22 February 2022 Afternoon Session Analysis

Euro slumped amid bearish manufacturing data.

The Euro slumped over the backdrop of bearish economic data as well as rising tensions between Russian and Ukraine, which dialled down the market optimism toward the economic progression in the European region. On the economic data front, Germany Manufacturing Purchasing Managers Index (PMI) notched down from the preliminary reading of 59.8 to 58.5, missing the market forecast at 59.5, according to Markit Economics. On the other hand, the Euro extend its losses amid rising geopolitical tensions around the world had stoked a shift in sentiment toward risk-free asset, which dragging down the appeal for the risky currency such as Euro. According to Reuters, Putin on Monday recognised two breakaway regions in eastern Ukraine as independent while ordering the Russian army to enter Ukraine, spurring concerns upon the major war between Russia-Ukraine. As of writing, EUR/USD depreciated by 0.16% to 1.1290.

In the commodities market, the crude oil price depreciated by 0.31% to 94.20 per barrel as of writing amid technical correction following it reached record high recently. On the other hand, the safe-haven gold surged 0.22% to $1909.40 per troy ounces as of writing amid rising geopolitical tensions between Russia-Ukraine had diminished the risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Feb) | 95.7 | 96.5 | – |

| 23:00 | USD – CB Consumer Confidence (Feb) | 113.8 | 109.8 | – |

Technical Analysis

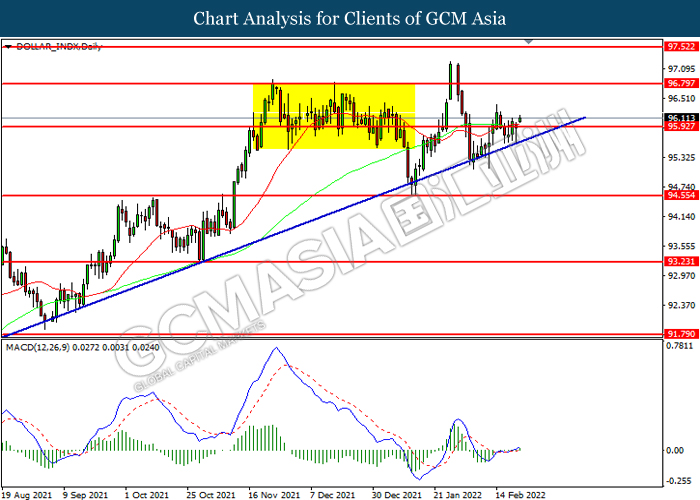

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 95.95. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 96.80.

Resistance level: 96.80, 97.50

Support level: 95.95, 94.55

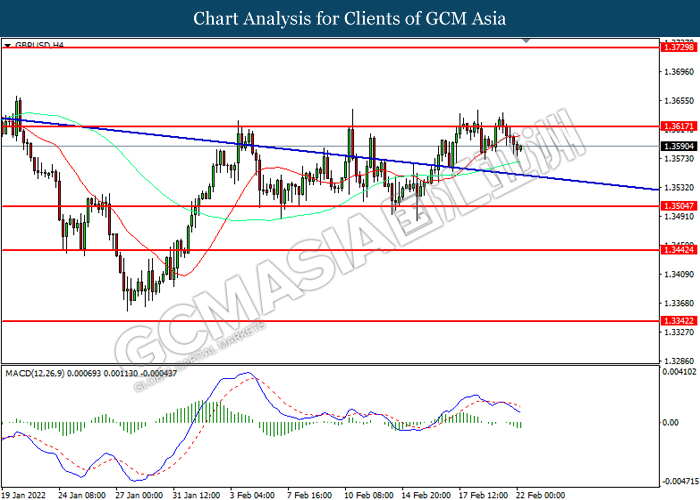

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3615. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3505.

Resistance level: 1.3615, 1.3730

Support level: 1.3505, 1.3440

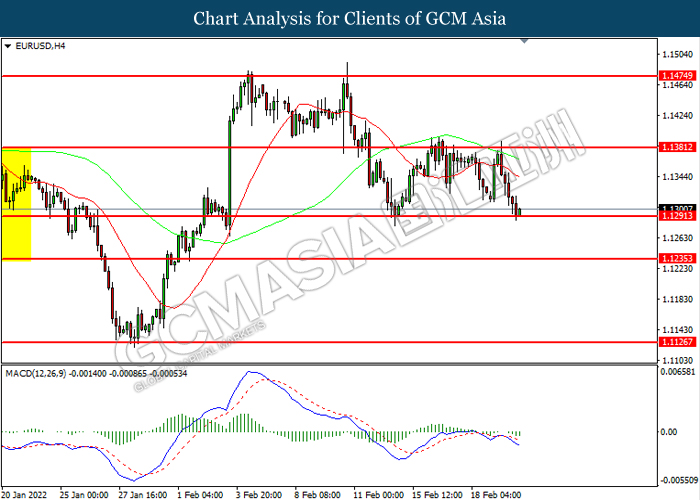

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1290. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

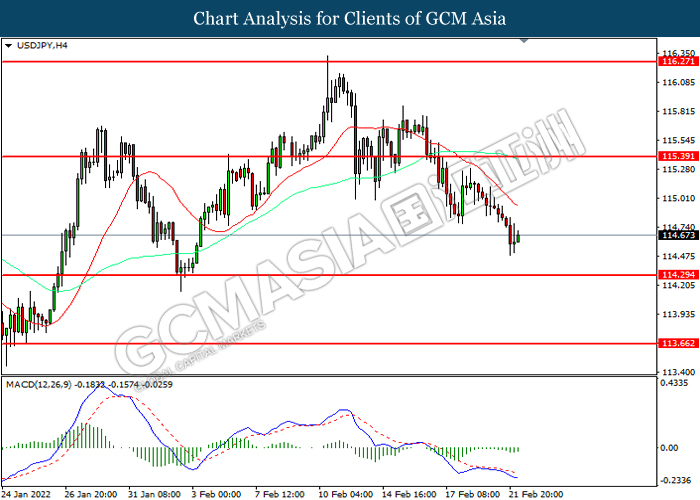

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 115.40. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 114.30.

Resistance level: 115.40, 116.25

Support level: 114.30, 113.65

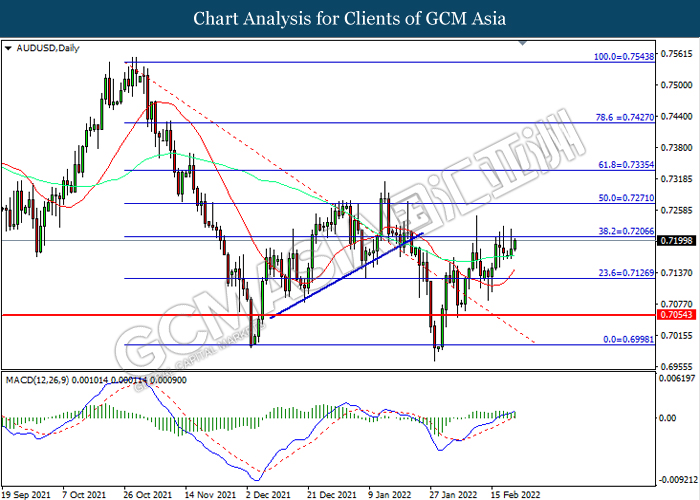

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7205. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

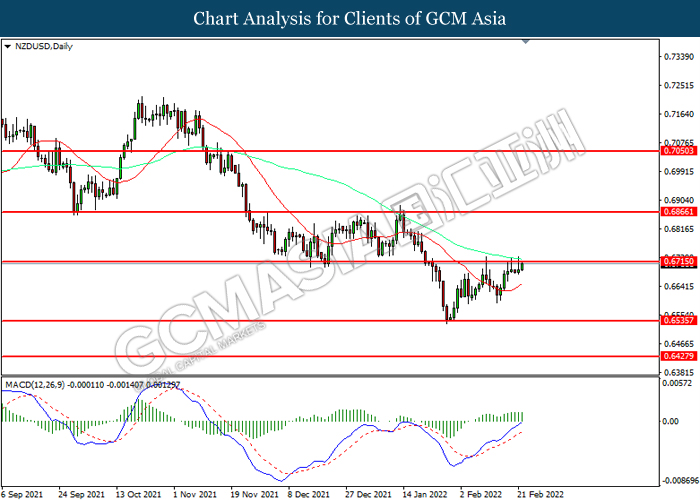

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6715, 0.6865

Support level: 0.6535, 0.6430

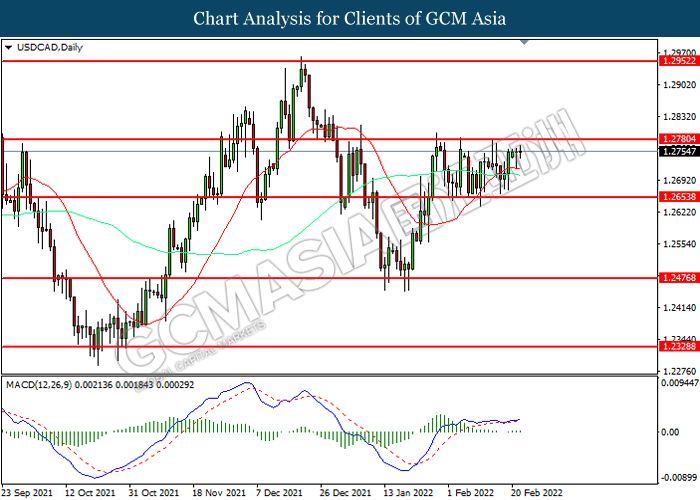

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2780. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2780, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9095.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

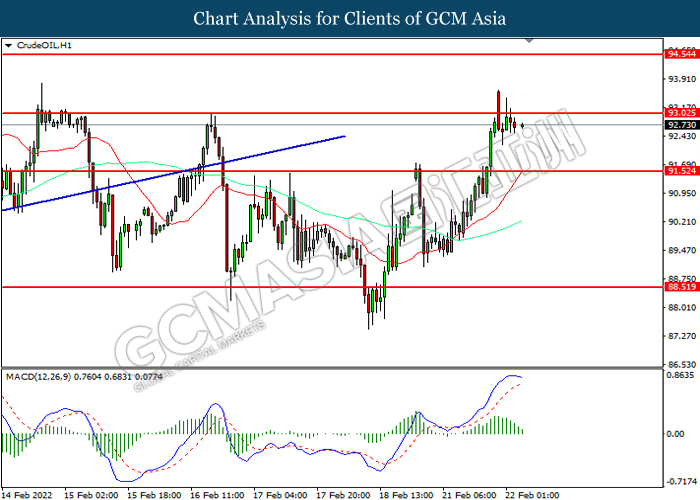

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 93.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 91.50

Resistance level: 93.05, 94.55

Support level: 91.50, 88.50

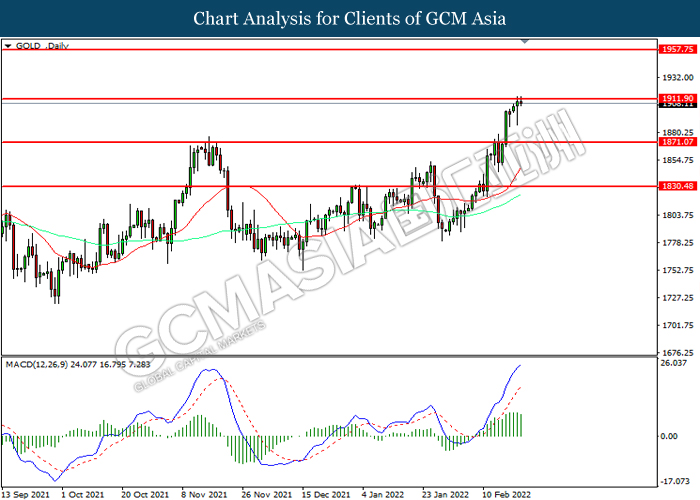

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1911.90. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1911.90, 1957.75

Support level: 1871.05, 1830.50