29 March 2022 Afternoon Session Analysis

Japanese Yen remained bearish amid dovish expectation from BoJ.

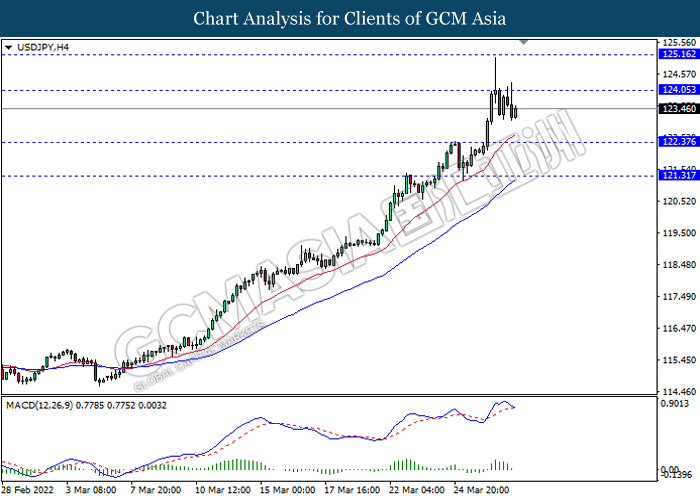

The USDJPY edged down from its recent high since Monday. Nonetheless, the overall trend of the pair remained bullish amid the backdrop of Bank of Japan retains dovish stance. According to Reuters, the Bank of Japan (BoJ) intervened to stop government bond yields from rising above its key target, while rising U.S. yields pushed the dollar higher against other currencies too. The BoJ, which has repeatedly said it is committed to keeping monetary policy loose on Monday, made two offers to buy an unlimited amount of government bonds with maturities of more than five years and up to 10 years. Bond buying program from BoJ bonds would likely to increase Japanese Yen supply in the market, dialing down the market optimism toward Japanese currency. It prompted investors to selloff Japanese Yen and purchase other currencies with better prospects such as US Dollar, spurring further bearish momentum on Yen. As of writing, USDJPY depreciated by 0.43% to 123.38.

In commodities market, crude oil price depreciated by 0.75% to $105.19 per barrel as of writing following drop in fuel demand in China after the financial hub of Shanghai shut down to curb a surge in COVID-19 cases. On the other hand, gold extend its losses by 0.75% to $1925.20 per troy ounces as of writing as Ukraine was hoping to have peace talks with Russia in over two weeks.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Mar) | 110.5 | 107 | – |

| 22:00 | USD – JOLTs Job Openings (Feb) | 11.263M | – | – |

Technical Analysis

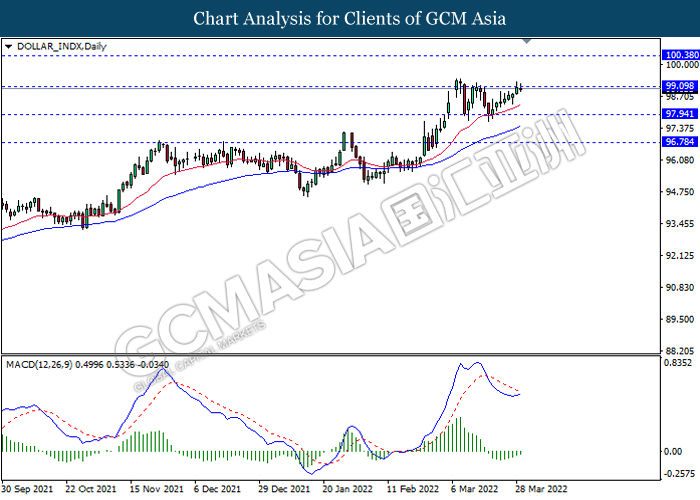

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 99.10, 100.40

Support level: 97.95, 96.80

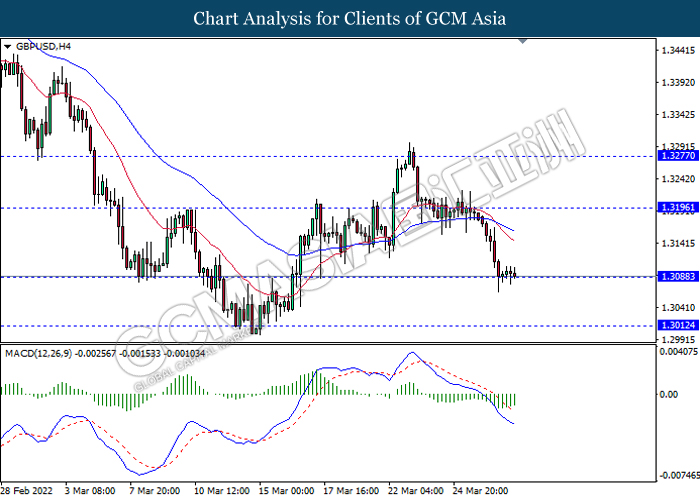

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

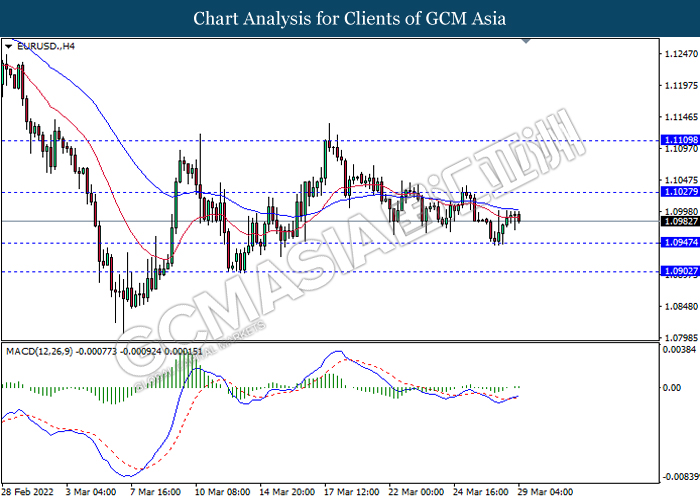

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1025, 1.1110

Support level: 1.0945, 1.0900

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 124.05, 125.15

Support level: 122.35, 121.30

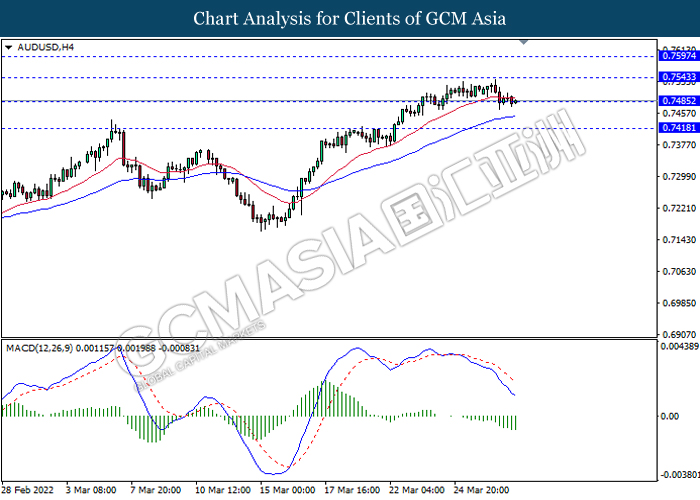

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7545, 0.7595

Support level: 0.7485, 0.7420

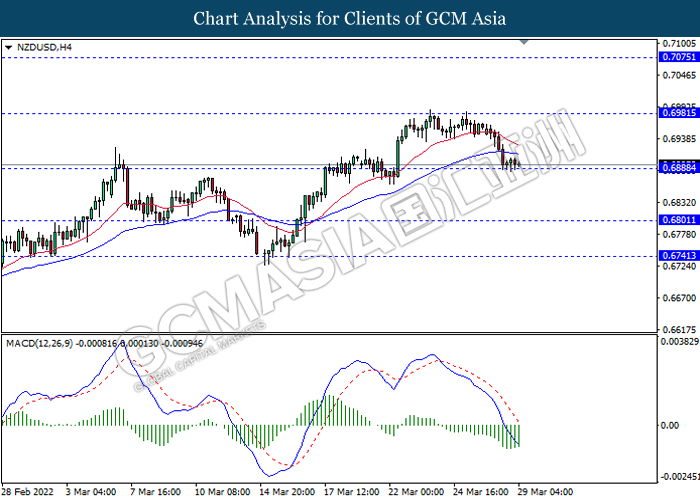

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

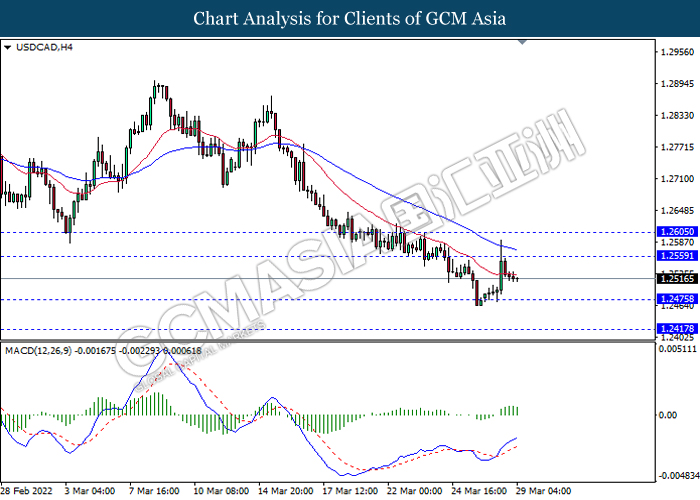

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

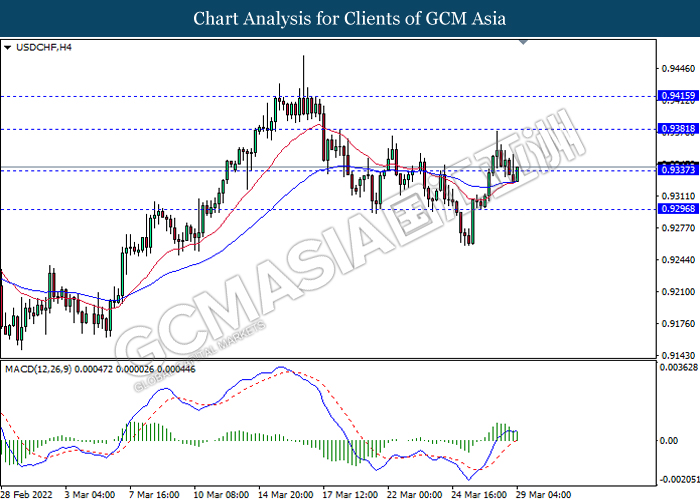

USDCHF, H4: USDCHF was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9380, 0.9415

Support level: 0.9335, 0.9295

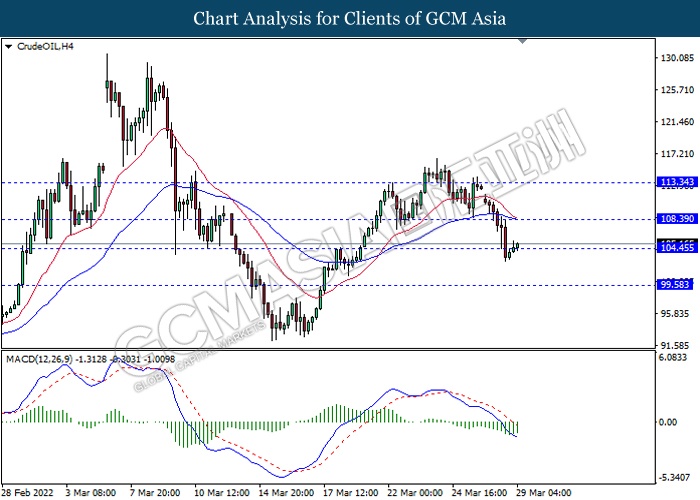

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 108.40, 113.35

Support level: 104.45, 99.60

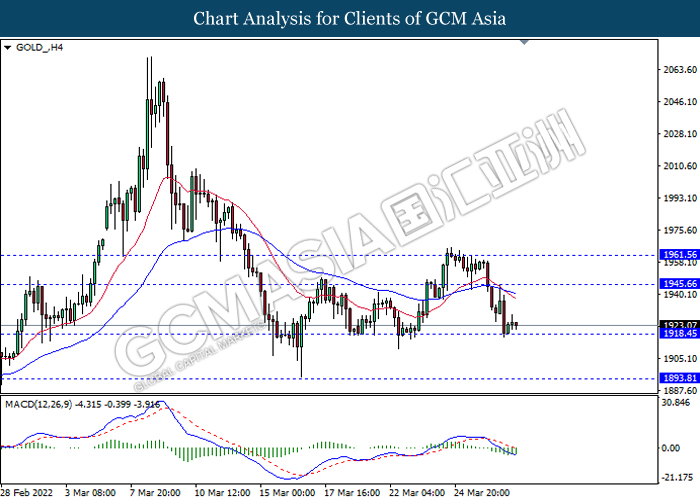

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1945.65, 1961.55

Support level: 1918.45, 1893.81