17 February 2022 Afternoon Session Analysis

UK consumer faces cost of living crisis.

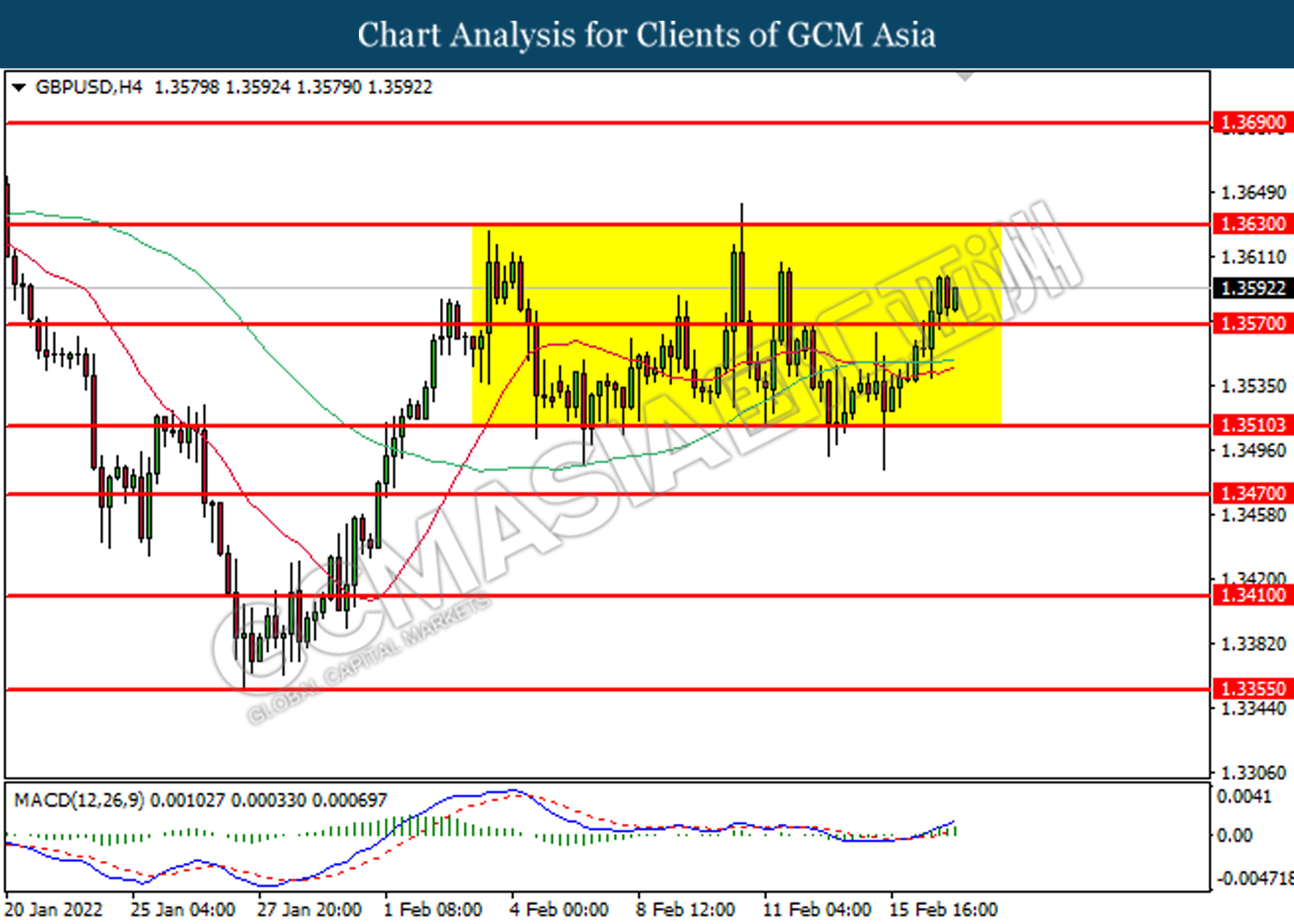

Pound sterling charges ahead from lower level as inflation pressure in the UK mounts. The latest figure from UK Office for National Statistics showed that Consumer Price Index rose 0.1% to 5.5% in January, its highest level since 1992. Last month’s inflation was mainly contributed by rising prices of clothing and footwear while other items such as electricity and food were also in the mix. Economists warned that recent jump in cost of living may appreciate further, peaking at 8% by April as household energy bills soars sharply. Although UK government introduced measures to ease rising household energy bills, economists cautioned that such measure could cost the government an extra £11 billion this year. Nevertheless, investors reacted positively towards the data as it may force Bank of England to take aggressive measures such as numerous interest rate hikes in order to curb rising inflation. As of writing, pair of GBP/USD was up 0.03% to 1.3590.

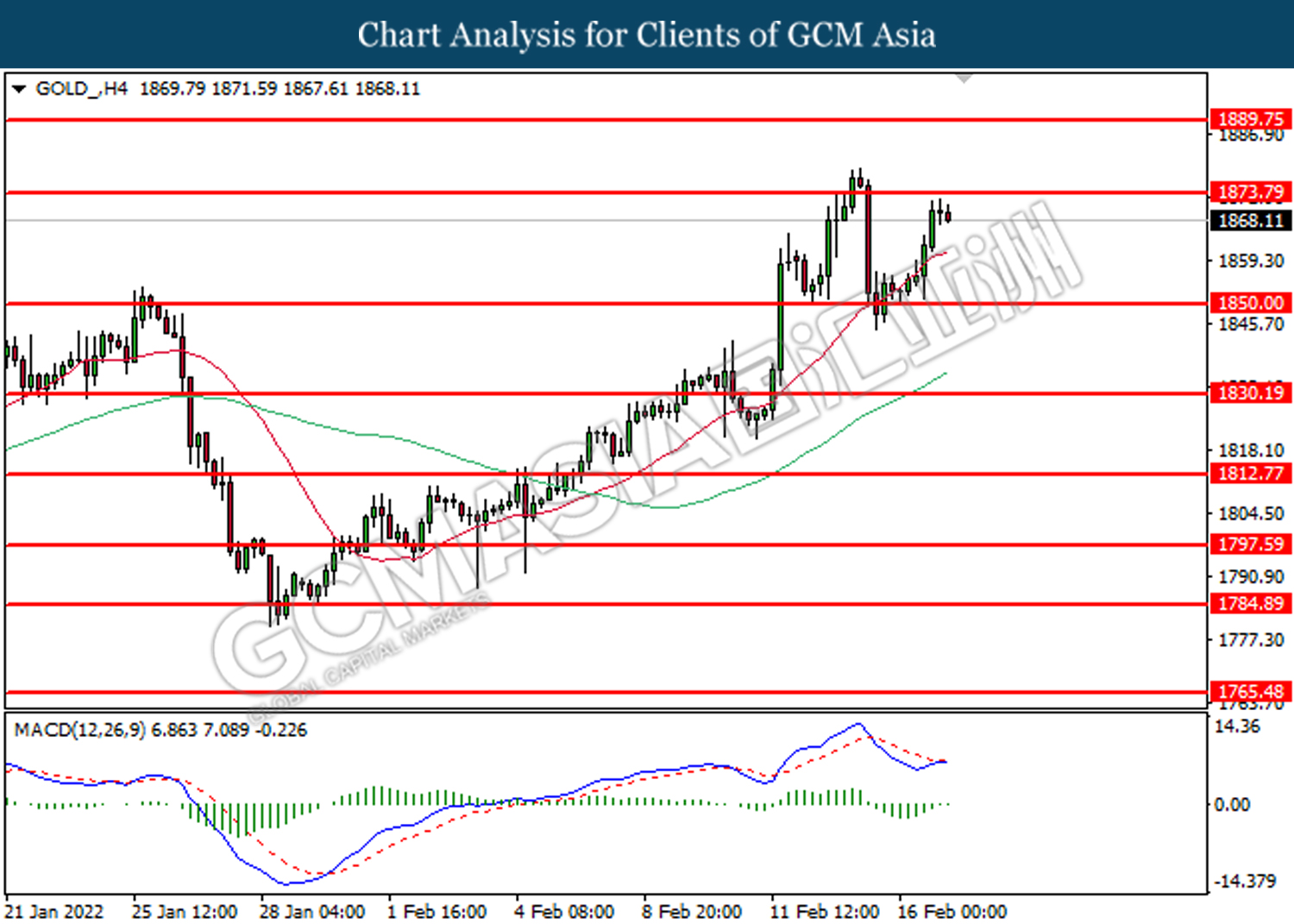

As for commodities, crude oil price was up by 0.79% to $89.65 per barrel following technical correction from lower levels. On the other hand, gold price was down 0.18% to $1,869.24 a troy ounce due to stronger greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Jan) | 223K | 220K | – |

| 21:30 | USD – Initial Jobless Claims | 23.2 | 20 | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | 64.8K | -15.0K | – |

Technical Analysis

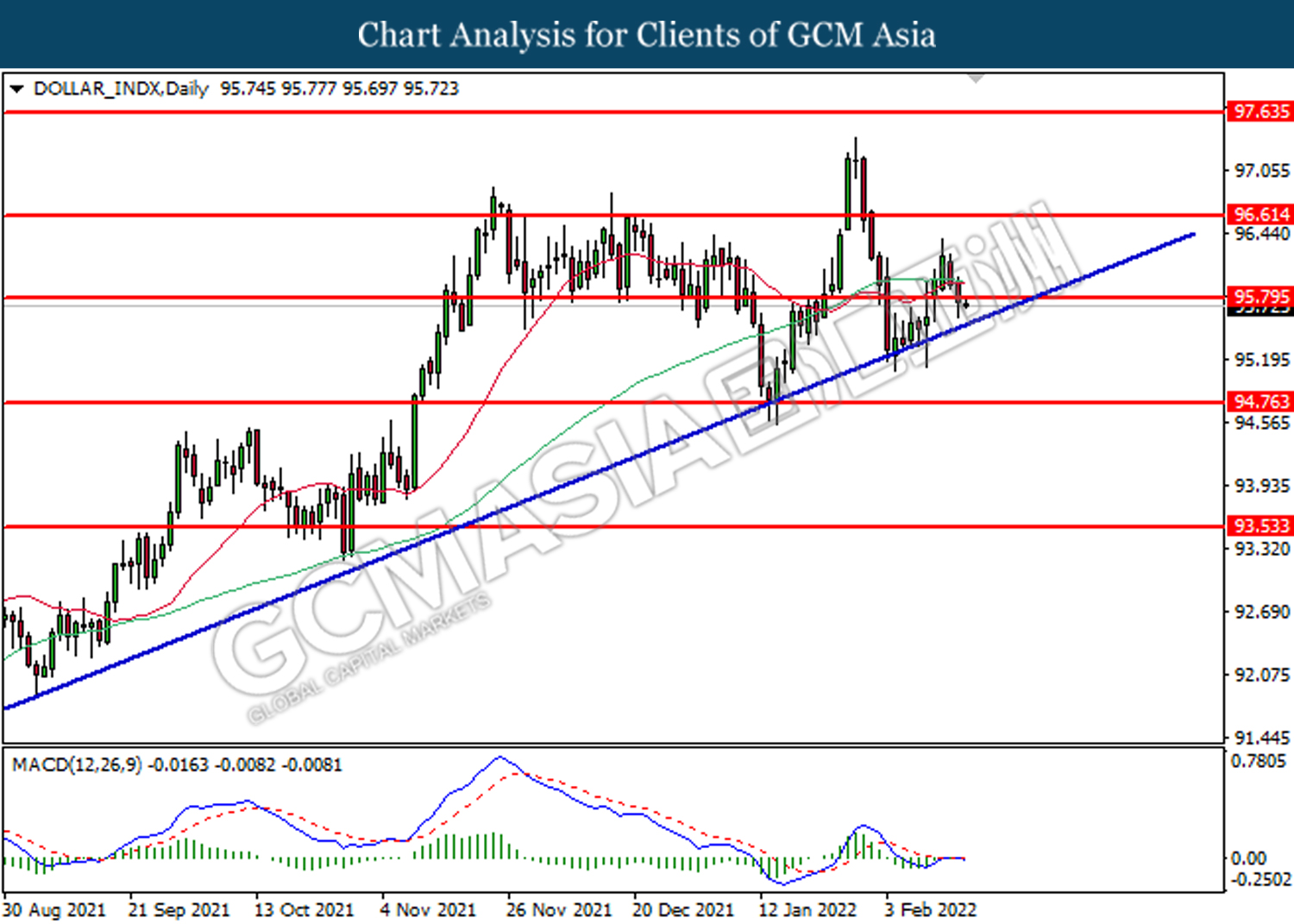

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. However, MACD which illustrate bearish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

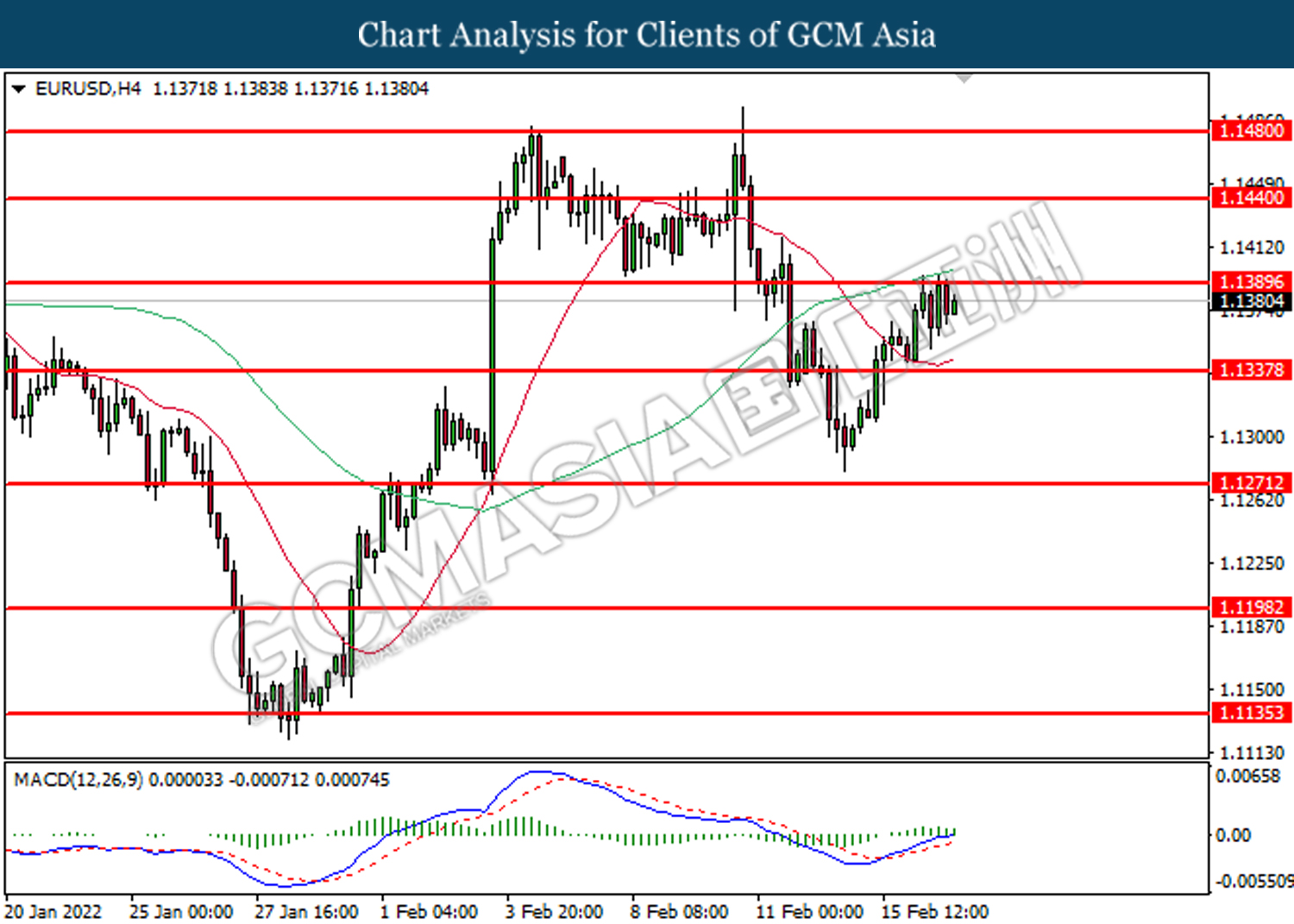

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

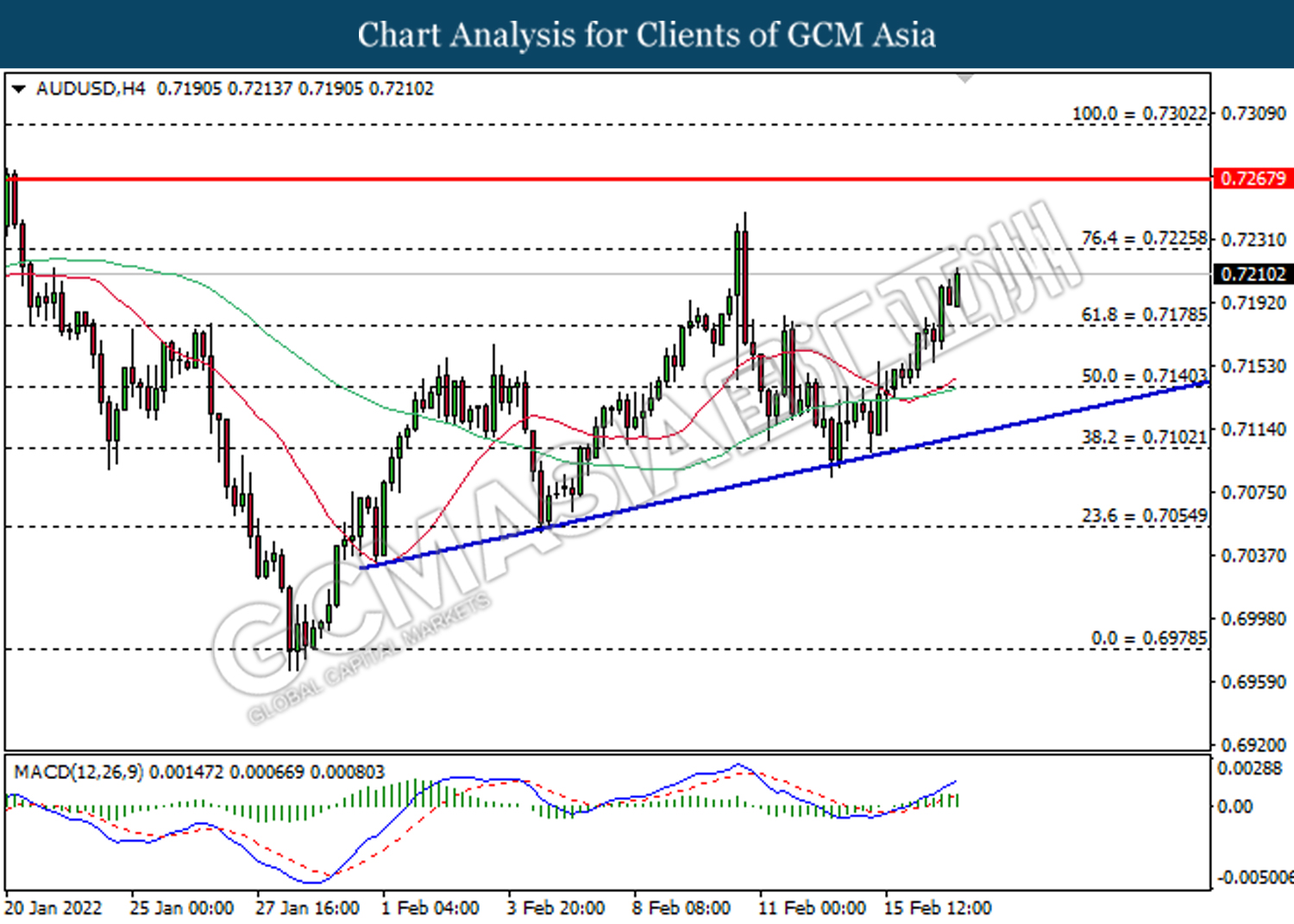

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

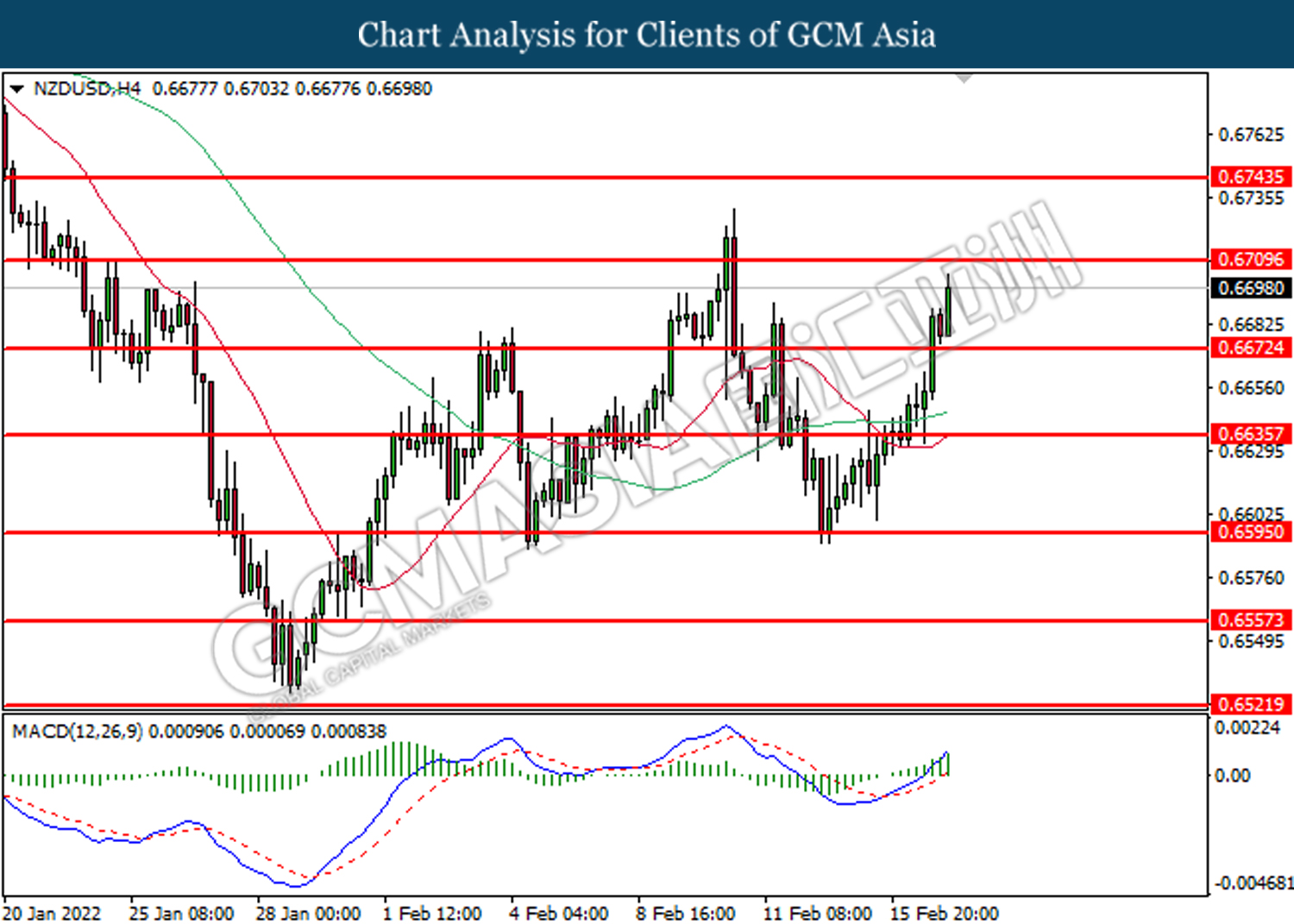

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2600

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9230, 0.9255

Support level: 0.9210, 0.9190

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after breaking the support level.

Resistance level: 91.00, 93.15

Support level: 88.95, 86.95

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20