22 February 2022 Morning Session Analysis

Russia declares separatist territories.

Greenback remains high in demand in the financial market as Russian and Ukraine tension rises since yesterday. According to reports, Russia President Vladimir Putin has signed a decree to recognize two separatist territories in Ukraine and declared their willingness for independence. The decree has sparked wide condemnation internationally, with US, UK and France calling the move as a violation to the international law. Following the incident, US stated that they will be sending in their troops to the separatist territories in the next few hours. Investors fear that a war may break out in between both countries as satellite images shows that Russian troops were moving into the two separatist territories. Recent move from Russia has also decrease the chances of a summit occurring in between US and Russia although US reiterates they are still open for discussion. As of writing, dollar index was up 0.01% to 95.91.

In the commodities market, crude oil price was down 0.48% to $92.32 per barrel due to technical correction from the higher levels. On the other hand, gold price was up 0.30% to $1,909.10 a troy ounce due to rising tension in between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Feb) | 95.7 | 96.5 | – |

| 23:00 | USD – CB Consumer Confidence (Feb) | 113.8 | 109.8 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

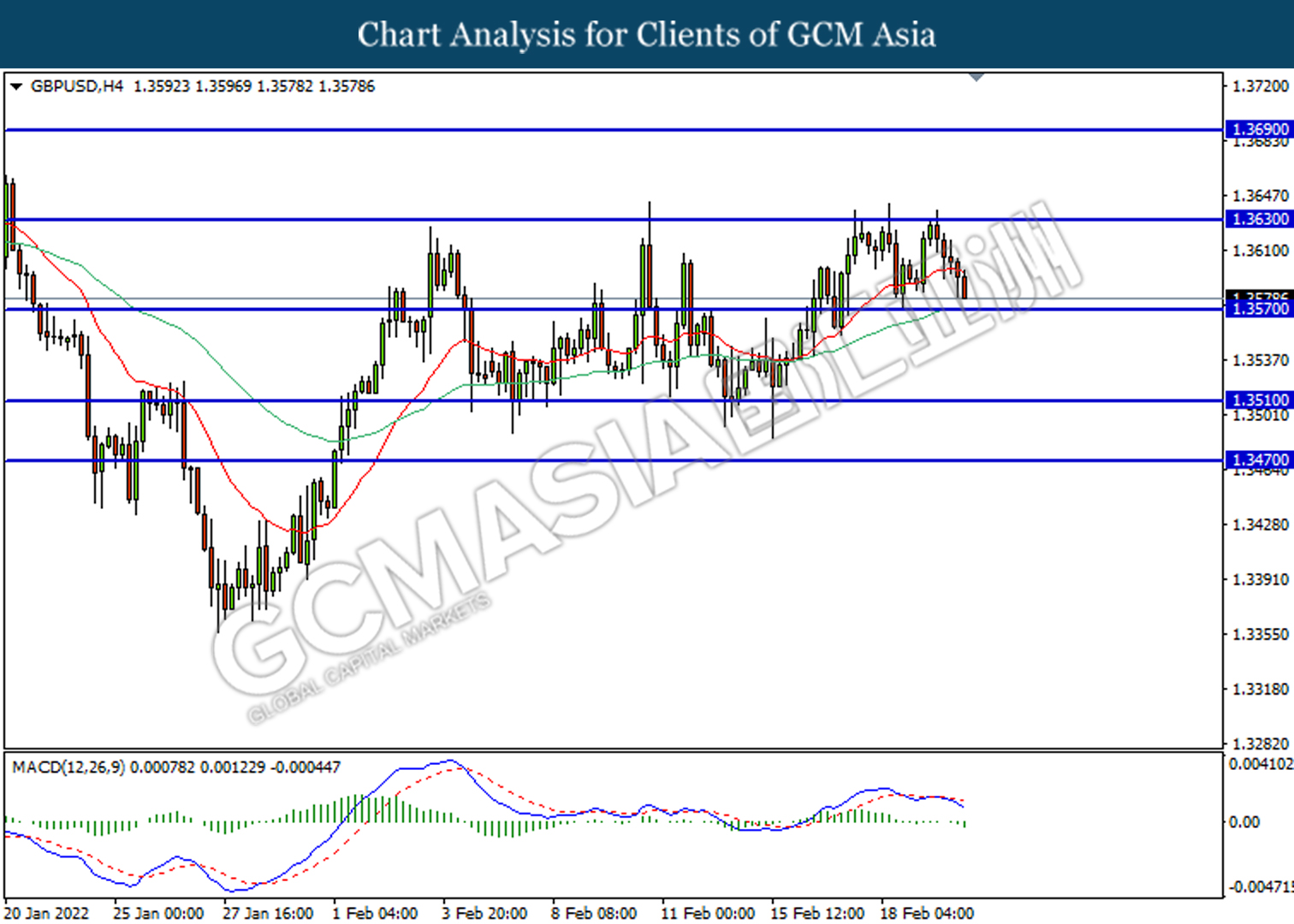

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

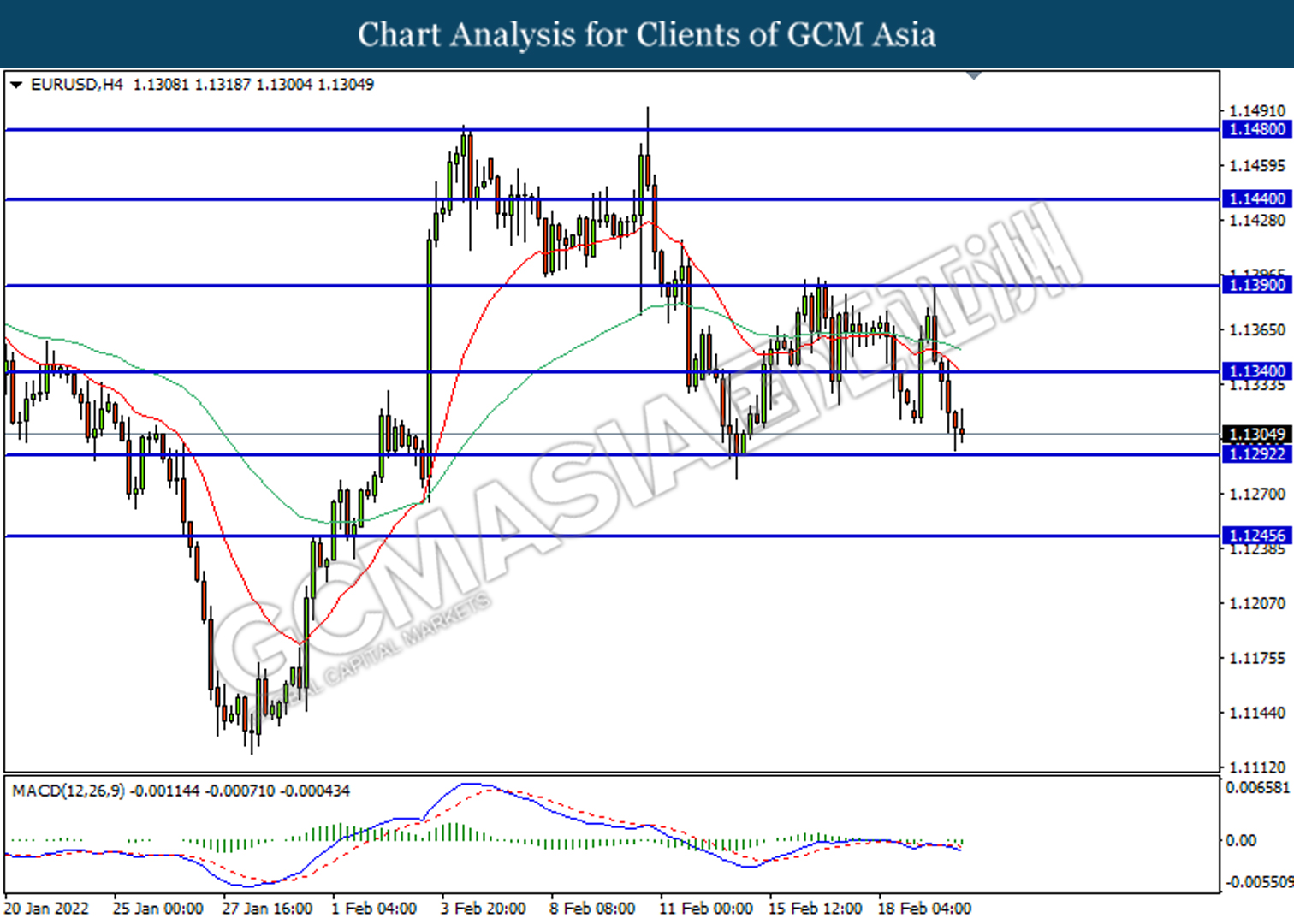

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1290, 1.1245

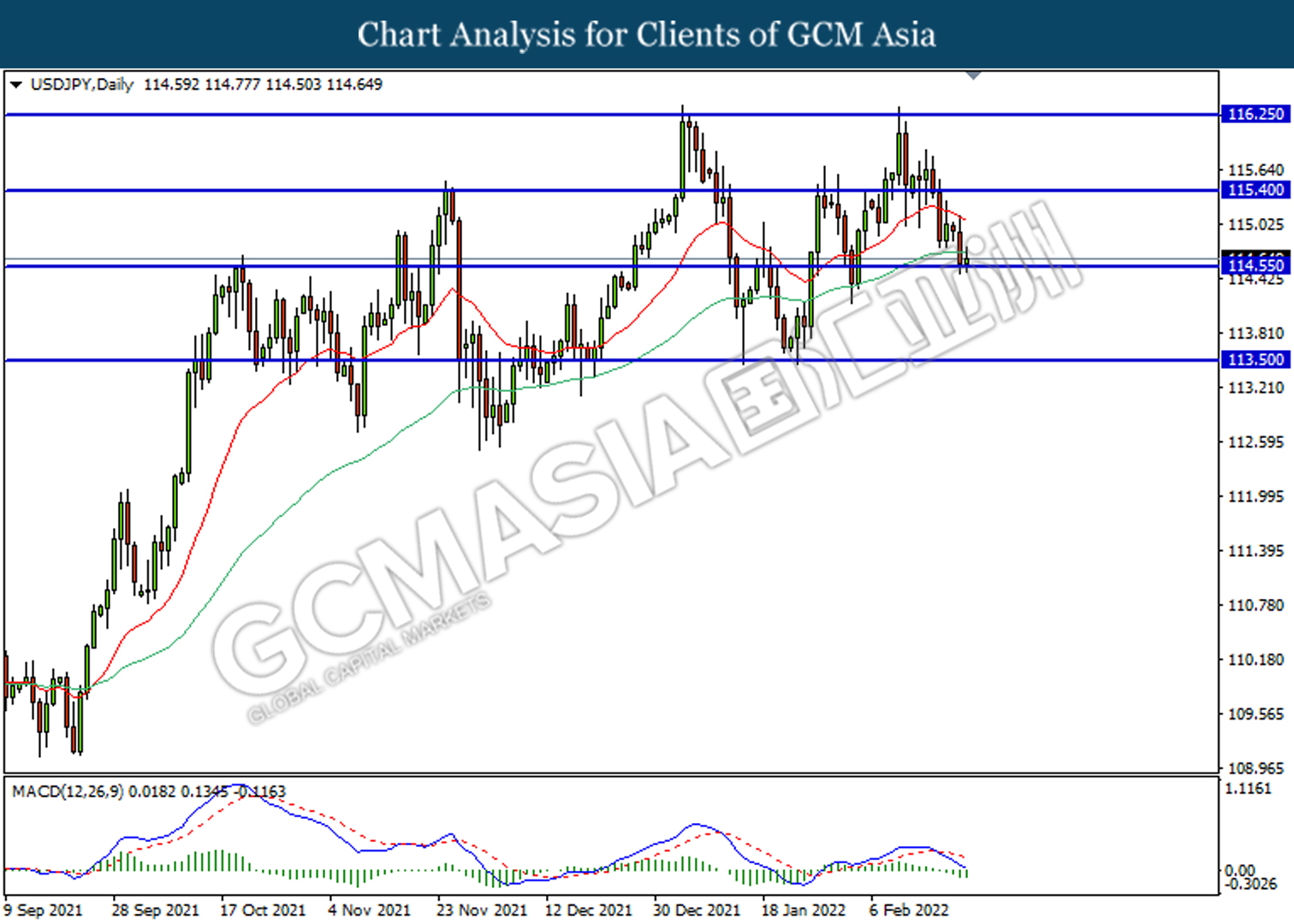

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

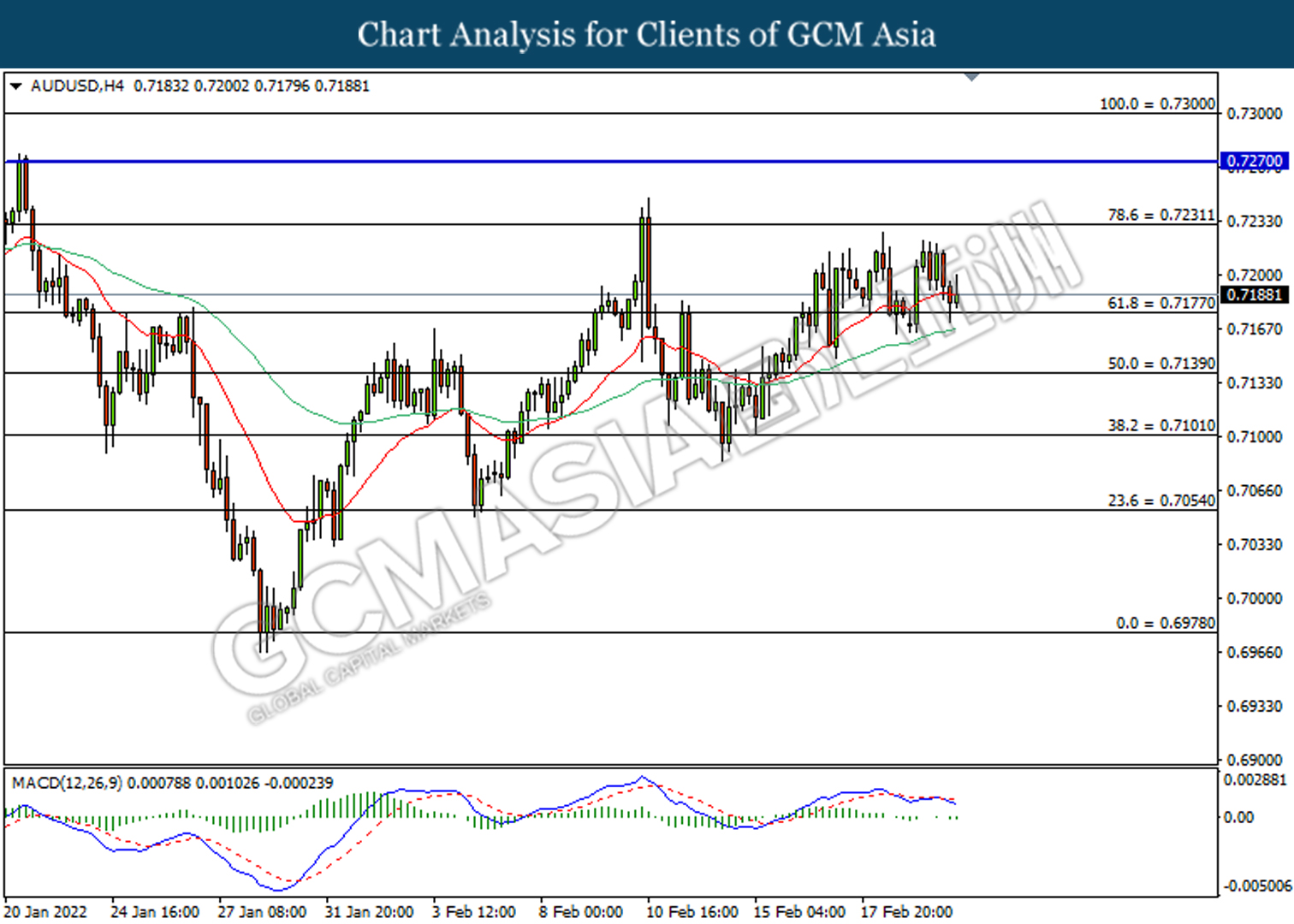

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7230, 0.7270

Support level: 0.7180, 0.7140

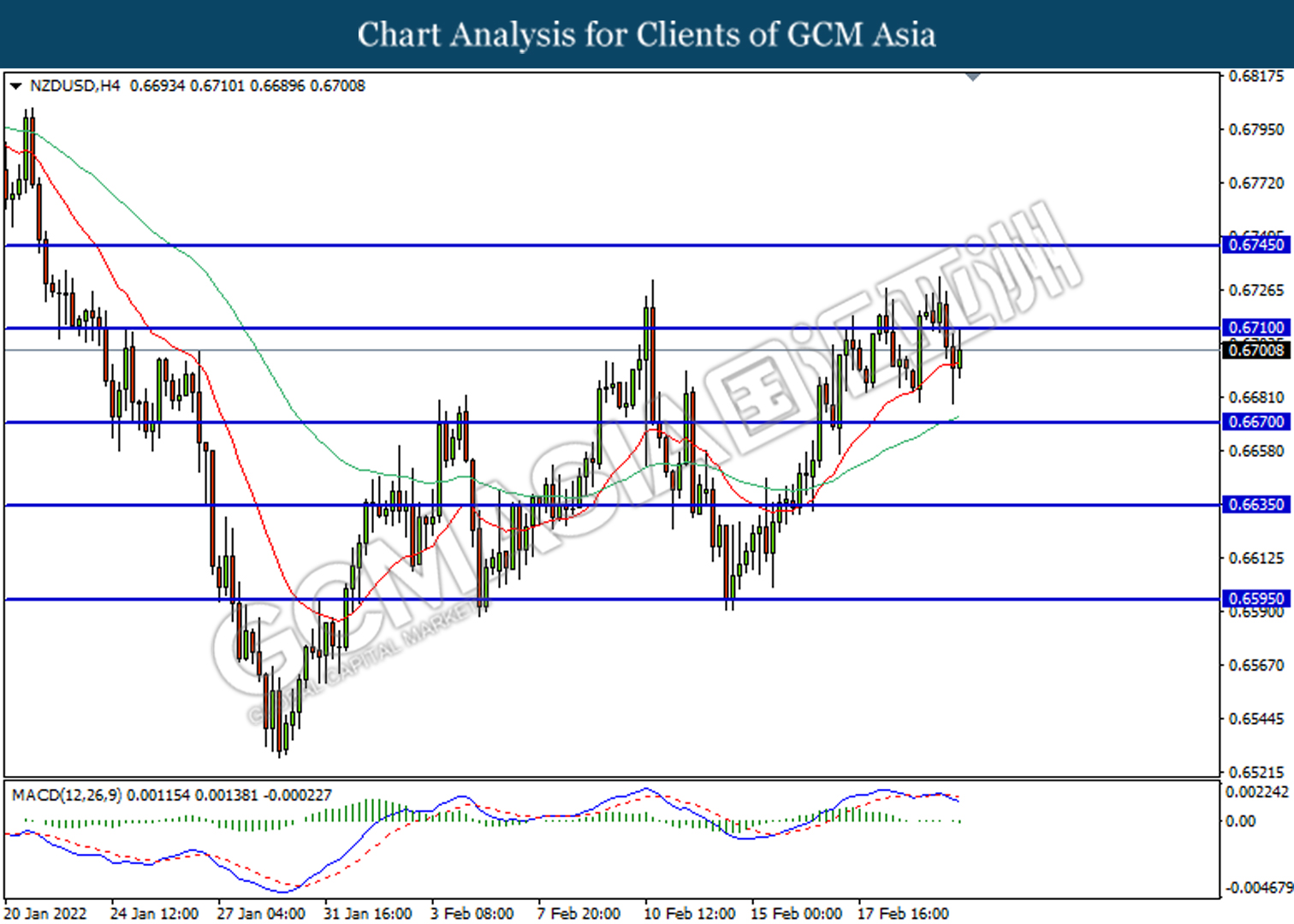

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

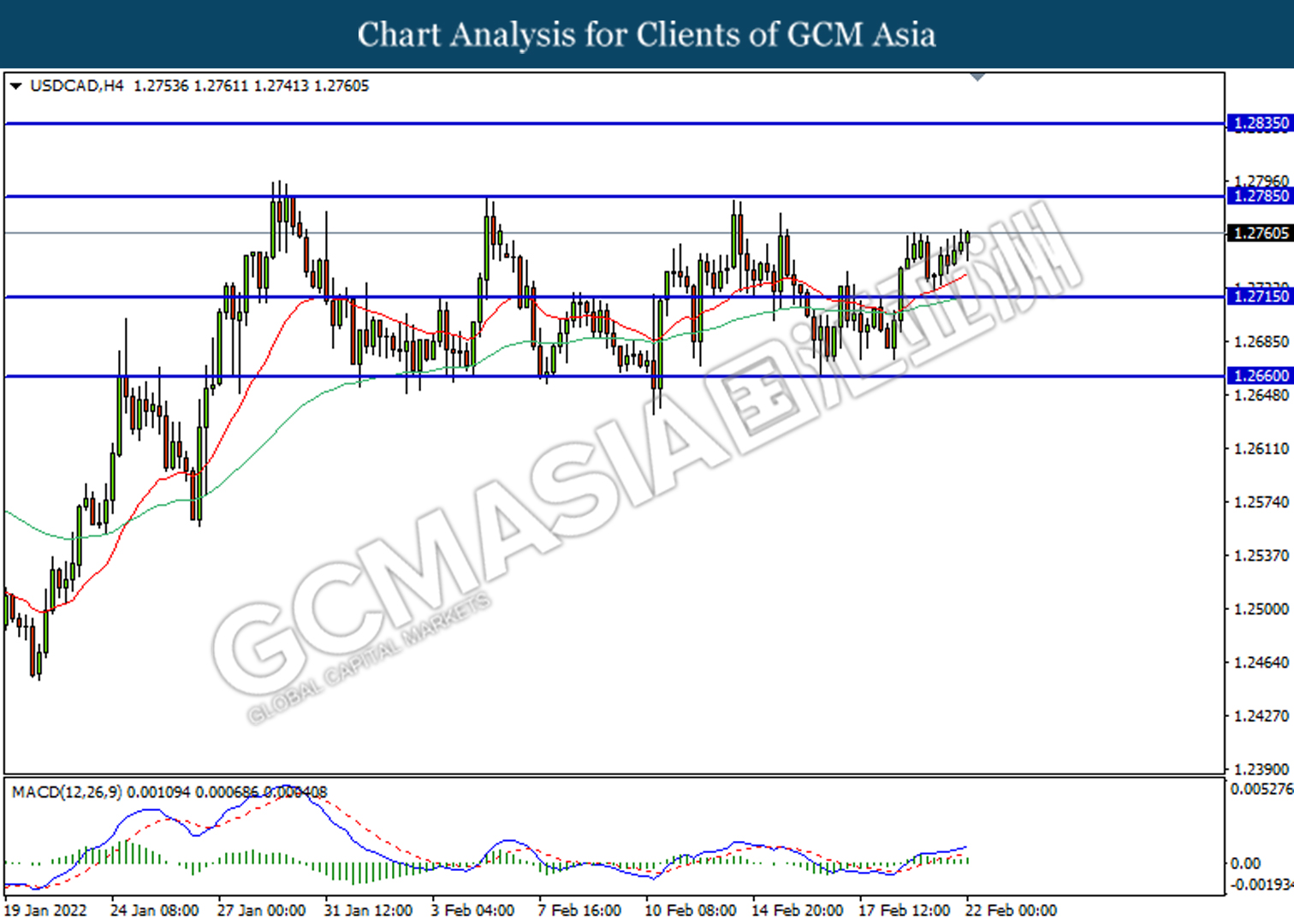

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

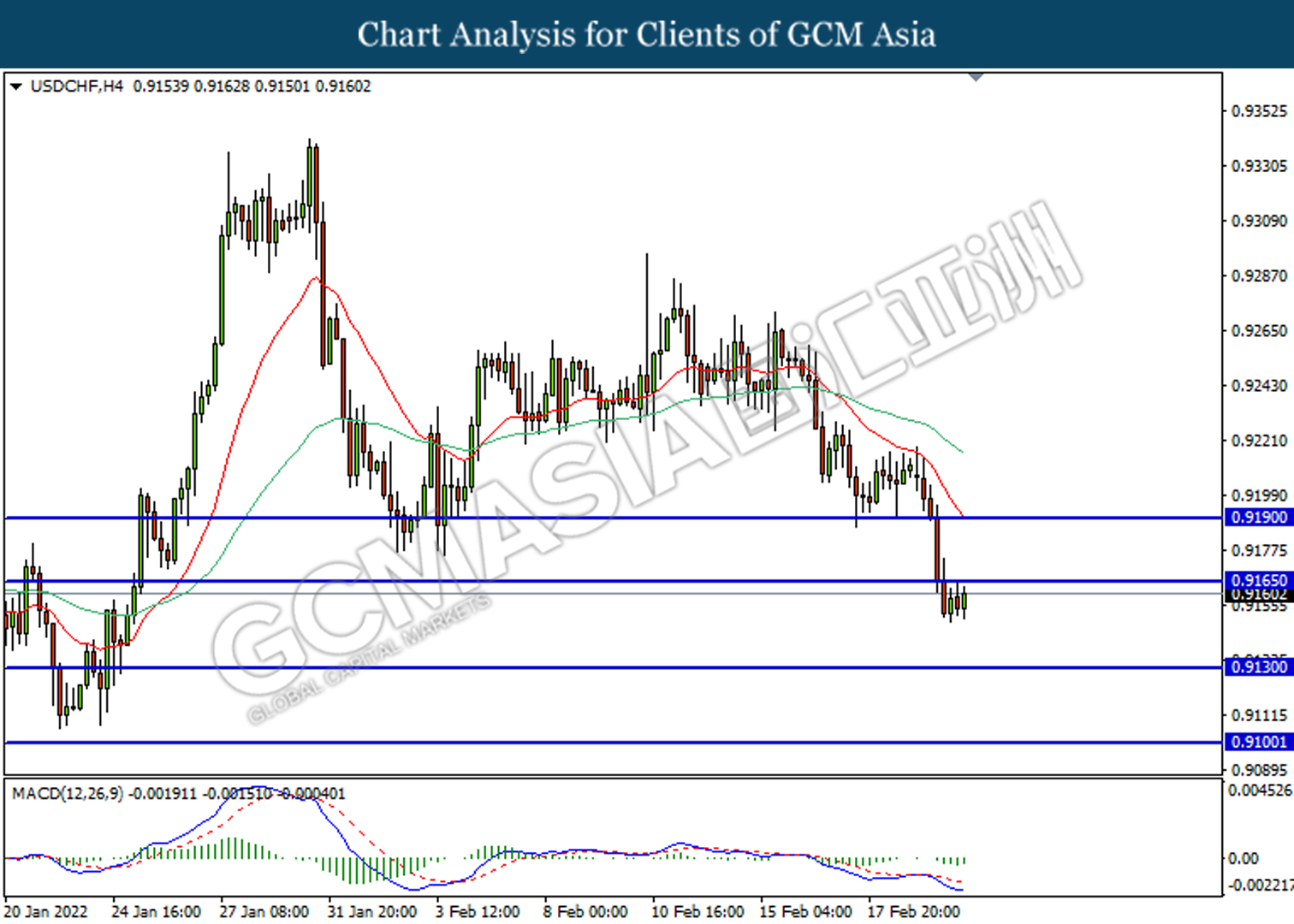

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9165, 0.9190

Support level: 0.9130, 0.9100

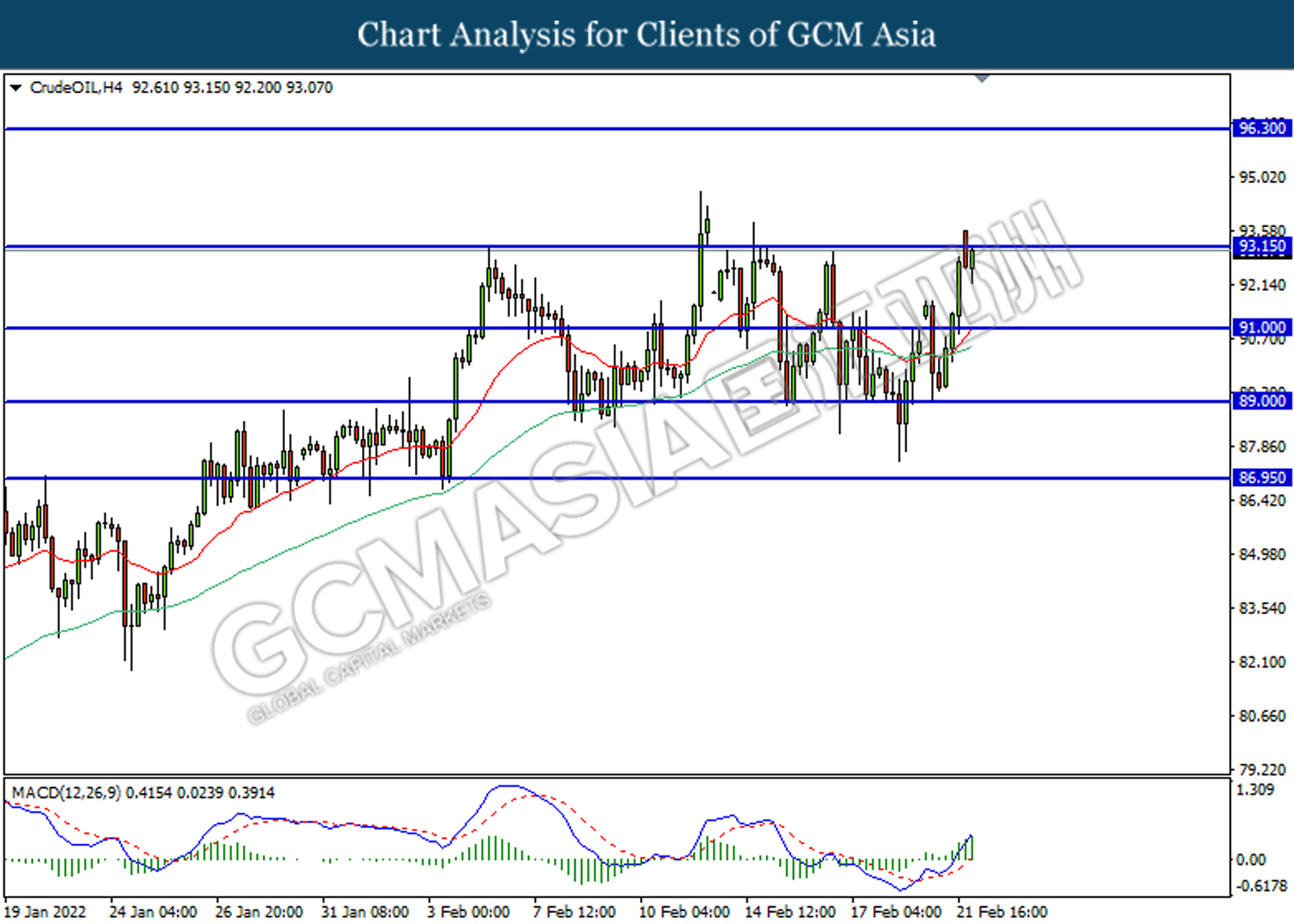

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.00

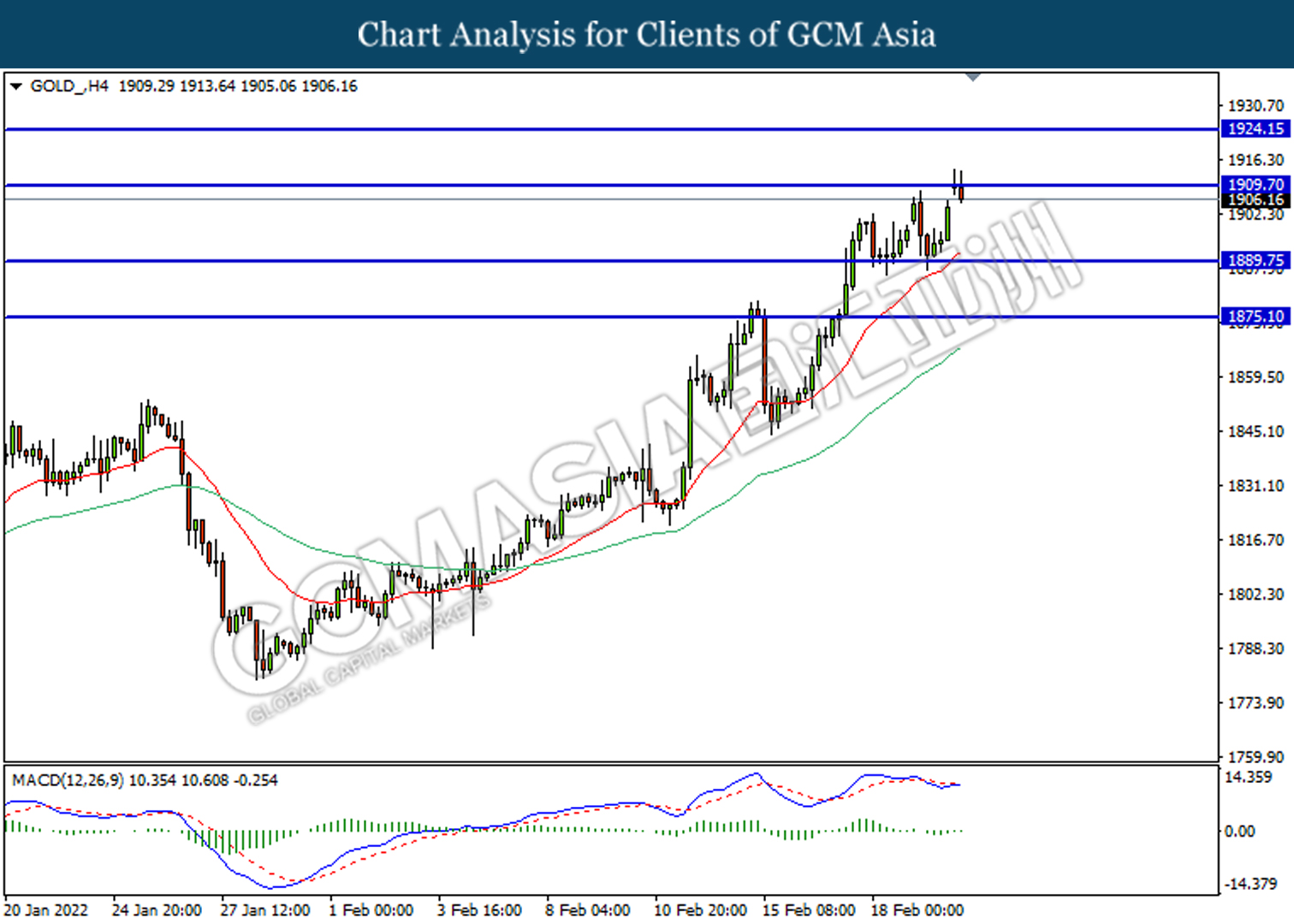

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1909.70, 1924.15

Support level: 1889.75, 1875.10