2 March 2022 Morning Session Analysis

War escalates although talks started.

War in between Russia and Ukraine escalates further even though both countries have kickstarted their negotiations on last Monday. According to Al Jazeera, several miles of Russian military convoy were seen near Ukraine’s capital Kyiv on yesterday. Russian government advanced through with their attack plans and reiterates that they will continue to do so until their “goals have been achieved”. On the other hand, US Treasury Secretary Janet Yellen announced that all members of G7 has agreed to setup a new task force in order to freeze and seize Russian owned assets. Likewise, Yellen also emphasized that they will enact new sanctions which targets Russia financially if the situation in Ukraine escalates further. Following risk aversion in the market, dollar index was up 0.01% to 97.34.

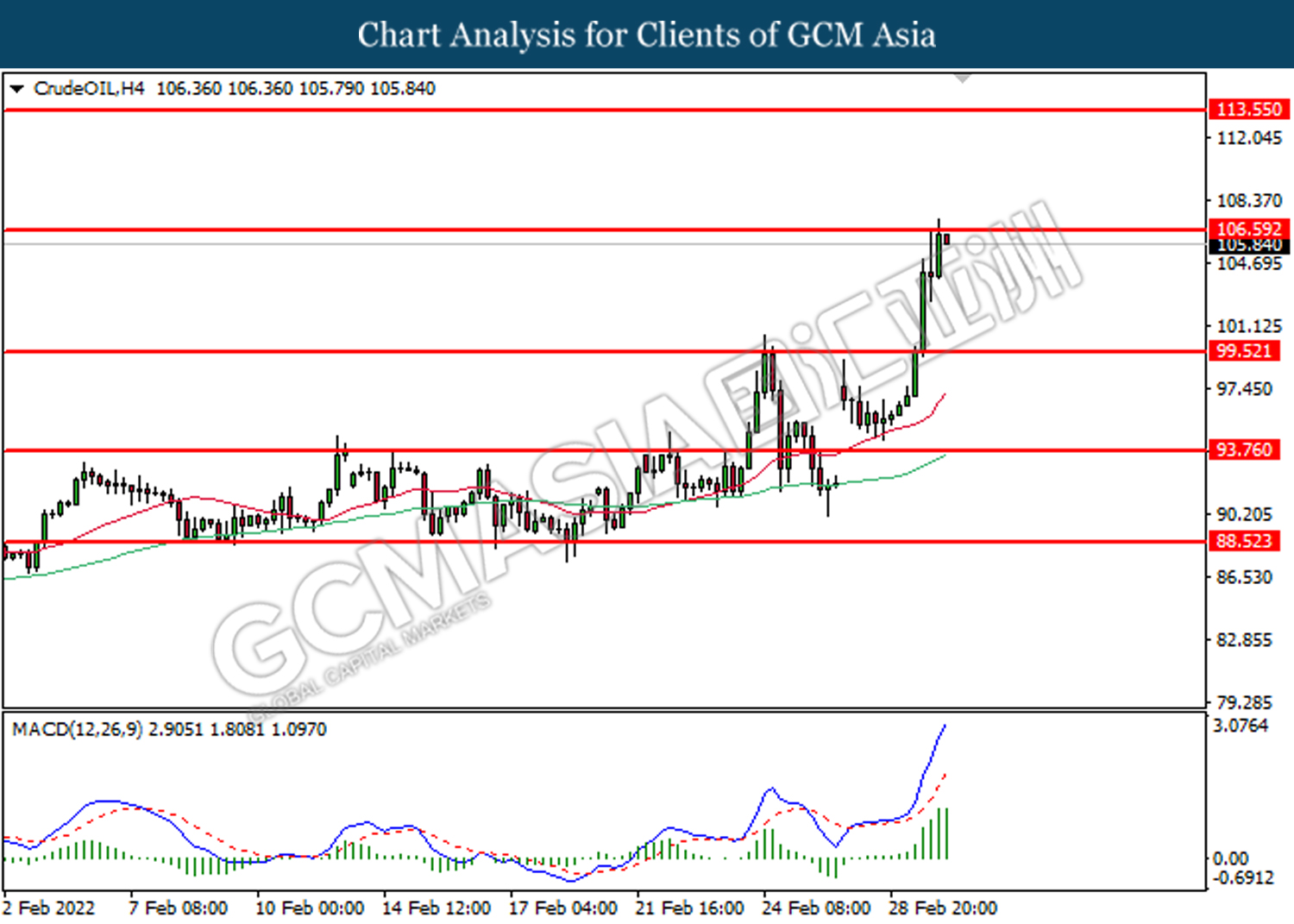

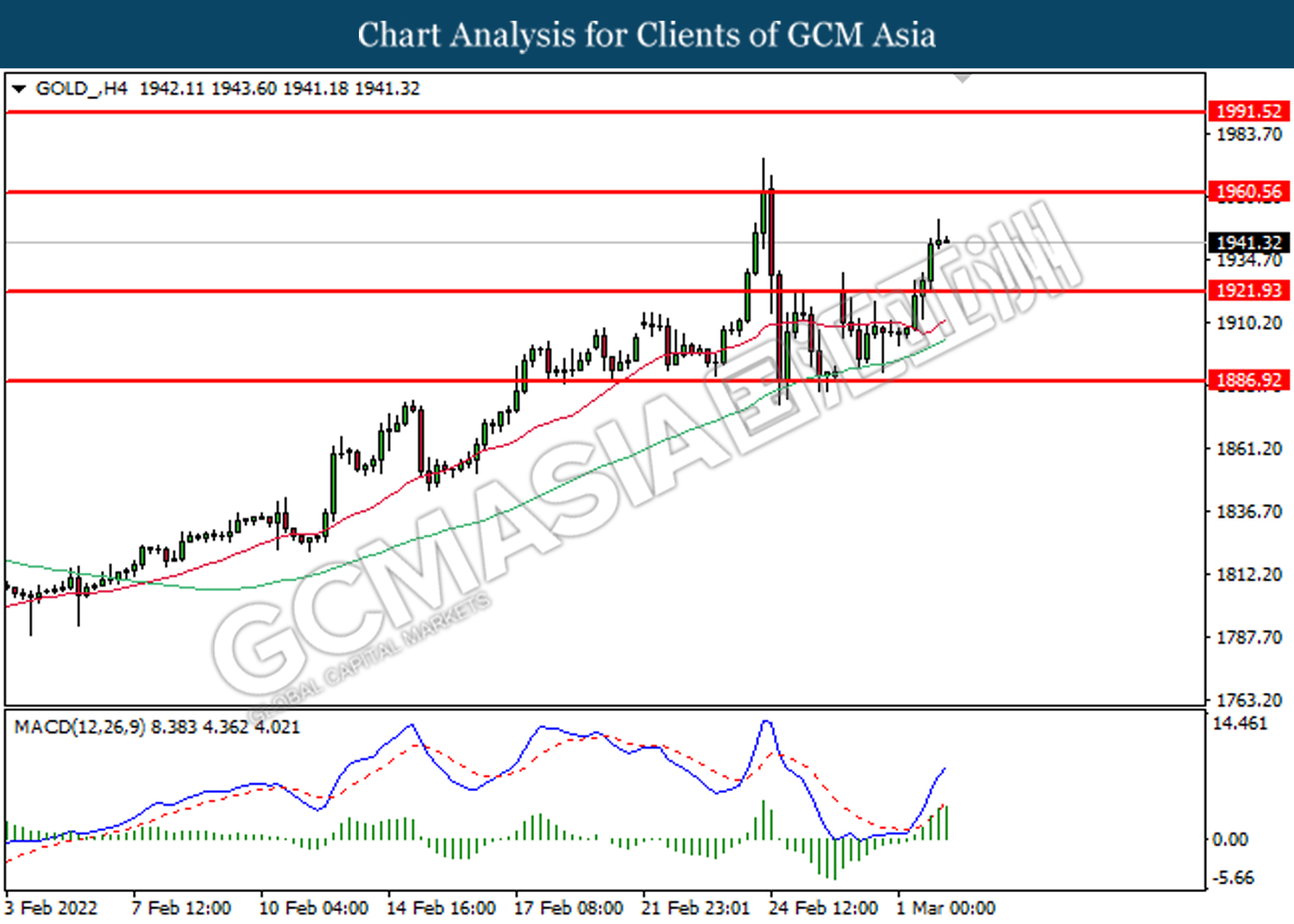

As for commodities market, crude oil price was up 1.54% to $106.45 per barrel due to escalating tension in between Russia and Ukraine which may disrupt global oil supply. On the other hand, gold price was up 0.10% to $1942.27 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP Annual Budget Release

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Feb) | -48K | -23K | – |

| 18:00 | EUR – CPI (YoY) (Feb) | 5.10% | 5.30% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Feb) | -301K | 350K | – |

| 23:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.50% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 4.515M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

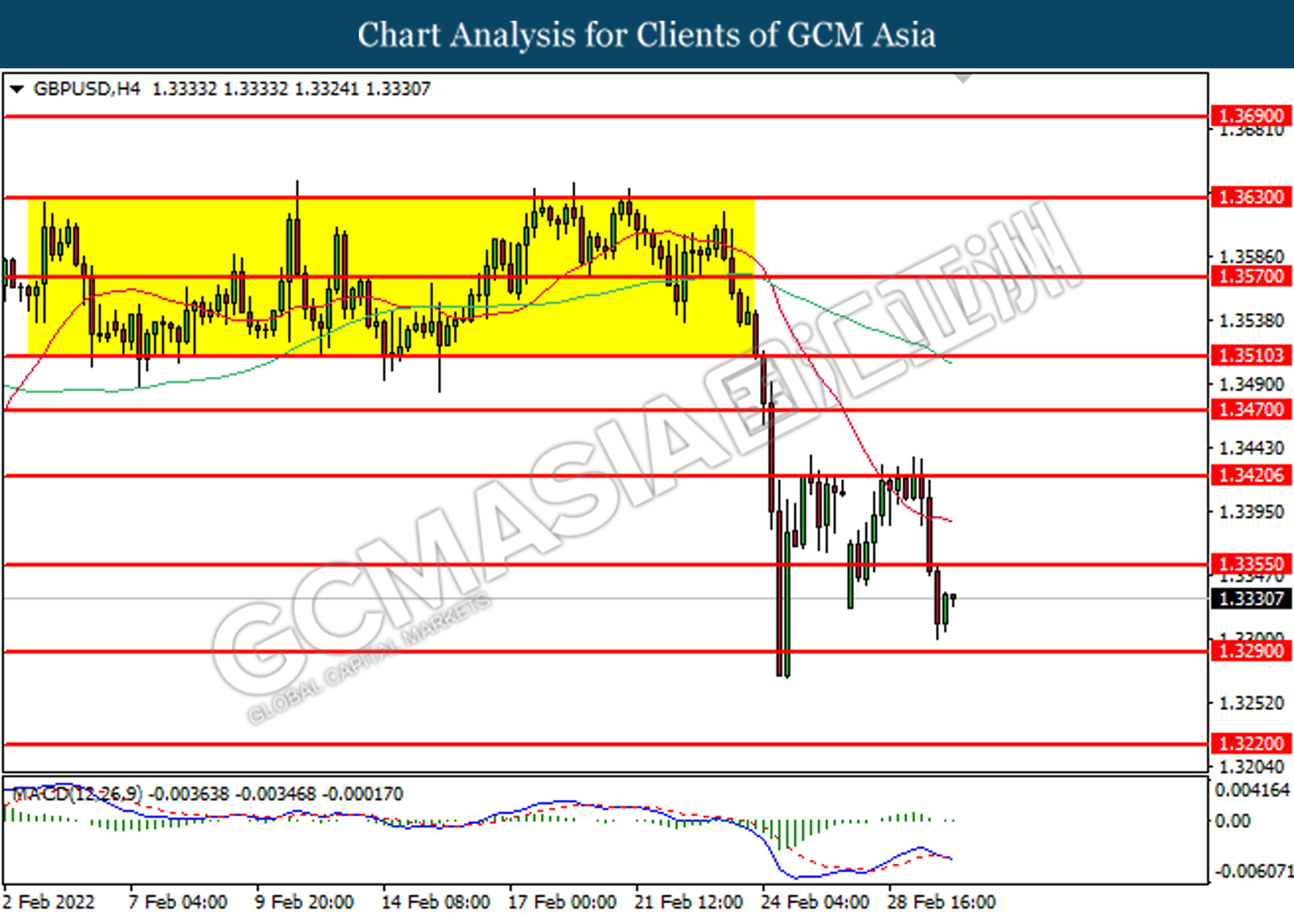

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.3355, 1.3420

Support level: 1.3290, 1.3220

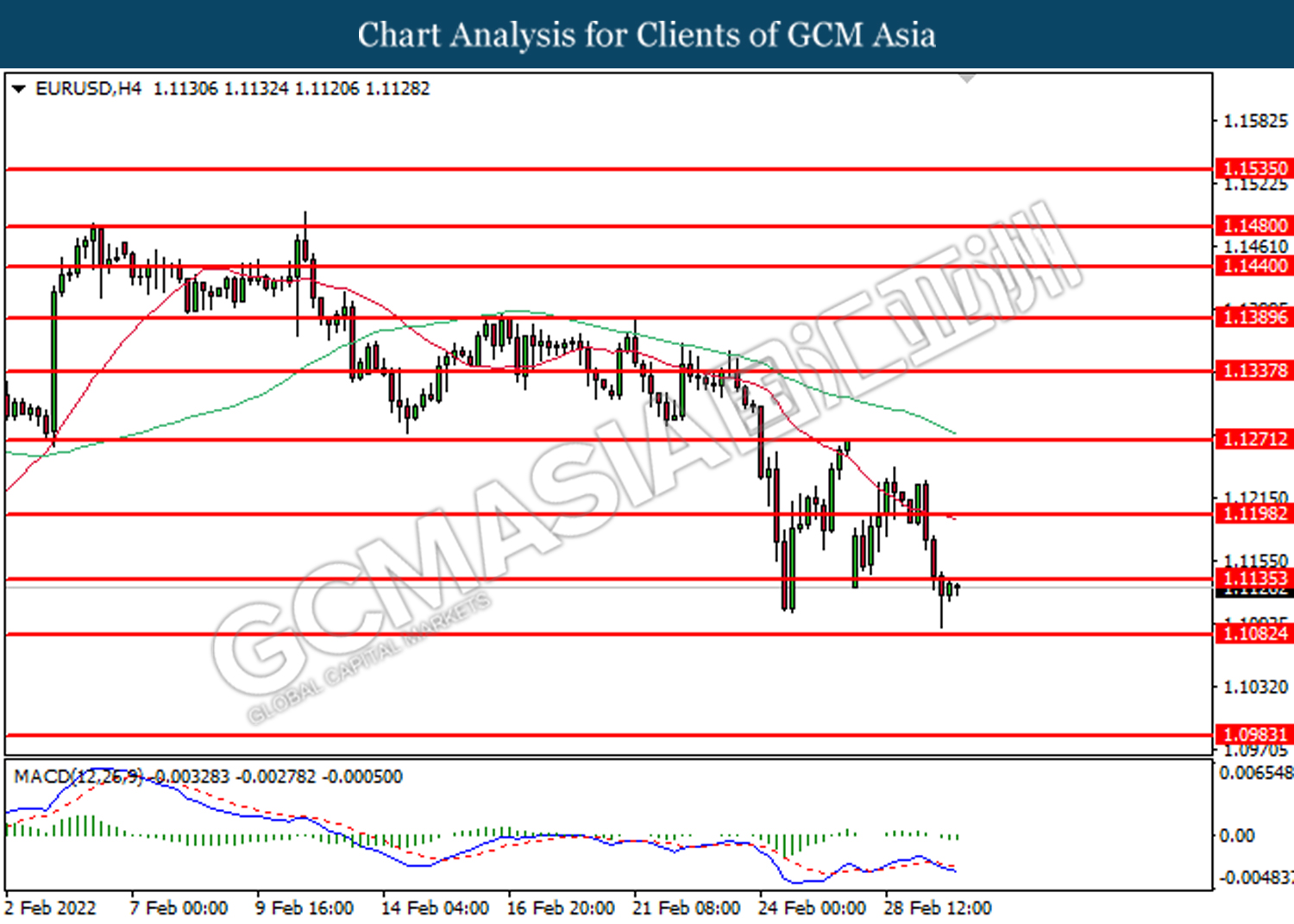

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1135, 1.1200

Support level: 1.1080, 1.0985

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which diminished bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7270, 0.7300

Support level: 0.7225, 0.7180

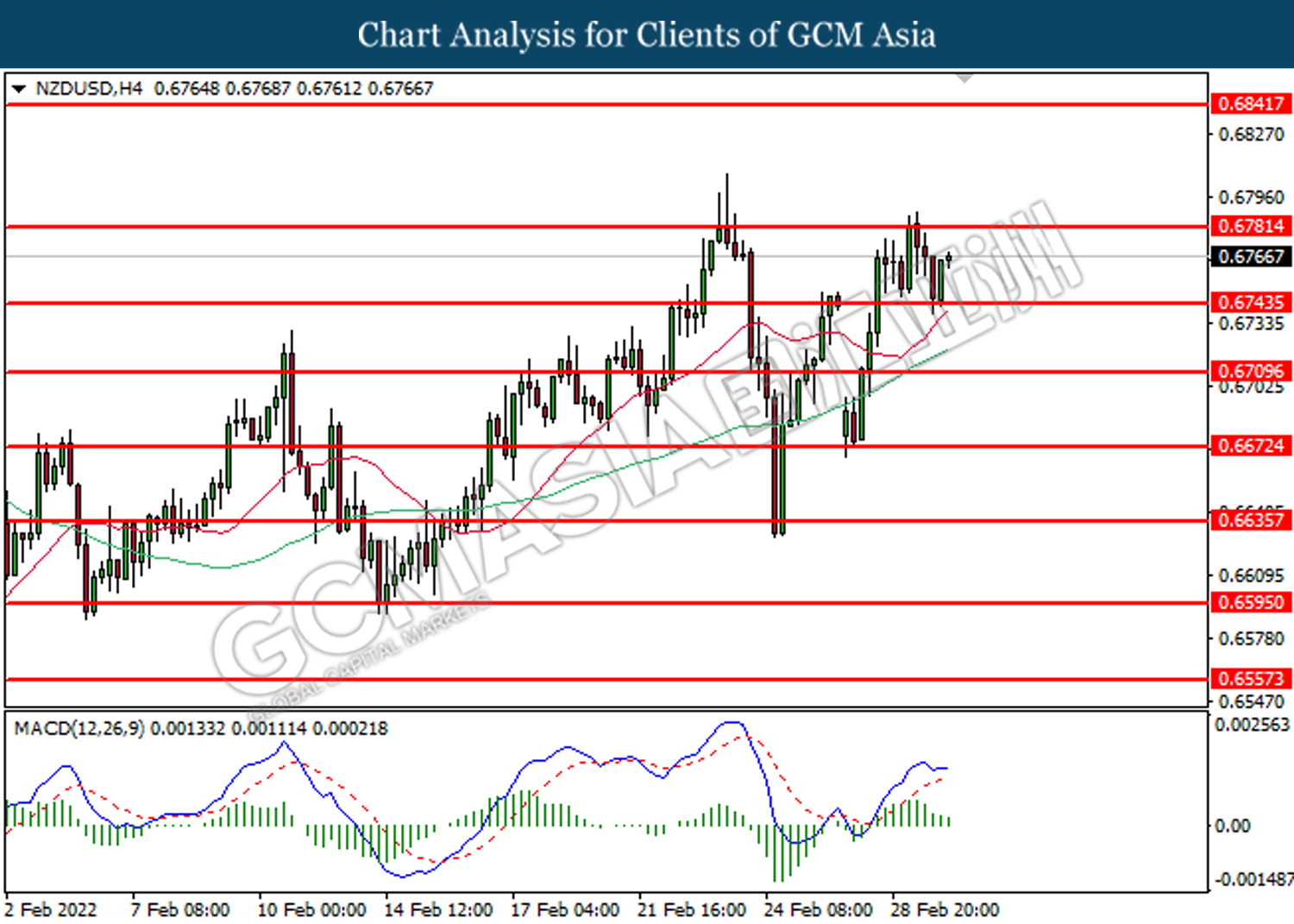

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6780, 0.6840

Support level: 0.6745, 0.6710

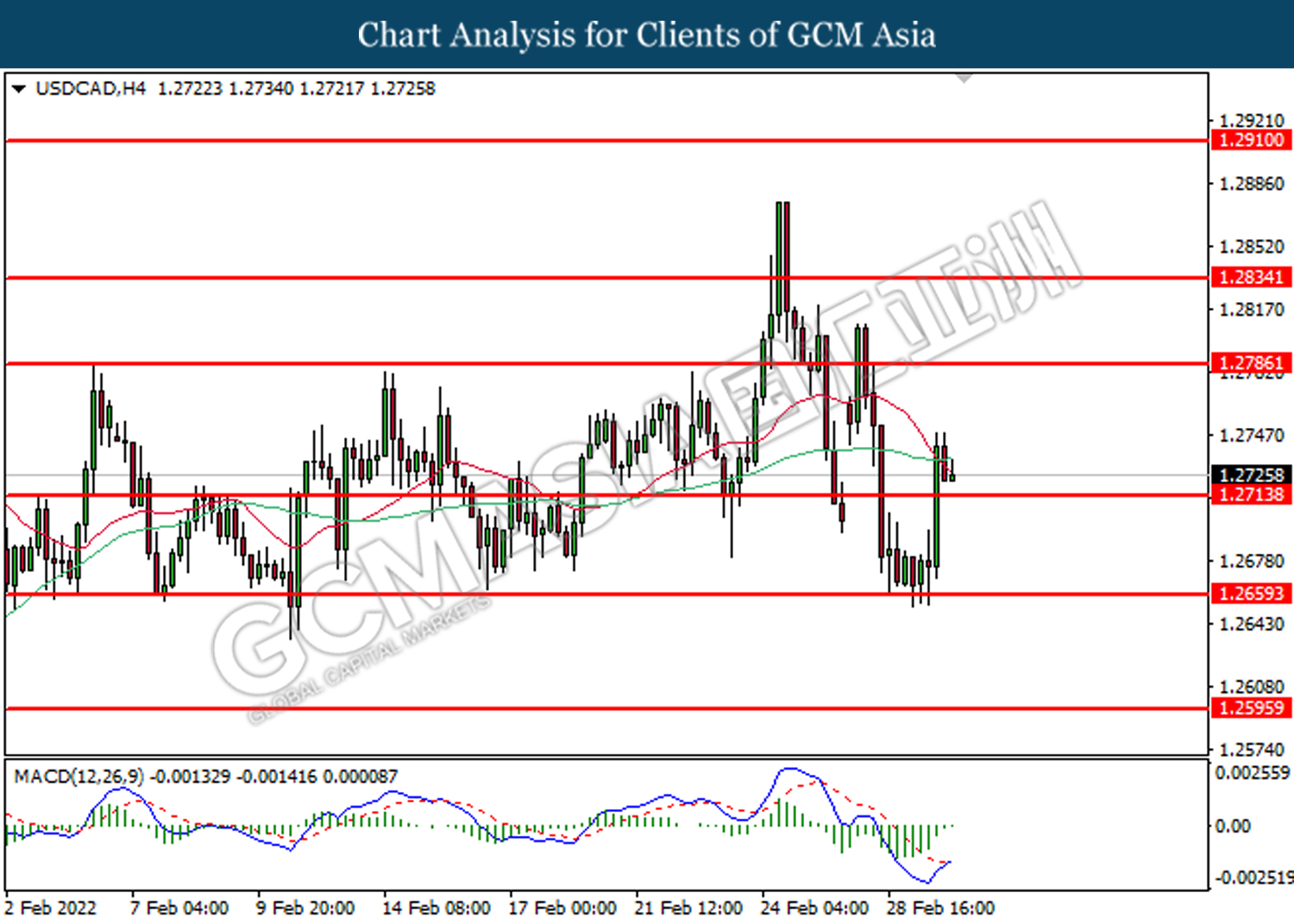

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

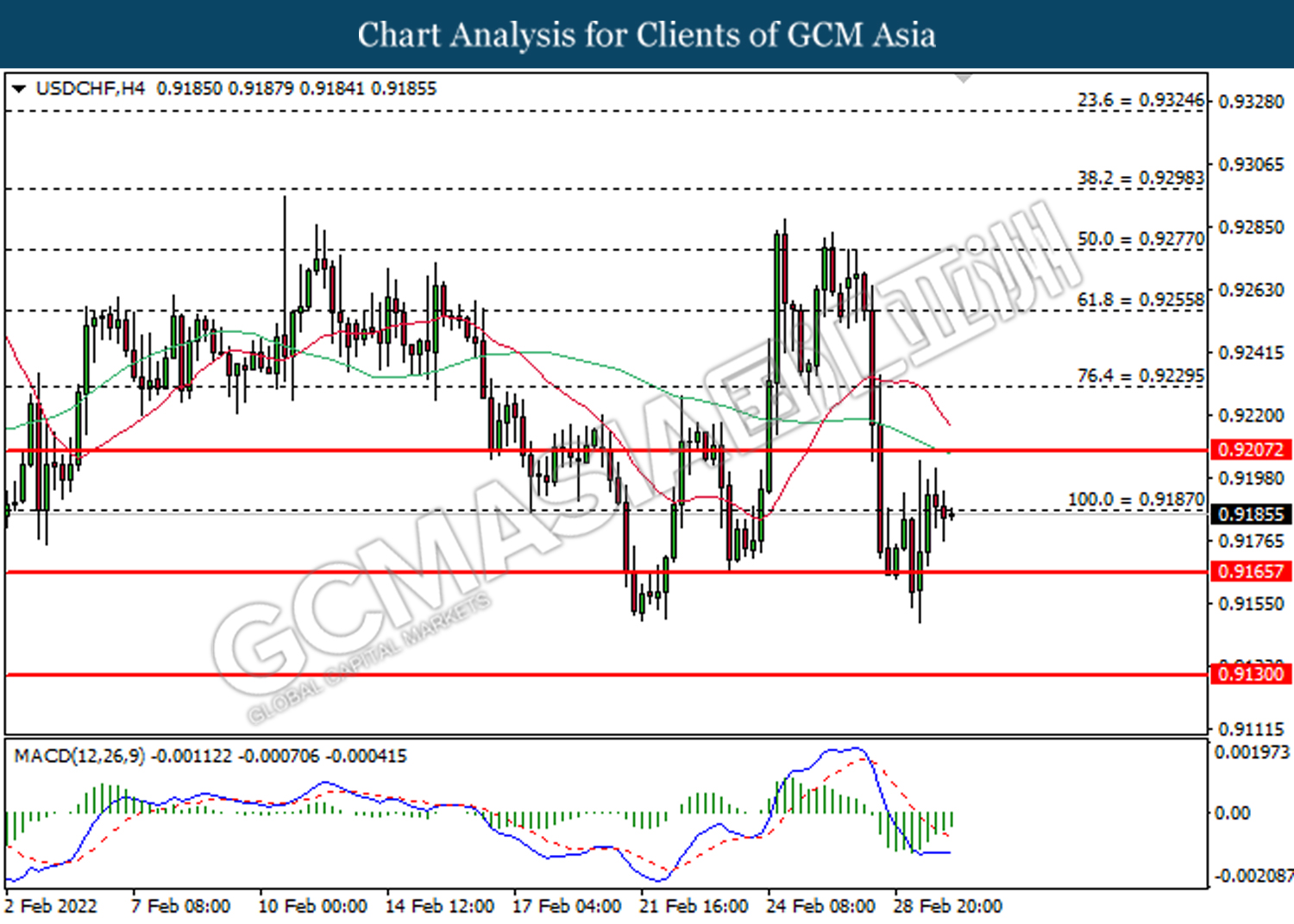

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 106.60, 113.55

Support level: 99.50, 93.75

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1960.55, 1991.50

Support level: 1921.95, 1886.90