04 March 2022 Afternoon Session Analysis

Euro dipped amid rising tensions Russia-Ukraine.

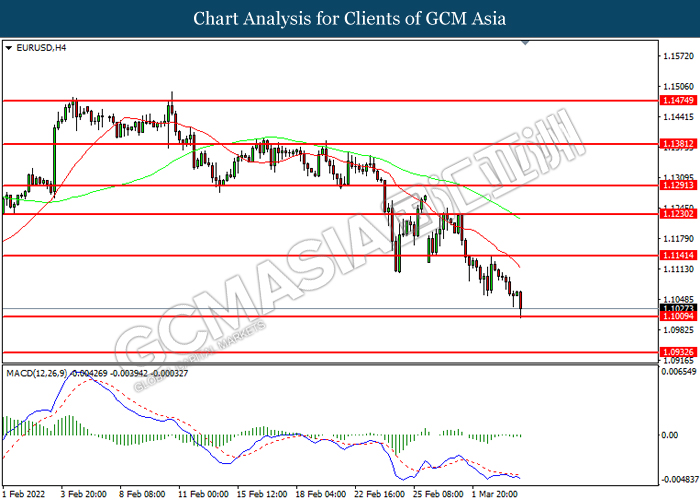

The Euro extend its losses over the backdrop of rising tensions between Ukraine and Russia, which prompting investors to shift their portfolio toward other risk-free currency while dialling down the appeal for Euro. The war in Ukraine and Russia would increase the commodity prices, continued to spur negative prospect toward the European economic growth. According to Reuters, the Ukrainian atomic energy ministry claimed that a generating unit at the Zaporizhzhia nuclear power plant, the largest of its kind in Europe, has been hit during an attack by Russian troops. Nonetheless, investors would continue to scrutinize the latest updates with regards of Russia-Ukraine tensions as well as further economic data to receive further trading signal. As of writing, EUR/USD depreciated by 0.33% to 1.1028.

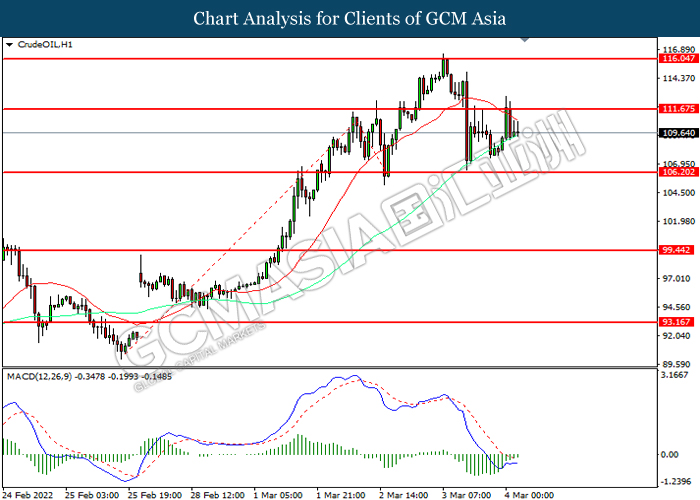

In the commodities market, the crude oil price appreciated by 1.48% to $111.10 per barrel as of writing. The oil market edged higher amid rising tensions between Russia-Ukraine had continue to spur fears upon the oil supply disruption in future. On the other hand, the gold price surged 0.25% to $1940.65 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Feb) | 56.3 | 54.3 | – |

| 21:30 | USD – Nonfarm Payrolls (Feb) | 467K | 450K | – |

| 21:30 | USD – Unemployment Rate (Feb) | 4.00% | 3.90% | – |

| 23:00 | CAD – Ivey PMI (Feb) | 50.7 | – | – |

Technical Analysis

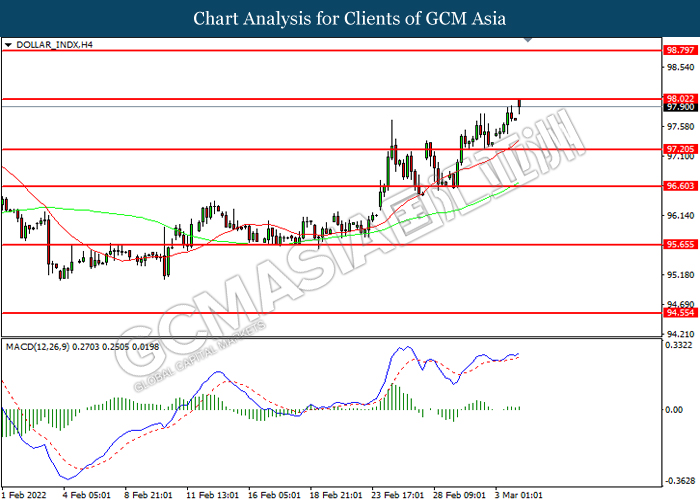

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 97.45. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 98.00, 98.80

Support level: 97.20, 96.60

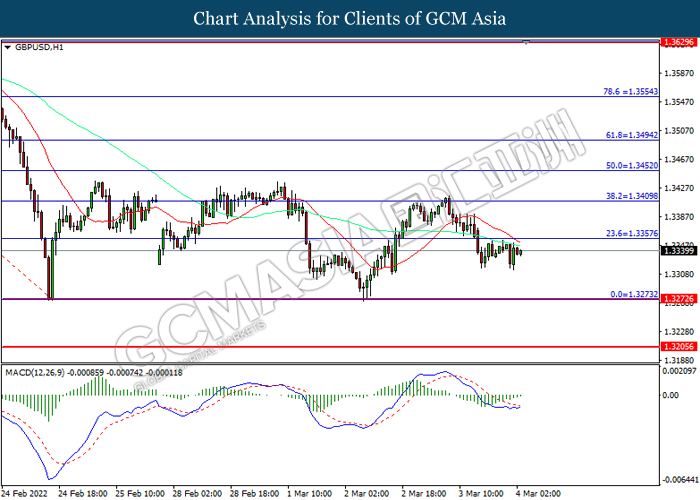

GBPUSD, H1: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3355, 1.3410

Support level: 1.3275, 1.3205

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1010. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1140, 1.1230

Support level: 1.1010, 1.0935

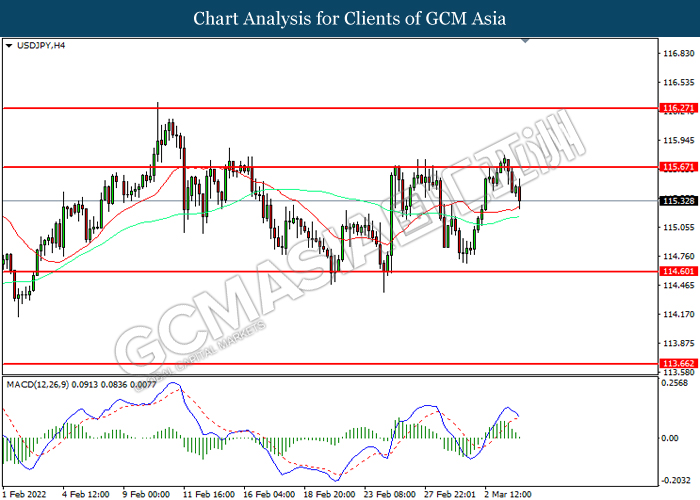

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 115.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 114.60.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

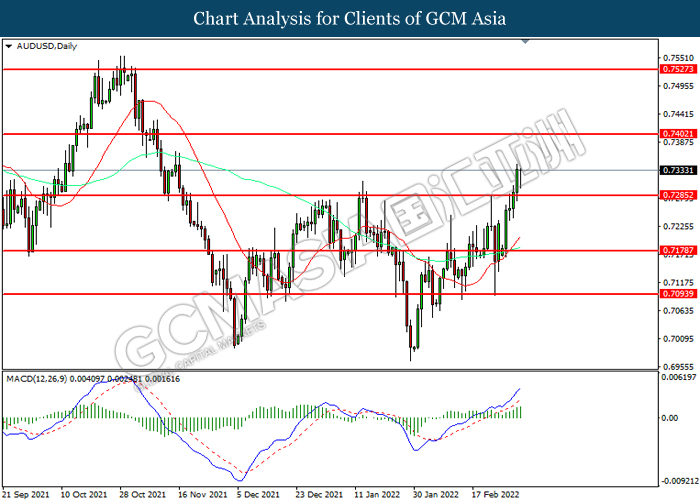

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7285. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7400.

Resistance level: 0.7400, 0.7525

Support level: 0.7285, 0.7180

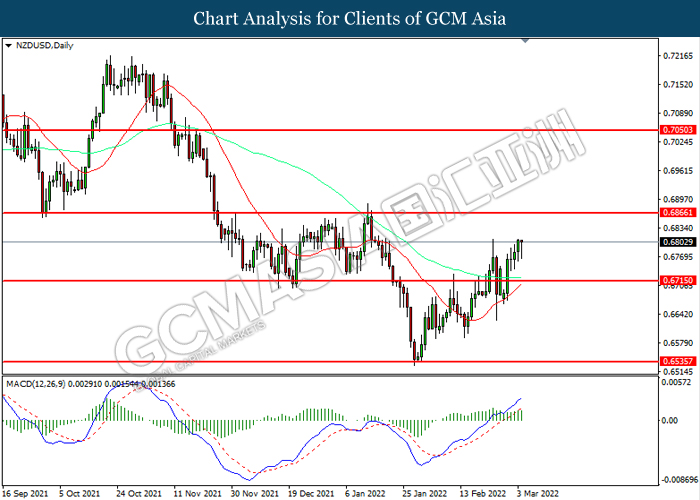

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

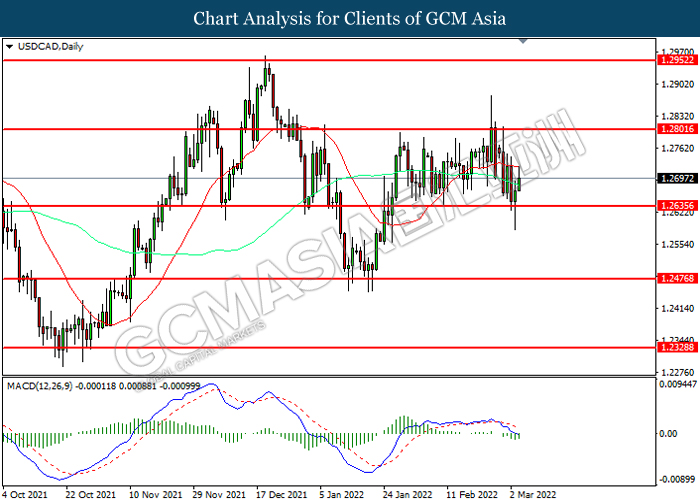

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2635. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2800, 1.2950

Support level: 1.2635, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 111.65. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 114.10, 117.90

Support level: 110.80, 106.20

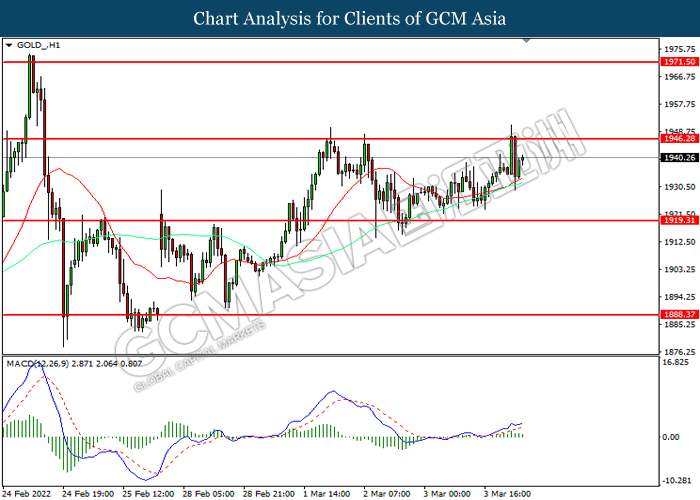

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level at 1946.30. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 1919.30.

Resistance level: 1946.30, 1971.50

Support level: 1919.30, 1888.35