17 March 2022 Afternoon Session Analysis

Aussie surged following China unleashed upbeat tone.

Australian Dollar started rebounding since Wednesday amid the backdrop of implementing policies favourable for capital markets in China. Yesterday, Vice Premier in China, Liu He appeared a speak that China will roll out policy steps favourable for its capital markets while cautiously unveiling measures that risk hurting markets in order to maintain market stability, according to The Edge Market. Besides, Liu reiterate the government will also promote the steady and healthy development of the platform economy and will steadily push forward and complete rectifications of big platform firms as soon as possible. China will take measures to boost the economy in the first quarter and monetary policy should embark on initiatives to support the economy. As China is the largest economic partner with Australia, it sparked positive prospects toward economic momentum in Australia as China government intentionally boost up its economic, prompting investors to stoke a shift sentiment toward Australian Dollar. On the other hand, negotiation between Russia and Ukraine had yielded some positive progress, leading to the market optimism toward risk-appetite assets, spurring further upward momentum on the pair. As of writing, Australian dollar appreciated by 0.35% to 0.7315.

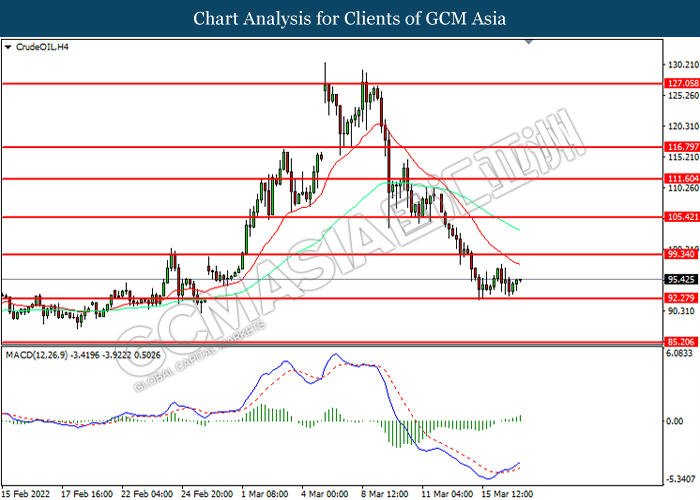

In commodities market, crude oil price appreciated by 1.33% to $96.30 per barrel as of writing. Nonetheless, according to Energy Information Administration, US Crude Oil Inventories notched up from the previous reading of -1.863M to 4.345M, exceeding market forecast of -1.375M, indicating the additional supply of oil and putting pressure on oil price. Besides, gold price appreciated by 1.57% to $1939.25 per troy ounces as of writing amid the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | EUR – ECB President Lagarde Speaks | – | – | – |

| 18:00 | EUR – CPI (YoY) (Feb) | 5.80% | 5.80% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Mar) | 0.50% | 0.75% | – |

| 21:30 | USD – Building Permits (Feb) | 1.895M | 1.850M | – |

| 21:30 | USD – Initial Jobless Claims | 227K | 220K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Mar) | 16 | 15 | – |

Technical Analysis

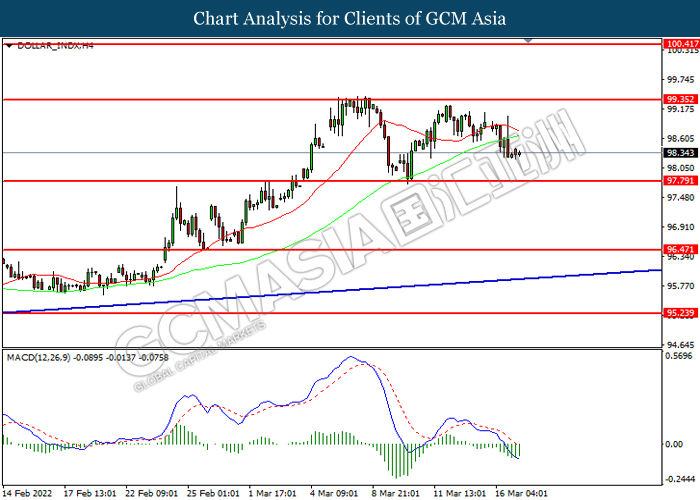

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

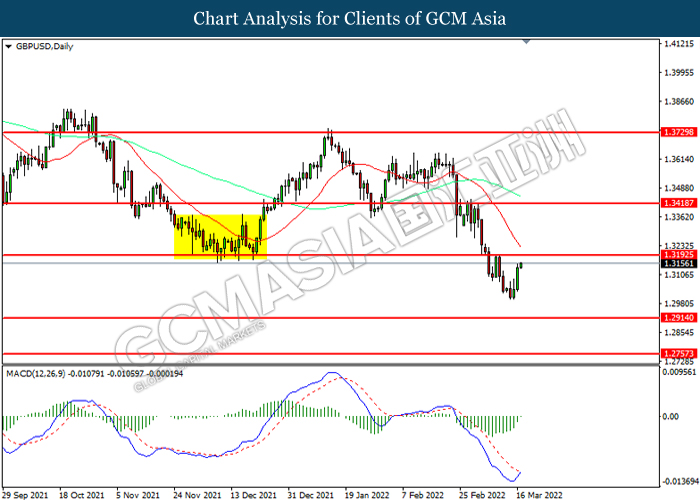

GBPUSD, Daily: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after successfully breakout.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

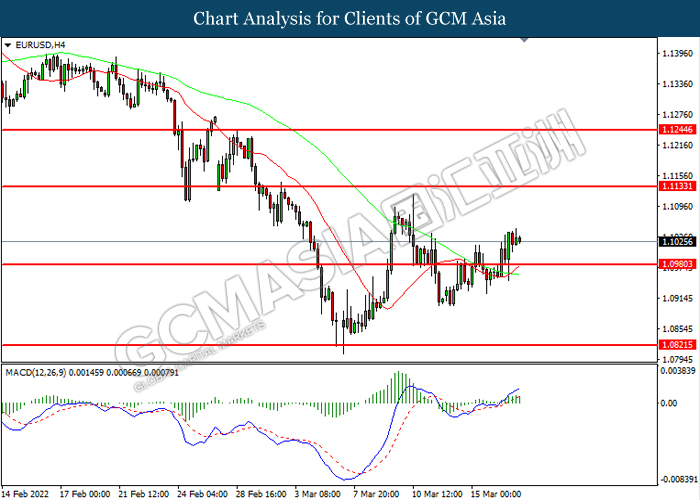

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

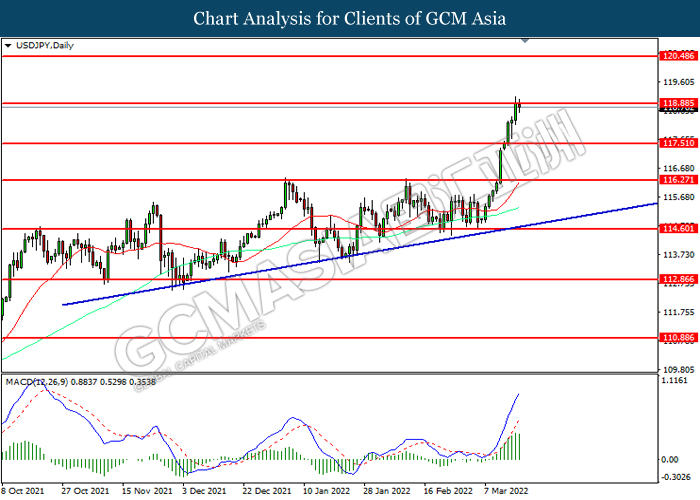

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

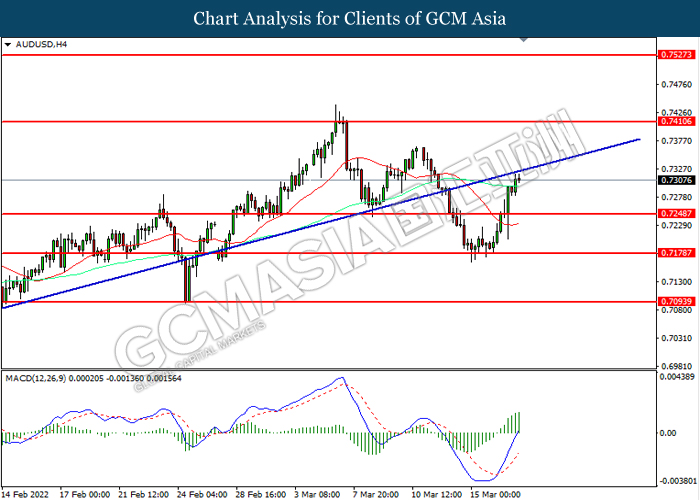

AUDUSD, H4: AUDUSD was traded higher following prior breakout above previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

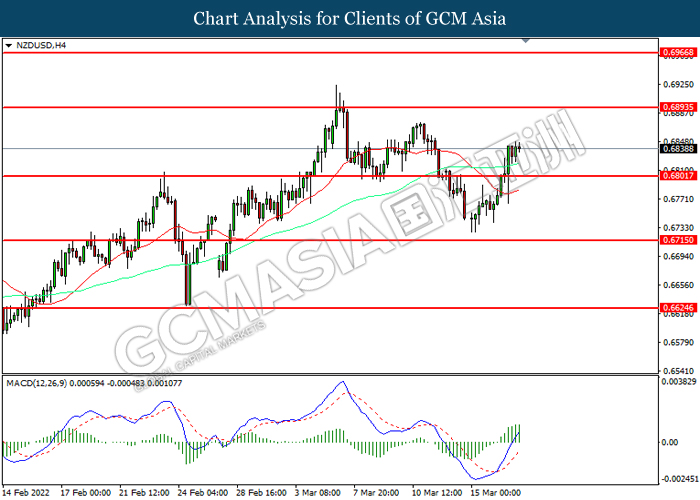

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6895, 0.6965

Support level: 0.6800, 0.6715

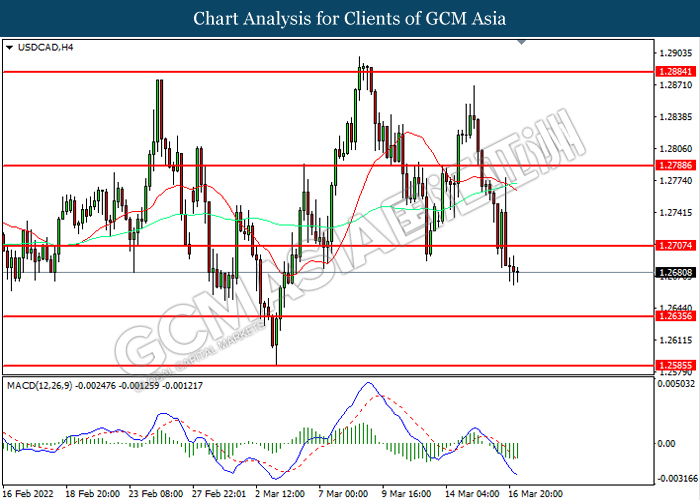

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2705, 1.2790

Support level: 1.2635, 1.2585

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 99.35, 105.40

Support level: 92.30, 85.20

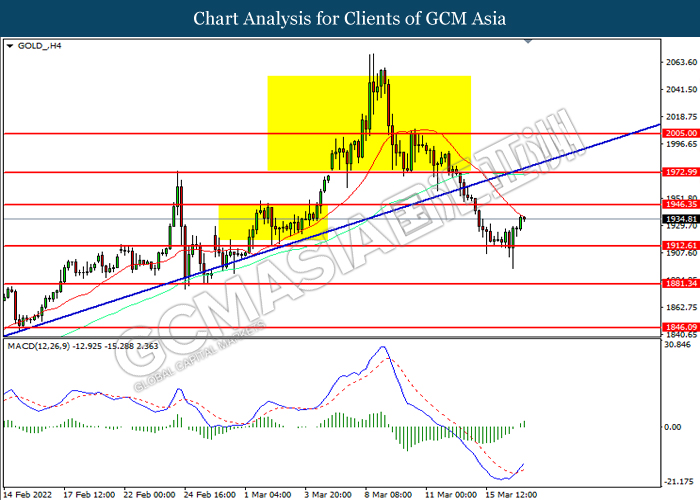

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35