23 February 2022 Afternoon Session Analysis

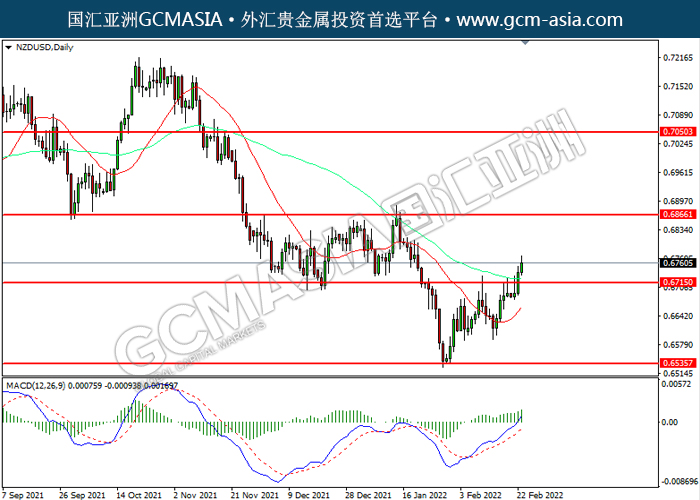

New Zealand Dollar surged following rate hike decision.

The New Zealand Dollar surged following the New Zealand’s central bank unleashed their hawkish tone toward the economic momentum, which raising their interest rates back to pre-pandemic levels and signalling the possibility of aa more aggressive contractionary monetary path in order to combat the rising inflationary risks. The Monetary Policy Committee (MPC) had voted to a 25-basis point interest hike in the official cash rate (OCR) to 1.0%. Faced with global supply-chain issues and increasingly tight labour market, the Reserve Bank of New Zealand (RBNZ) is struggling to contain inflationary pressures. With the inflation rate hitting a three-decade high of 5.9% for last quarter, economists have priced in more hikes in the year of 2022. Nonetheless, the uncertainties remain over the outlook as the Omicron variant spreads more rapidly through New Zealand and rising tensions between Russia-Ukraine. As of writing, NZDU/USD appreciated by 0.45% to 0.6761.

In the commodities market, the crude oil price surged 0.57% to 93.80 per barrel as of writing. The oil market extends its gains amid market participants concerned that the rising geopolitical tensions between Russia-Ukraine would disrupt the oil supply in future. On the other hand, the gold price appreciated by 0.03% to $1899.15 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 GBP Inflation Report Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Jan) | 5.00% | 5.10% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 96.00. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 96.00, 9.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3515. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3615, 1.3730

Support level: 1.3505, 1.3440

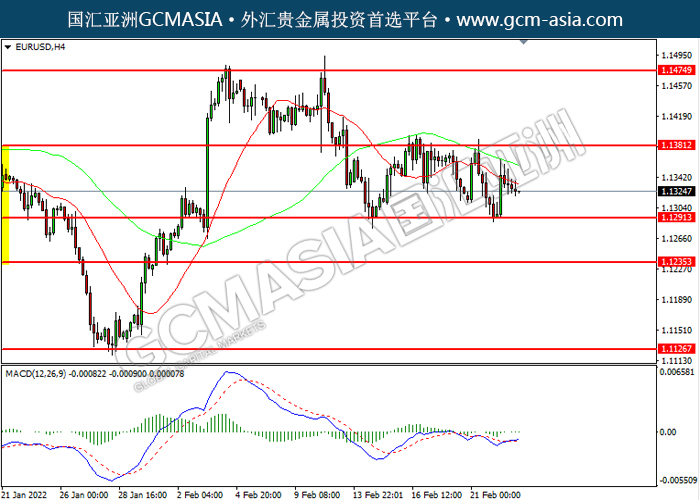

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1290. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1380, 1.1475

Support level: 1.1290, 1.1235

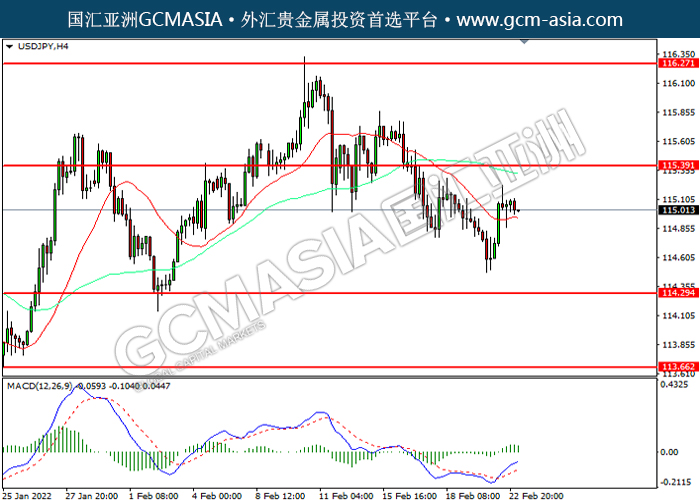

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 114.30. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 115.40.

Resistance level: 115.40, 116.25

Support level: 114.30, 113.65

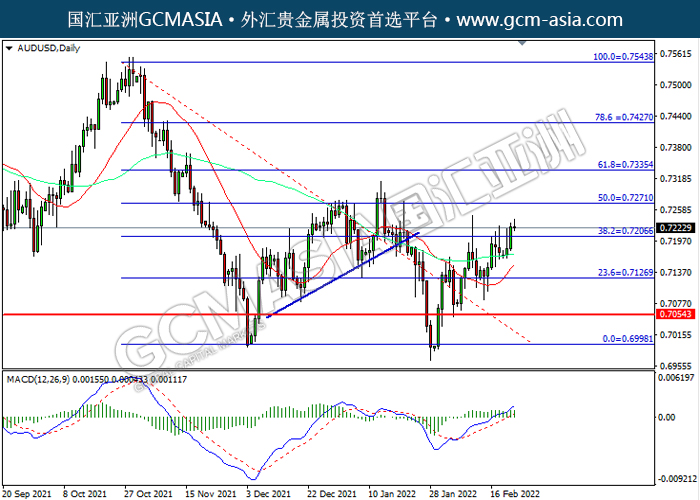

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7205. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7270.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2780. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2780, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9175. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.9270.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 93.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 91.50

Resistance level: 93.05, 94.55

Support level: 90.60, 88.50

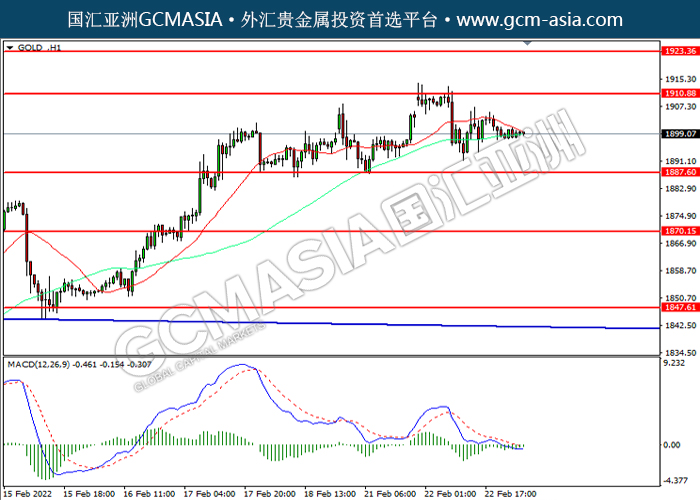

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level at 1910.90. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1887.60.

Resistance level: 1910.90, 1923.35

Support level: 1887.60, 1870.15