21 March 2022 Afternoon Session Analysis

Canada Dollar surged following the released retail sales data.

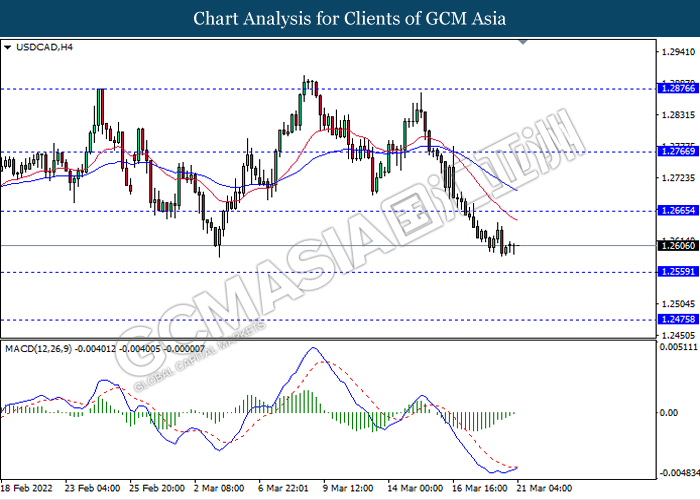

The USDCAD extend its losses on Monday amid the upbeat retail sales data in Canada. According to Statistics Canada, Canada Core Retail Sales (MoM) notched up from the previous reading of -2.7% to 2.5%, exceeding the market forecast of 2.4%. The retail sales index measure the change in total value of sales at retail level, which is taken as an indicator of consumer confident. An upbeat retail sales index data in Canada indicates that Canada residents are willing to spend for consumption, leading market optimism toward economic momentum in Canada region and prompting investors to purchase Canada Dollar. Besides, US Existing Home Sales came in at 6.2M, which lower than the previous reading of 6.49M and the market forecast of 6.10M, according to National Association of Realtors. The housing market in US which lower than expected reading was dialing down the market optimism toward US economic momentum, prompting investors to selloff US Dollar and purchase other currencies such as Canada Dollar, spurring further bearish momentum on USDCAD pairing. Nonetheless, the dump of the pair was limited over the backdrop of hawkish tone from Federal Reserve. As of writing, USDCAD appreciated by 0.06% to 1.2609.

In commodities market, crude oil price extend its gains by 2.92% to $106.10 per barrel as of writing amid the backdrop of European Union is to mull a Russian oil embargo this week. On the other hand, gold price depreciated by 0.10% to $1927.35 per troy ounces as of writing as the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 EUR ECB President Lagarde Speaks

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

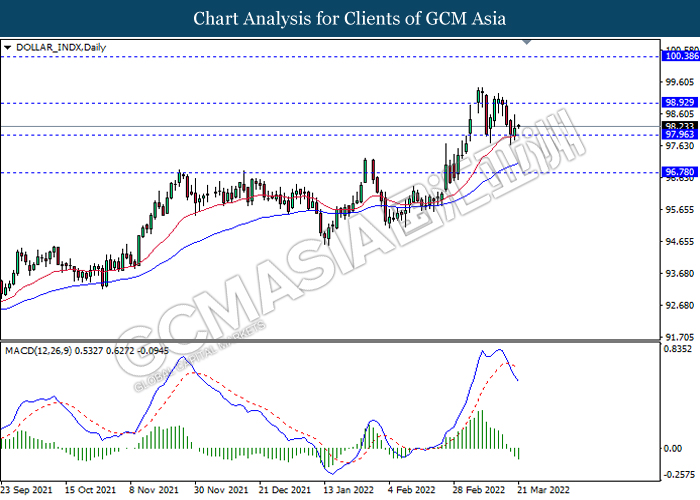

DOLLAR_INDX, Daily: The Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 98.90, 100.40

Support level: 97.95, 96.80

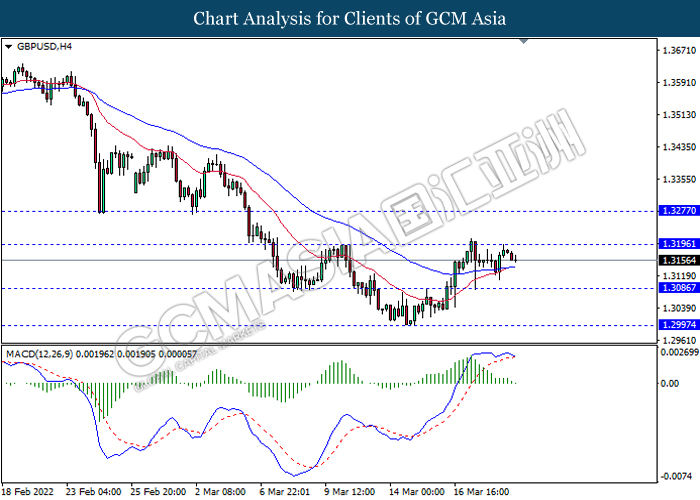

GBPUSD, H4: GBPUSD was traded higher while following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3275

Support level: 1.3085, 1.2995

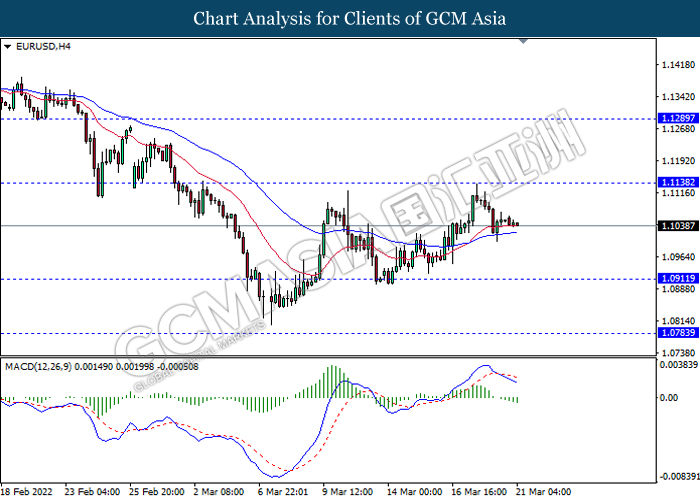

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1140, 1.1290

Support level: 1.0910, 1.0785

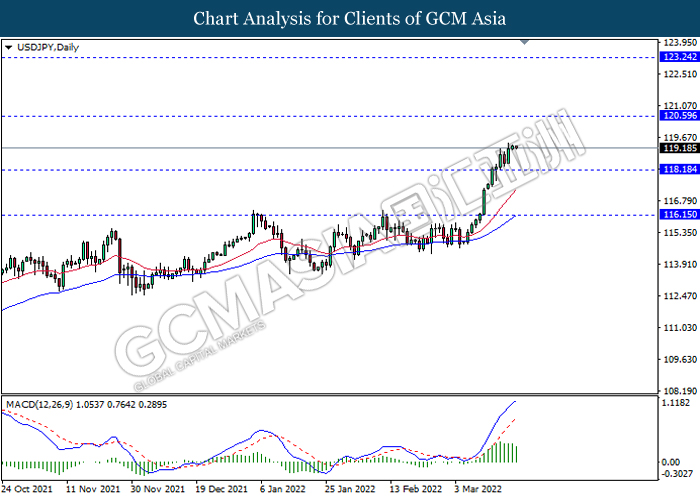

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 120.60, 123.25

Support level: 118.20, 116.15

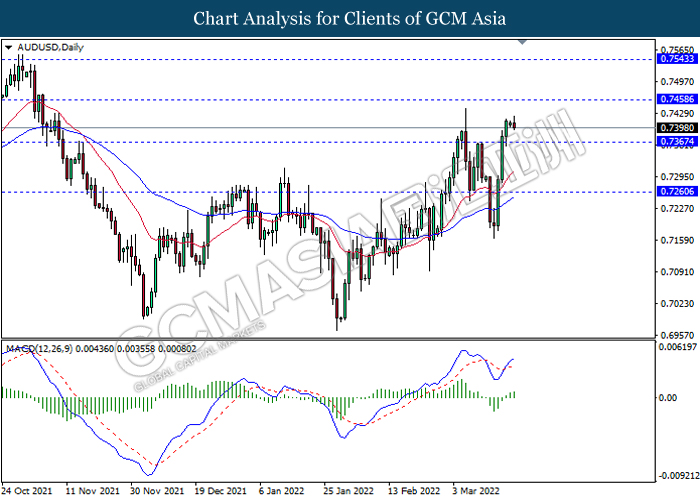

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7460, 0.7545

Support level: 0.7365, 0.7260

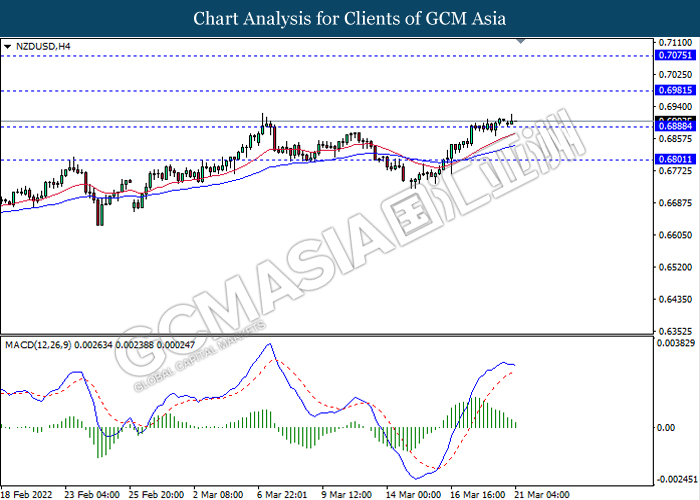

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2665, 1.2465

Support level: 1.2560, 1.2475

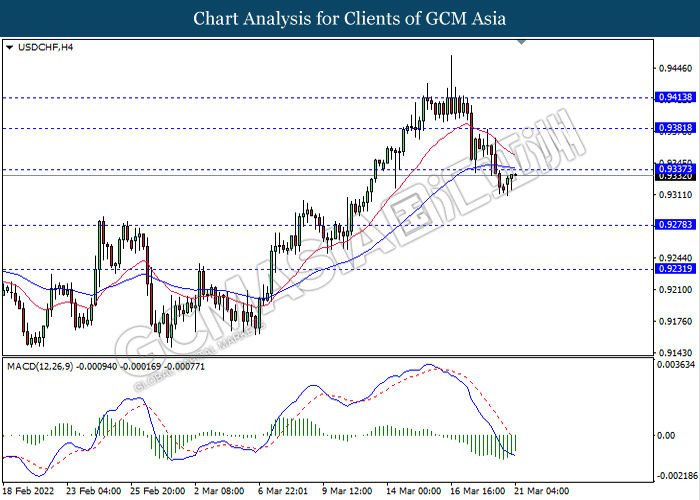

USDCHF, H4: USDCHF was traded lower while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9335, 0.9380

Support level: 0.9280, 0.9230

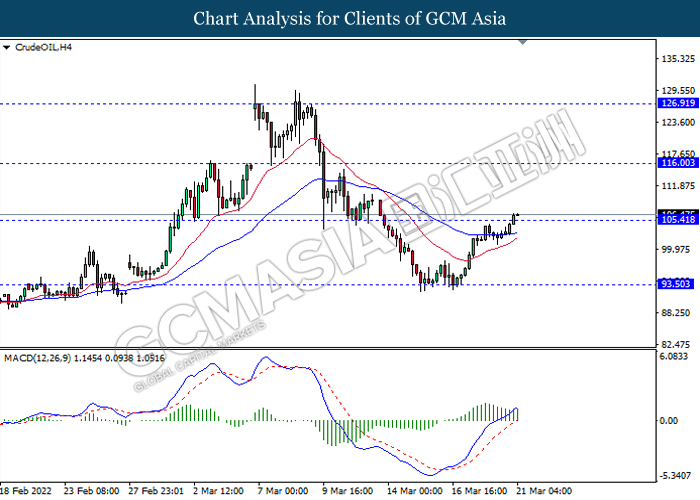

CrudeOIL, H4: Crude oil was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 116.00, 126.90

Support level: 105.40, 93.50

GOLD, H4: Gold was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1961.55, 1999.45

Support level: 1924.20, 1886.90