15 February 2022 Afternoon Session Analysis

Risk-off sentiment spurred demand on safe-haven Yen.

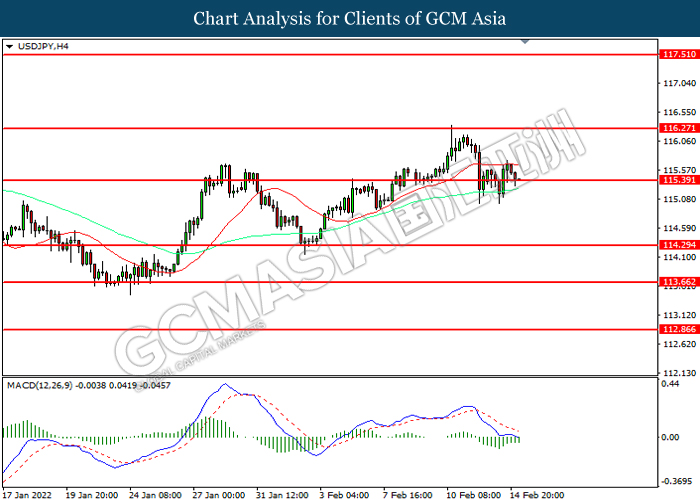

USDJPY extended its losses as tensions between Russia and Ukraine are increasing. As Ukraine President Volodymyr Zelensky stated that Russia would attack his country on February 16, investors are heading towards Japanese Yen as one of the safe haven assets aside commodities. Besides that, the data of Japan’s Preliminary Gross Domestic Product (GDP) for the fourth quarter rose 1.3% versus 1.4% expected and -0.9% prior. Further, GDP Annualized also rose 5.4% as compared to -3.6% prior, below forecast of 5.8%. Despite being lower than expected data, the positive data has helped the pair to limit its losses. For the time being, investors will continue to monitor crucial updates from the Russia-Ukraine tensions as well as other news event from Japan in order to gauge the movement of the pair. As of writing, the USDJPY was down 0.21% to 115.364.

In the commodities market, crude oil price was down 0.45% to $92.82 per barrel after price has reached a higher level of resistance. On the other hand, gold price was up 0.27% to $1876.94 per troy ounce due to Russia and Ukraine tensions.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Dec) | 4.20% | 3.90% | – |

| 15:00 | GBP – Claimant Count Change (Jan) | -43.3K | -36.2K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 51.7 | 53.5 | – |

| 21:30 | USD – PPI (MoM) (Jan) | 0.30% | 0.50% | – |

Technical Analysis

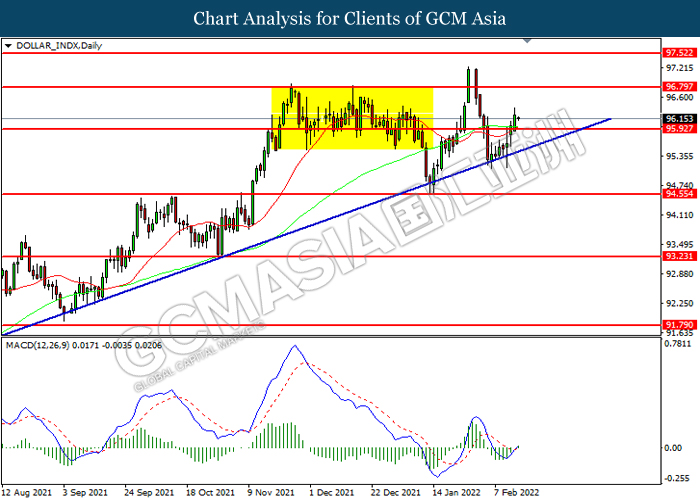

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 95.95. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level at 96.80.

Resistance level: 96.80, 97.50

Support level: 95.95, 94.55

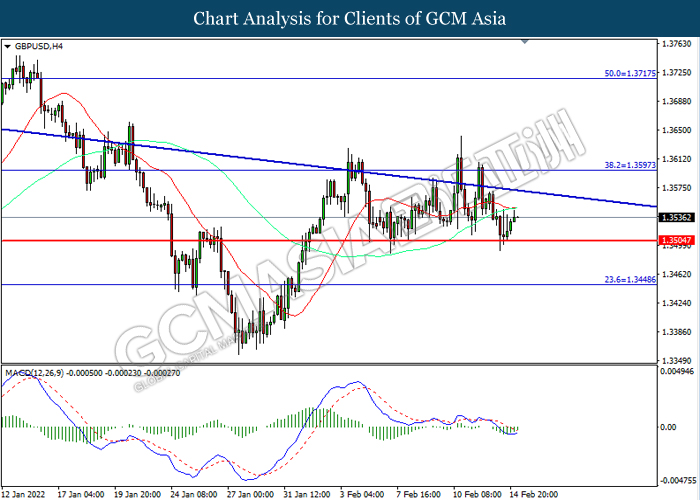

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3505. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.3595.

Resistance level: 1.3595, 1.3715

Support level: 1.3505, 1.3450

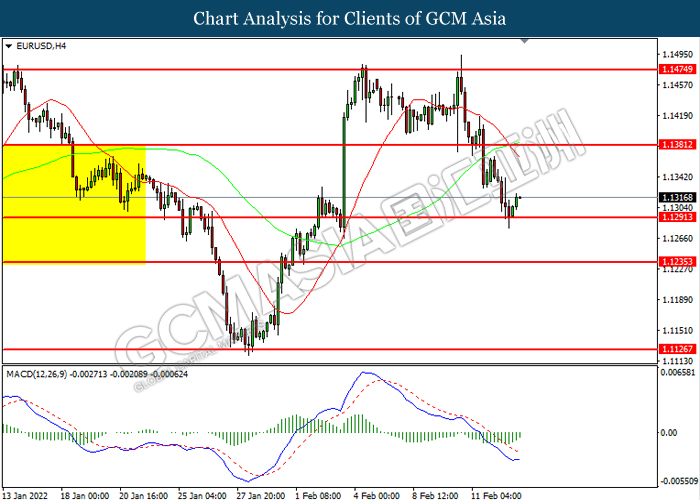

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1290. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 115.40. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 116.25, 117.50

Support level: 115.40, 114.30

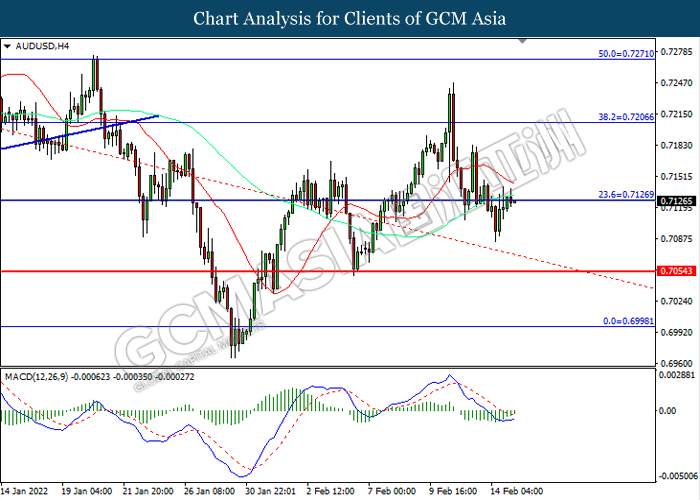

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7125. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7125, 0.7205

Support level: 0.7055, 0.7000

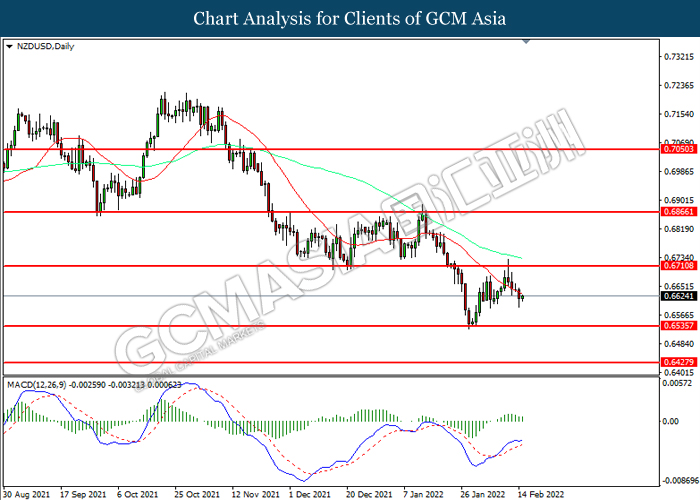

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6710. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6535.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

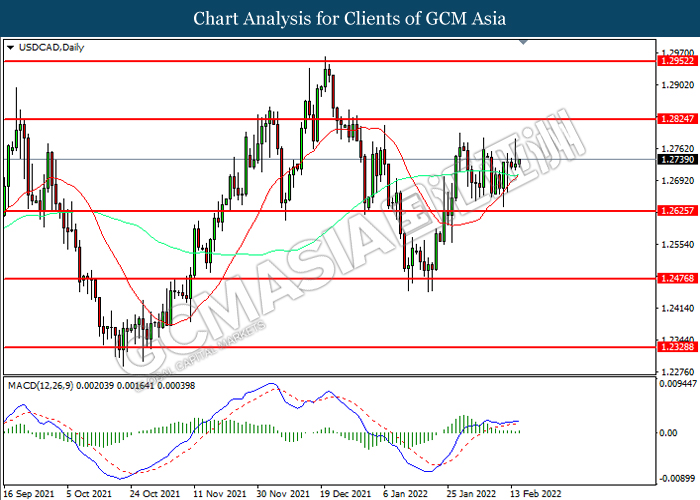

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2825.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

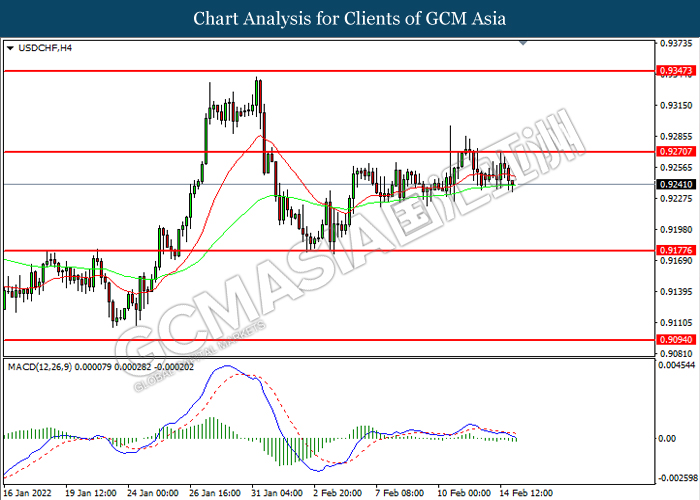

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9270. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9180.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

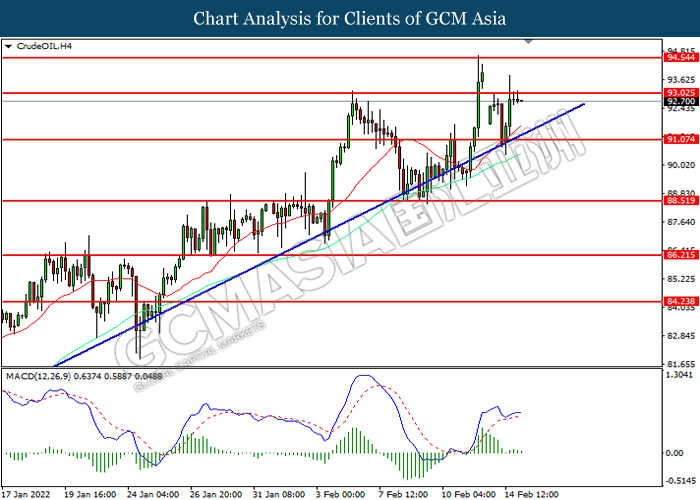

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 93.05. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 93.05, 94.55

Support level: 91.10, 88.50

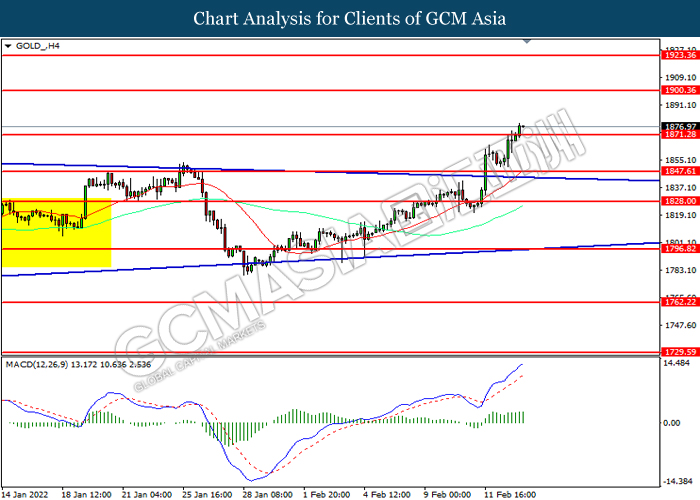

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1871.30. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1900.35.

Resistance level: 1900.35, 1923.35

Support level: 1871.30, 1847.60