16 February 2022 Morning Session Analysis

Peaceful world ahead?

Greenback reverses its course and stages a substantial correction on yesterday after tensions in between Russia and Ukraine begins to subside. According to reports, US satellite image shows that Russia has recalled a portion of their troops from Ukraine borders. Russia President’s Office also confirmed the recall, showing Kremlin’s approach to dial down both parties’ tension which could open up to diplomatic talks in between both countries. However, US counterpart warned that Russia may stage an attack at any point of time as 60% of their troops still remains near the border. Nonetheless, US dollar’s losses were limited following substantial increase in PPI. Last month, PPI rose 1.0%, its largest increase in 8 months amid surge in cost of hospital outpatient care and goods such as food. The data has reinforced Federal Reserve’s view to tighten monetary policy at a faster pace to curb rising inflation in the US. As of writing, dollar index was up 0.01% to 95.92.

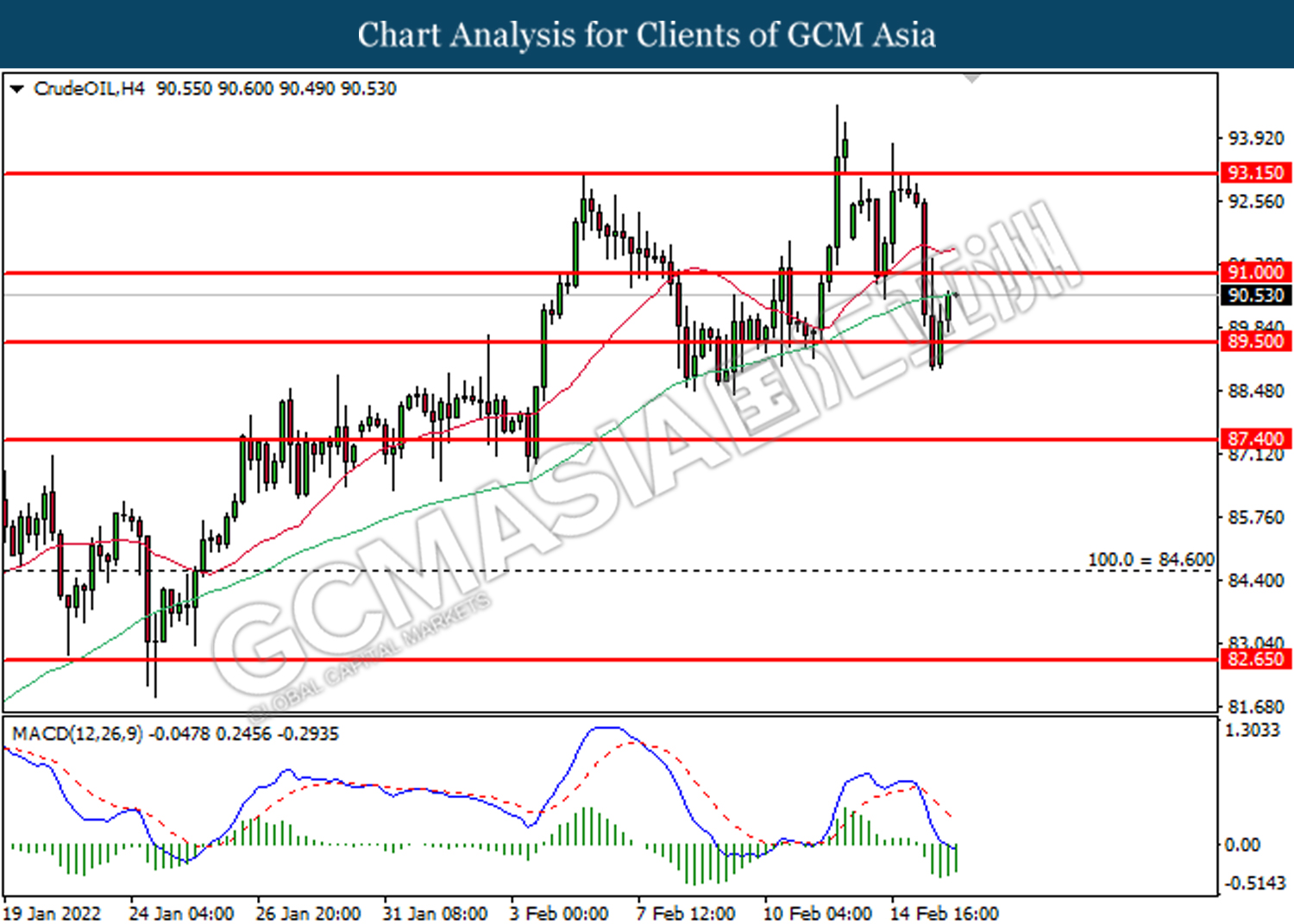

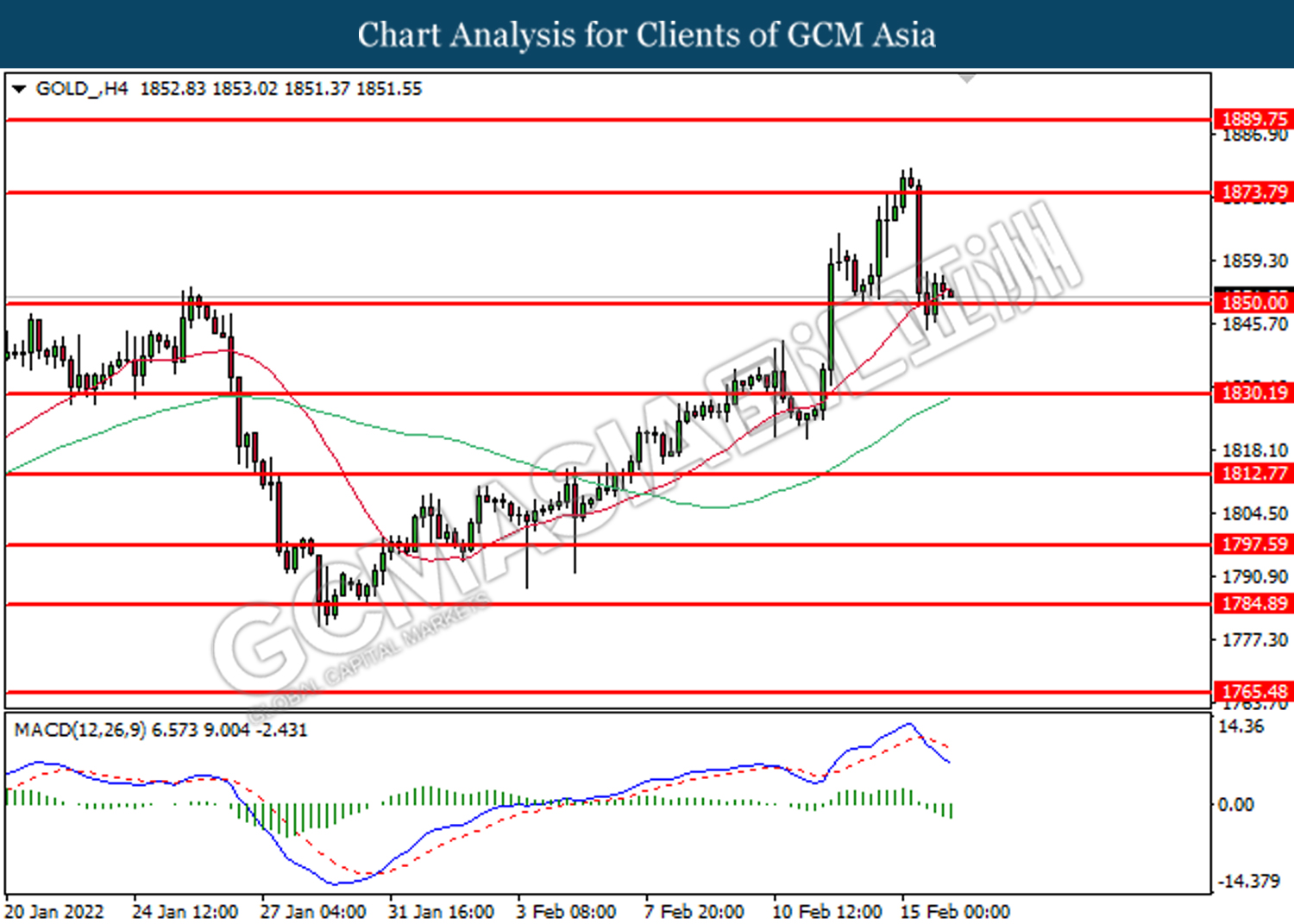

For commodities, crude oil price rose 0.29% to $90.48 per barrel. Oil prices were traded lower on yesterday following diminishing tension in between Russia and Ukraine. On the other hand, gold price was down by 0.01% to $1,853.05 a troy ounce due to lower geopolitical risk.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Jan) | 5.40% | 5.40% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Jan) | -2.30% | 0.80% | – |

| 21:30 | USD – Retail Sales (MoM) (Jan) | -1.90% | 1.80% | – |

| 21:30 | CAD – Core CPI (MoM) (Jan) | 0.00% | 0.00% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -4.756M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. However, MACD which illustrate bearish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

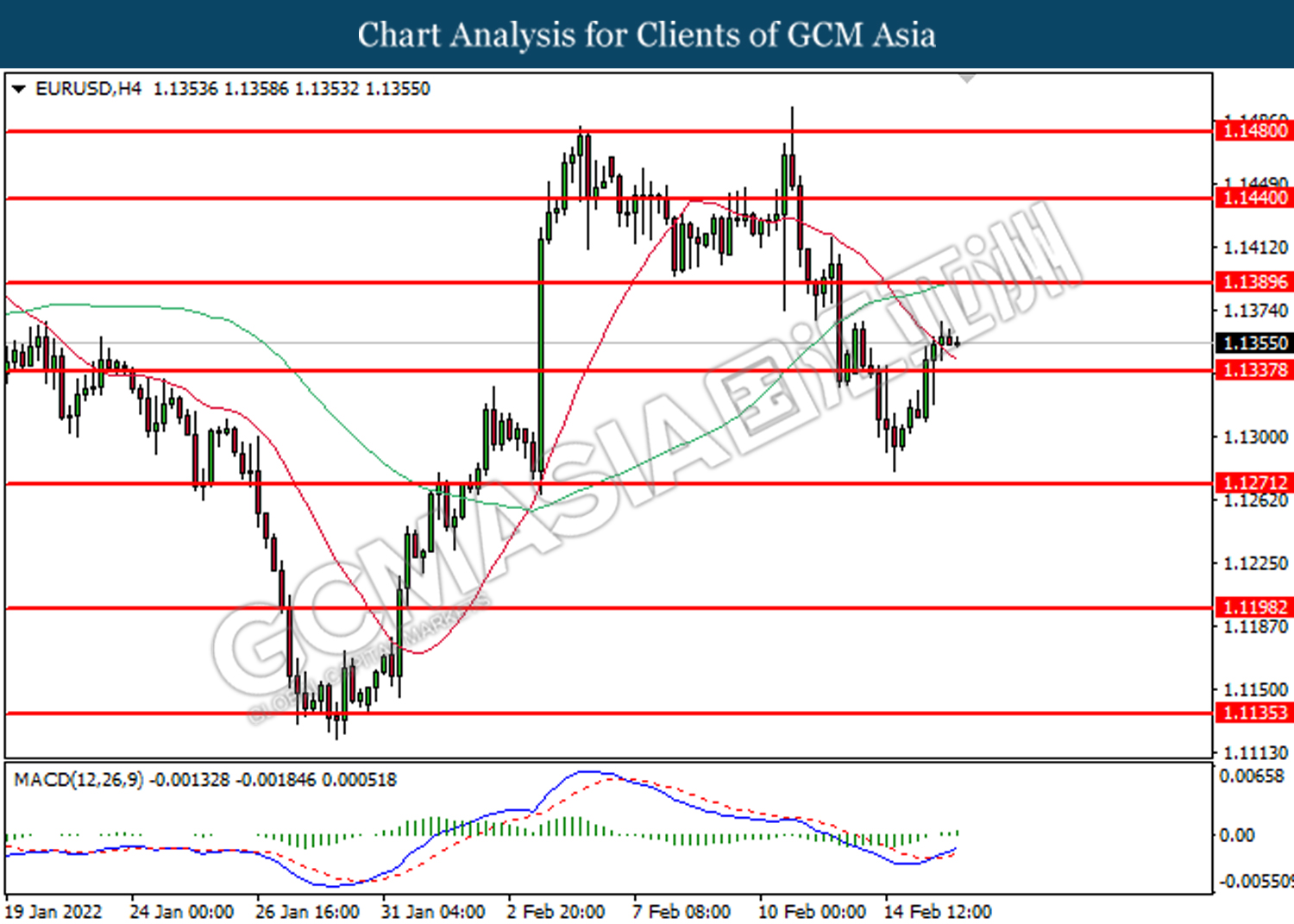

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

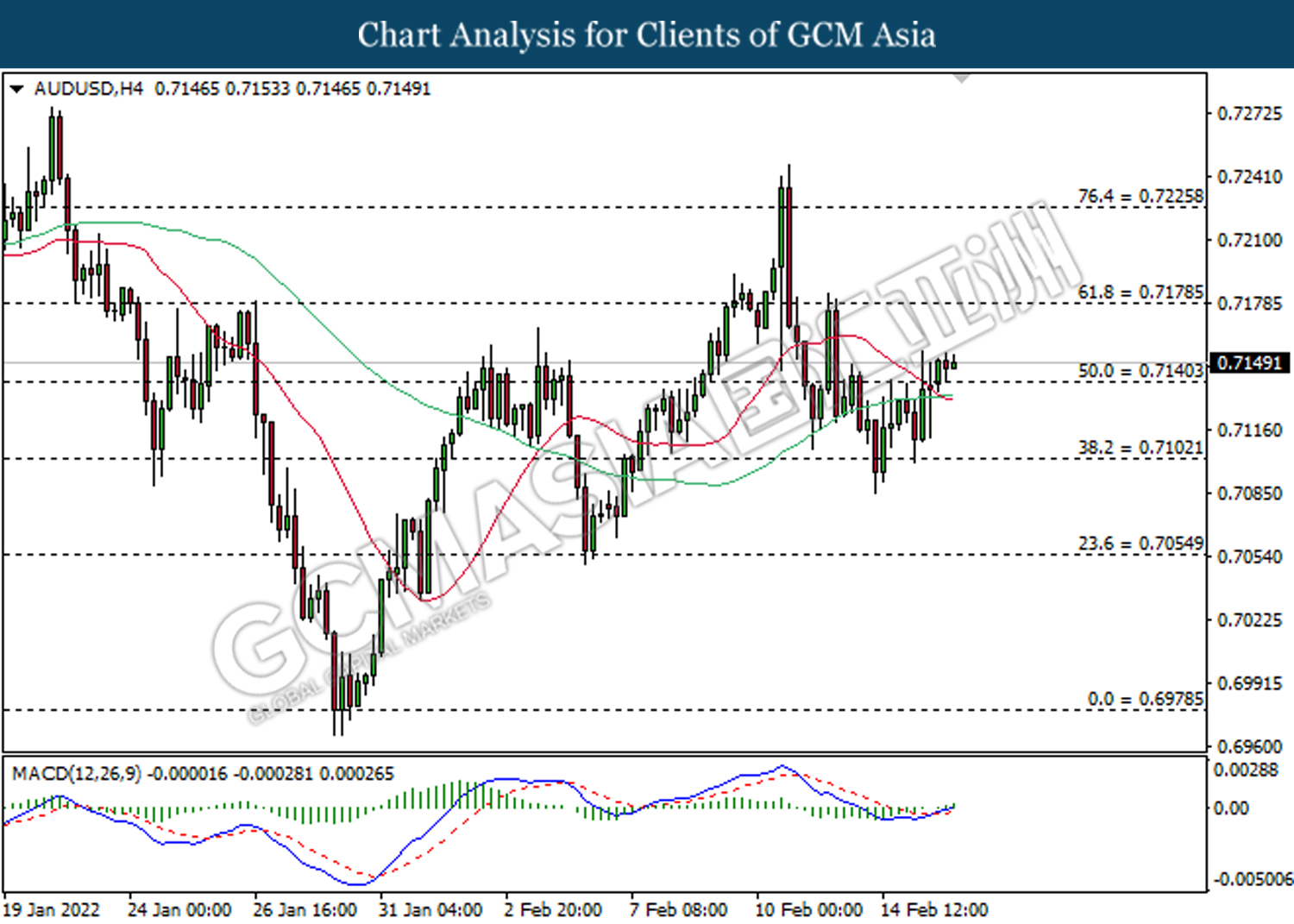

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

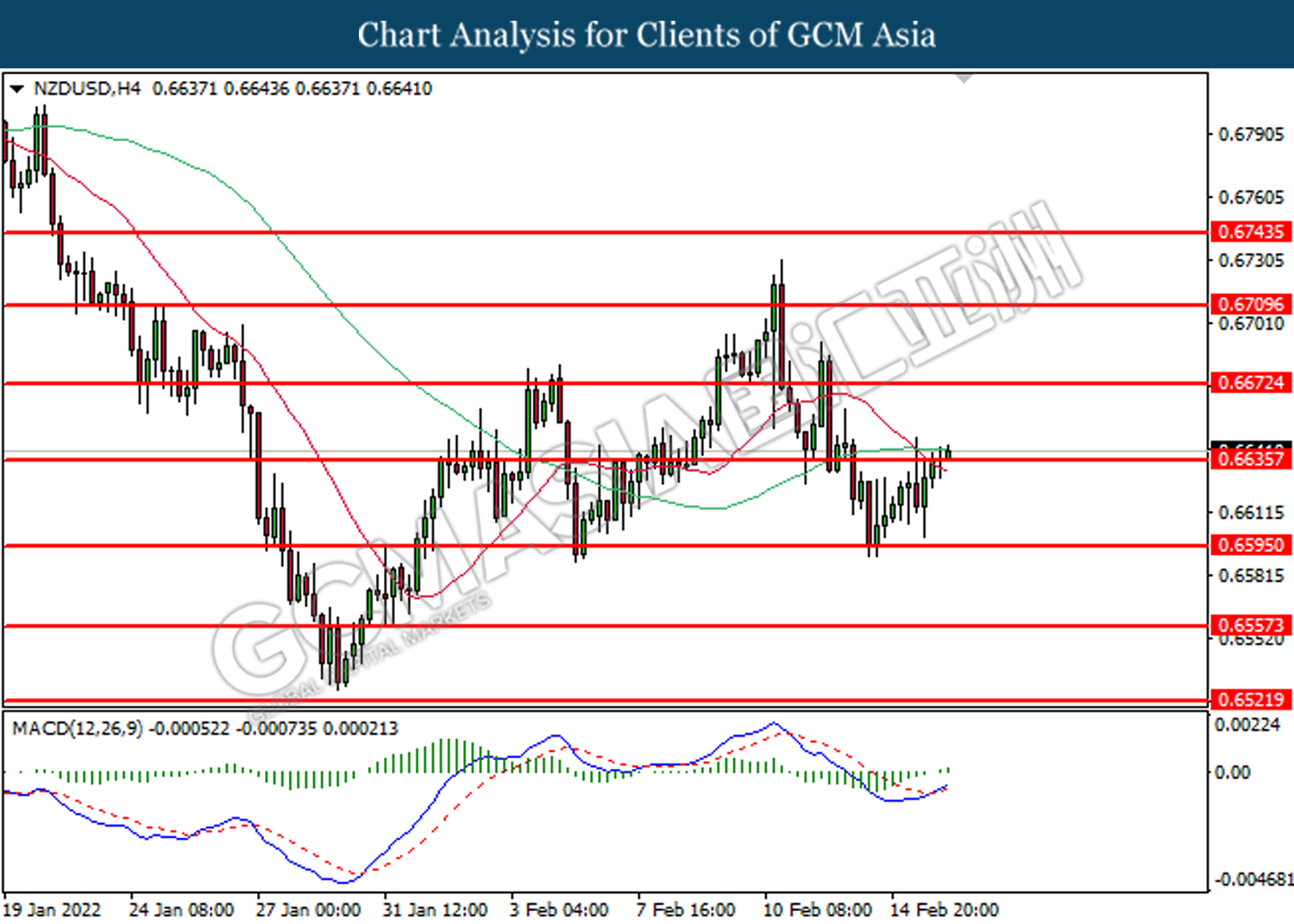

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

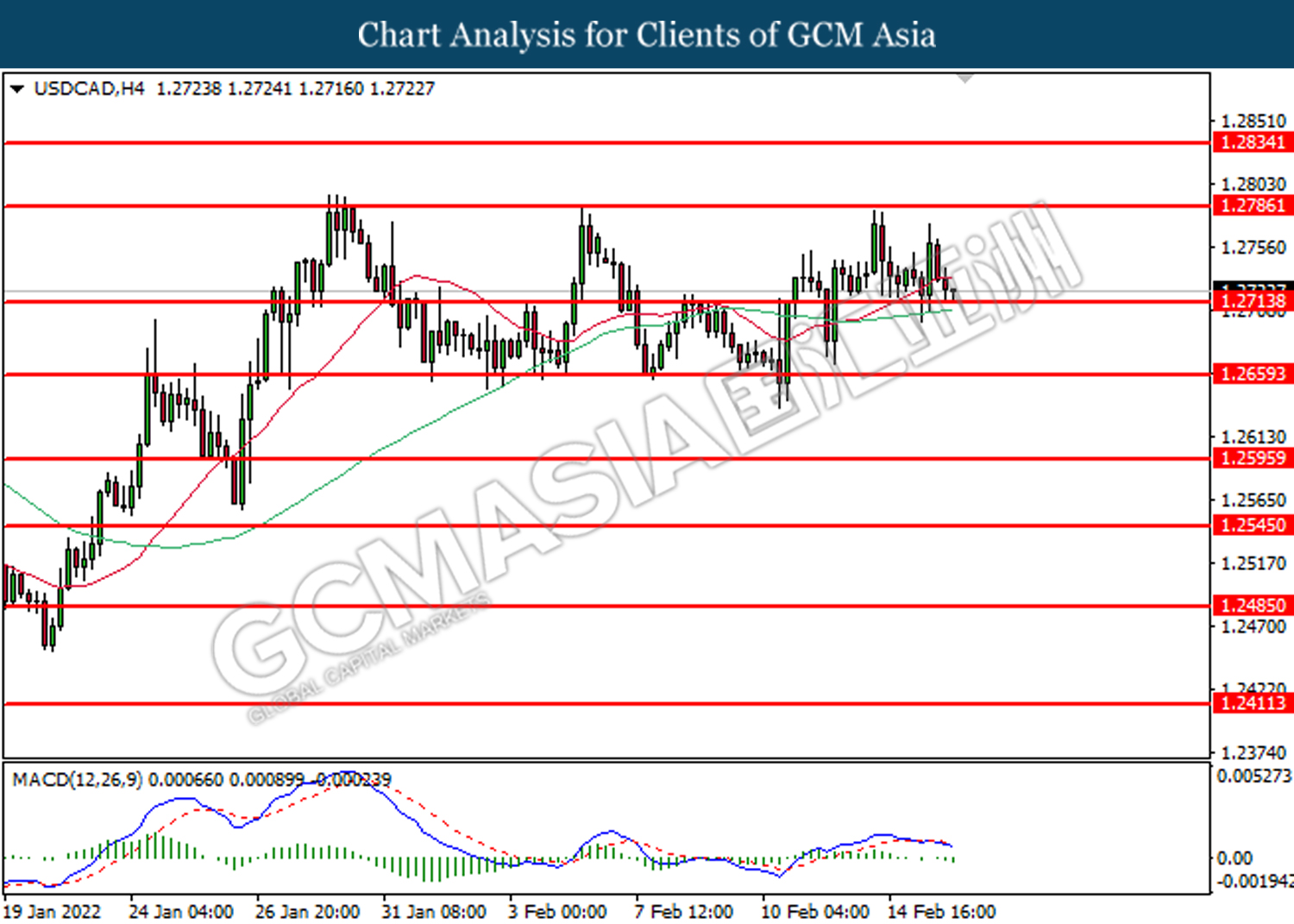

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

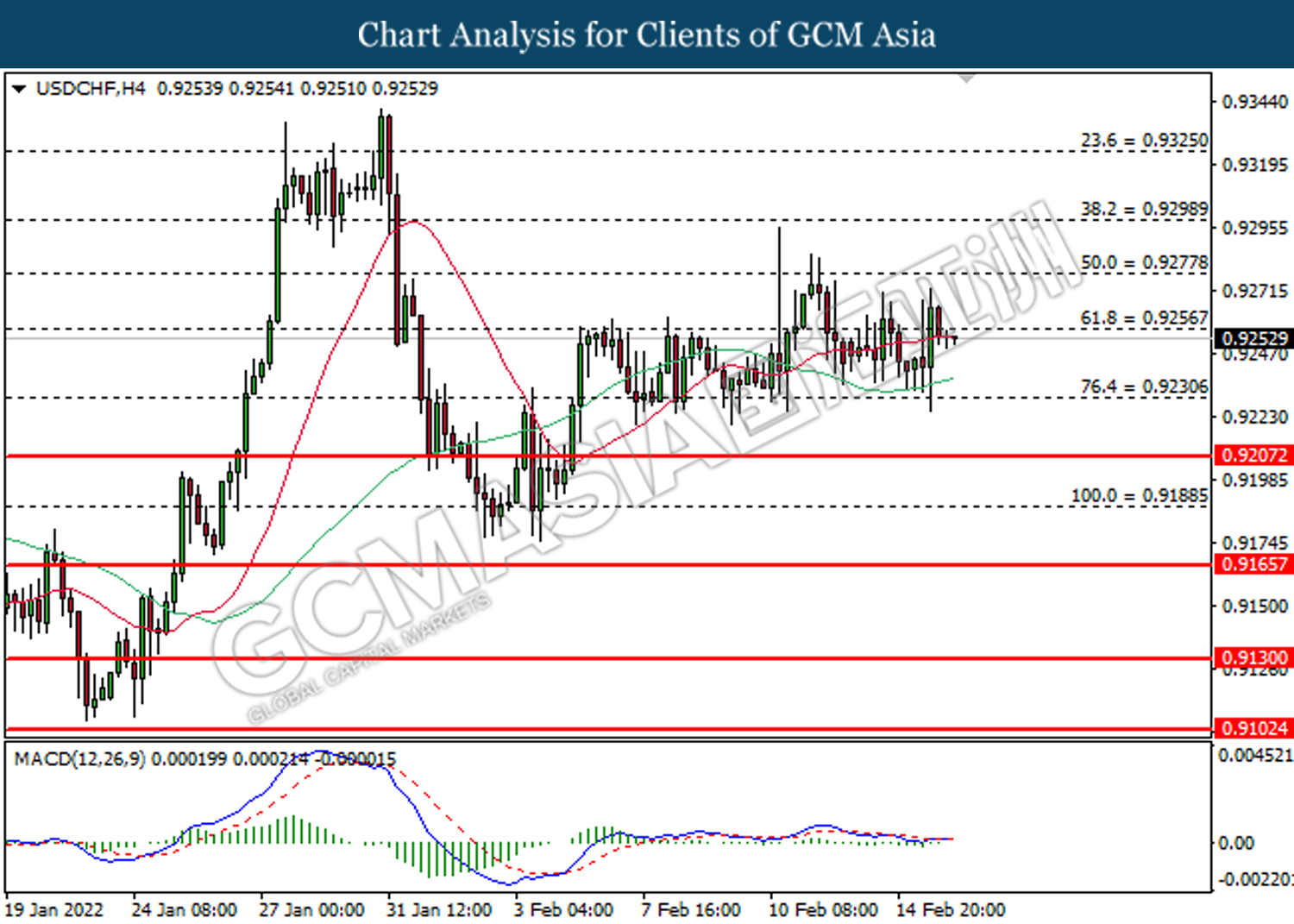

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after breaking the support level.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20