24 March 2022 Morning Session Analysis

US Dollar surged ahead of the sanction’s announcement.

The Dollar Index which traded against a basket of six major currencies surged over the backdrop of diminishing risk appetite in the global financial market ahead of the meeting between United States, NATO and European leaders. As for now, market participants would continue to scrutinize the latest updates with regards of the meeting in order to receive further trading signal. The meeting for the Western countries would likely to announce new sanctions against Russia. The price for commodities product such as crude oil and wheat have risen as tensions in Ukraine have escalated, spurring additional pressure on high inflation rate due to supply chain disruption recently. Spiking numbers of inflation rate has led many central banks, including US Federal Reserve to implement contractionary monetary policy, spurring further bullish momentum for the US Dollar in longer-term basis. As of writing, the Dollar Index appreciated by 0.12% to 98.61.

In the commodities market, the crude oil price surged 0.04% to 116.35 per barrel as of writing following the released of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at -2.508M, better than the market forecast at 0.114M. On the other hand, the gold price appreciated by 0.11% to $1946.50 per troy ounces as of writing amid risk-off sentiment in the financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

17:30 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q1) | -0.75% | -0.75% | – |

| 16:30 | EUR – German Manufacturing PMI (Mar) | 58.4 | 56 | – |

| 17:30 | GBP – Composite PMI | 59.9 | 58.7 | – |

| 17:30 | GBP – Manufacturing PMI | 58 | 57 | – |

| 17:30 | GBP – Services PMI | 60.5 | 58 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Feb) | 0.70% | 0.60% | – |

| 20:30 | USD – Initial Jobless Claims | 214K | 211K | – |

Technical Analysis

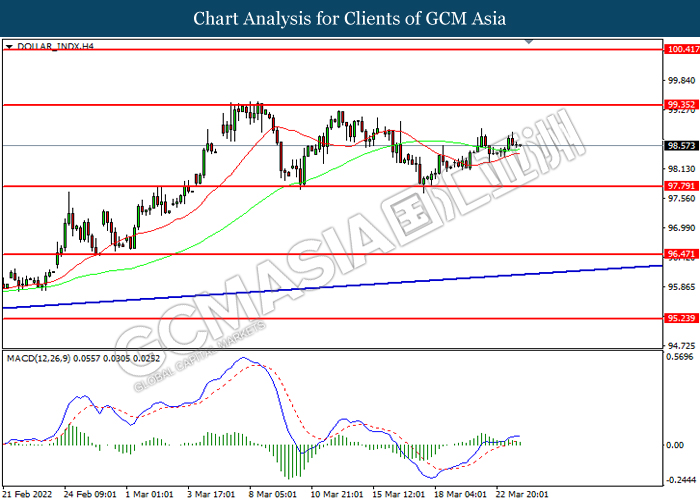

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

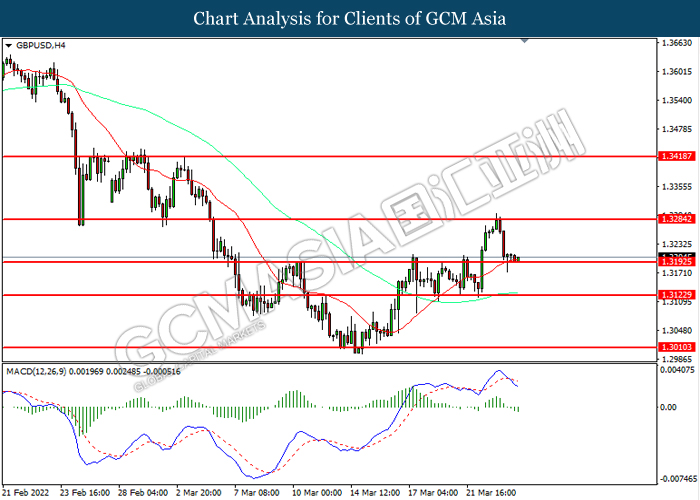

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3300, 1.3420

Support level: 1.3195, 1.3125

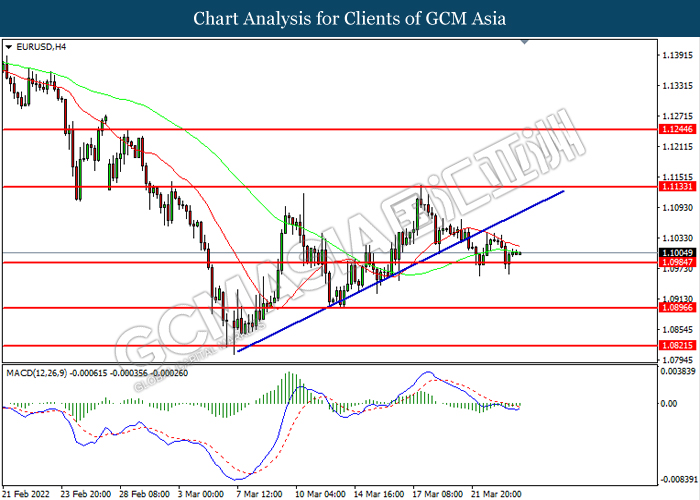

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

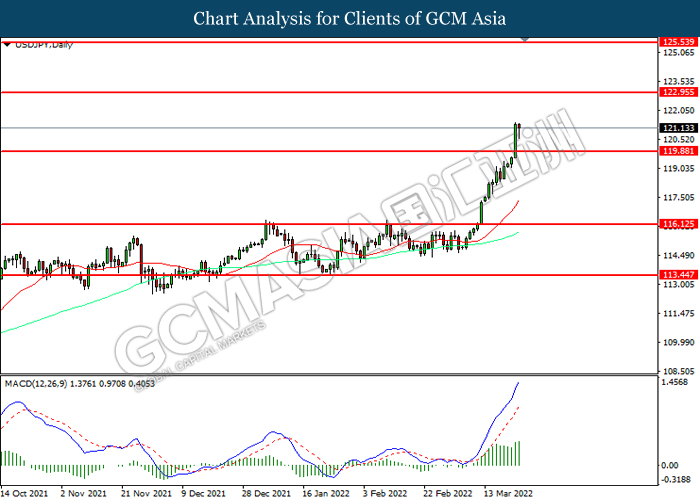

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

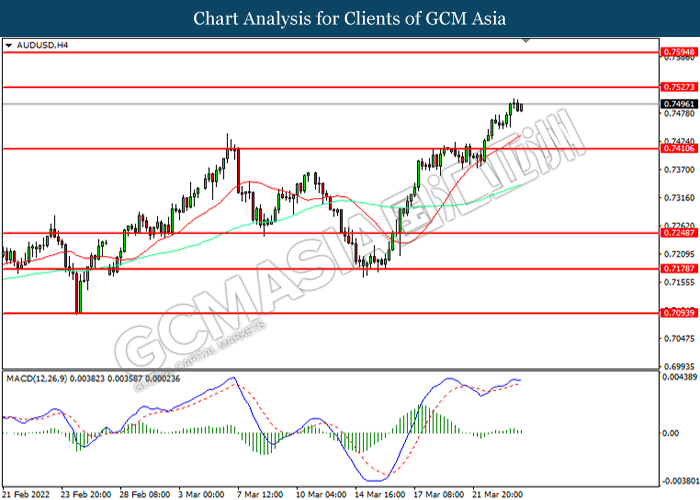

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

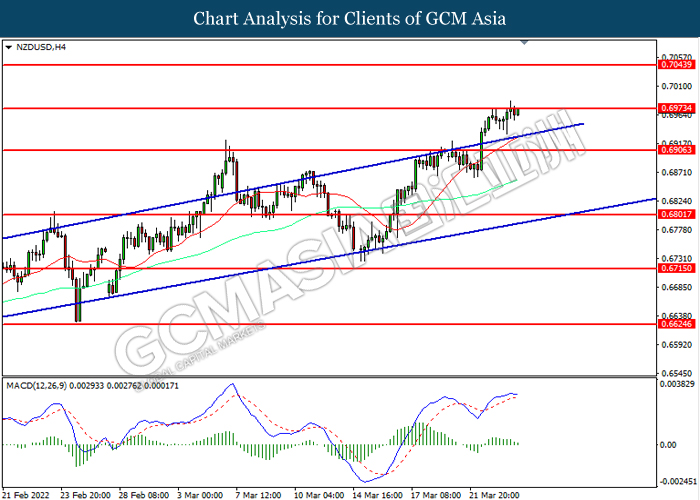

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

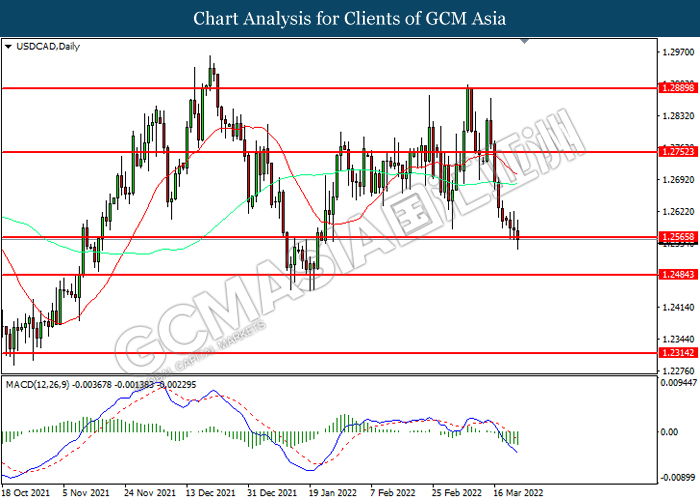

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2565, 1.2485

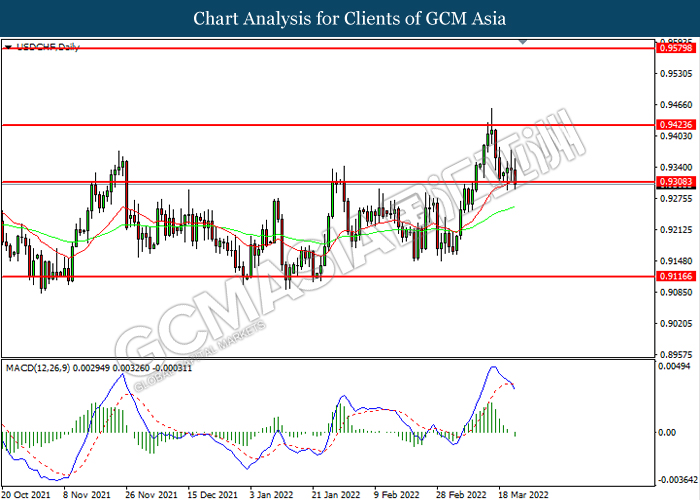

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

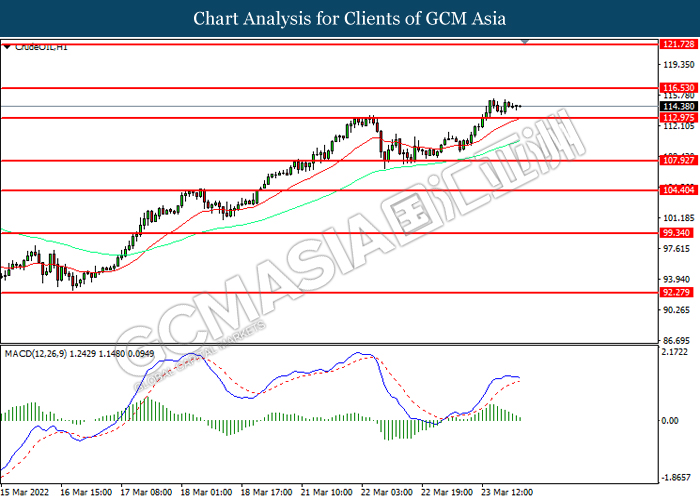

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it breakout.

Resistance level: 116.55, 121.75

Support level: 112.95, 107.95

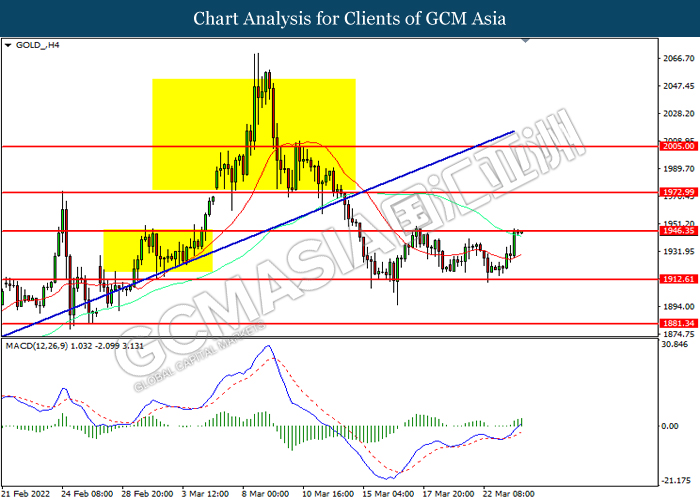

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35