22 March 2022 Morning Session Analysis

Rising US Treasury yield, spurring bullish momentum on US Dollar.

The Dollar Index which traded against a basket of six major currencies extend its gains following Federal Reserve Chair Jerome Powell unleashed his hawkish tone yesterday, sparking bets of more aggressive interest hikes while prompting investors to shift their portfolio toward US Dollar. Investors are now speculating a 60.7% chance of a 50-basis point rate hike during the next monetary policy meeting at May, notched up from about 52% before Powell’s comments. The US 10-year Treasury yield hit 2.28%, the highest since the year of 2019. Besides, Federal Reserve Chair Jerome Powell also reiterated that the US central bank must move quicky to stabilize the spiking number of inflation risks, adding that they could use a more aggressive contractionary monetary policy if needed. As of writing, the Dollar Index appreciated by 0.25% to 98.48.

In the commodities market, the crude oil price appreciated by 0.40% to 113.42 per barrel as of writing amid major European nations considered joining the United States to impose sanction on Russian oil, spurring fears upon the further oil supply disruption in future. On the other hand, the gold price slumped 0.03% to $1935.25 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

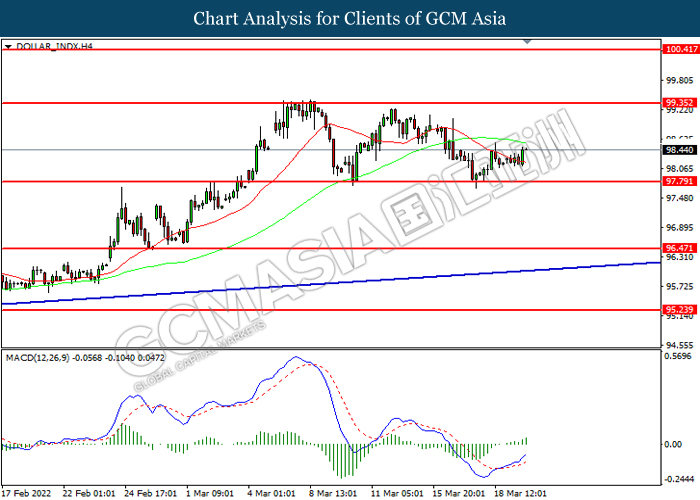

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

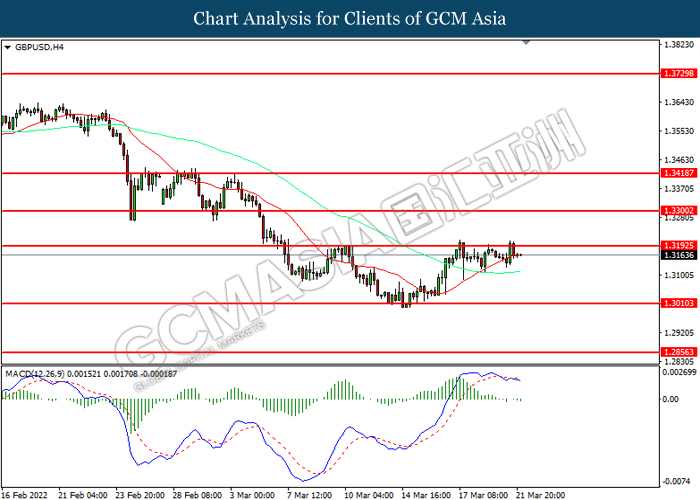

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. However, MACD which illustrated increasing bearish suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.3010, 1.2855

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

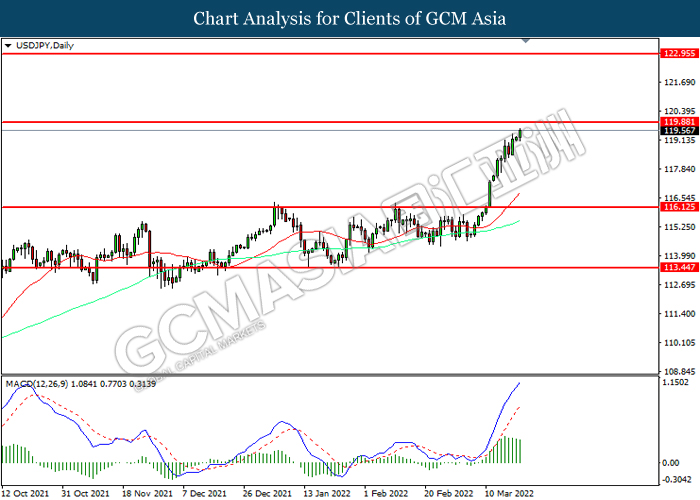

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 119.90, 122.95

Support level: 116.15, 113.45

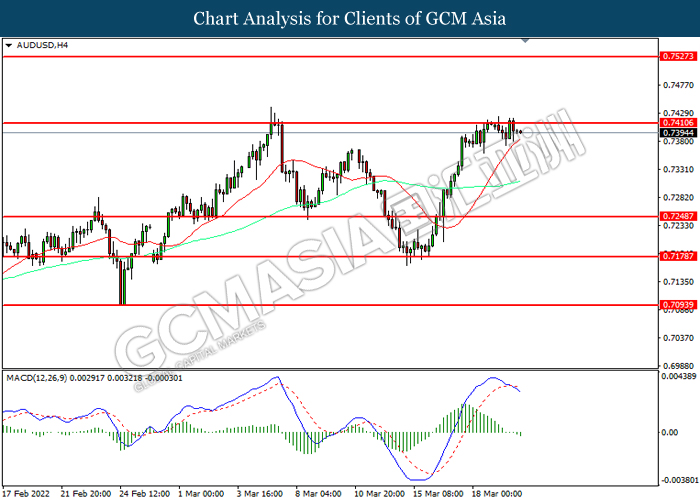

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6905, 0.6965

Support level: 0.6800, 0.6715

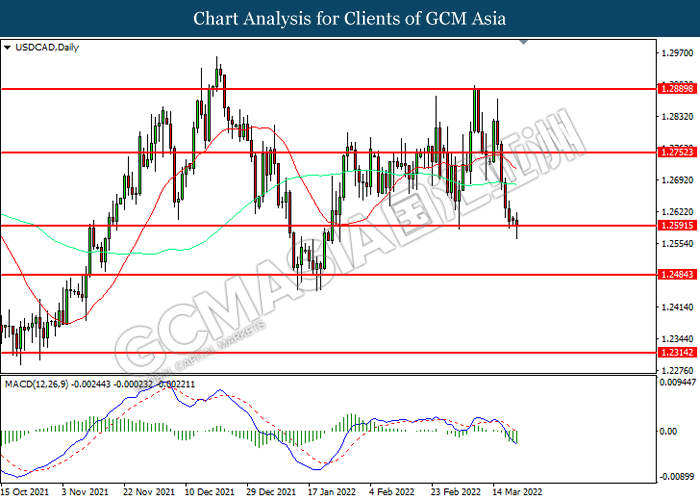

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2590, 1.2485

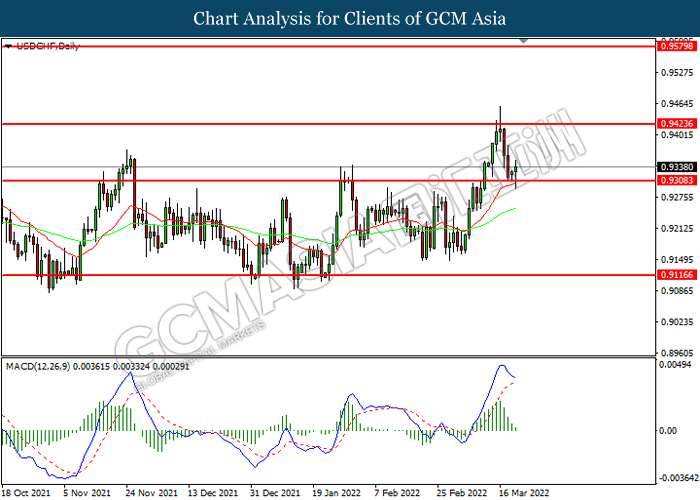

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

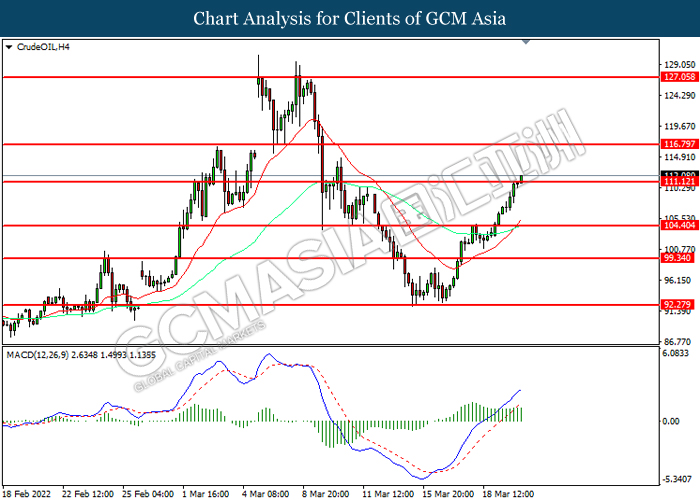

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 111.10, 116.80

Support level: 104.40, 99.35

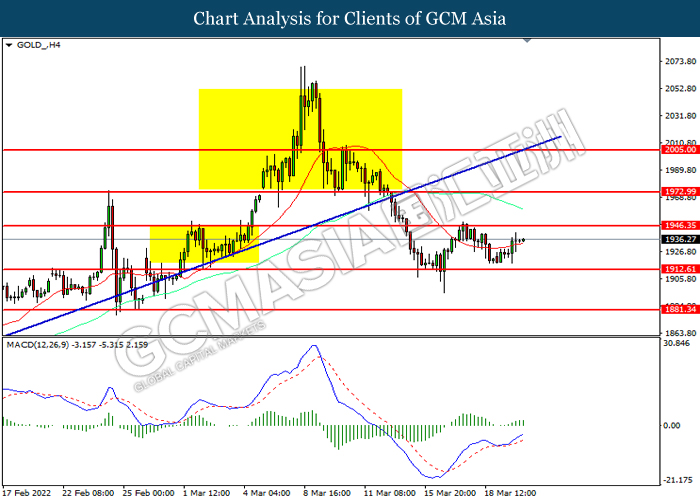

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35