11 March 2022 Afternoon Session Analysis

Euro retreated as Dollar pumped.

Euro started to ease after the pumping on yesterday. Yesterday, European Central Bank’s announced it will phase out its monetary stimulus in the third quarter, while the dollar strengthened after a strong US inflation report. As the inflation risk was soaring in the future amid the backdrop of Russia invasion of Ukraine, it increased the odds of Federal Reserve to execute tightening monetary policy in order to diminish money circulation in US, spurring upward momentum on Dollar. Investors are prompted to purchase Dollar and selloff Euro. However, the retreat of Euro was limited as ECB would stop pumping Euro into market in third quarter as ECB remained concern on war-driven inflation risk would likely to depreciate Euro in future. Thus, ECB decided to decrease money supply to offset inflation risk. As of writing, Euro edged up by 0.15% to 1.0999.

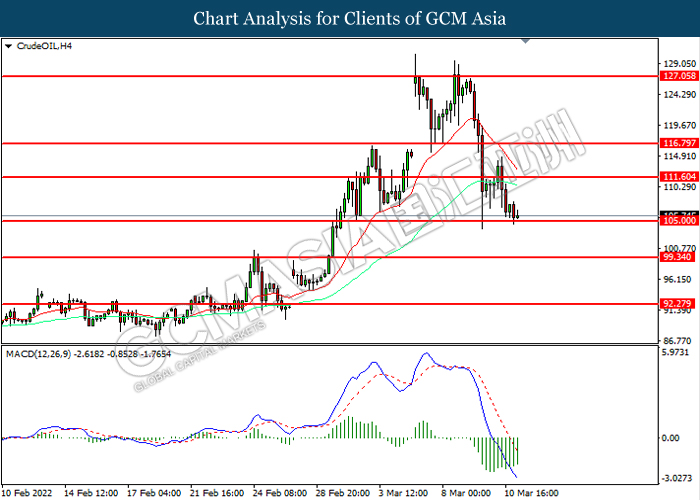

In the commodities market, crude oil price appreciated by 0.01% to 106.03 per barrel as of writing. However, the overall trend for crude oil remained bearish as UAE committed to increase oil supply. On the other hand, gold price depreciated by 0.21% to 1996.15 as of writing due to the rallies of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EUR Leader Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) | -0.20% | – | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Jan) | 0.20% | 0.20% | – |

| 21:30 | CAD – Employment Change (Feb) | -200.1K | 160.0K | – |

Technical Analysis

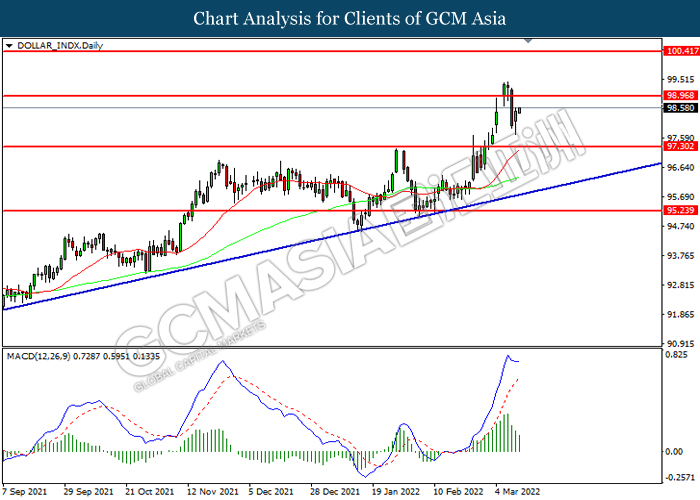

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

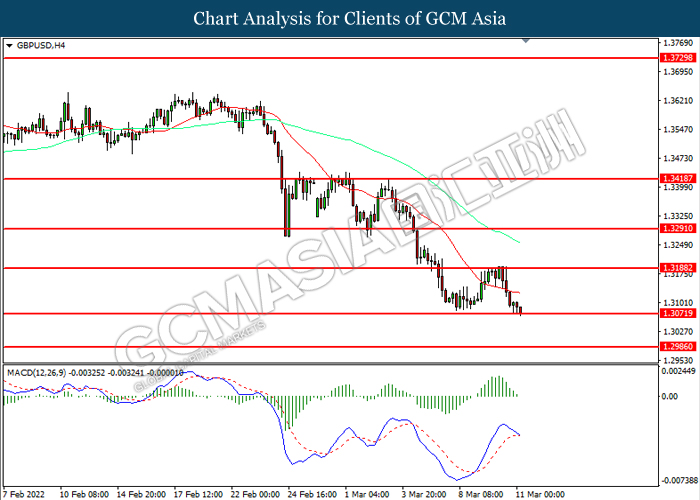

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after successfully breakout.

Resistance level: 1.3190, 1.3290

Support level: 1.3070, 1.2985

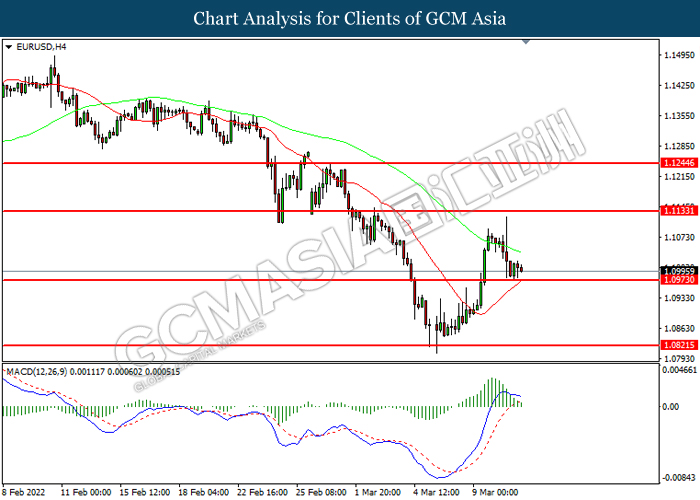

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1135, 1.1245

Support level: 1.0975, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 117.50, 118.90

Support level: 116.25, 114.60

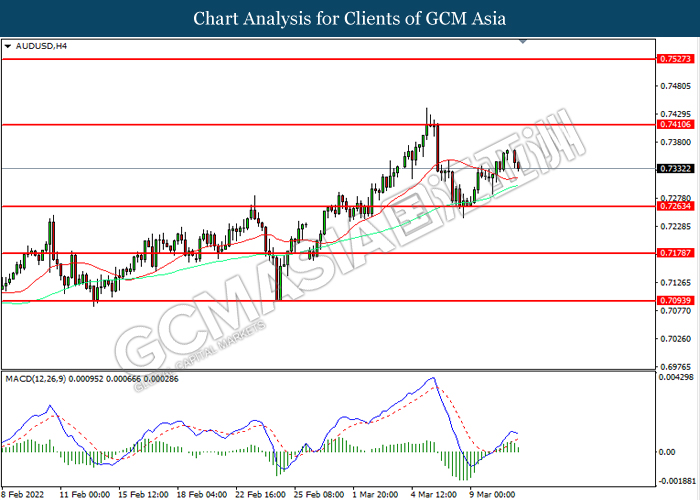

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correcton.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

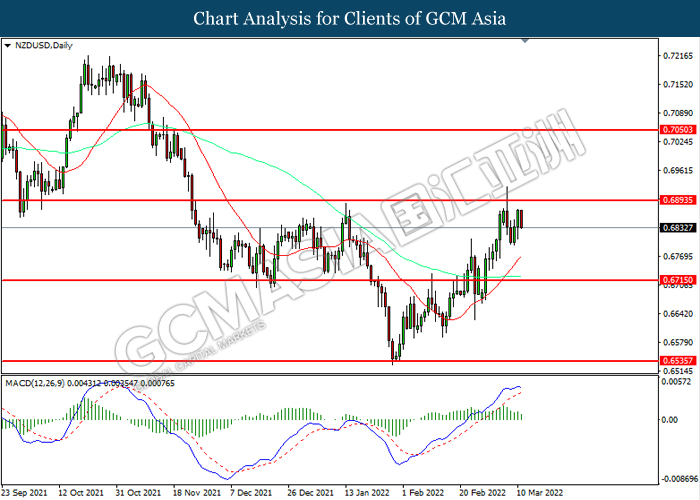

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

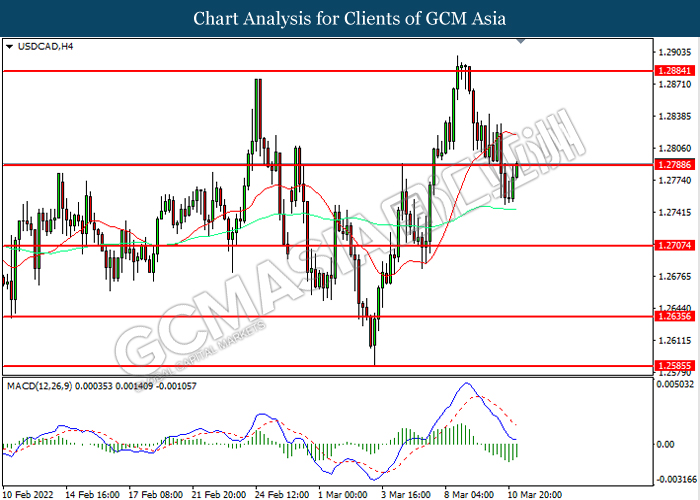

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2785, 1.2885

Support level: 1.2705, 1.2635

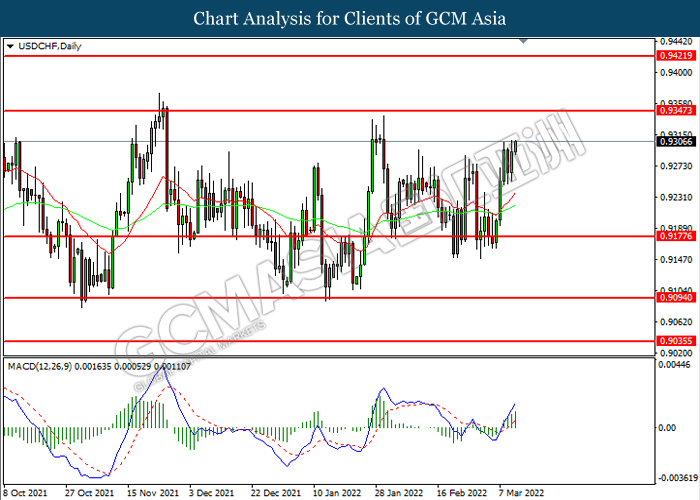

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9345, 0.9420

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 111.60, 116.80

Support level: 105.00, 99.35

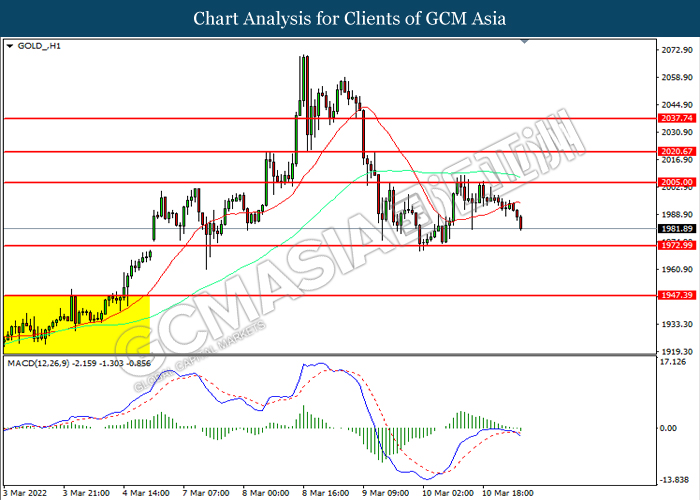

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level.. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower.

Resistance level: 2005, 2020.65

Support level: 1973.00, 1947.40