17 March 2022 Morning Session Analysis

US Dollar retreated following FOMC statement.

The Dollar Index which traded against a basket of six major currencies retreated following US Federal Reserve unleashed their monetary policy plan without delivering a tougher surprise. According to Reuters, the Federal Reserve on Wednesday had increased their interest rates for the first time since 2018 and laid out an aggressive plan to reduce the bond buying program. The Fed raised interest rates by the expected quarter of a percentage point into 0.5% and forecast the policy rate would reach a range of 1.75% to 2% by the end of this year and 2.8% next year in order to combat the high inflation rate. Besides, the safe-haven US Dollar extend its losses over the backdrop of upbeat sentiment Russia-Ukraine, which prompting investors to shift their portfolio toward other riskier assets. According to the Guardian, currently Russia and Ukraine had indicated that discussion between both sides had yielded some positive progress. As of writing, the Dollar Index depreciated by 0.70% to 98.40.

In the commodities market, the crude oil price depreciated by 0.05% to $96.80 per barrel as of writing. The oil market edged lower amid positive development upon the Russia-Ukraine war had diminished the concerns of supply disruption. On the other hand, the gold price slumped 0.02% to $1926.40 per troy ounces as of writing amid risk-on sentiment in the global market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | EUR – ECB President Lagarde Speaks | – | – | – |

| 18:00 | EUR – CPI (YoY) (Feb) | 5.80% | 5.80% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Mar) | 0.50% | 0.75% | – |

| 21:30 | USD – Building Permits (Feb) | 1.895M | 1.850M | – |

| 21:30 | USD – Initial Jobless Claims | 227K | 220K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Mar) | 16 | 15 | – |

Technical Analysis

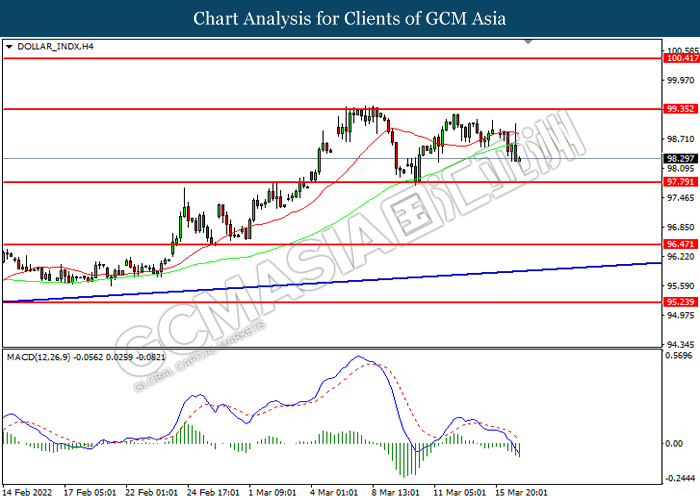

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

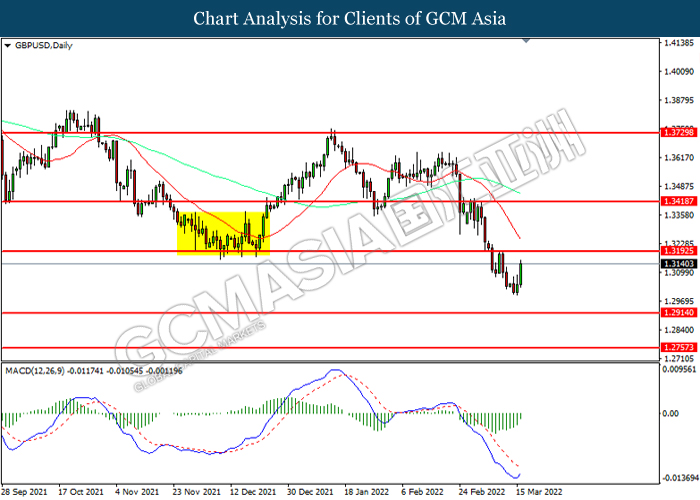

GBPUSD, Daily: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after successfully breakout.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

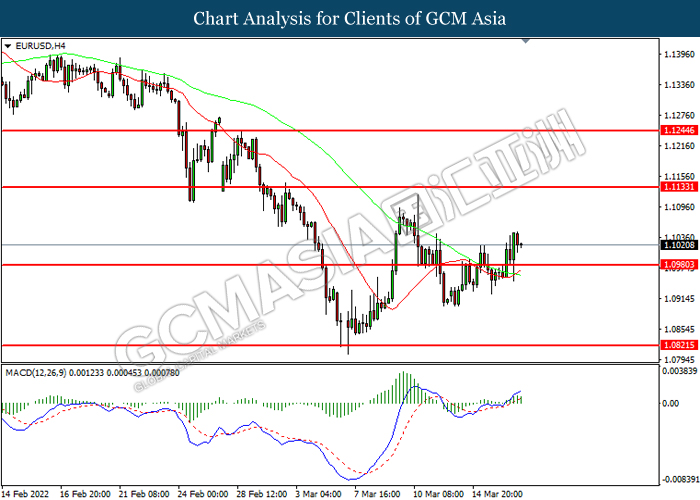

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

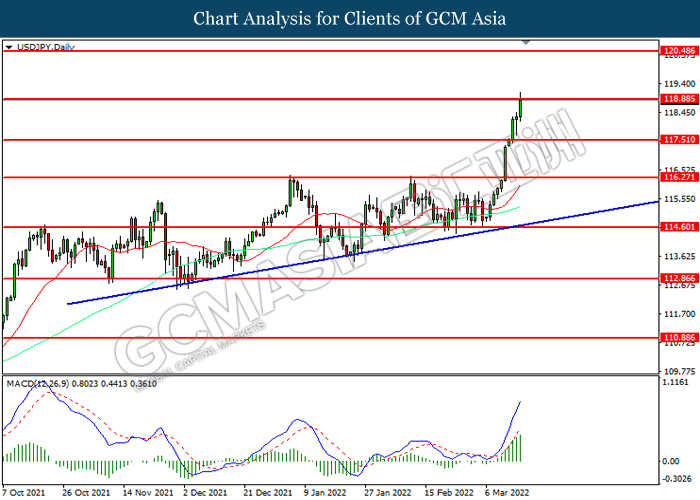

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

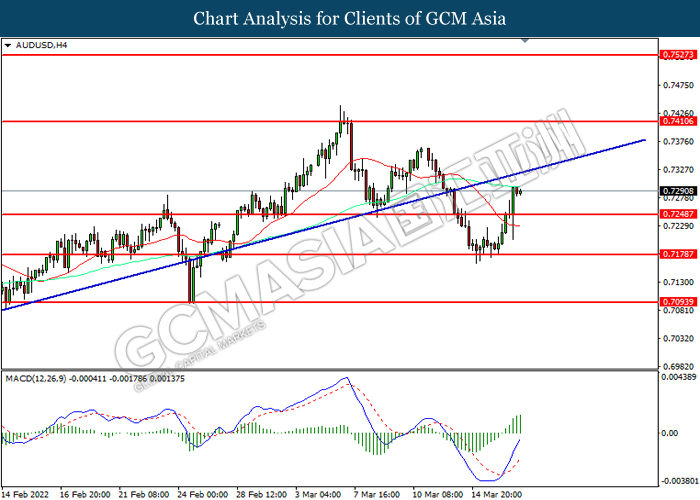

AUDUSD, H4: AUDUSD was traded higher following prior breakout above previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

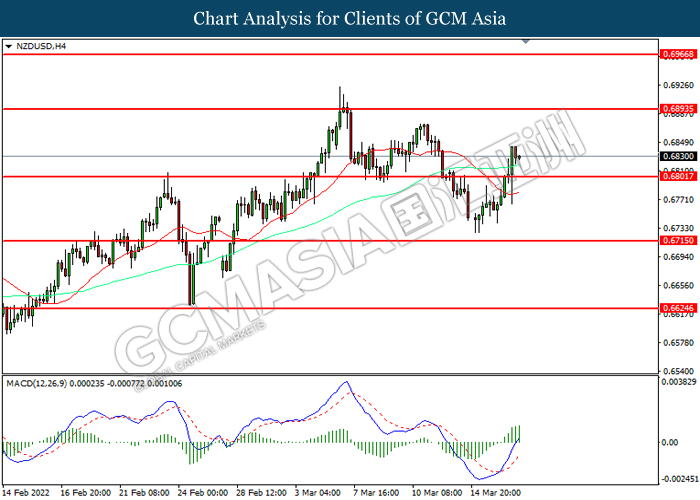

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6895, 0.6965

Support level: 0.6800, 0.6715

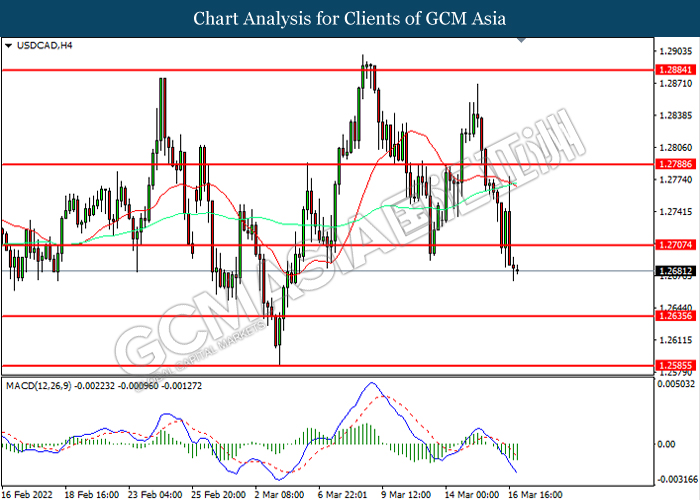

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2705, 1.2790

Support level: 1.2635, 1.2585

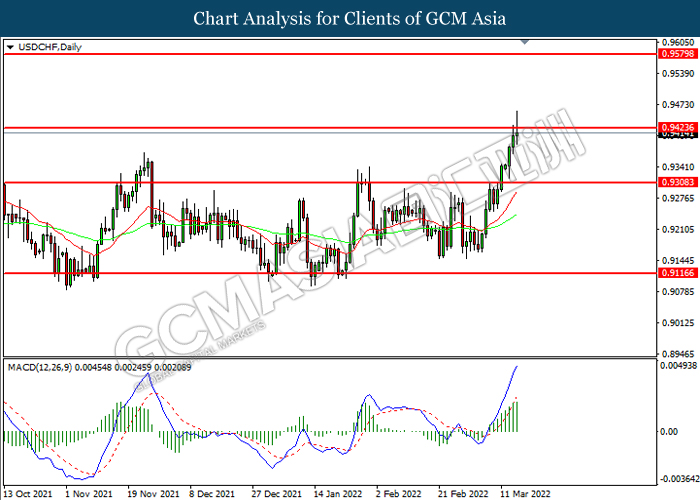

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

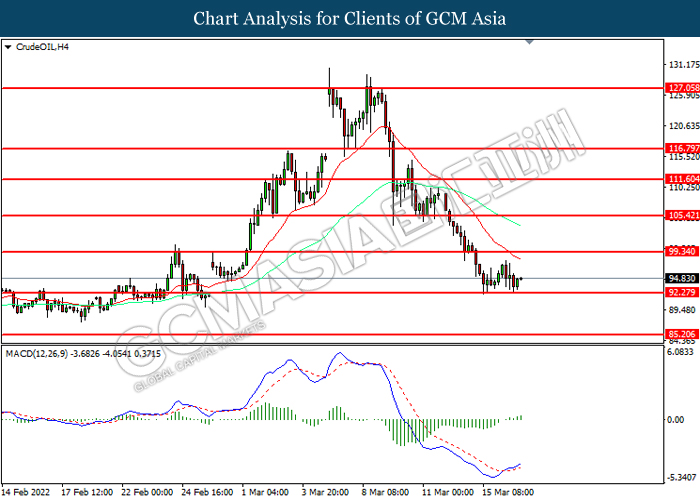

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 99.35, 105.40

Support level: 92.30, 85.20

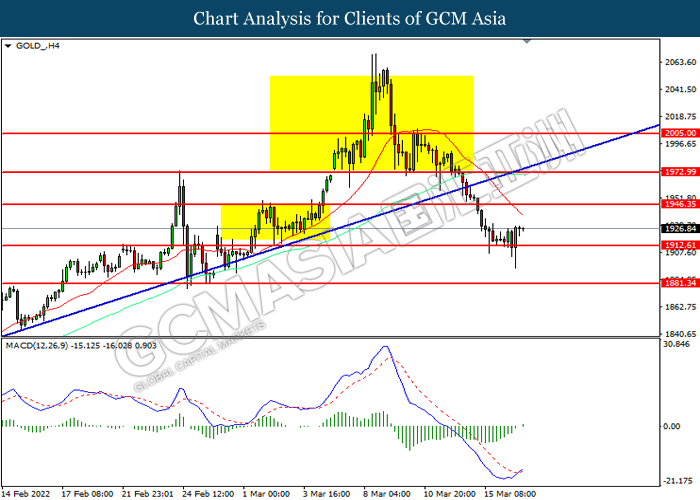

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35