21 February 2022 Afternoon Session Analysis

Pound Sterling surged amid easing tensions between Ukraine-Russia.

The Pound Sterling received bullish momentum following the easing tensions between Ukraine and Russia, which spurring risk-on sentiment in the global financial market while prompting investors to shift their portfolio toward riskier currency such as Pound Sterling. According to Reuters, French leaders claimed that US President Joe Biden and Russian President Vladimir Putin have agreed in principle to a summit over Ukraine issues, discussing a possible path out of one of the most dangerous global crises in decades. Though, investors would continue to scrutinize the latest development with regards of such issues to receive further trading signal. Besides that, the Pound Sterling extend its gains over the backdrop of bullish economic data last week. According to Office for National Statistics, UK Retail Sales notched up from the previous reading of -4.0% to 1.9%, exceeding the market forecast at 1.0%. As of writing, GBP/USD appreciated by 0.22% to 1.3620.

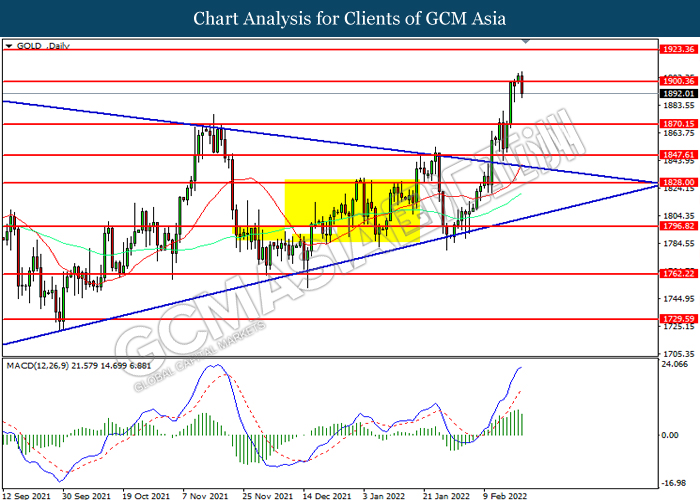

In the commodities market, the crude oil price slumped 1.25% to $91.35 per barrel as of writing. The oil market edged lower following the easing tensions between Russia-Ukraine, which spurring the hopes upon the resolution of oil supply disruption in future. On the other hand, the gold price depreciated by 0.02% to $1898.30 per troy ounces as of writing amid risk-on sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – President’s Day

All Day CAD Canada – Family Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 59.8 | 59.5 | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 57.3 | – | – |

| 17:30 | GBP – Services PMI | 54.1 | – | – |

Technical Analysis

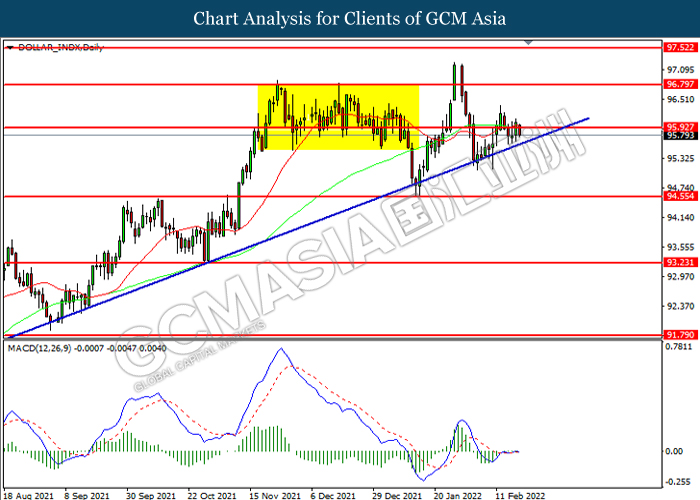

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 95.95. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

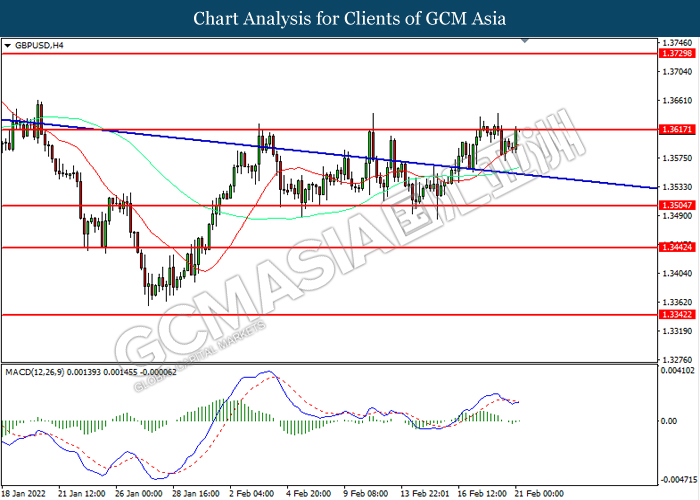

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3505. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3615, 1.3730

Support level: 1.3505, 1.3440

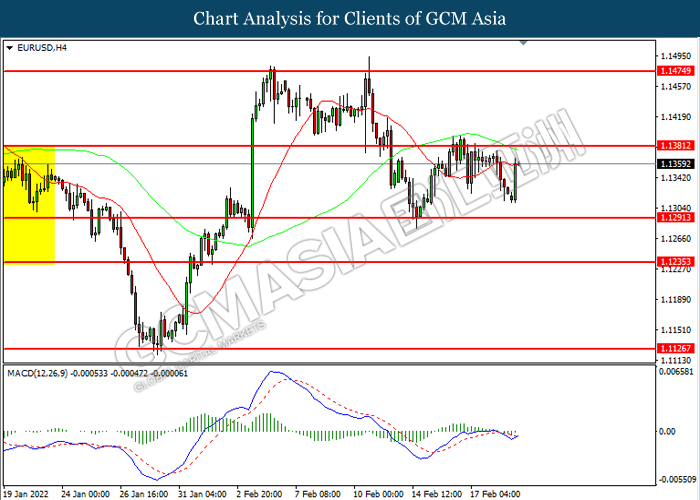

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1380. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 115.40. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 114.30.

Resistance level: 115.40, 116.25

Support level: 114.30, 113.65

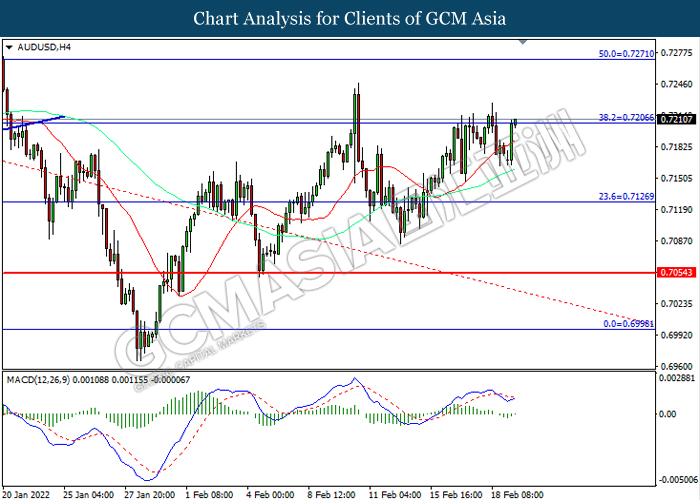

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7205. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

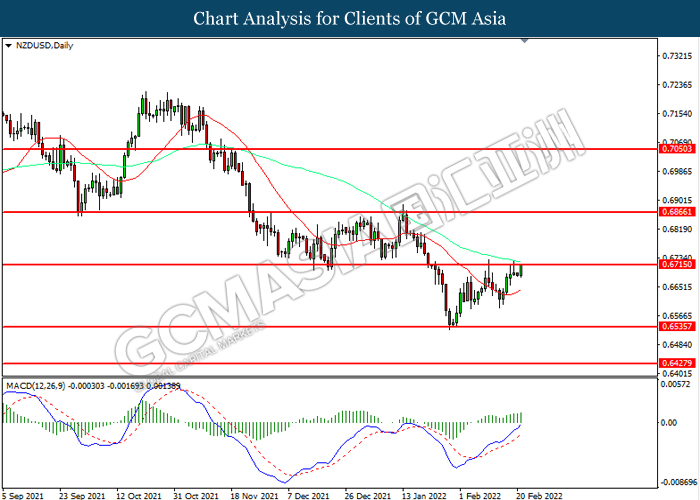

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

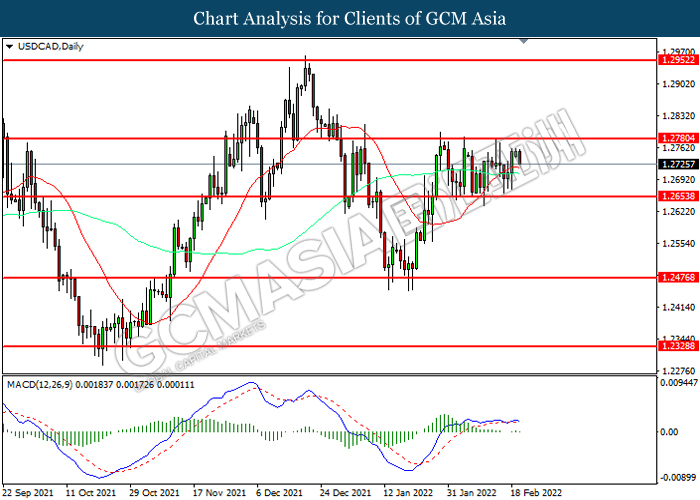

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.2780. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.2655.

Resistance level: 1.2780, 1.2950

Support level: 1.2655, 1.2475

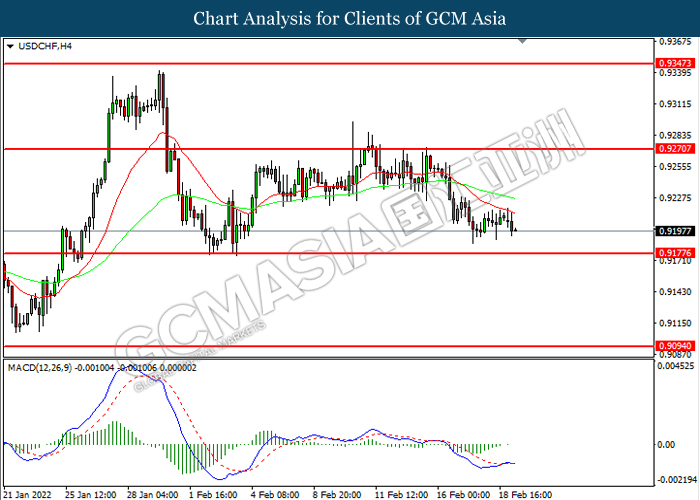

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9175. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 91.50. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 88.50.

Resistance level: 91.50, 93.05

Support level: 88.50, 86.20

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1900.35. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1900.35, 1923.35

Support level: 1870.15, 1847.60