25 February 2022 Morning Session Analysis

New US sanction upon Russia.

Greenback rebounds from its lower level while investors reassess US sanction against Russia and its impact towards the global economy. In a statement, US President Joe Biden announced several sanctions which includes restricting international transaction of 5 major Russian banks, freezing of Russian owned asset in the US as well as halting the process of technological export into Russia for the means of military and industrial upgrades. The latest sanction from the US excludes targeting Russia in terms of crude oil exports. The latest measure, as proclaimed by economists, does not pose great impact towards the global economy as it scrutinizes mainly on Russian economy. Thus, investors reassess their portfolio and shift towards risky assets in the market such as equities. Nonetheless, the demand for US dollar remains high as investors speculate Federal Reserve to tighten monetary policy at a faster pace throughout the year. As of writing, the dollar index was up 0.01% to 97.03.

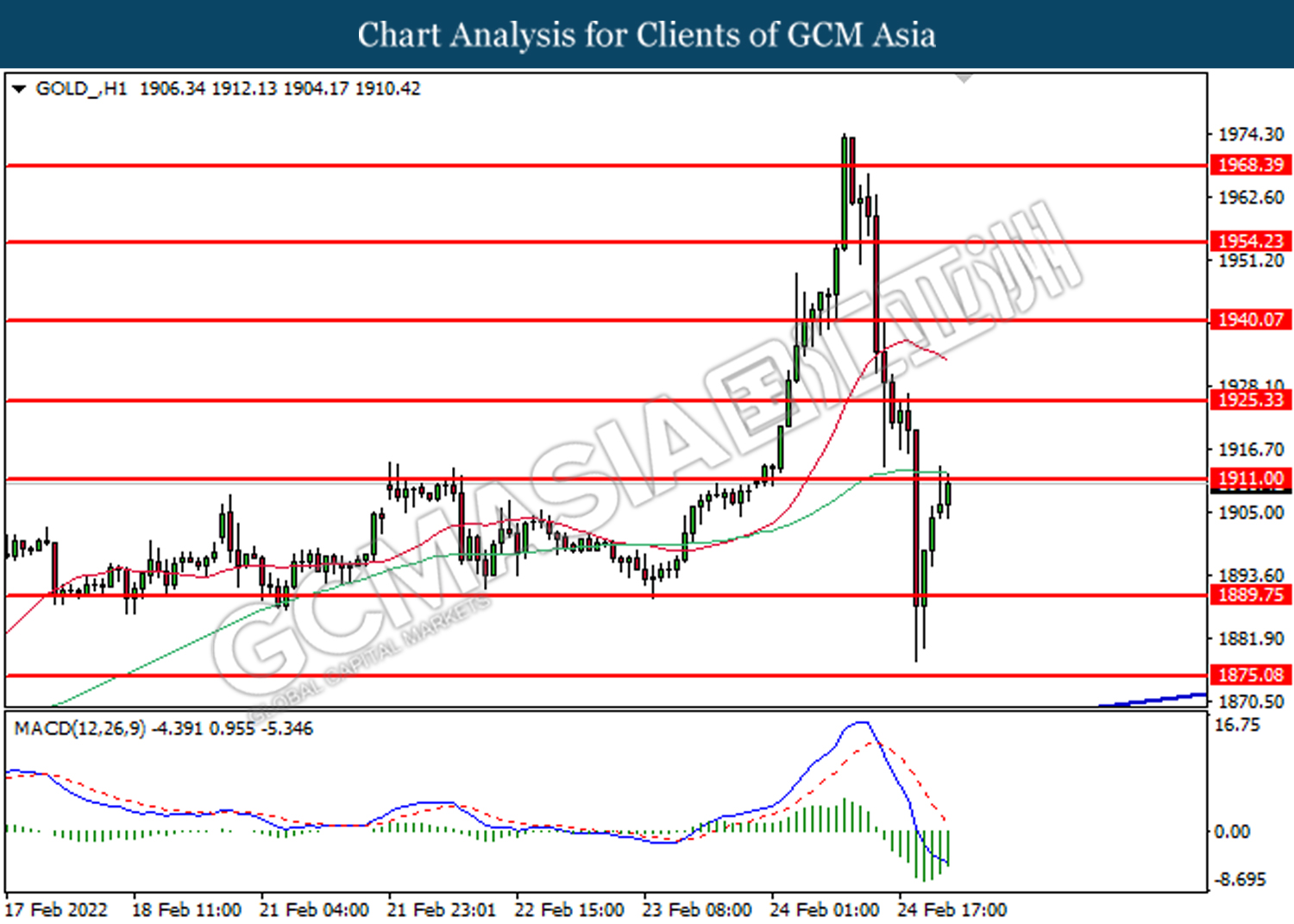

As for commodities market, crude oil price rebounds by 1.04% to $94.31 per barrel. Oil futures received tremendous selloff on yesterday night after US latest sanction fails to target Russian oil export. On the other hand, gold price rose 0.33% to $1,904.30 a troy ounce following prior technical correction from its higher level.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q4) | -0.70% | -0.70% | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Jan) | 0.60% | 0.40% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Jan) | -3.80% | 0.50% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

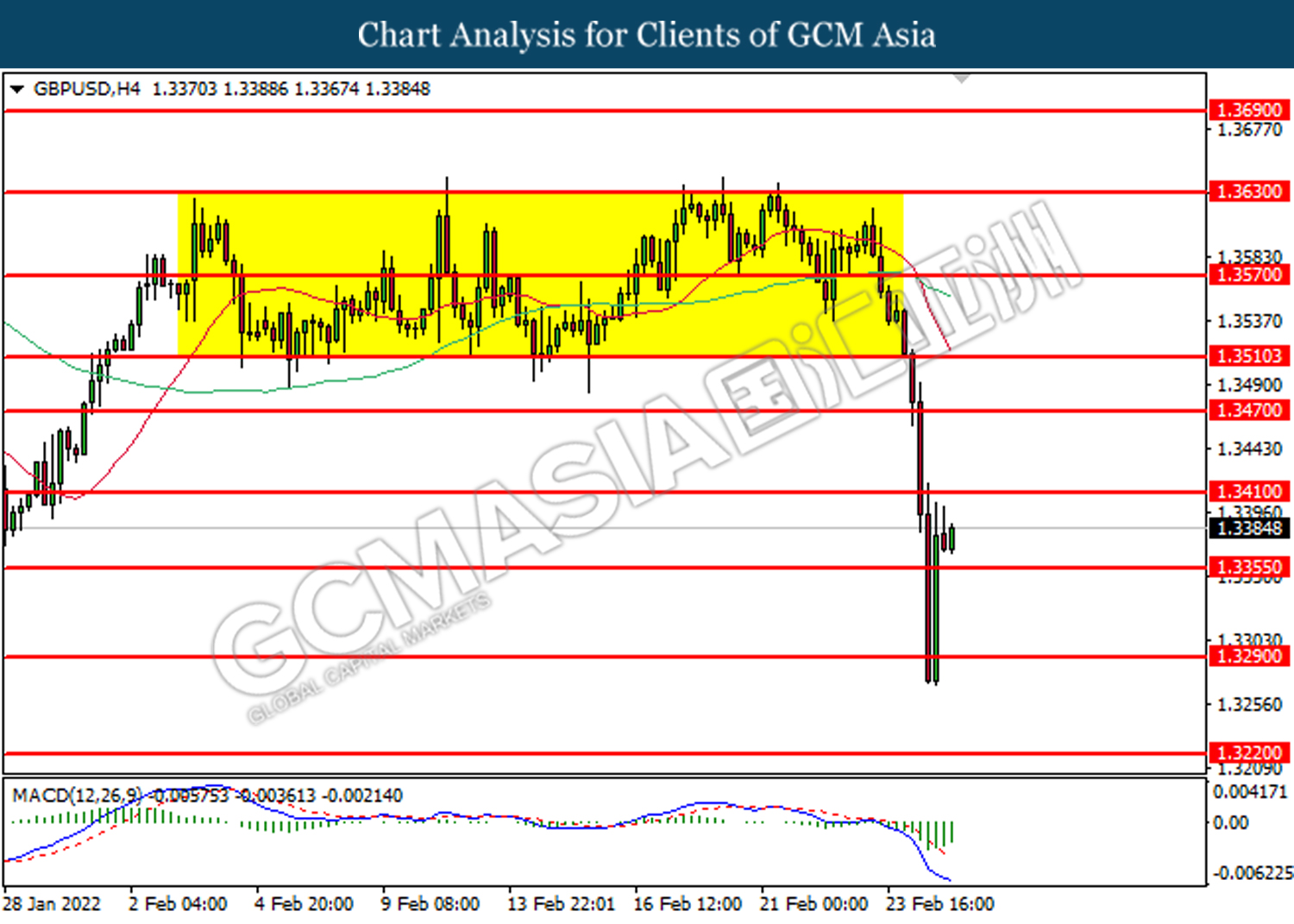

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3410, 1.3470

Support level: 1.3355, 1.3290

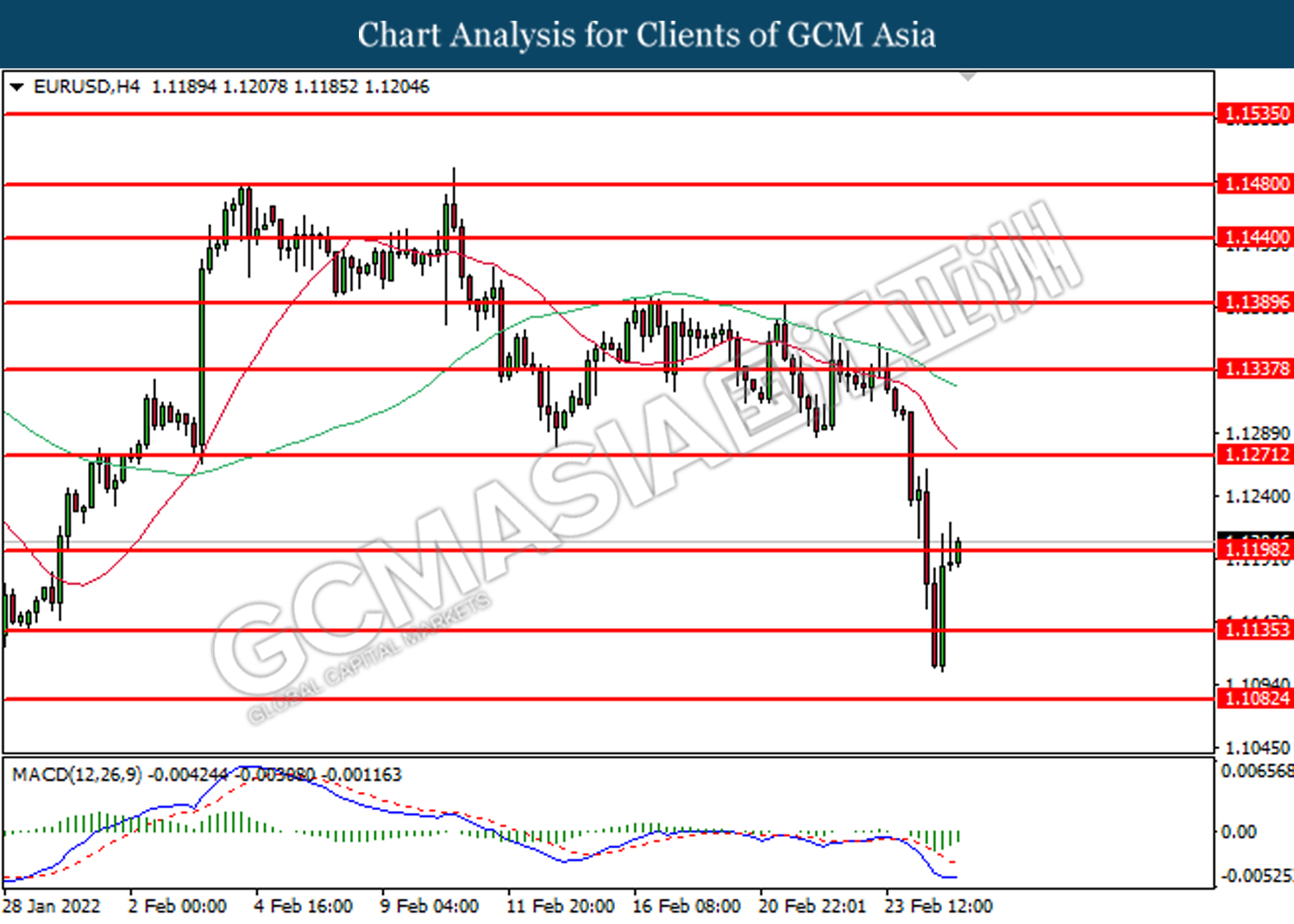

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1200, 1.1270

Support level: 1.1135, 1.1080

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which diminished illustrate bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

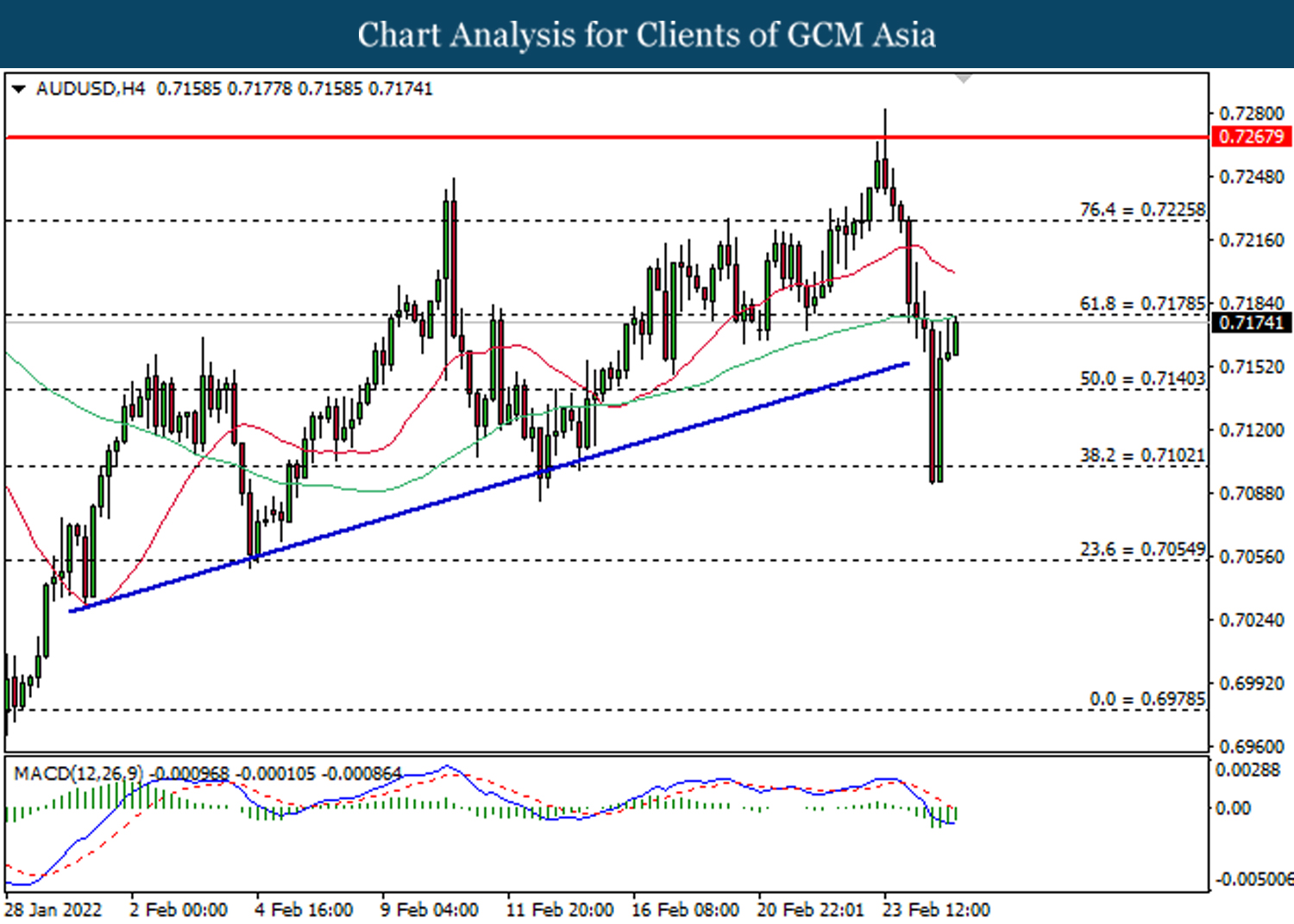

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

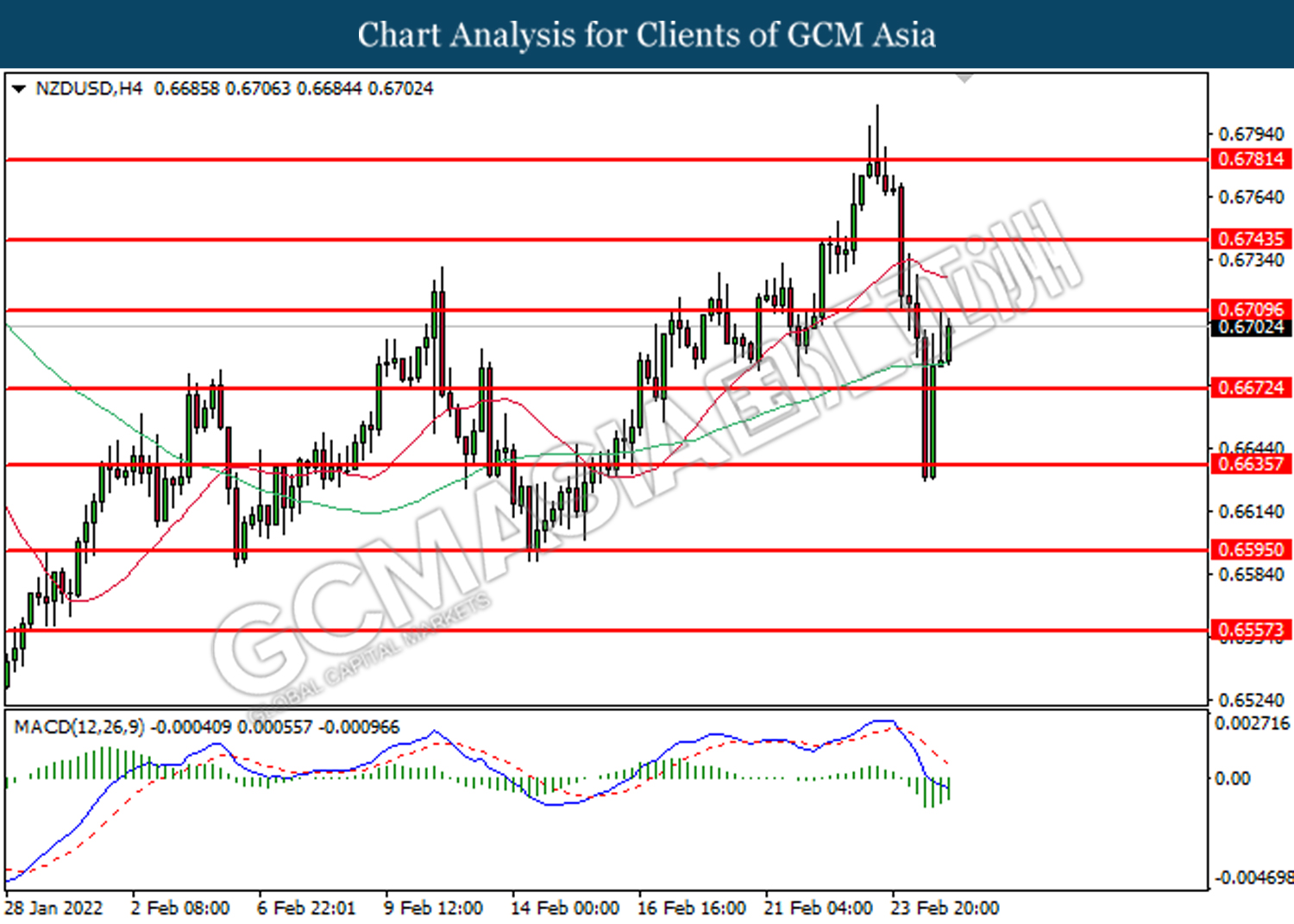

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

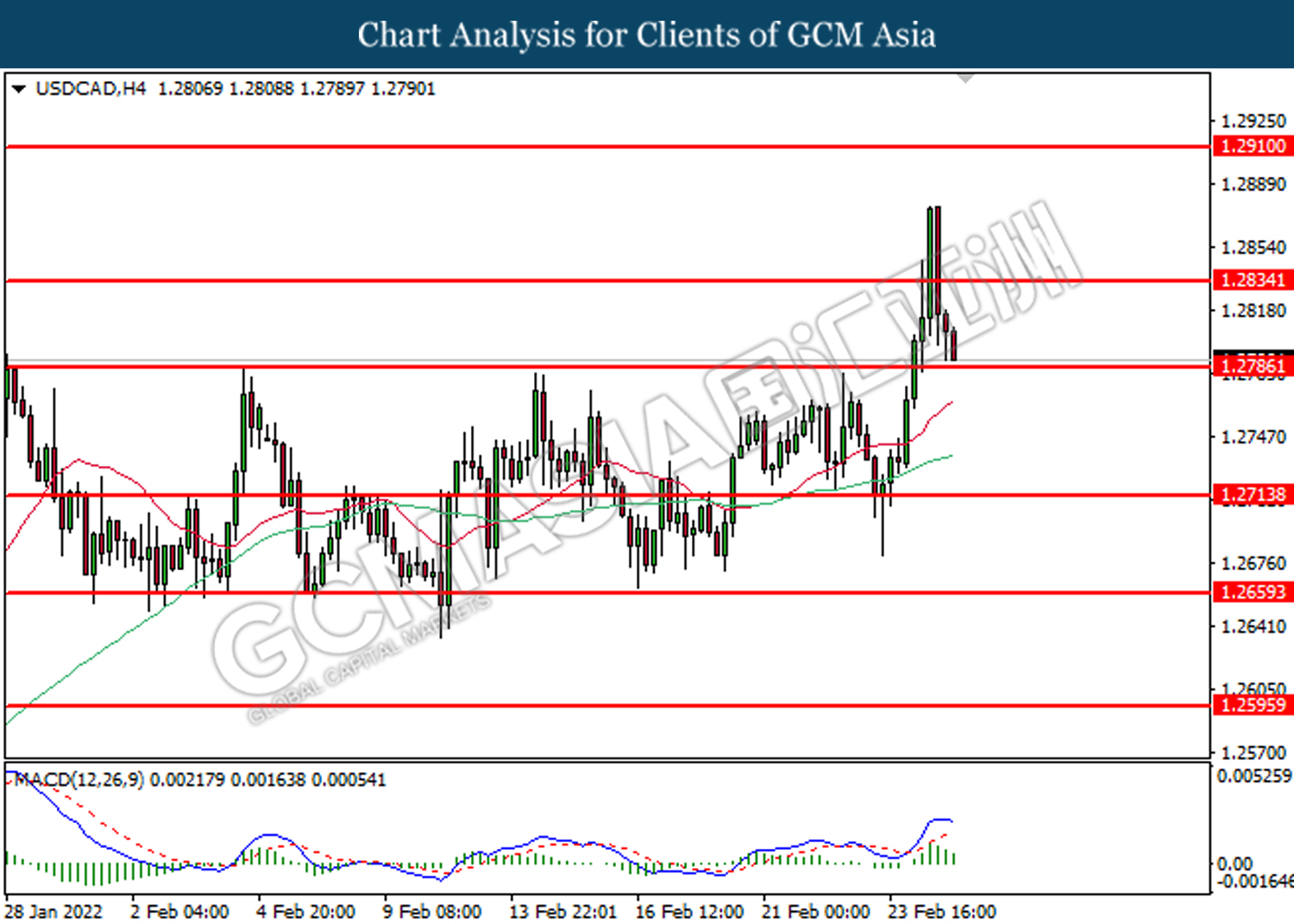

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2835, 1.2910

Support level: 1.2785, 1.2715

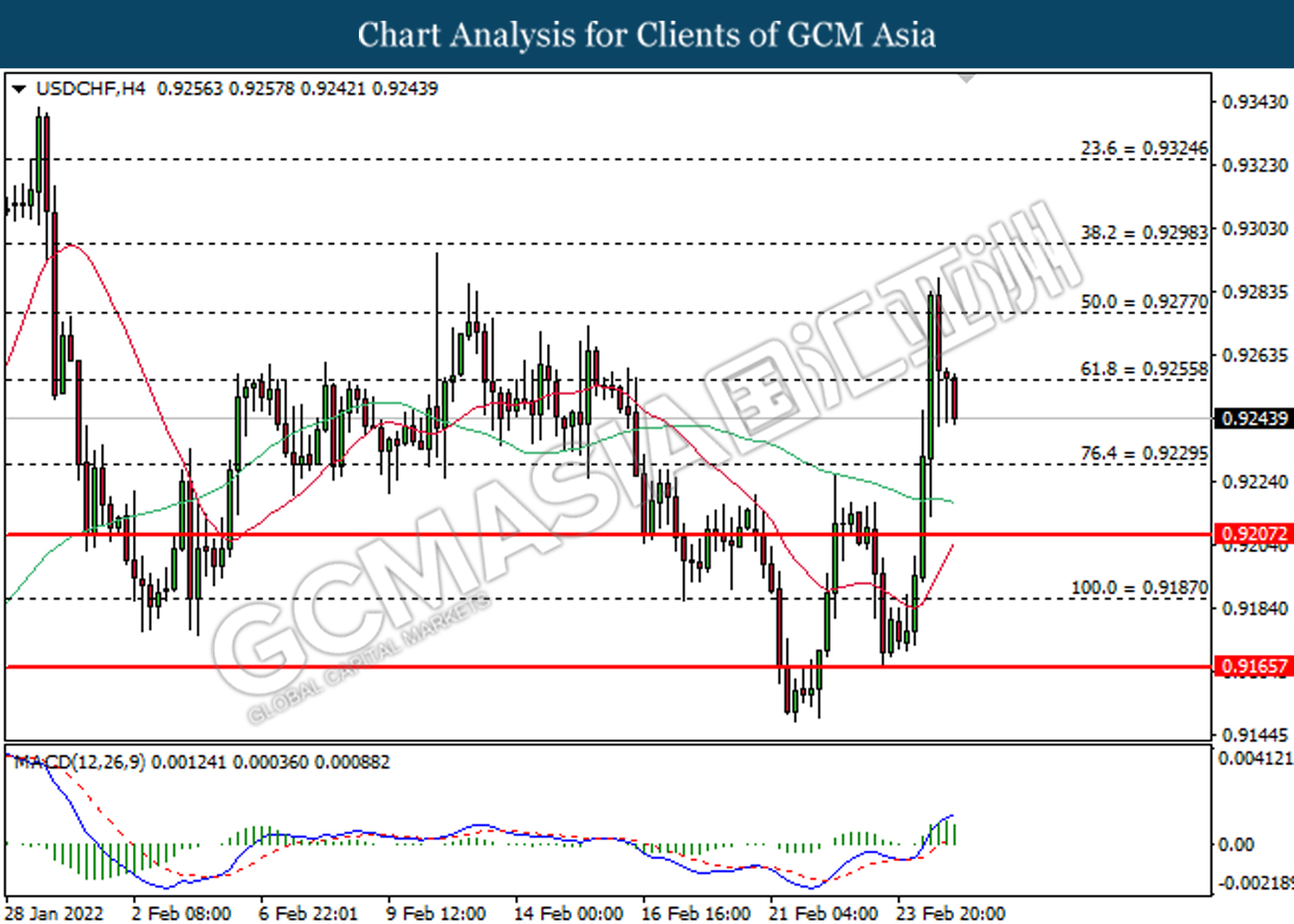

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 96.30, 99.20

Support level: 93.15, 91.00

GOLD_, H1: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after closing above its resistance level.

Resistance level: 1911.00, 1925.35

Support level: 1889.75, 1875.10