18 February 2022 Morning Session Analysis

Russia and Ukraine on the brink of war.

Greenback oscillates within a small range as market participants digests mixed signals in the financial market. Earlier yesterday, US dollar received some substantial selloff following the release of bearish economic data. For the month of February, Philadelphia Fed Manufacturing Index slumped to 16.0, lower than forecast of 20.0. Likewise, Initial Jobless Claims ticks up to 248K as ongoing infections of Omicron variant in the US ravage through the employment market. Nonetheless, losses on the greenback is rather limited as tensions in between Russia and Ukraine rises. Latest report shows that Russia has sent back US’s diplomat from its Moscow embassy. The move came after US rejected Russia’s request of national security as US and NATO troops amasses near the Russian border. US also reemphasize that Ukraine is still vulnerable as Russia may attack at any point of time. As of writing, the dollar index was down 0.01% to 95.77.

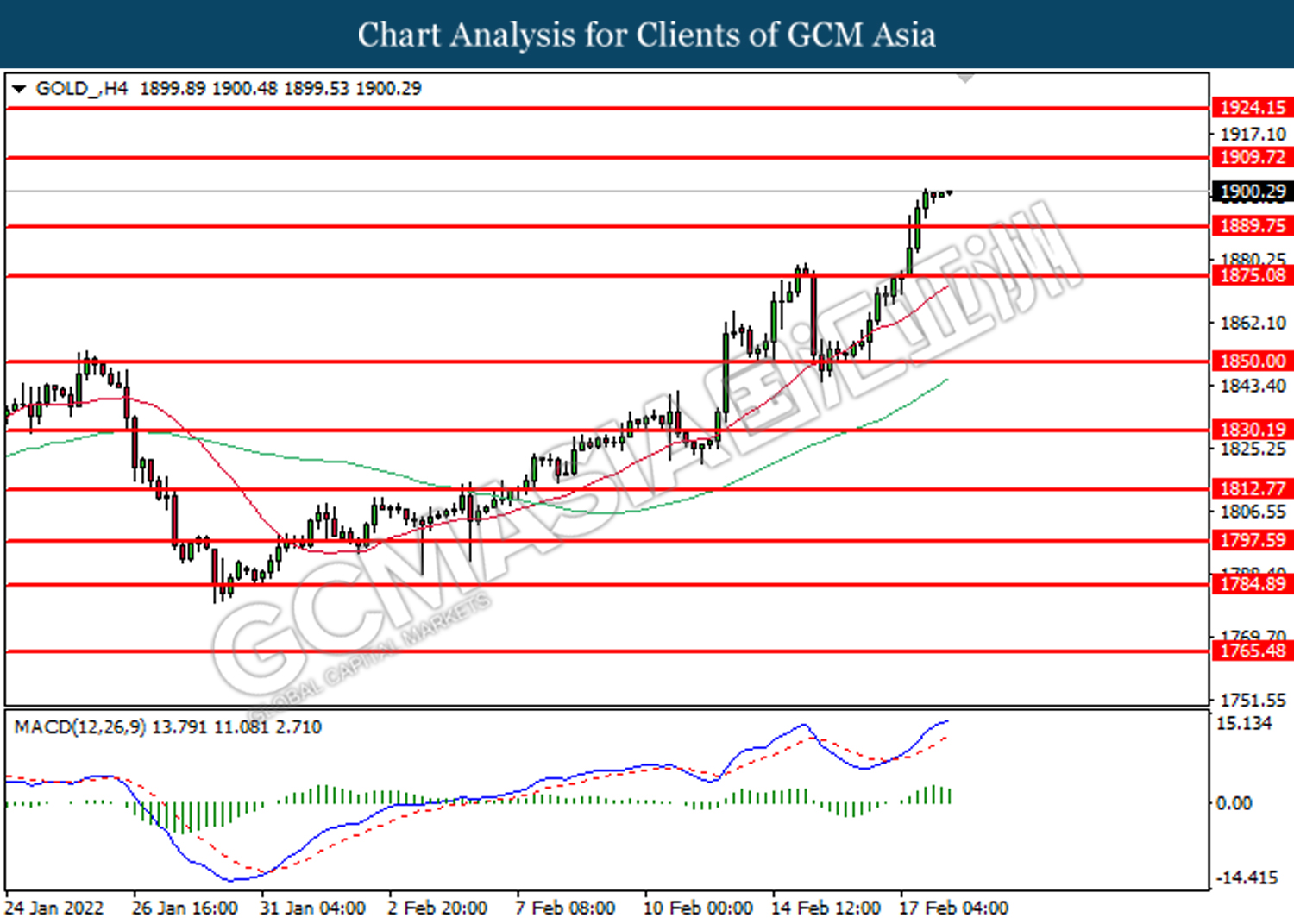

For commodities, crude oil price was up 0.10% to $89.93 per barrel due to growing tension in between Russia and Ukraine. Likewise, recent tension has also pushed gold price higher, up by 0.05% to $1,899.40 a troy ounce.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jan) | -3.7% | 1.0% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | 1.1% | -2.0% | – |

| 23:00 | USD – Existing Home Sales (Jan) | 6.18M | 6.10M | – |

Technical Analysis

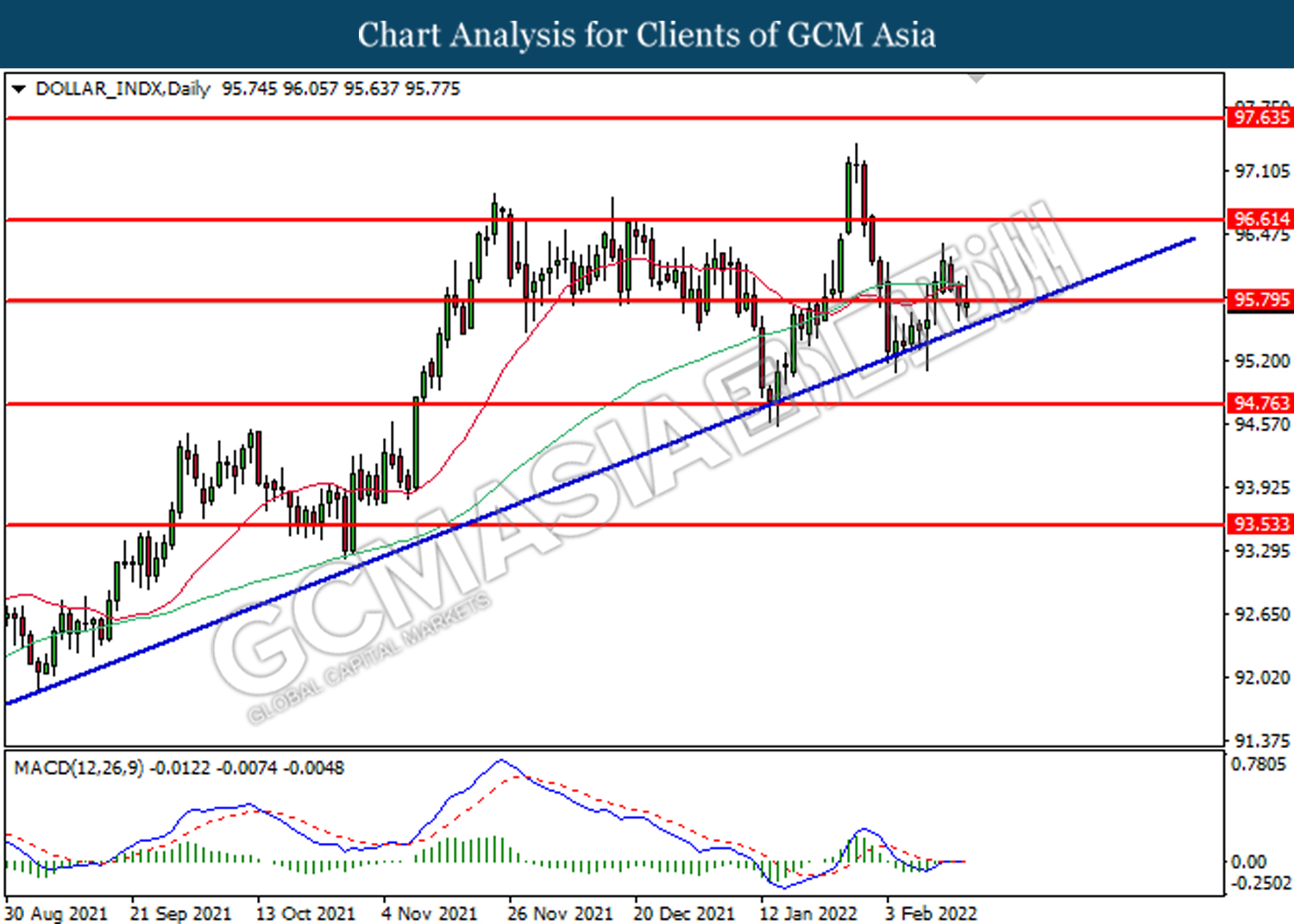

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the index to be traded lower in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

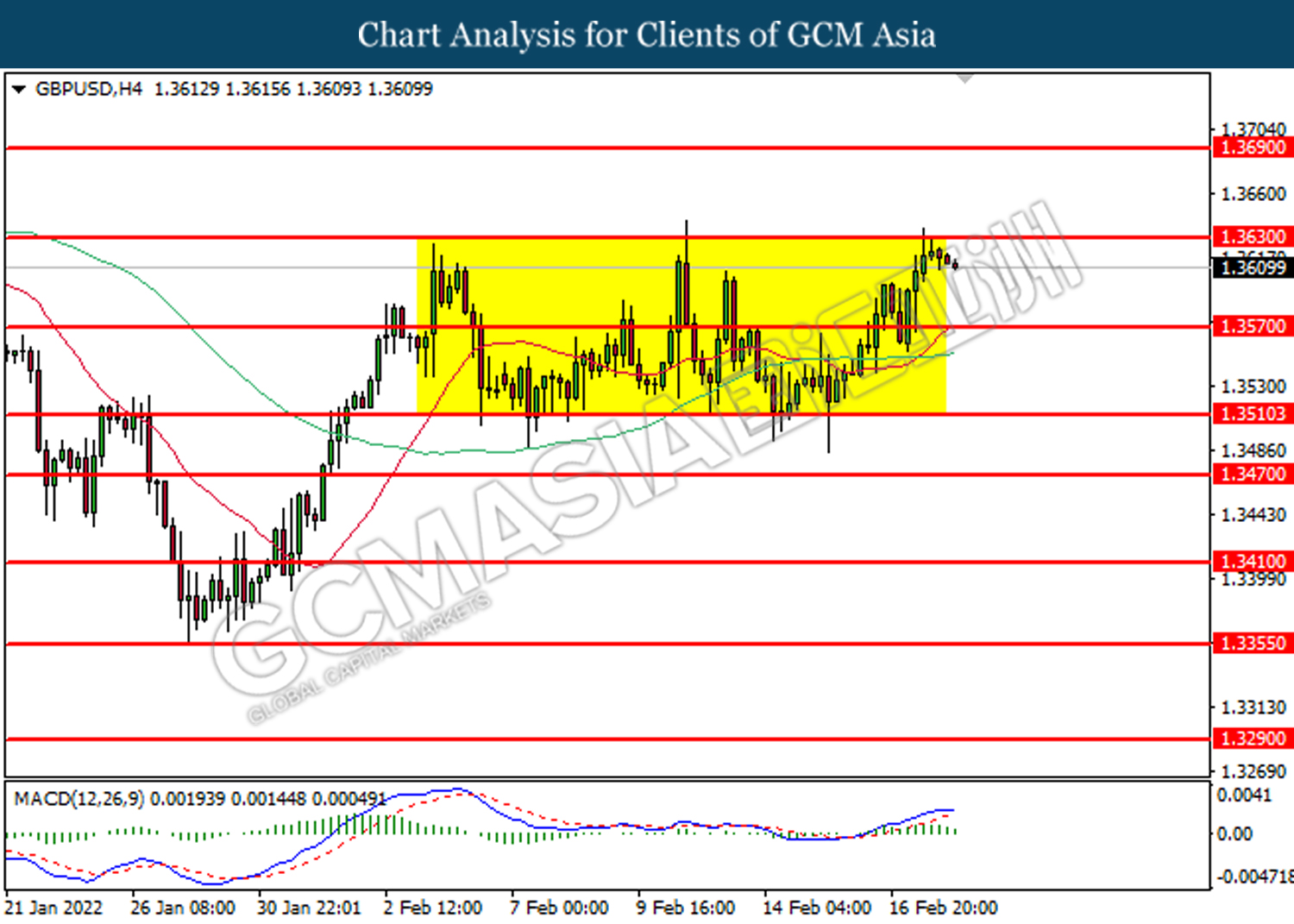

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

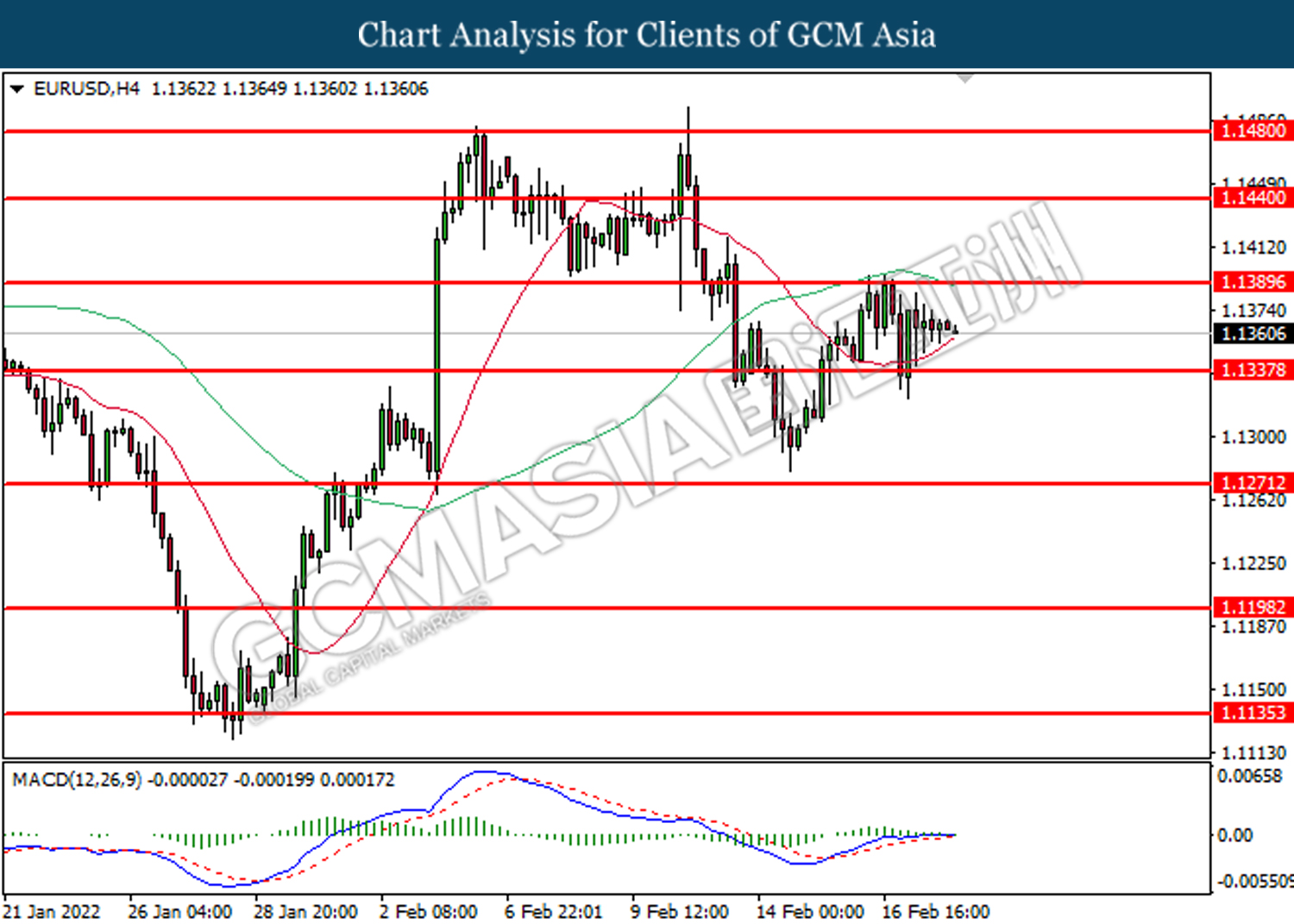

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

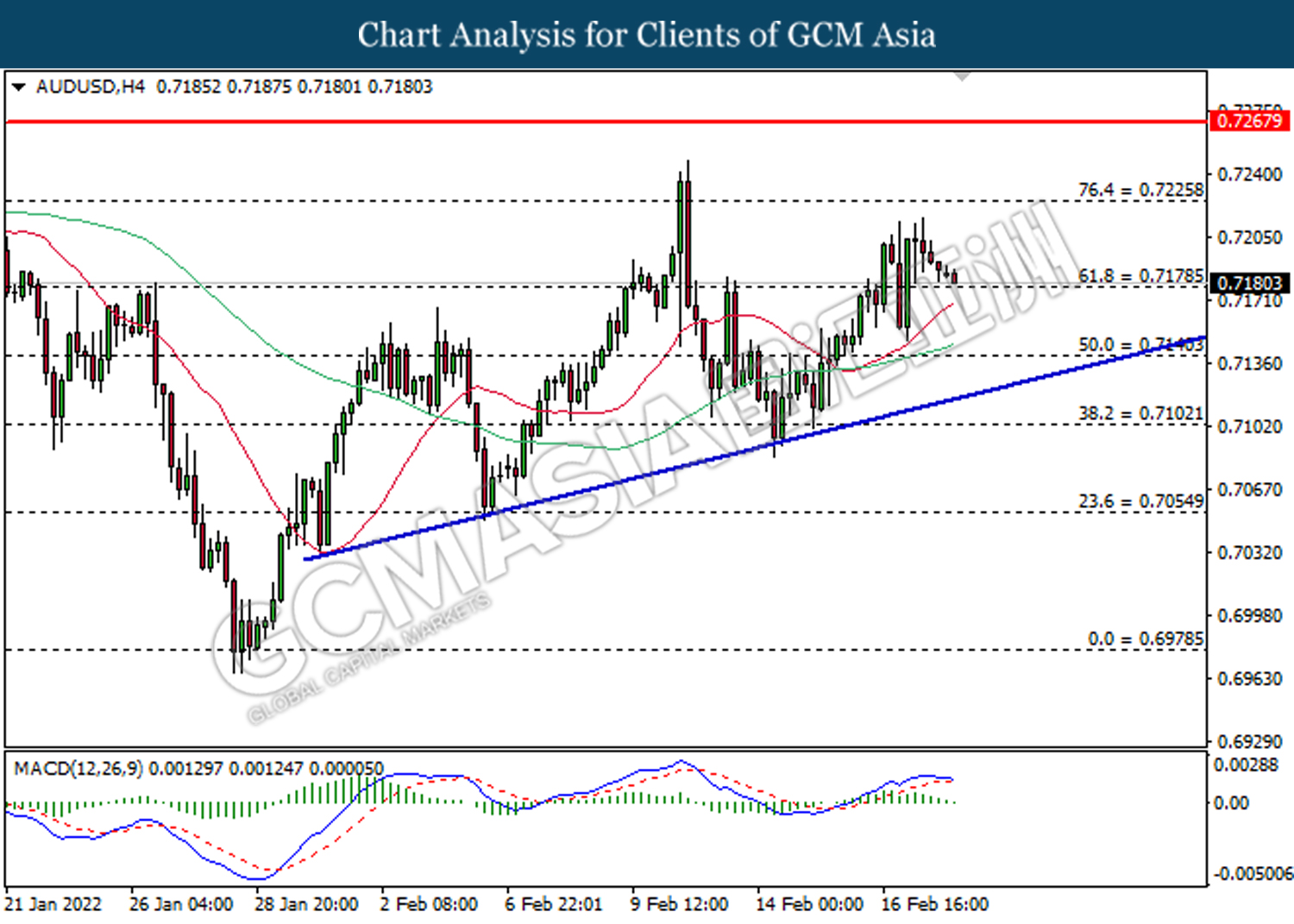

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

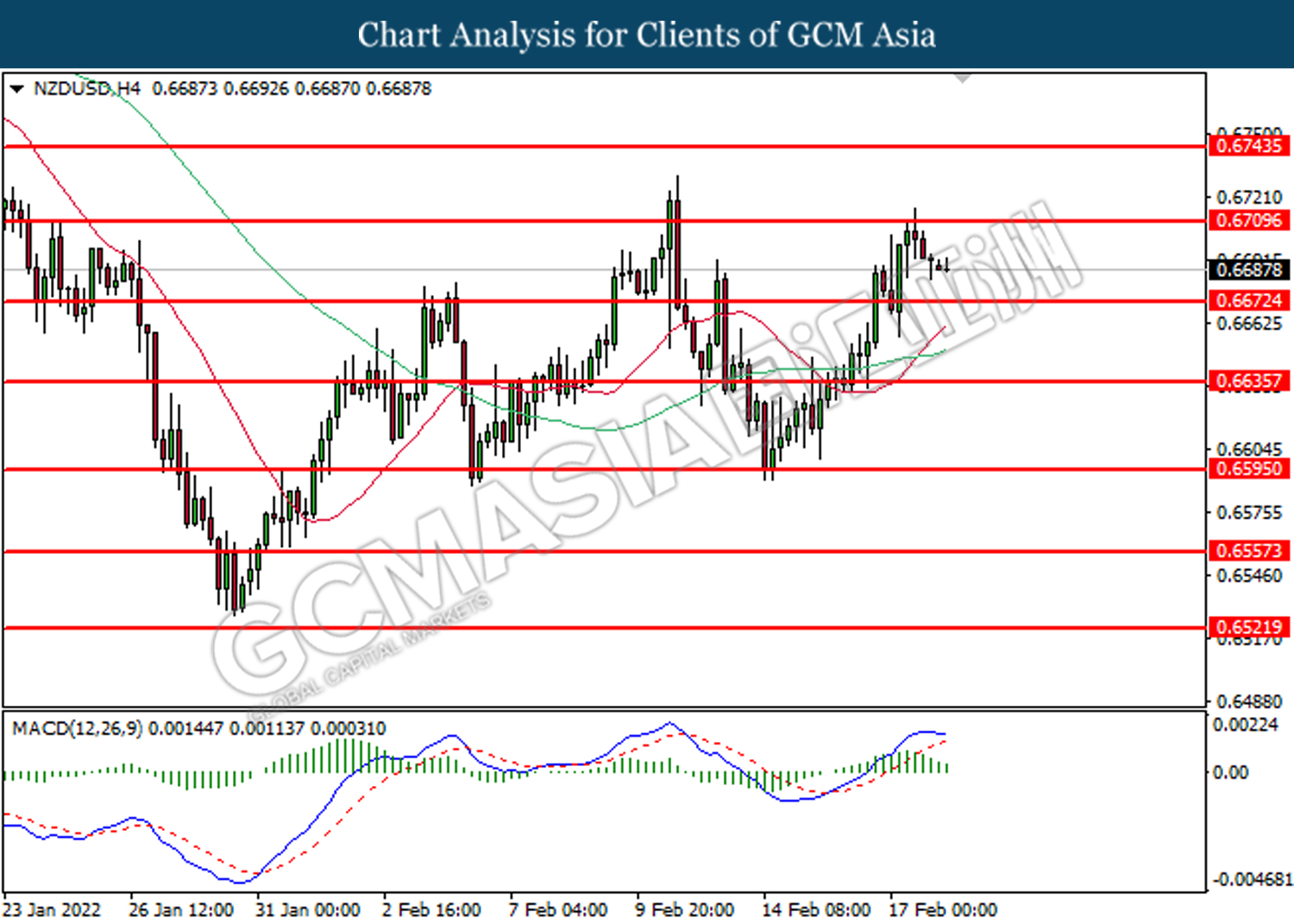

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2600

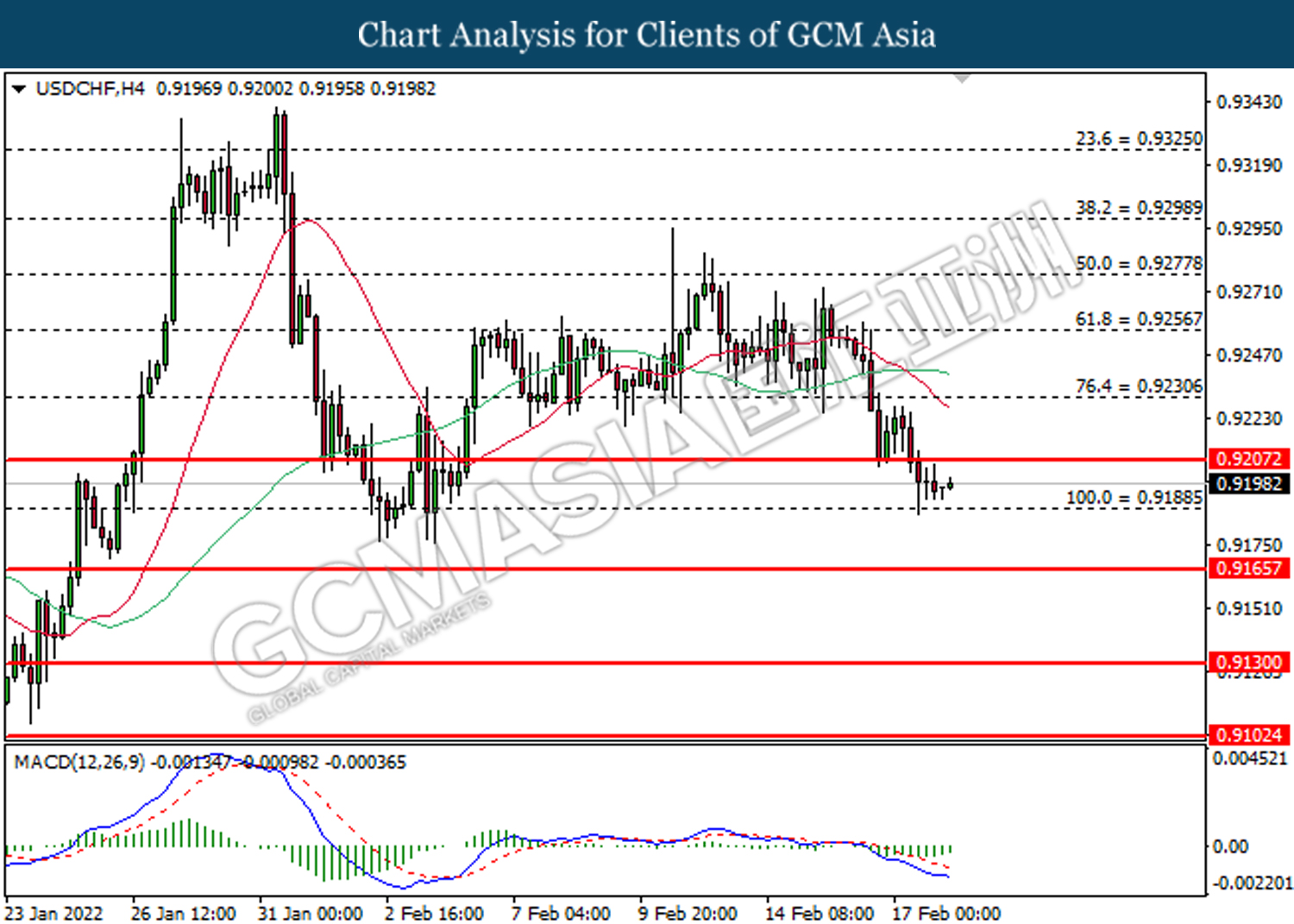

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 91.00, 93.15

Support level: 88.95, 86.95

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1909.70, 1924.15

Support level: 1889.75, 1875.10