18 March 2022 Afternoon Session Analysis

Pound surged over the hawkish tone from BoE.

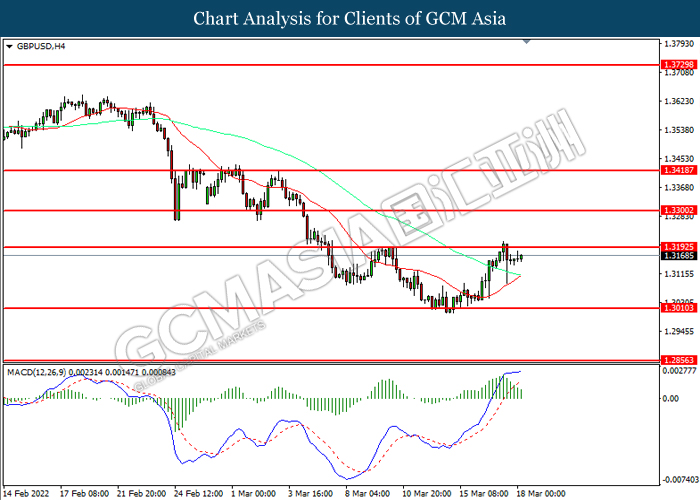

Pound Sterling surged over the backdrop of hawkish sentiment from the Bank of England. Yesterday, the Bank of England increased interest rates for the third consecutive meeting while reiterating that the Russia-Ukraine conflict is expected to keep inflation higher in long-term basis. The Monetary Policy Committee voted 8-1 in favor of a further 0.25 percentage point hike to its main Bank Rank, taking it to 0.75%. Currently, UK inflation was already running at a 30-year high prior to Russian’s invasion of Ukraine, which sent energy prices surging and spurring further pressure on the central bank’s inflation projections. The Bank now forecasted that the inflation rate could be expected to increase further in the coming months, hitting around 8% in the second quarter of 2022 or even higher. The MPC also claimed that further modest tightening in monetary policy may be appropriate in the coming months. As of writing, GBP/USD appreciated by 0.12% to 1.3163.

In commodities market, gold price appreciated by 0.10% to $1933.95 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

14:30 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core Retail Sales (MoM) (Jan) | -2.50% | -2.00% | – |

| 23:00 | USD – Existing Home Sales (Feb) | 6.50M | 6.16M | – |

Technical Analysis

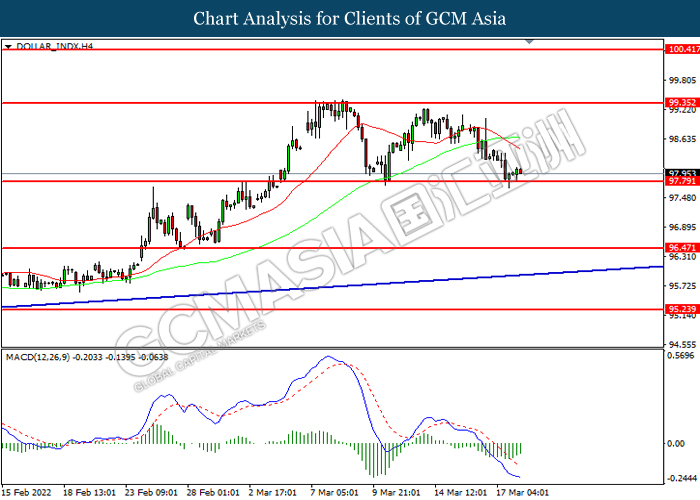

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.3010, 1.2855

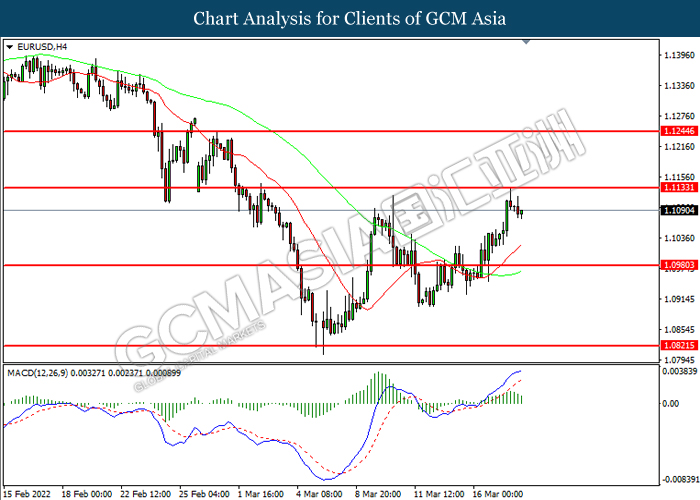

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

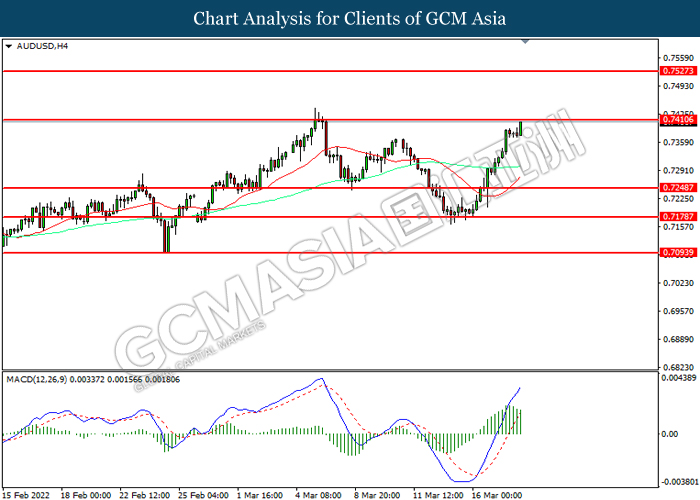

AUDUSD, H4: AUDUSD was traded higher following prior breakout above previous resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

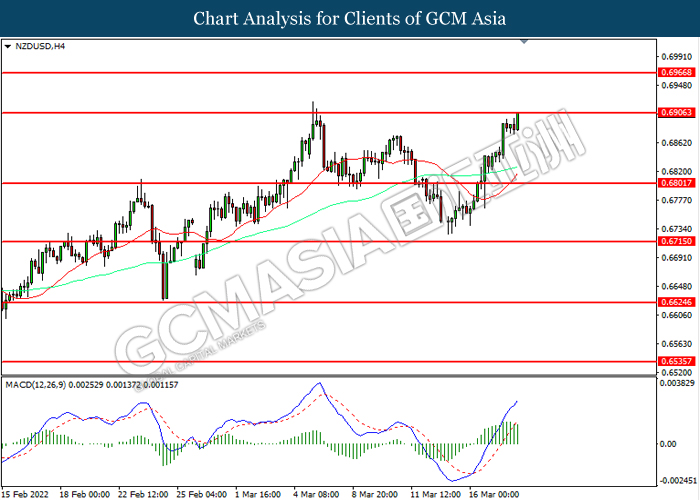

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6895. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 0.6905, 0.6965

Support level: 0.6800, 0.6715

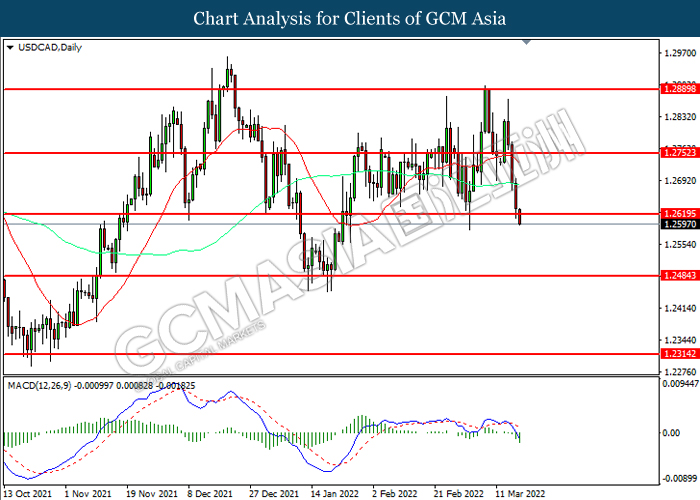

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2620, 1.2485

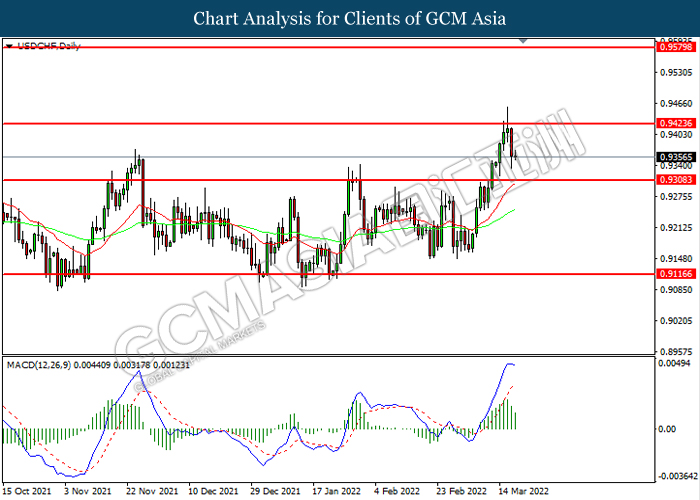

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

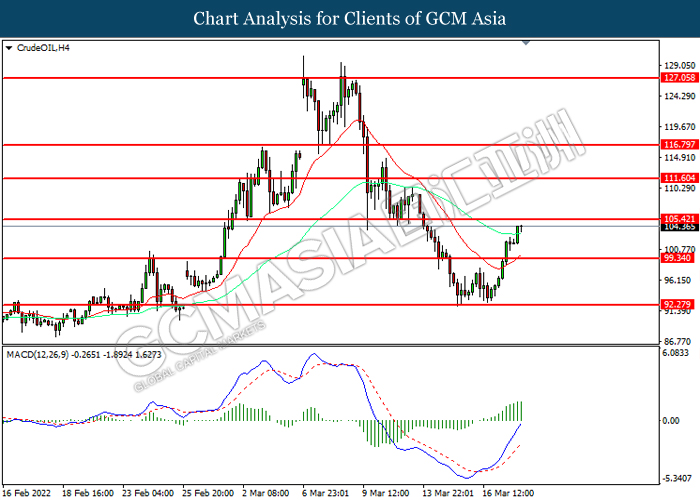

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 99.35. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 105.40.

Resistance level: 105.40, 111.60

Support level: 99.35, 92.30

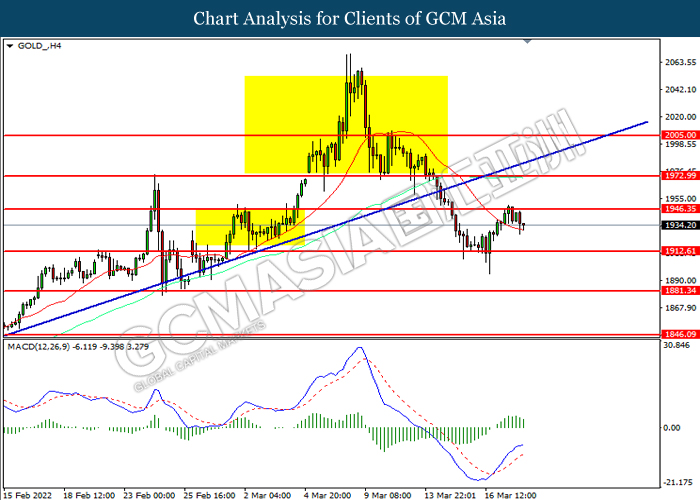

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35