1 March 2022 Morning Session Analysis

Russia-Ukraine talk held.

Market participants began to shift their capital into risky assets after Russia and Ukraine agreed to hold talks on yesterday. The talk which is held near Poland-Belarus border discussed the possibility of achieving peace with certain criteria which are being requested from both parties. Ukrainian government requested for an immediate cease fire and Russia will be required to recall their troops from their country. At the same time, Russia also requires a guarantee of Ukraine’s neutrality in global politics as well as withdrawing their application to join NATO. According to head of Russian delegation Vladimir Medinsky, he commented that both parties have agreed upon several requests that were being discussed. Although a peace agreement has not yet been solidified, Medinsky expresses his confidence to achieve it in the near future and both countries is set to meet again in the next few days. Following lower risk of escalation in Russia-Ukraine war, the dollar index was down 0.01% to 96.64.

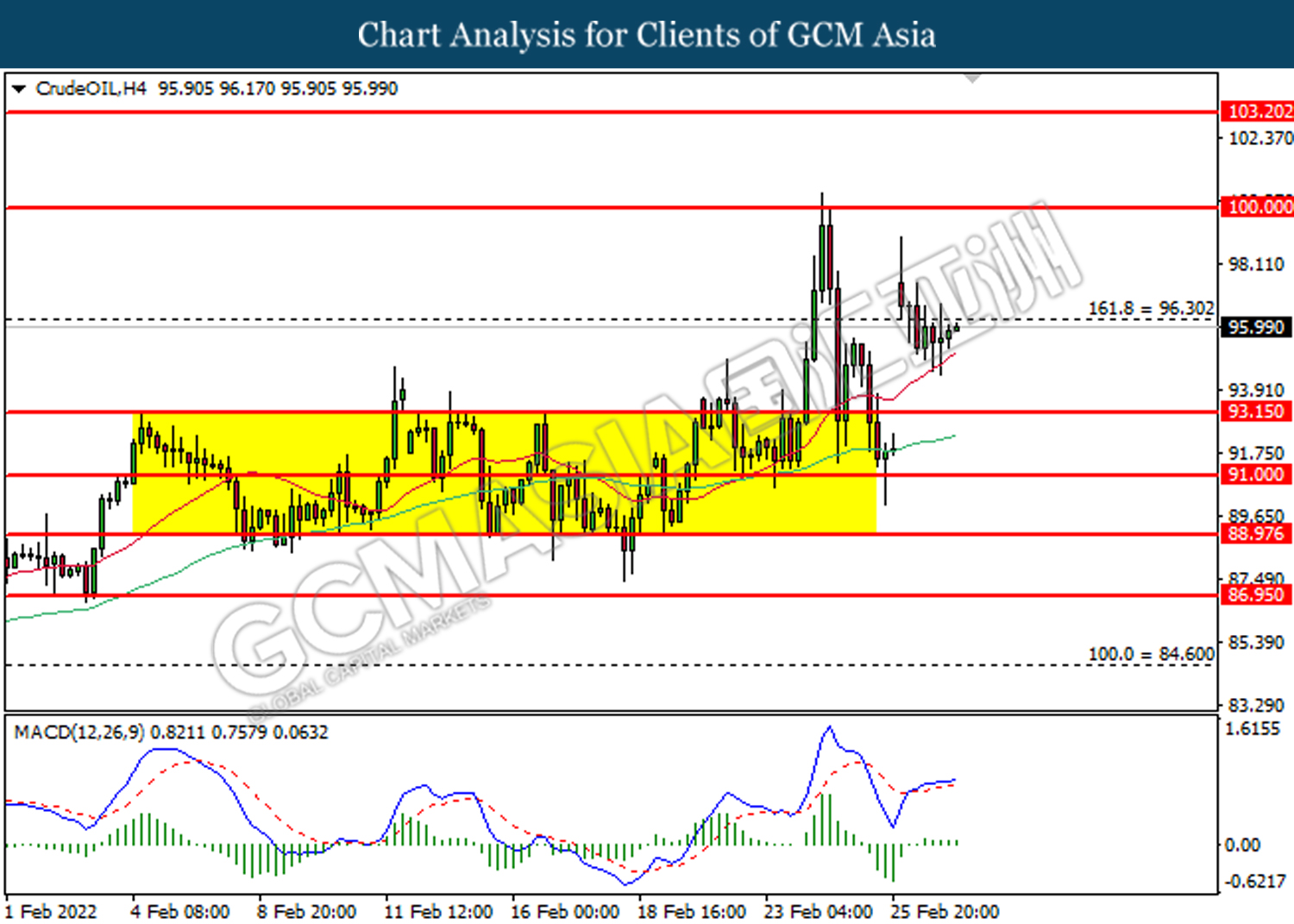

In the commodities market, crude oil price was down 0.31% to $95.71 per barrel following possible peace agreement in between Russia and Ukraine. On the other hand, gold price was down 0.13% to $1907.39 a troy ounce due to higher demand for risky assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Mar) | 0.10% | 0.10% | – |

| 16:55 | EUR – German Manufacturing PMI (Feb) | 58.5 | 58.5 | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 57.3 | 57.3 | – |

| 21:30 | CAD – GDP (MoM) (Dec) | 0.60% | 0.10% | – |

| 23:00 | USD – ISM Manufacturing PMI (Feb) | 57.6 | 58 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

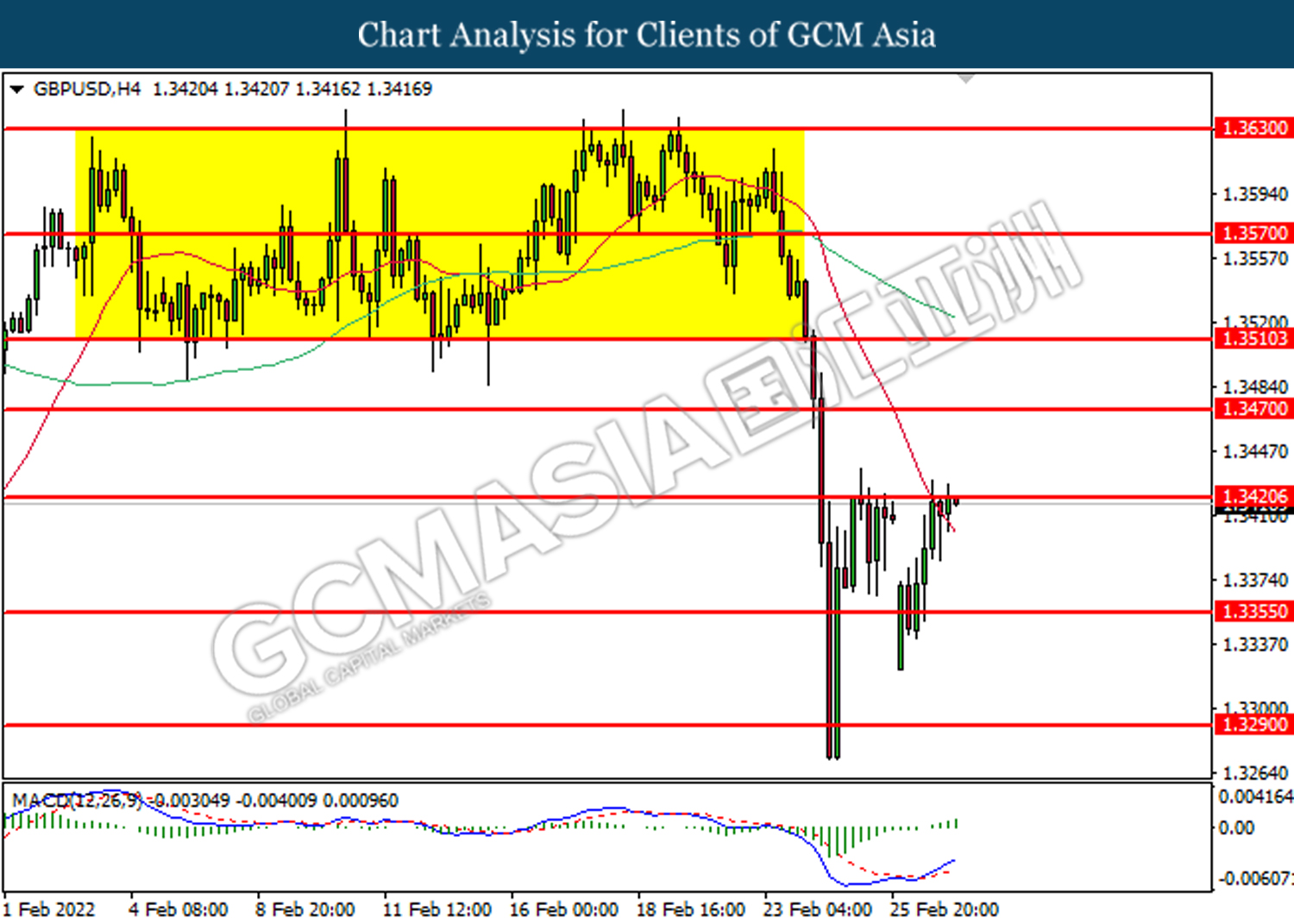

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 1.3420, 1.3470

Support level: 1.3355, 1.3290

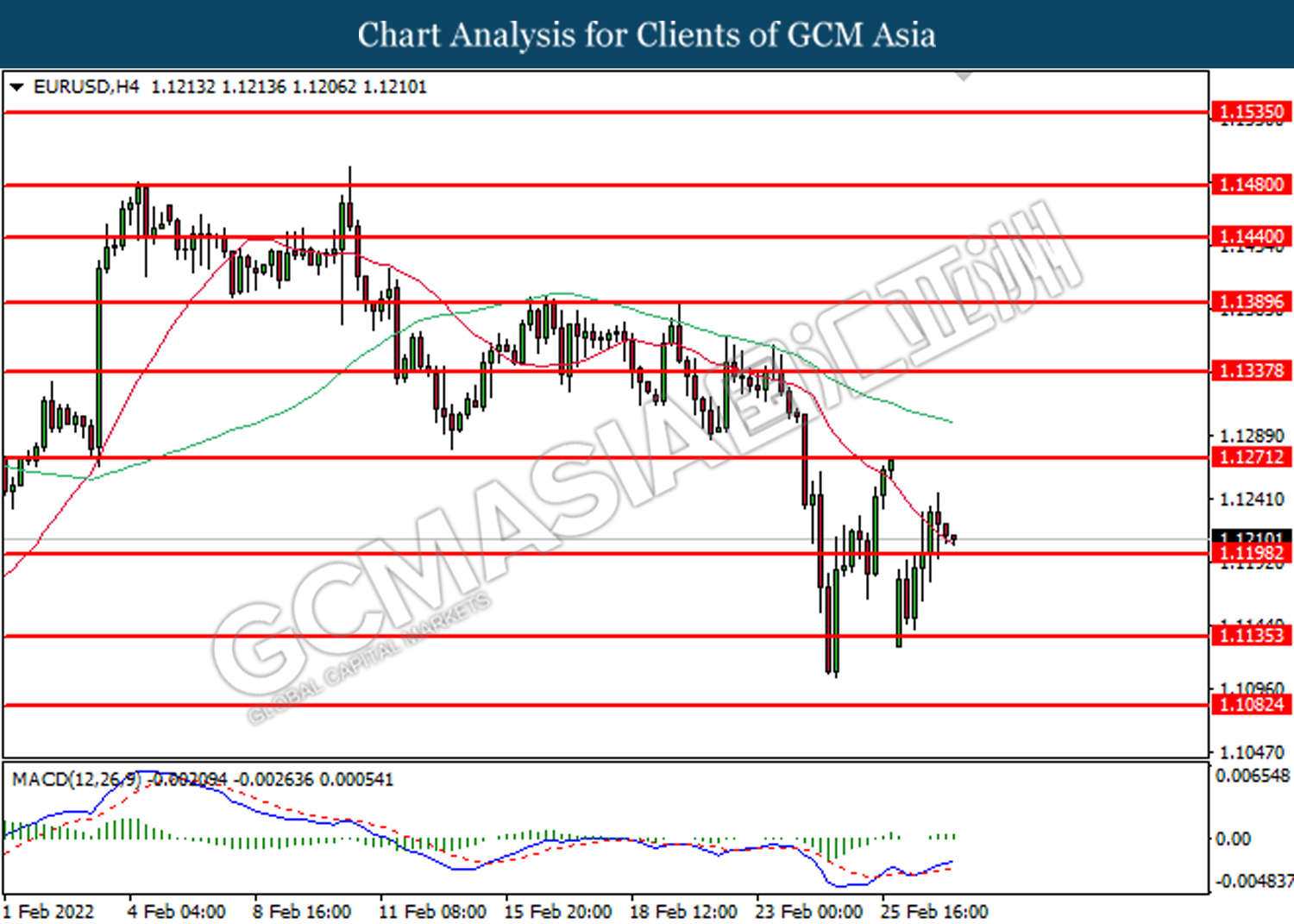

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1270, 1.1340

Support level: 1.1200, 1.1135

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which diminished illustrate bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

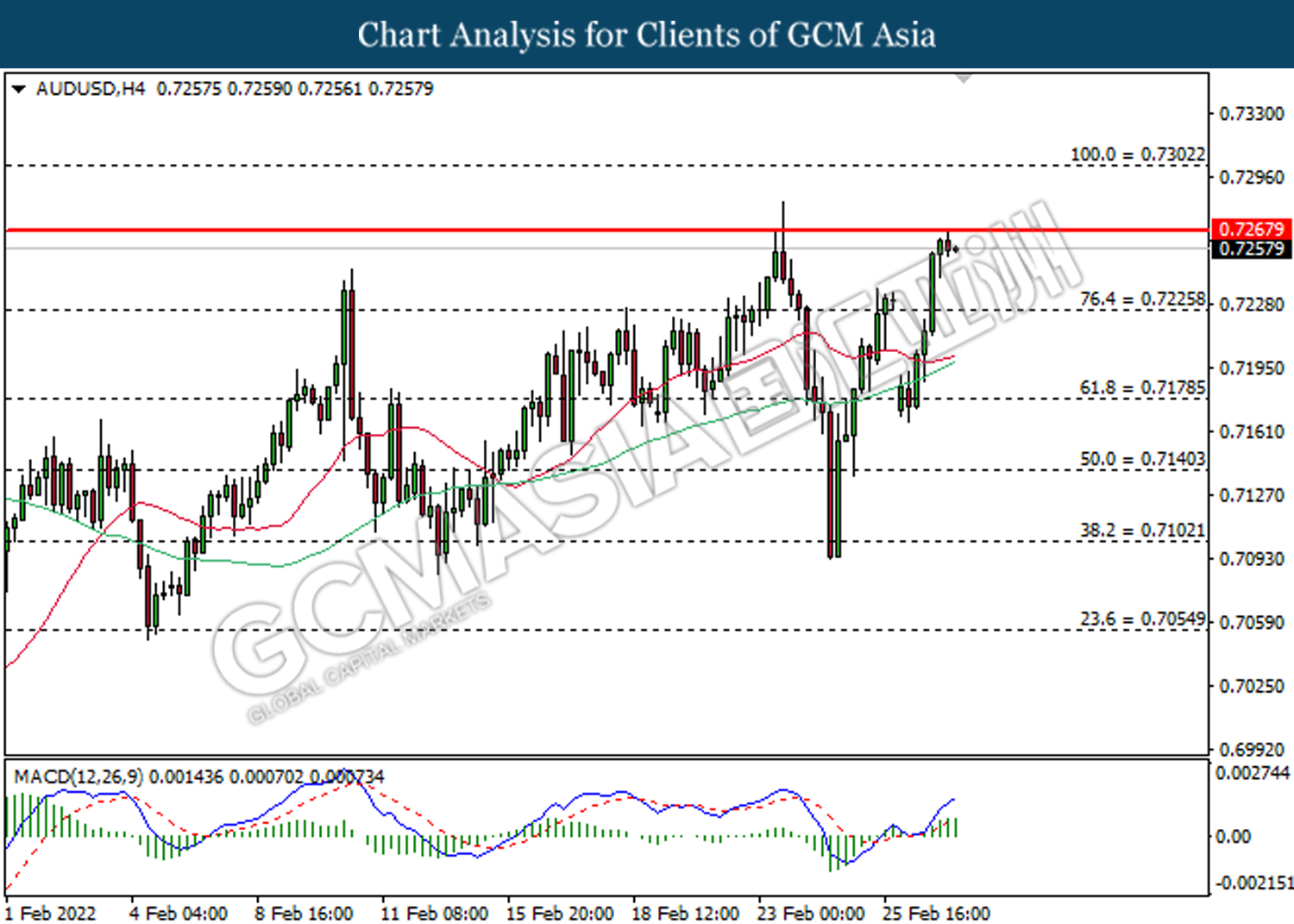

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7270, 0.7300

Support level: 0.7225, 0.7180

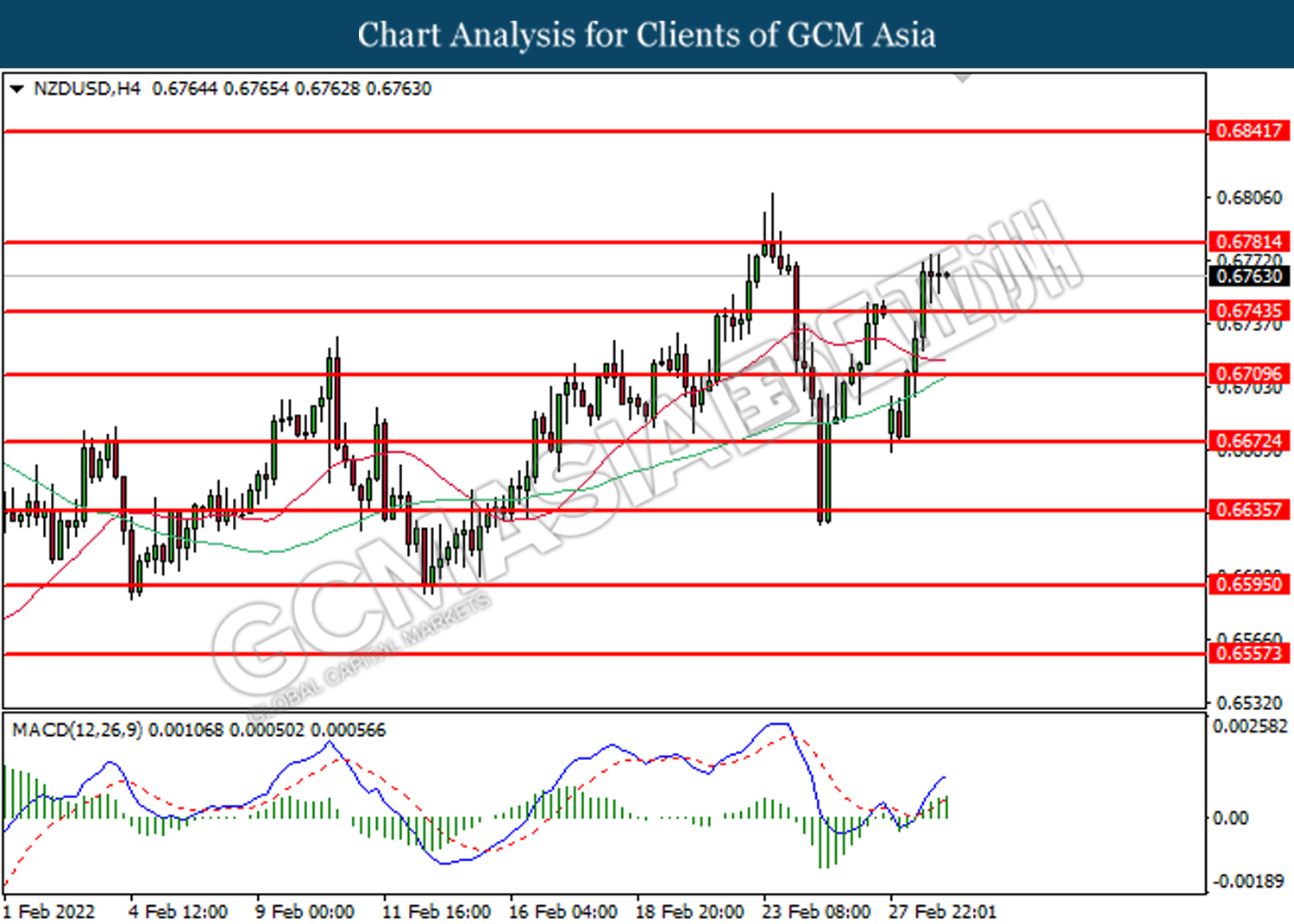

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6780, 0.6840

Support level: 0.6745, 0.6710

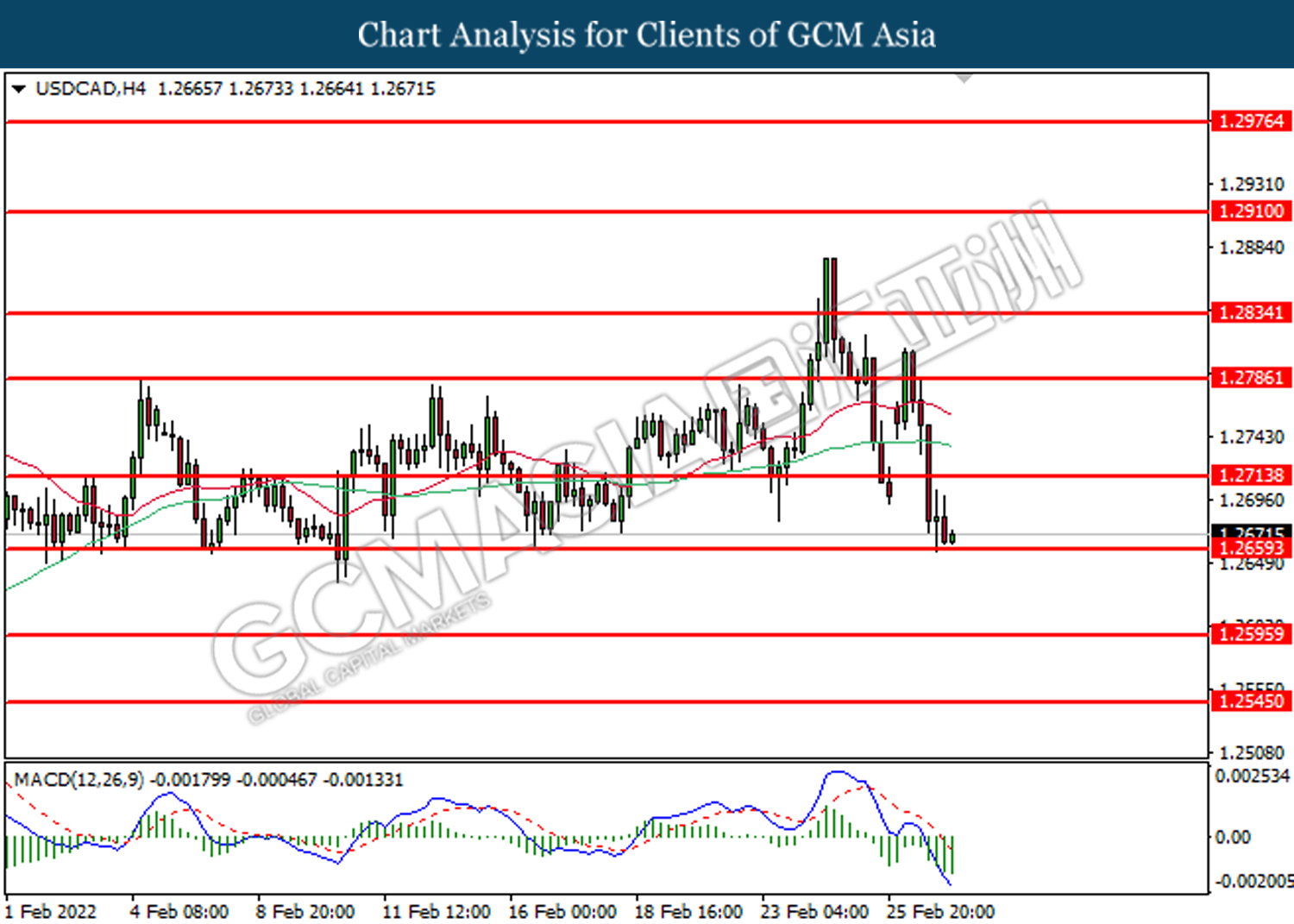

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2595

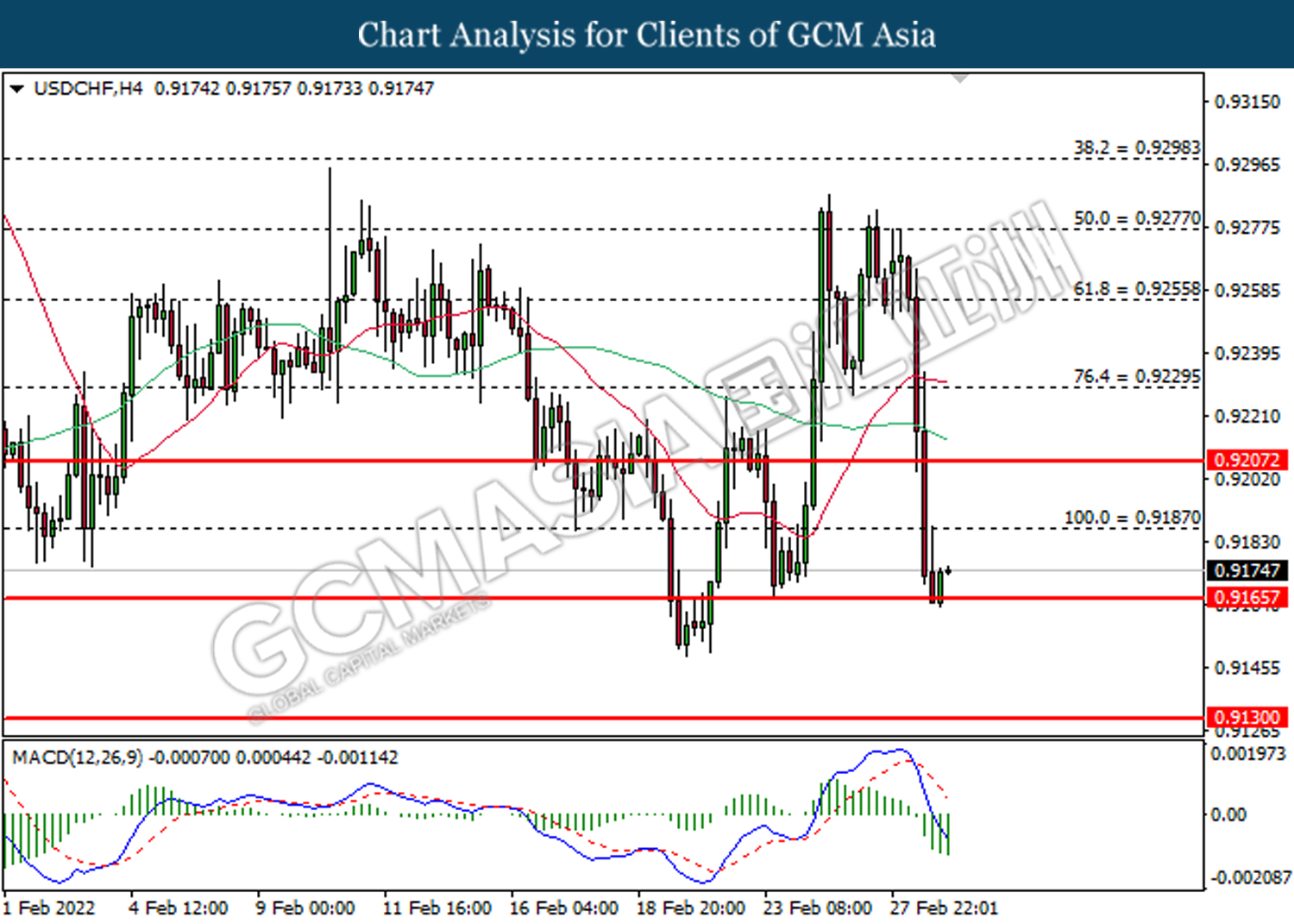

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 96.30, 100.00

Support level: 93.15, 91.00

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after closing above its resistance level.

Resistance level: 1911.00, 1925.35

Support level: 1889.75, 1875.10