15 February 2022 Morning Session Analysis

Fed geared up to hike rates.

US dollar receives higher demand as Federal Reserve continuously deliver hawkish tone towards the financial market. According to an interview with CNBC, Fed member James Bullard emphasized that current inflationary pressure in the US is still high and it warrants for more drastic measures to be taken. Bullard suggests that they will need to hike interest rates at least 100 basis points before July in order to prevent the economy from overheating. In summary, majority of Fed officials has revealed their willingness to support for an interest rate hike starting March while several of them supports for the idea to have an interest rate hike at least 25 basis points. For the time being, investors will continue to place their attention upon upcoming signals from the US in order to gauge US dollar’s trend direction. As of writing, the dollar index was up 0.01% to 96.20.

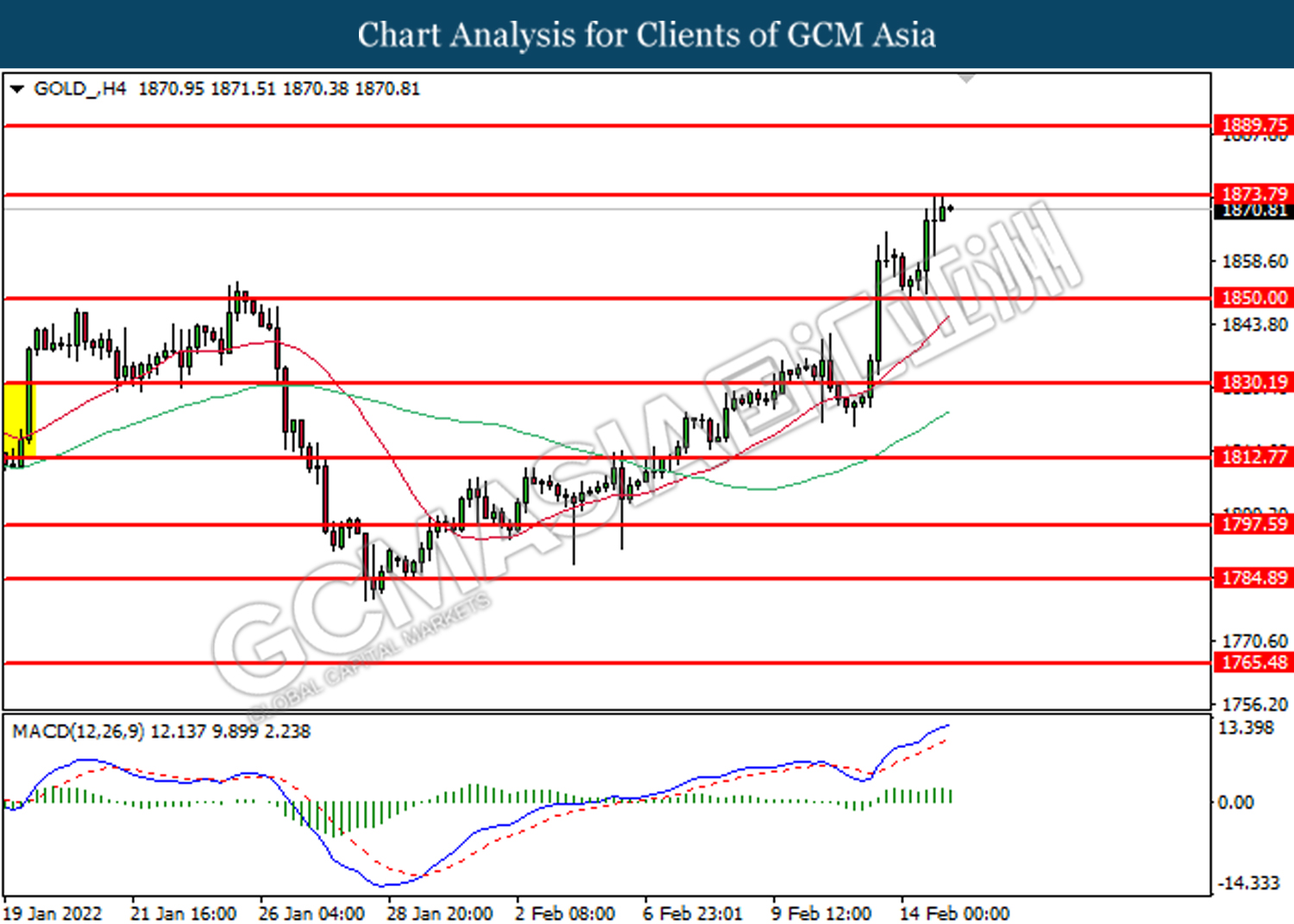

In the commodities market, crude oil price was down by 0.34% to $92.81 per barrel following technical correction from its higher levels. On the other hand, gold price was up 0.01% to $1,870.87 a troy ounce due to escalating tension in between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Dec) | 4.20% | 3.90% | – |

| 15:00 | GBP – Claimant Count Change (Jan) | -43.3K | -36.2K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 51.7 | 53.5 | – |

| 21:30 | USD – PPI (MoM) (Jan) | 0.30% | 0.50% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

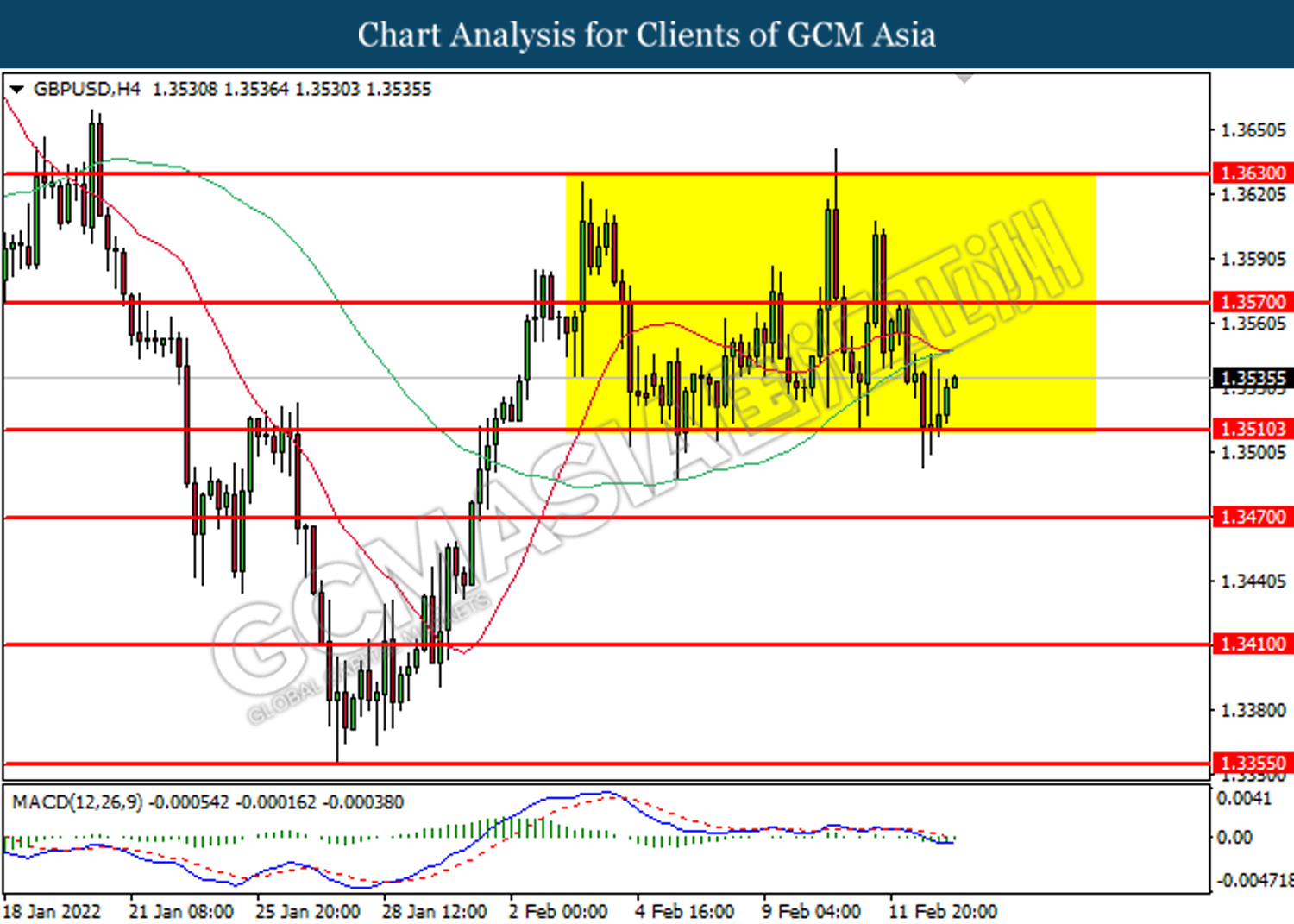

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

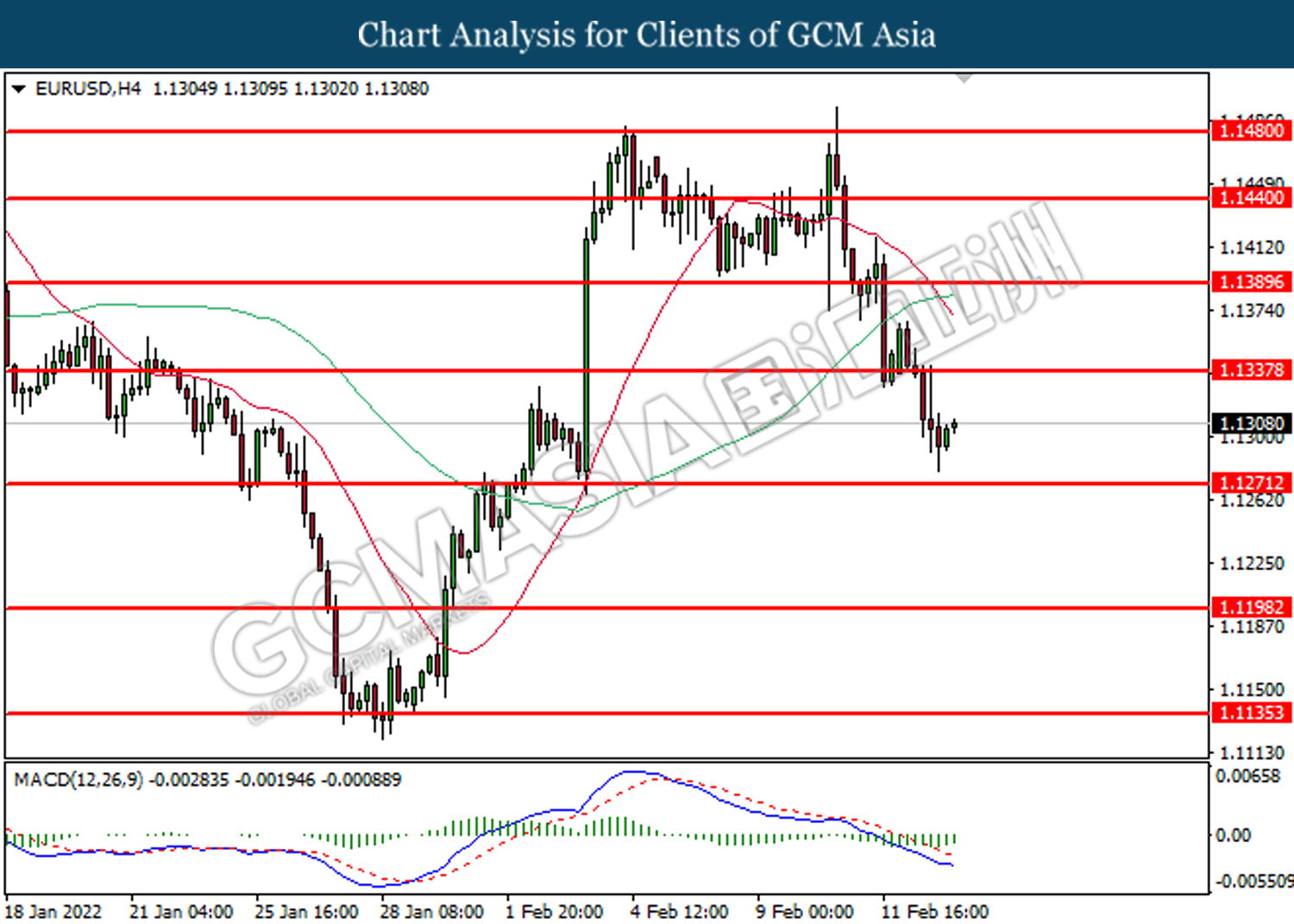

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. However, MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower after breaking its support level.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

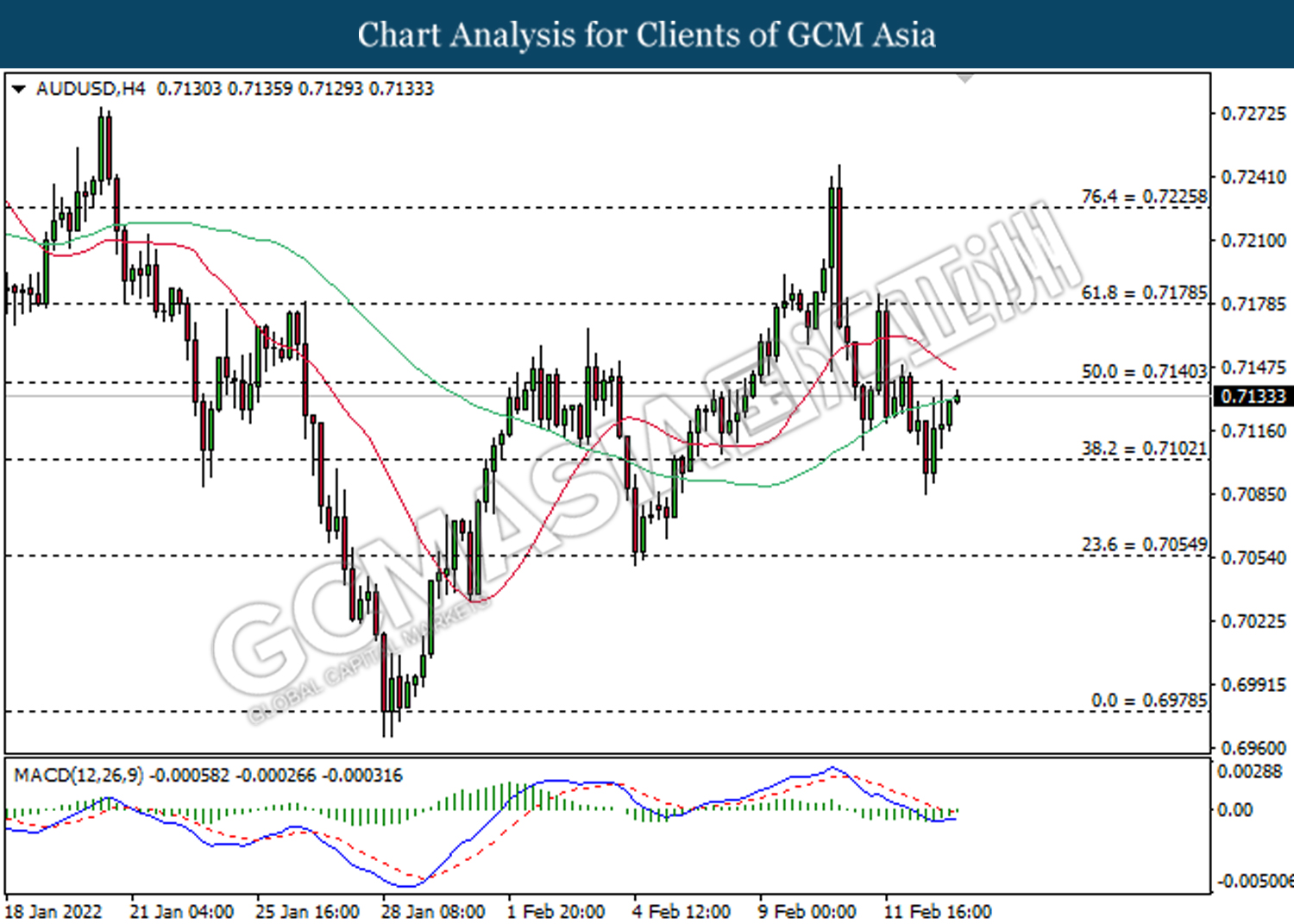

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

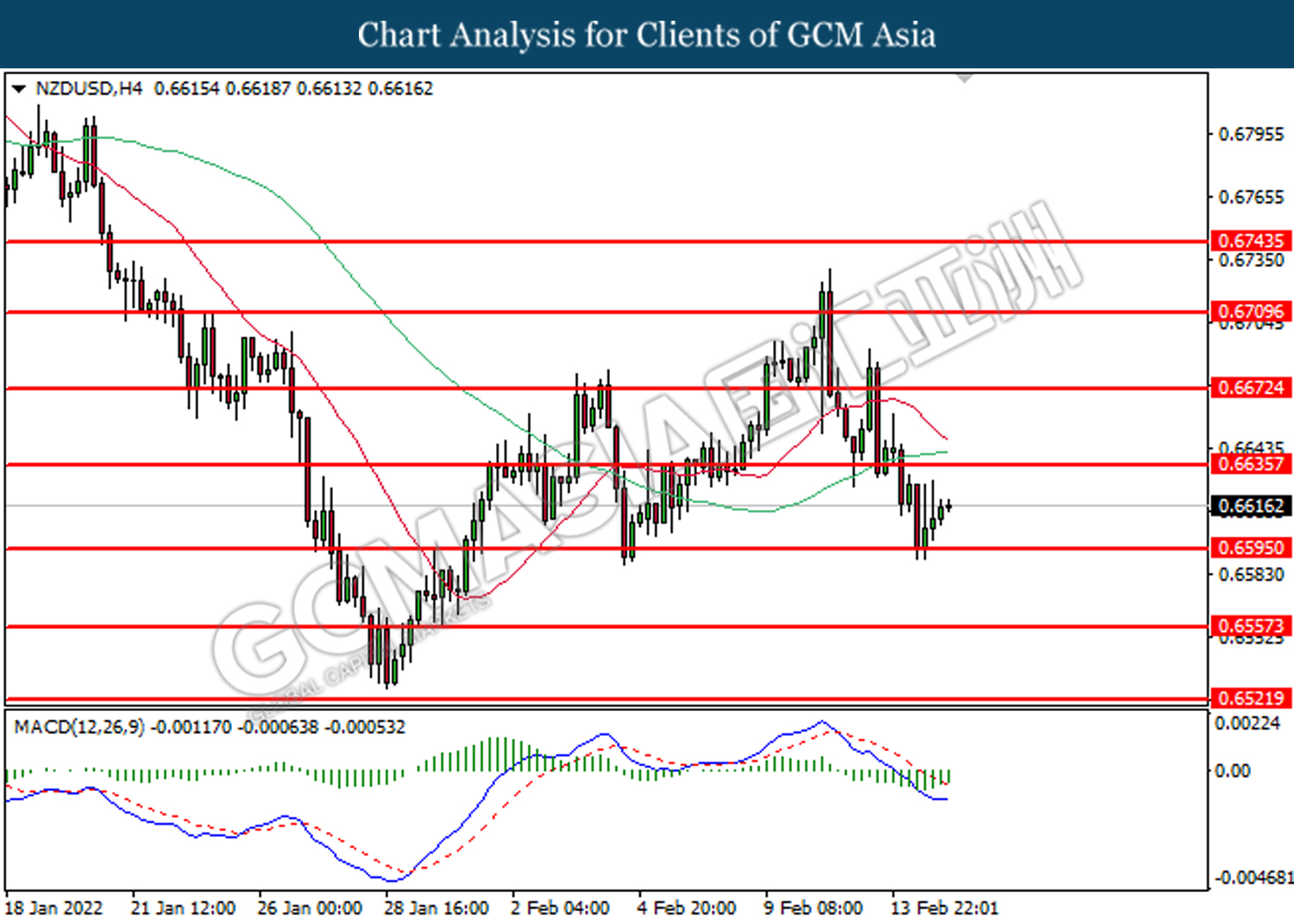

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6635, 0.6670

Support level: 0.6595, 0.6560

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

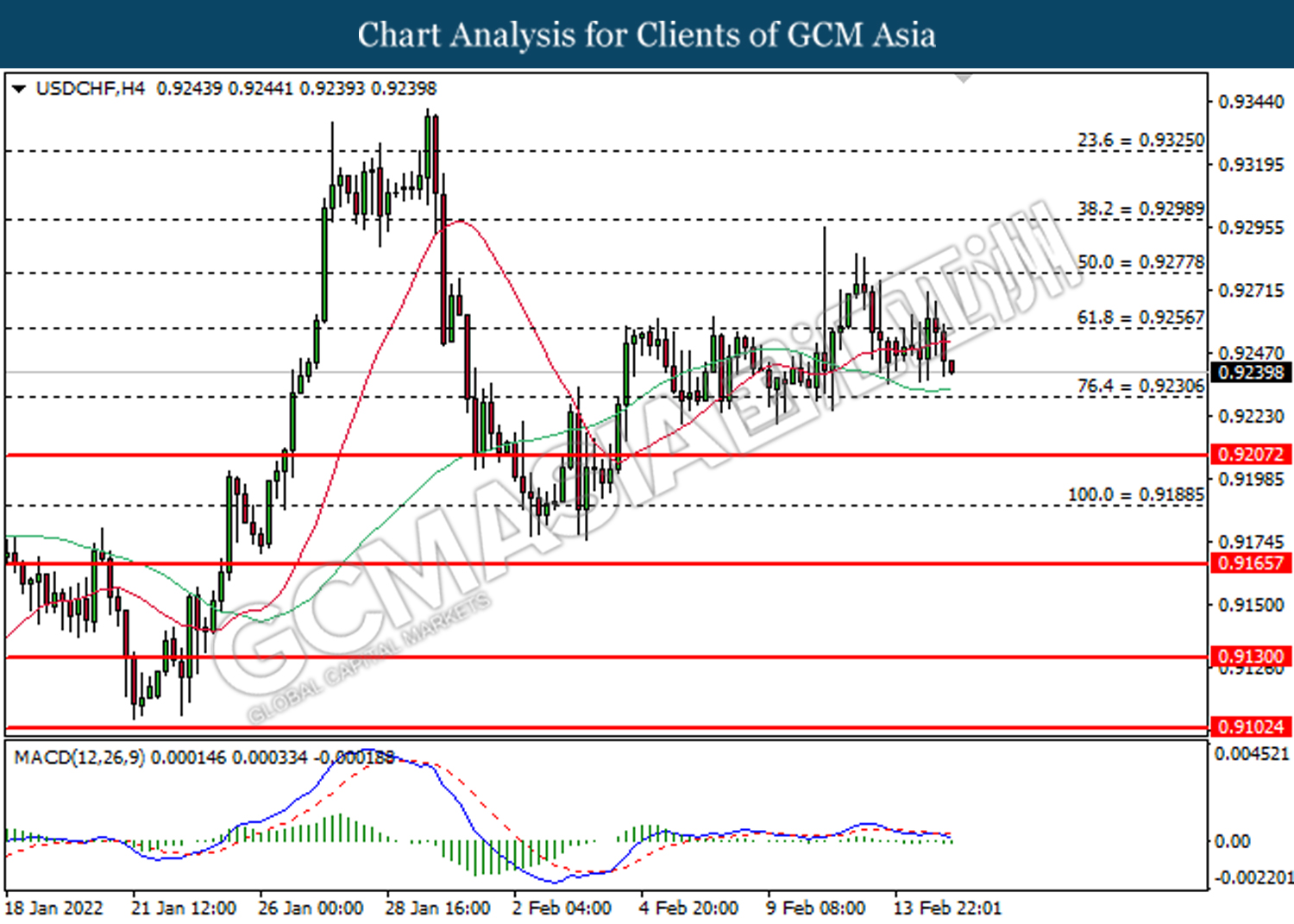

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.50

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20