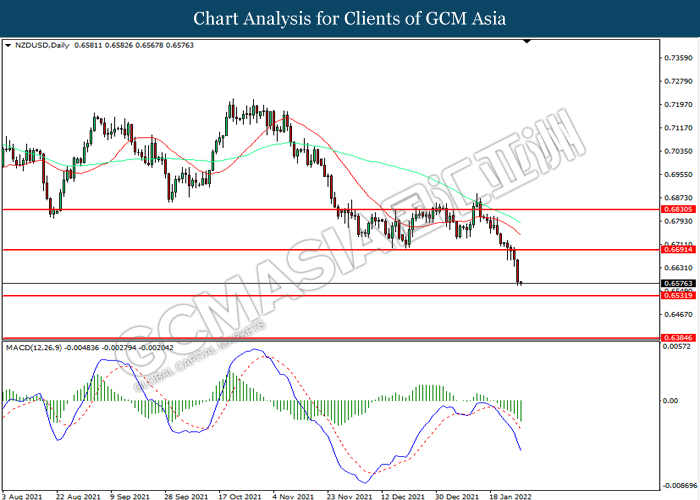

Fed hawkish expectation continue to weigh down the pair of NZD/USD.

The pair of NZD/USD remained bearish despite upbeat economic data from the New Zealand region, amid the hawkish expectation from the Federal Reserve continue to spark the market demand on US Dollar. According to Statistics New Zealand, New Zealand Consumer Price Index (CPI) came in at 1.4%, exceeding the market forecast at 1.3%. The economic momentum for New Zealand remained strong due to strong consumer spending following the Covid-19 cases eased. Such high reading had increased the odds for the Reserve Bank of New Zealand (RBNZ) to take further steps in order to curb rising living costs. On the other hand, the US Dollar surged over the hawkish expectation from Federal Reserve following the US unleashed upbeat GDP data. As of writing, NZD/USD depreciated by 0.02% to 0.6575.

In the commodities market, the crude oil price depreciated by 0.30% to $87.50 per barrel as of writing amid technical correction following it reached recent high. Nonetheless, the overall trend for the crude oil remained bullish amid concerns of supply disruption following the rising tensions between Russia and Ukraine. On the other hand, the gold price surged 0.10% to $1799.00 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German GDP (QoQ) (Q4) | 1.70% | -0.20% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 97.60, 98.35

Support level: 96.80, 95.55

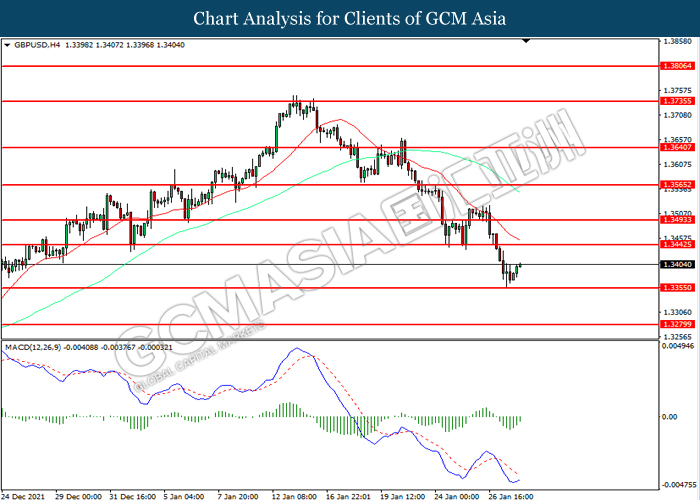

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3445, 1.3495

Support level: 1.3355, 1.3280

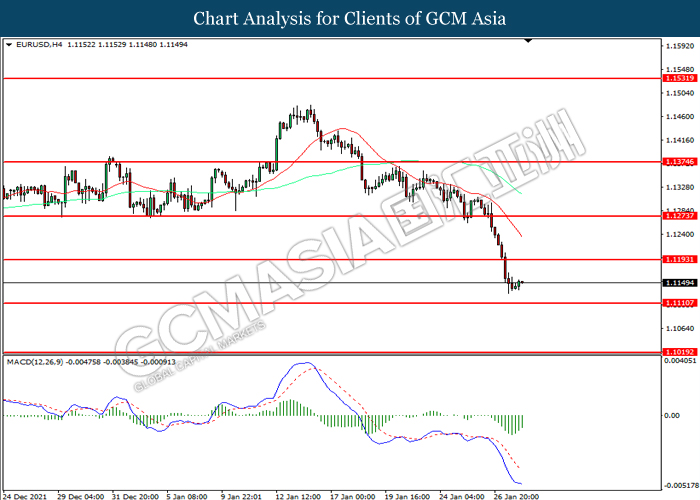

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1195, 1.1275

Support level: 1.1110, 1.1020

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.40. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.40, 116.20

Support level: 114.50, 113.35

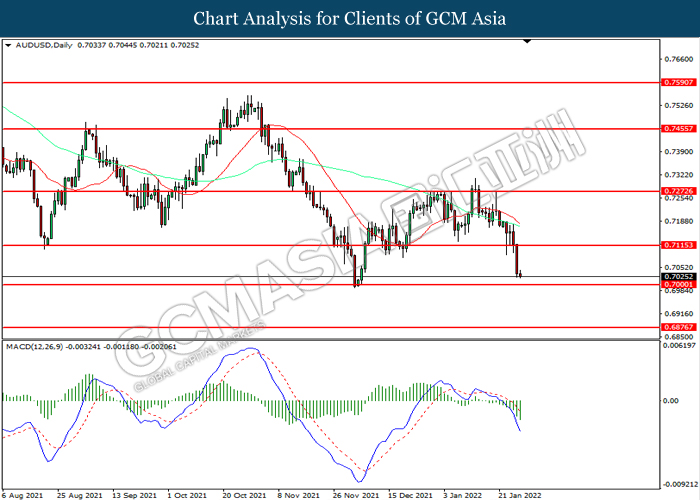

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7115, 0.7275

Support level: 0.7000, 0.6865

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6690, 0.6830

Support level: 0.6530, 0.6385

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.2755, 1.2825

Support level: 1.2685, 1.2580

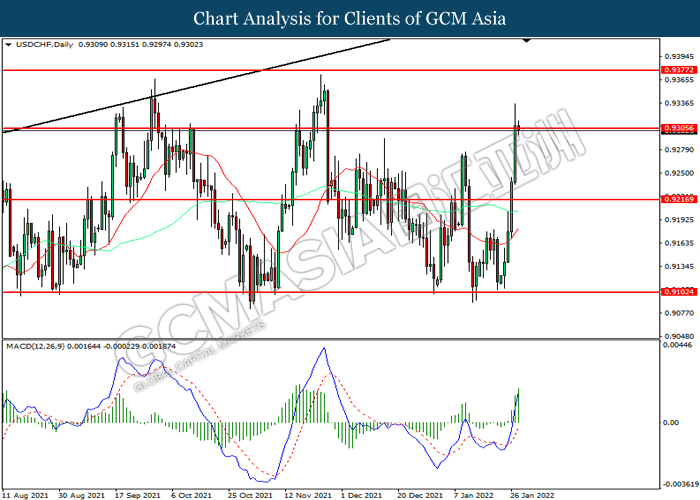

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9305. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9305, 0.9375

Support level: 0.9215, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 88.20, 90.90

Support level: 86.30, 84.80

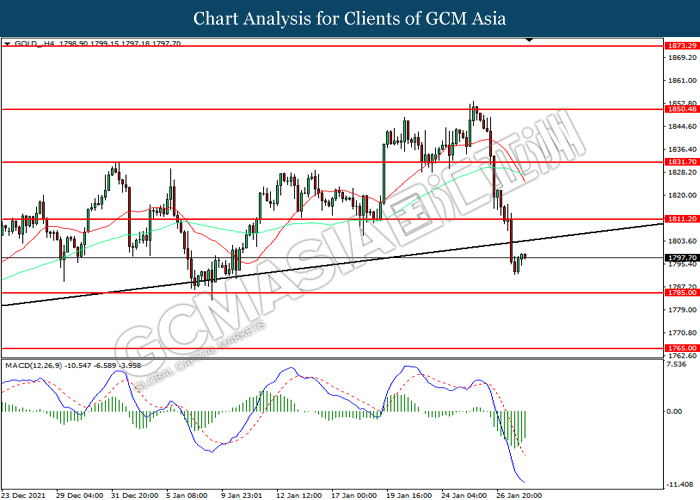

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1811.20. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1811.20, 1831.70

Support level: 1785.00, 1765.00