10 March 2022 Morning Session Analysis

Easing tensions between Russia-Ukraine, safe-haven Dollar dipped.

The Dollar Index which traded against a basket of six major currencies slumped amid positive hopes upon the diplomatic resolution to the Russia-Ukraine, which spurring risk appetite in the global financial market while prompting investors to shift their portfolio toward riskier asset. According to Reuters, Maria Zakharova claimed that the Russia will achieve its goal of ensuring Ukraine’s neutral status and would prefer to achieve consensus through talks instead of war. Besides, she also reiterated that Russian hopes to achieve more significant progress in the next round of talks with Ukraine. Nonetheless, the gains experienced by the US Dollar was limited by the upbeat economic data from US region. According to Bureau of Labor Statistics, US JOLTs Job Opening came in at 11.263M, exceeding the market forecast at 10.925M. As of writing, the Dollar Index depreciated by 1.07% to 98.00.

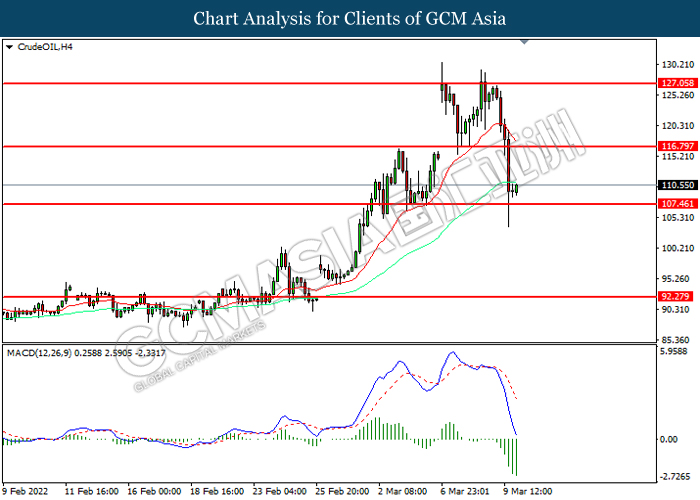

In the commodities market, the crude oil price rebounded 0.14% to $111.14 per barrel as of writing following the released of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at -1.863M, less than the market forecast at -0.657M. On the other hand, the gold price slumped 0.03% to $1991.45 per troy ounces as of writing amid risk-on sentiment in the market following the easing tensions between Russian-Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EUR Leader Summit

20:45 EUR ECB Monetary Policy Statement

20:45 EUR ECB Interest Rate Decision (Mar)

21:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Feb) | 0.60% | 0.50% | – |

| 21:30 | USD – Initial Jobless Claims | 215K | 216K | – |

Technical Analysis

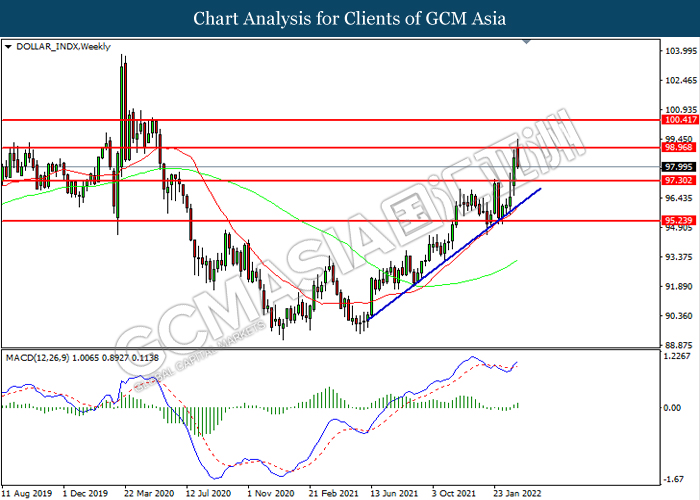

DOLLAR_INDX, Weekly: Dollar index was traded lower following prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

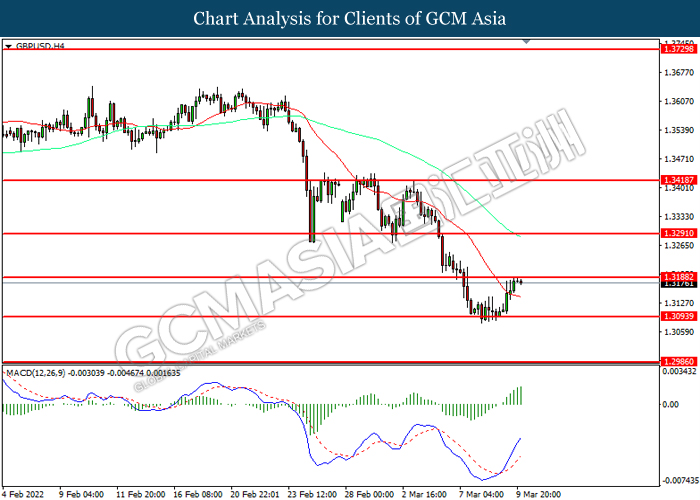

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3190. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

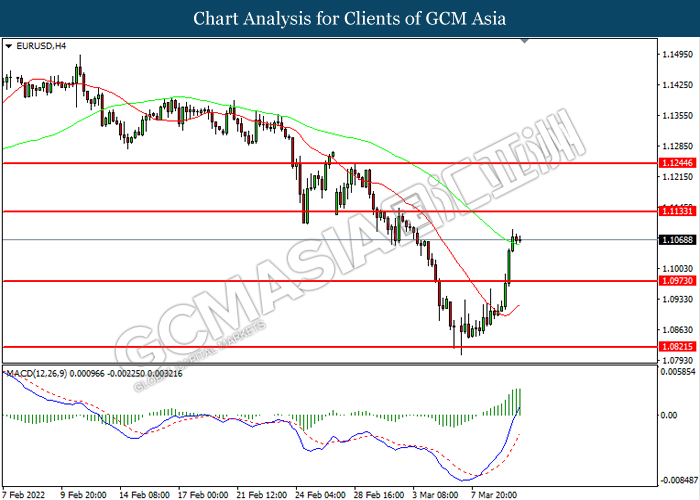

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0975. MACD which illustrated increasing bullish momentum suggest the pair to extend its gain.

Resistance level: 1.1135, 1.1245

Support level: 1.0975, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout the resistance level.

Resistance level: 116.25, 117.50

Support level: 114.60, 113.65

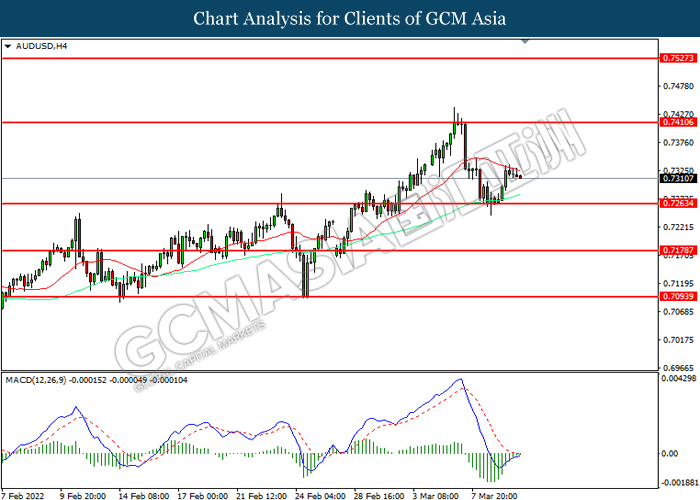

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

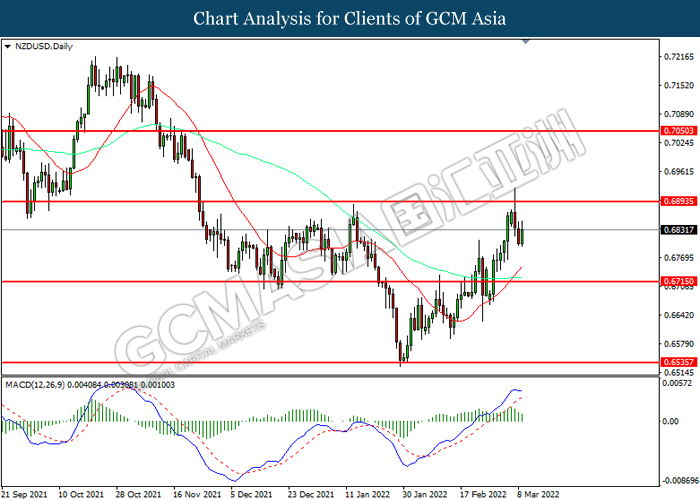

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

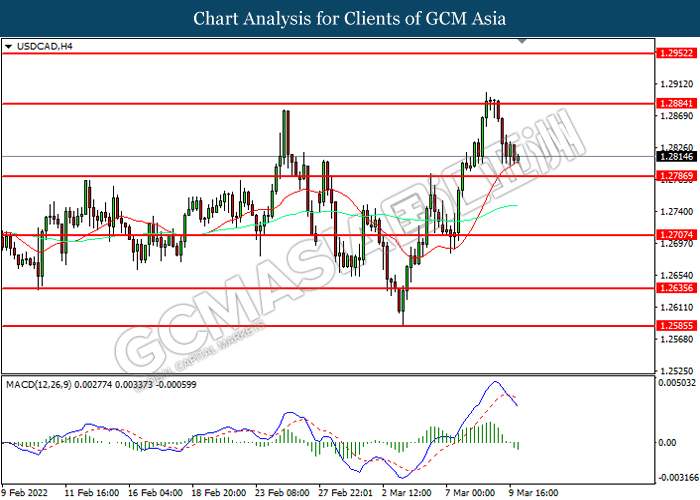

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.2885, 1.2950

Support level: 1.2785, 1.2705

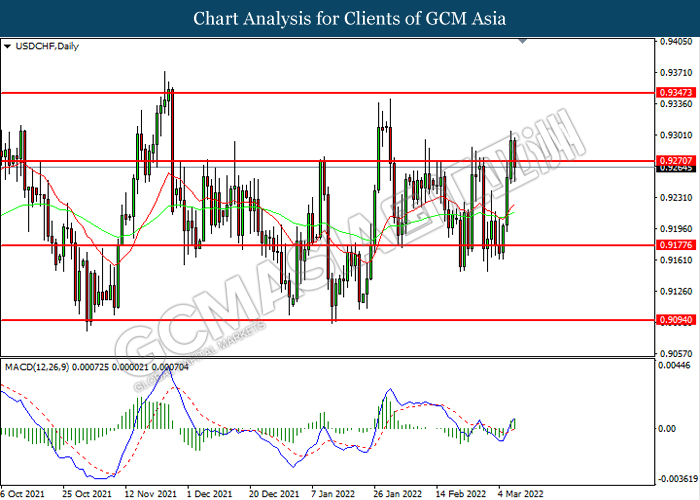

USDCHF, Daily: USDCHF was traded higher while testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after successfully breakout.

Resistance level: 116.80, 127.05

Support level: 107.45, 92.30

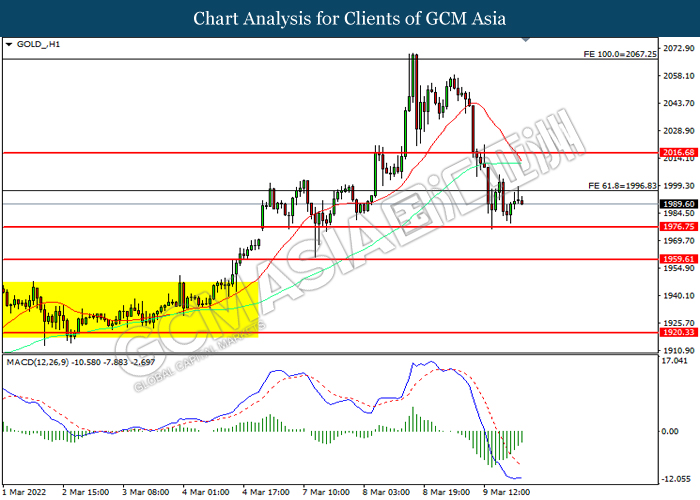

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1996.85. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1996.85, 2016.70

Support level: 1976.75, 1959.60