21 February 2022 Morning Session Analysis

Greenback rises as war imminent.

Investors shifted their focus from risky assets to safe-havens such as US dollar following rising tension in between Russia and Ukraine. According to CBS News, US intelligence has received information that Russian commander received directive to invade Ukraine. Moreover, they are currently planning strategies to carry out the attack which may happen in the near future. Although Moscow has denied such allegations, US emphasized that recent military exercise near the borders shows their preparedness to carry out the invasion. As of writing, more than 30,000 Russian troops have amassed near the Ukrainian border. At the same time, it is reported that US Secretary Antony Blinken is scheduled to meet Russia’s Foreign Minister Sergei Lavrov within this week for further discussion. During Asian trading session, the dollar index was up 0.02% to 96.05.

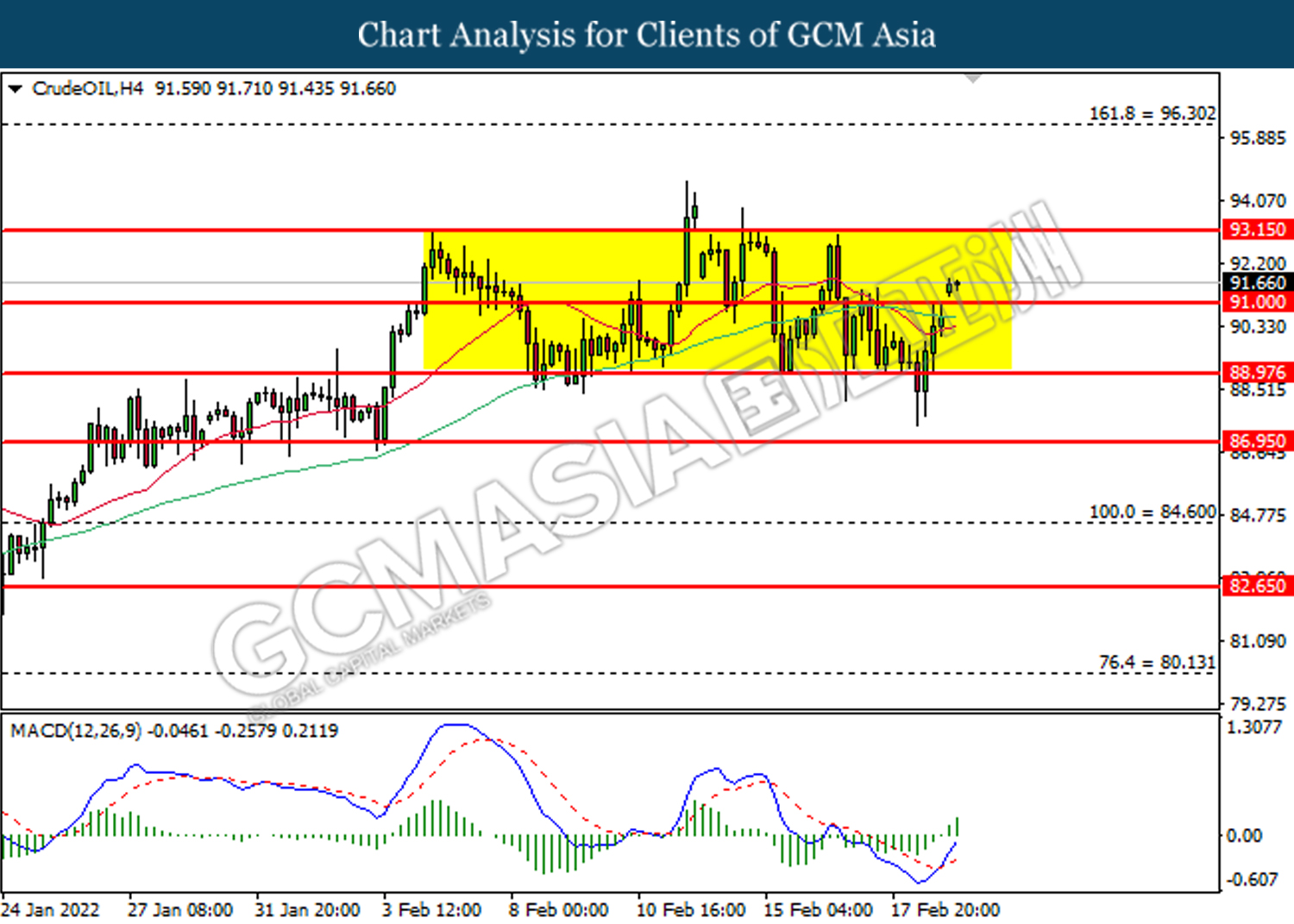

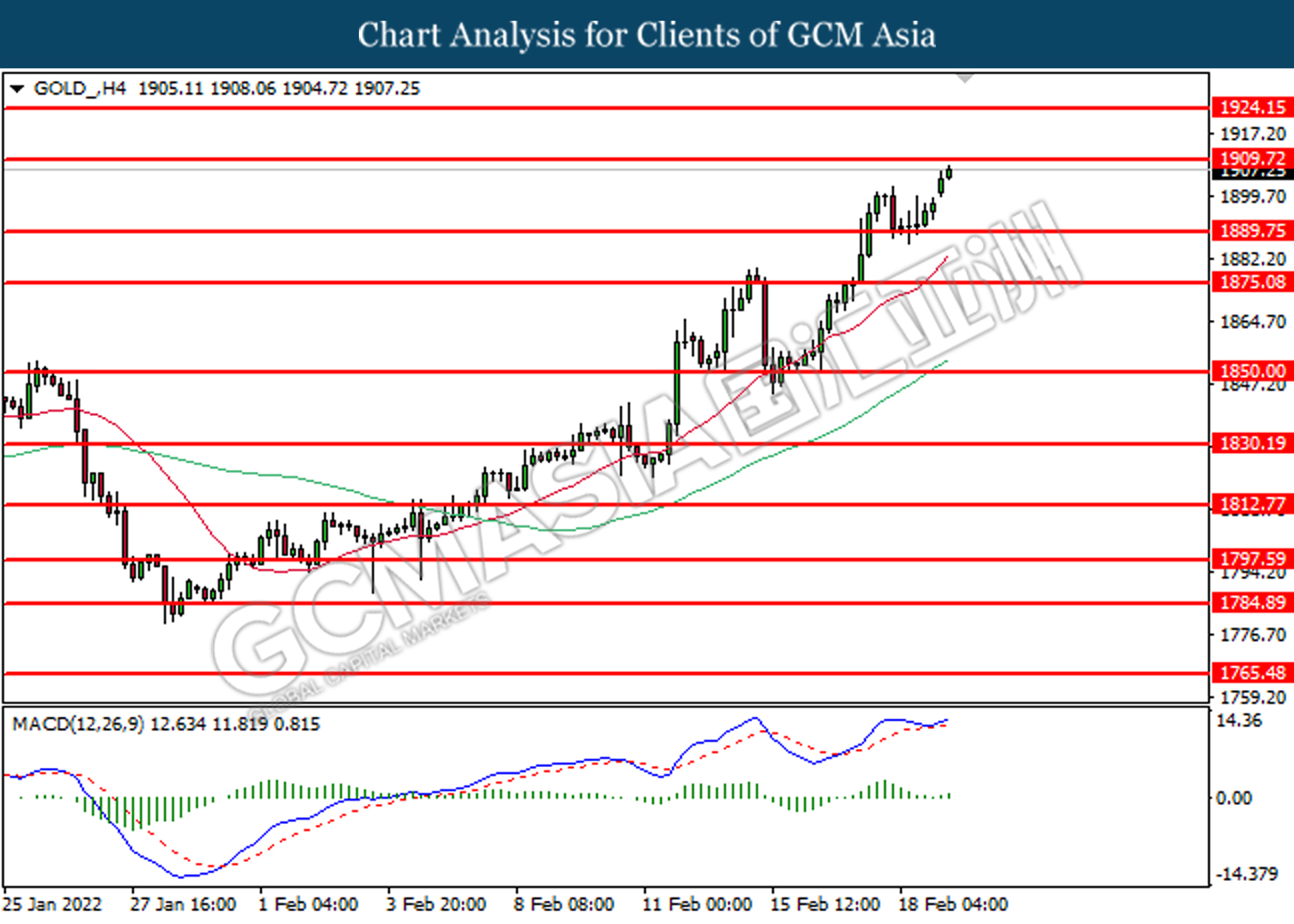

As for commodities, crude oil price skyrocketed 1.32% to $91.57 per barrel over rising tension in between Russia and Ukraine. Likewise, gold price rose 0.45% to $1,905.04 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – President’s Day

All Day CAD Canada – Family Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 59.8 | 59.5 | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 57.3 | – | – |

| 17:30 | GBP – Services PMI | 54.1 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

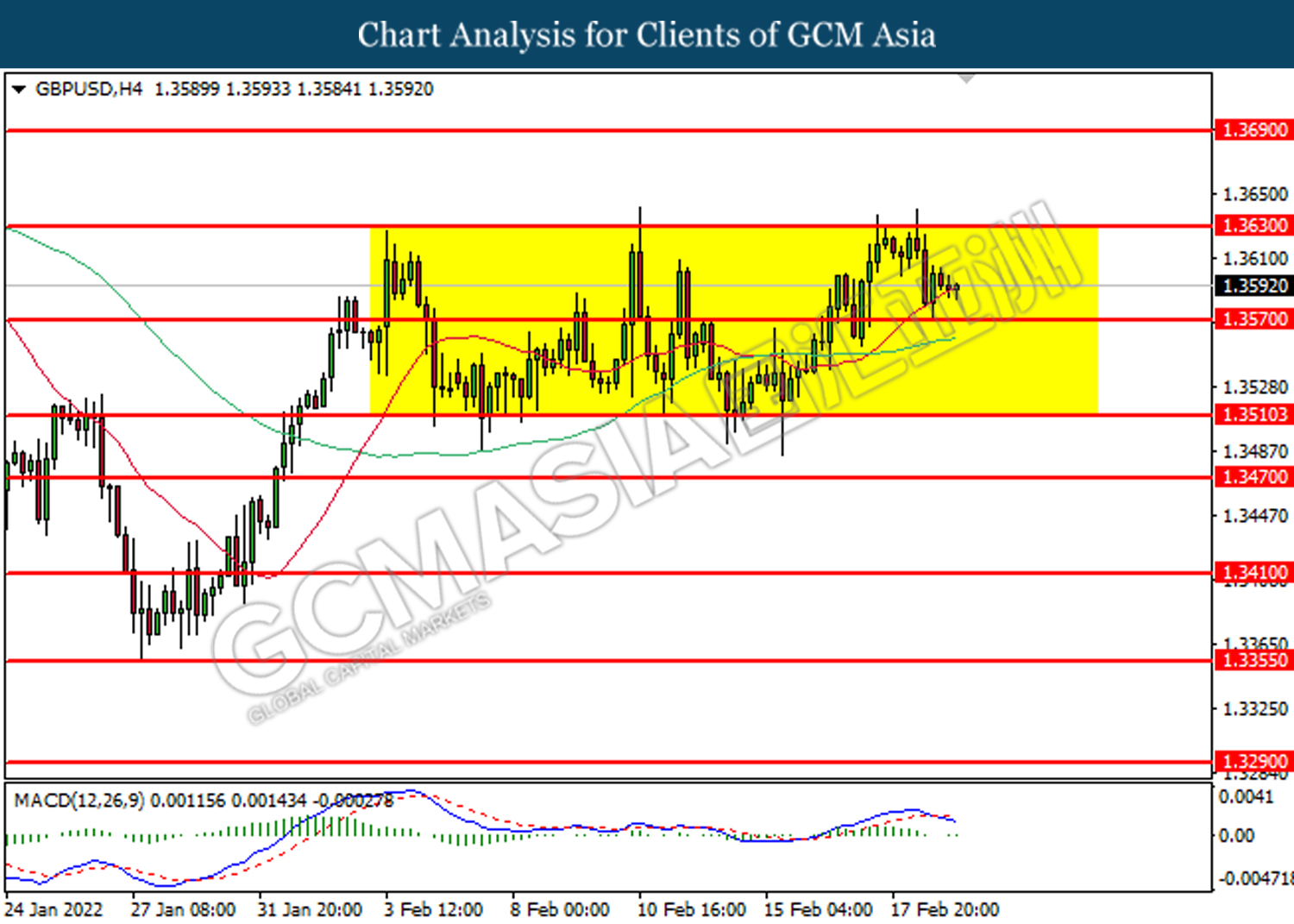

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

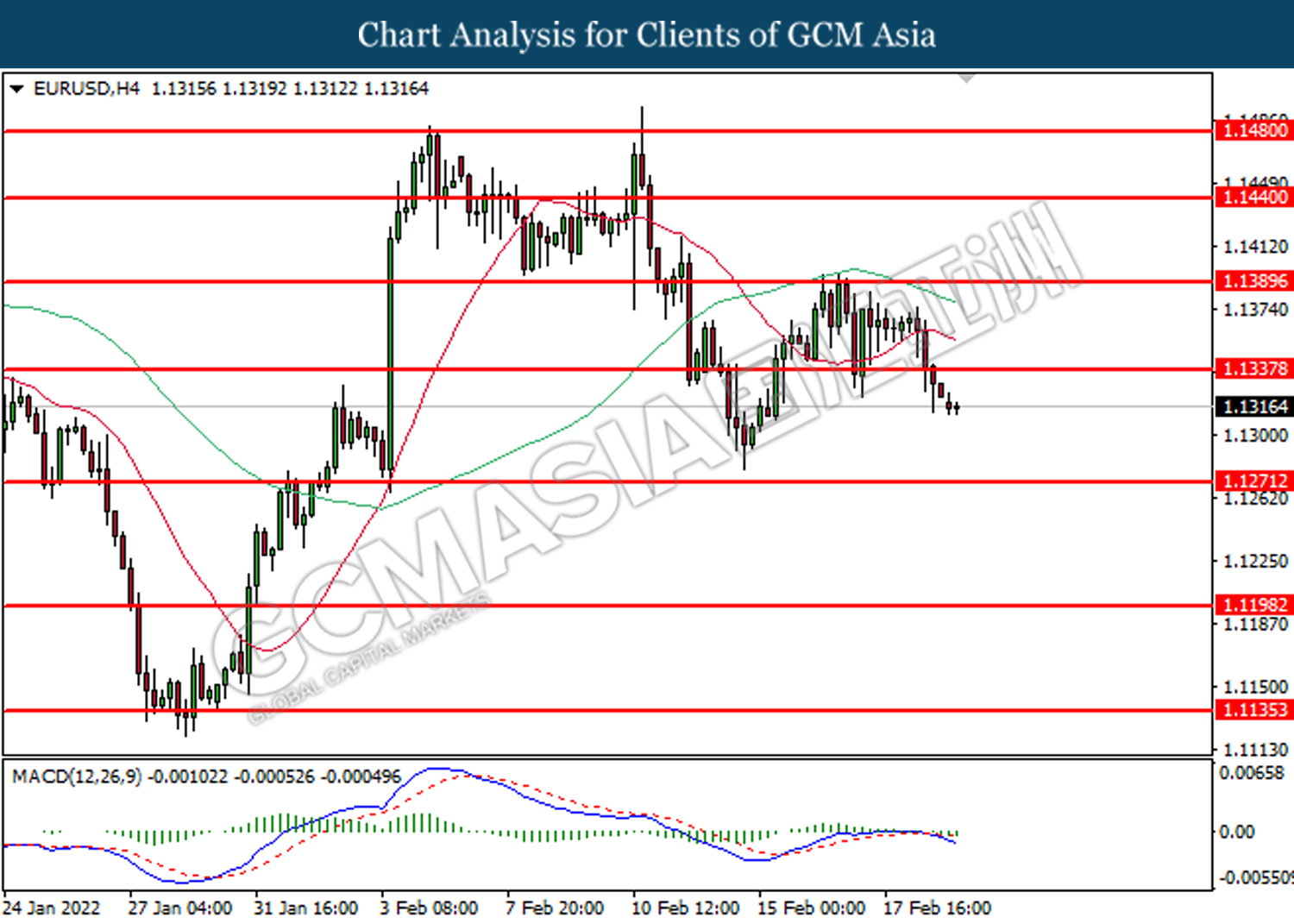

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

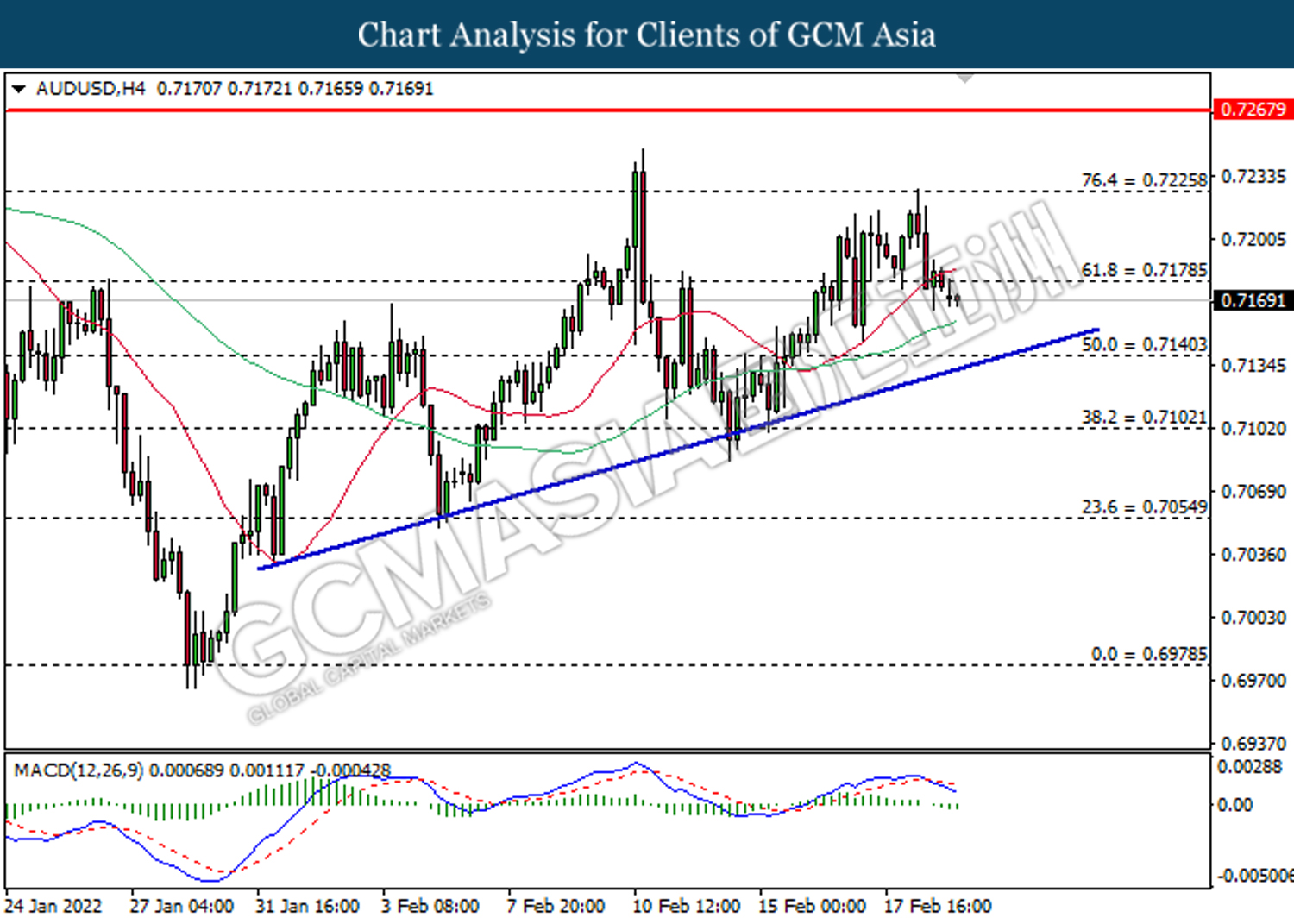

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

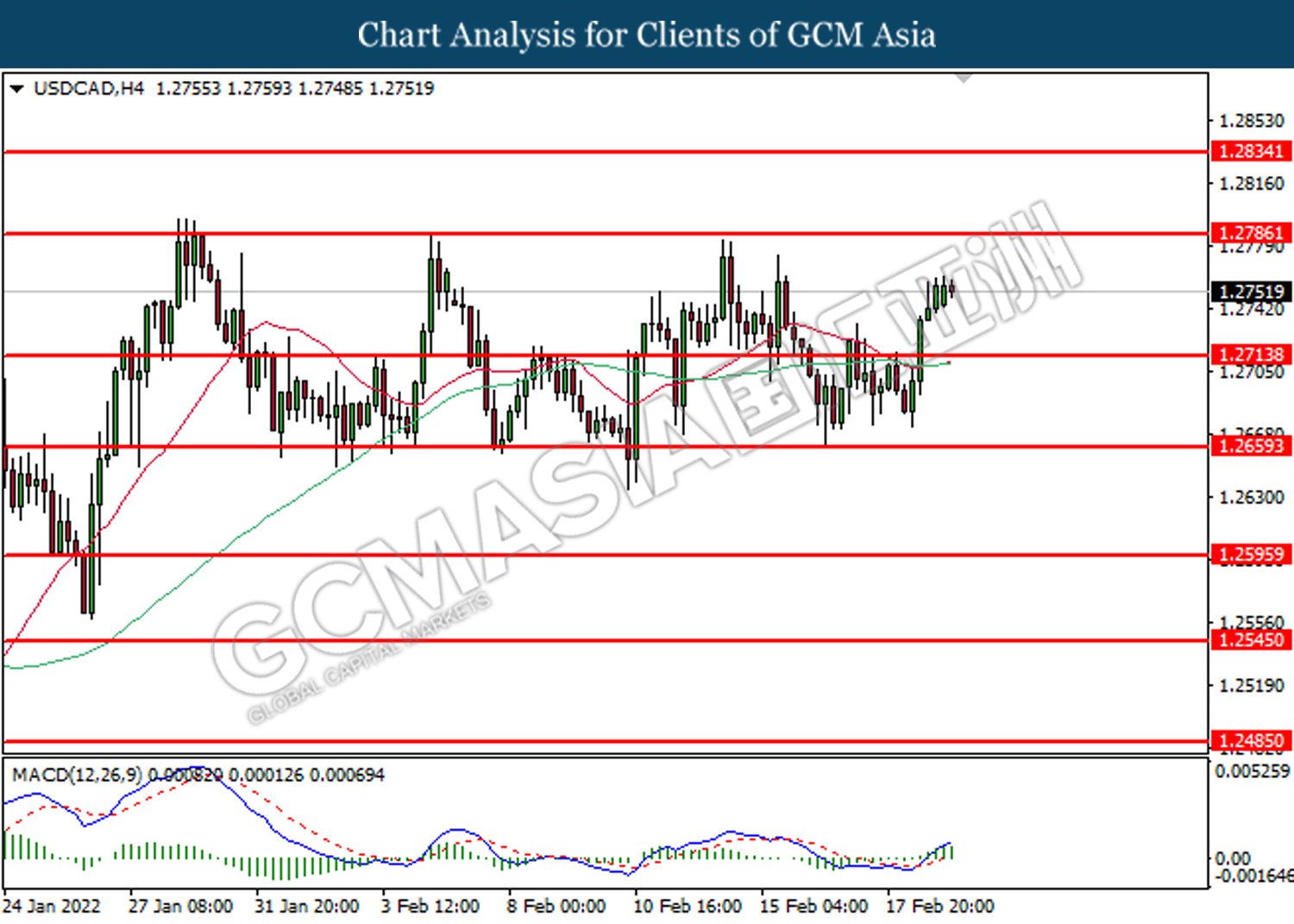

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

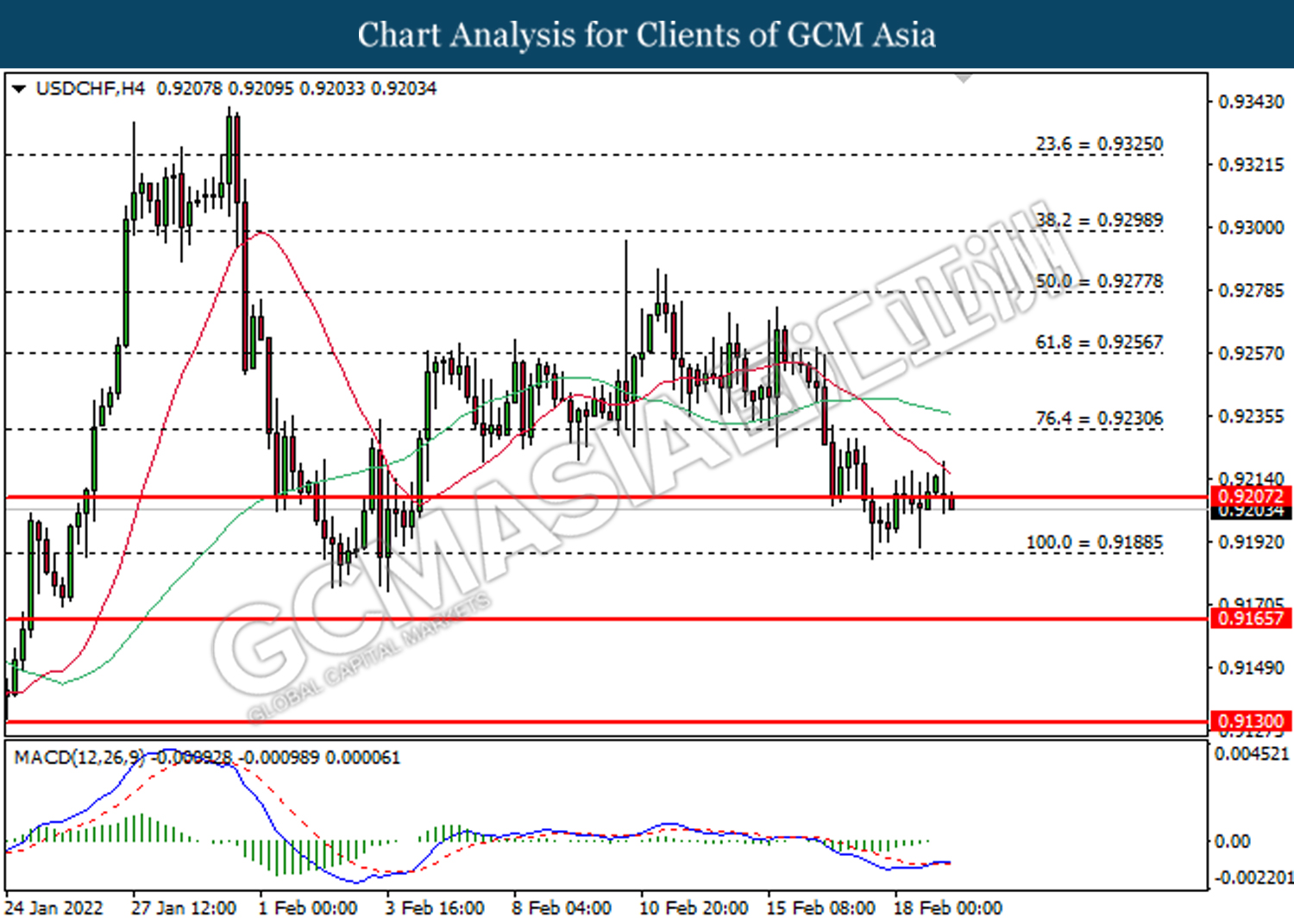

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.00

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1909.70, 1924.15

Support level: 1889.75, 1875.10