24 March 2022 Afternoon Session Analysis

Pound Sterling slumped amid negative economic prosect.

The Pound Sterling slumped over the backdrop of negative economic prospect as the announcement of fiscal policy from UK Chancellor Rishi Sunak’s failed to impress investors. Yesterday, Chancellor Rishi Sunak had announced the implementation of a fuel duty tax cut, a lift to the tax-free earnings threshold, a slight reduction to the tax rate for the bottom bracket and new support for businesses. Investors speculated that such new policies would not do much to improve the weak outlook for the UK economy as the high inflation risk continue to hover in in the market. According the Office for National Statistics, UK Consumer Price Index (CPI) notched up significantly from the previous reading of 5.5% to 6.2%, exceeding the market forecast at 5.9%. Besides, the rising tensions between Russia-Ukraine ahead of the meeting for the Western leaders had also diminished further risk appetite in the global financial market, dragging down the appeal for the risker asset such as Pound Sterling. As of writing, GBP/USD depreciated by 0.08% to 1.3192.

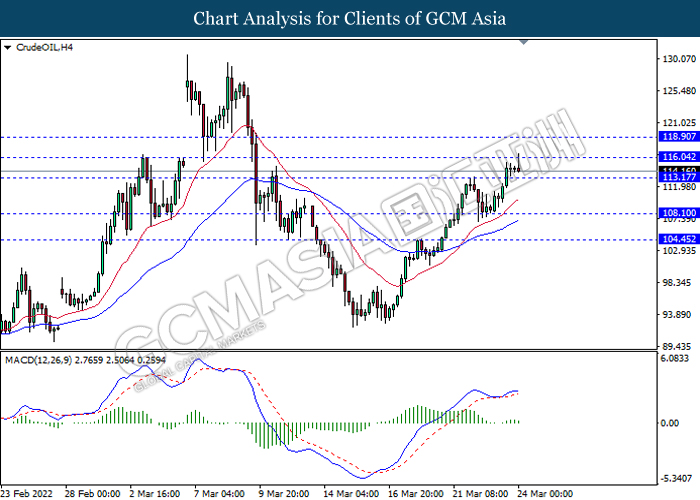

In the commodities market, the crude oil price depreciated by 0.55% to $115.65 per barrel as of writing mostly due to technical correction. Investors would continue to remain their focus toward US-EU meeting today to receive further trading signal. On the other hand, the gold price appreciated by 0.03% to $1940.45 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

17:30 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q1) | -0.75% | -0.75% | – |

| 16:30 | EUR – German Manufacturing PMI (Mar) | 58.4 | 56 | – |

| 17:30 | GBP – Composite PMI | 59.9 | 58.7 | – |

| 17:30 | GBP – Manufacturing PMI | 58 | 57 | – |

| 17:30 | GBP – Services PMI | 60.5 | 58 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Feb) | 0.70% | 0.60% | – |

| 20:30 | USD – Initial Jobless Claims | 214K | 211K | – |

Technical Analysis

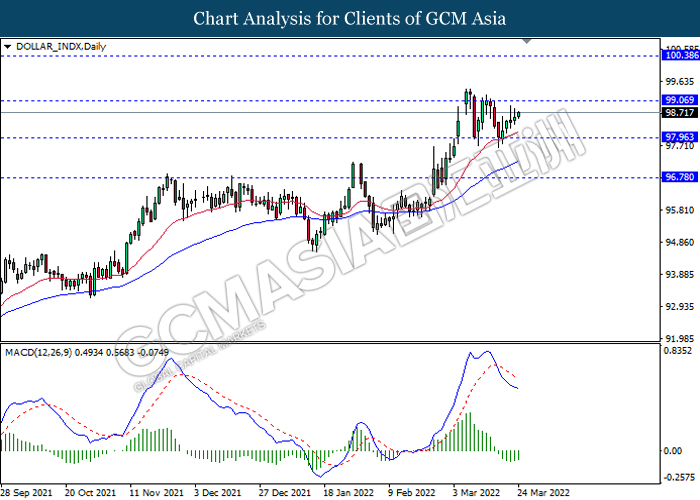

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 99.05, 100.40

Support level: 97.95, 96.80

GBPUSD, H4: GBPUSD was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

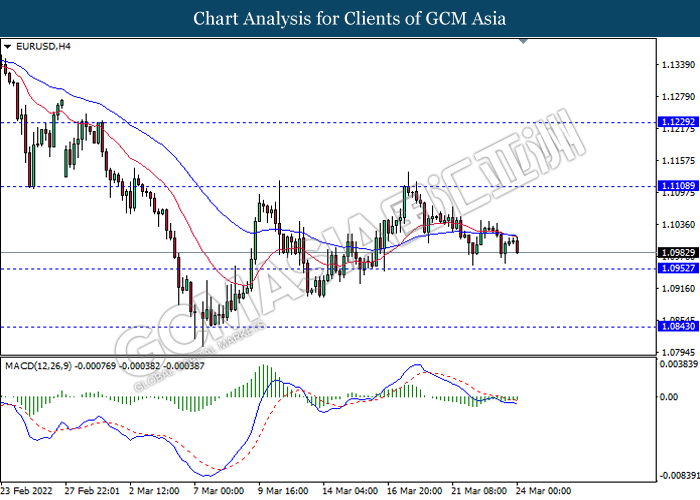

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1110, 1.1230

Support level: 1.0950, 1.0845

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.25, 125.15

Support level: 120.60, 118.20

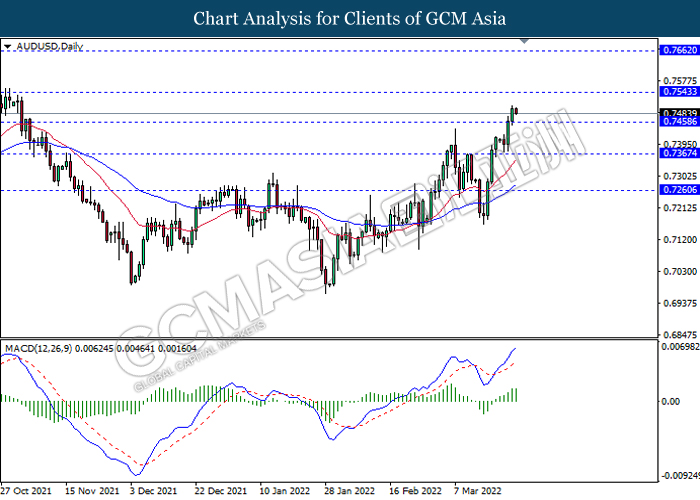

AUDUSD, Daily: AUDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7545, 0.7660

Support level: 0.7460, 0.7365

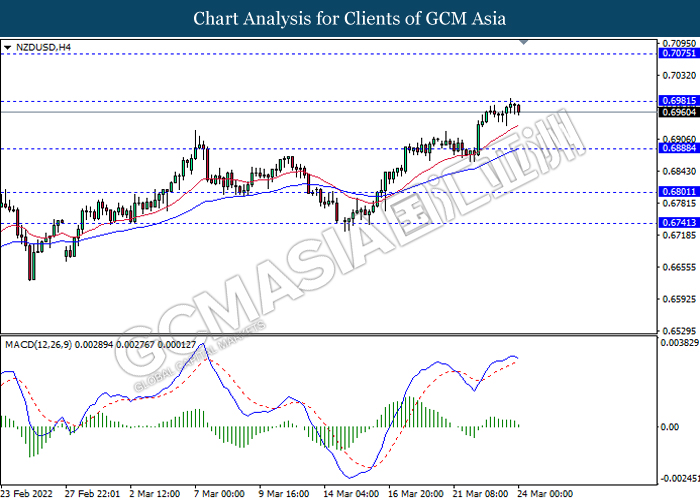

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

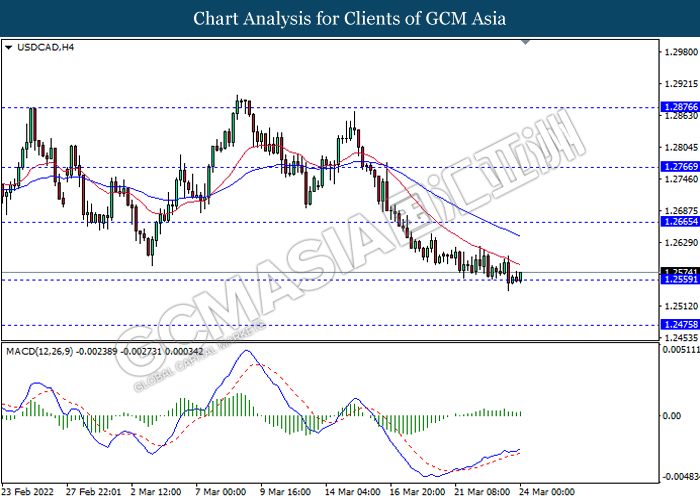

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2665, 1.2765

Support level: 1.2560, 1.2475

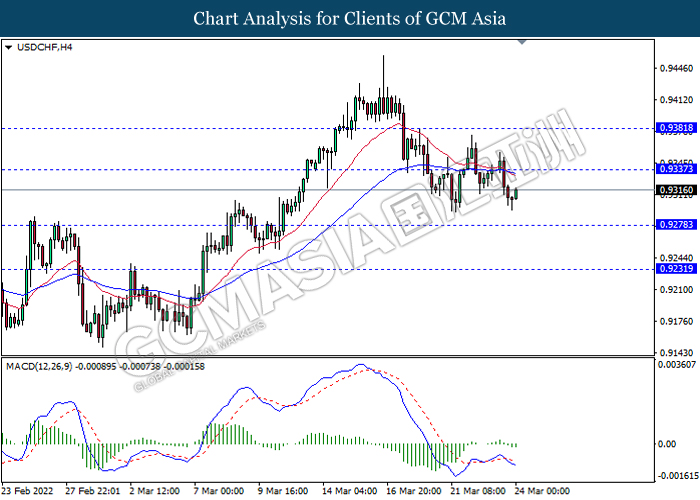

USDCHF, H4: USDCHF was traded lower following prior breakout the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9335, 0.9380

Support level: 0.9280, 0.9230

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 116.05, 118.90

Support level: 113.15, 108.10

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1961.55, 1980.75

Support level: 1940.95, 1924.20