30 March 2022 Afternoon Session Analysis

Euro spiked following peace talks between Russia-Ukraine.

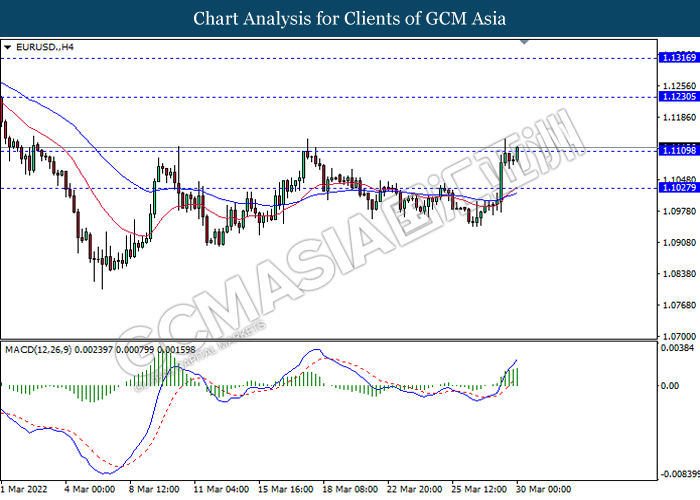

The Euro extend its gains on Wednesday over the backdrop of Russia-Ukraine peace talks on yesterday. According to Reuters, Russia appeared a speech on Tuesday, which promised to scale down military operations around Kyiv and another city. Nonetheless, Russia has started moving very small numbers of troops away from positions around Kyiv in a move that is more of a repositioning than a retreat or a withdrawal from the war, according to the Pentagon. The easing tensions of Russia invasion of Ukraine would likely to relieve sanction imposed on Russia by other countries such as US, leading to the slump of commodities price such as crude oil. Diminishing of crude oil price would reduce companies’ import cost in Europe region, as Europe is the most dependent on Russia oil. It dialed up the market optimism toward economic progression in Europe region, prompting investors to purchase Euro which having better prospects, spurring further bullish momentum on Euro. Investors should continue to scrutinize the latest updates with regards of Russia-Ukraine peace talks in order to receive further trading signals on the pair. As of writing, Euro appreciated by 0.22% to 1.1109.

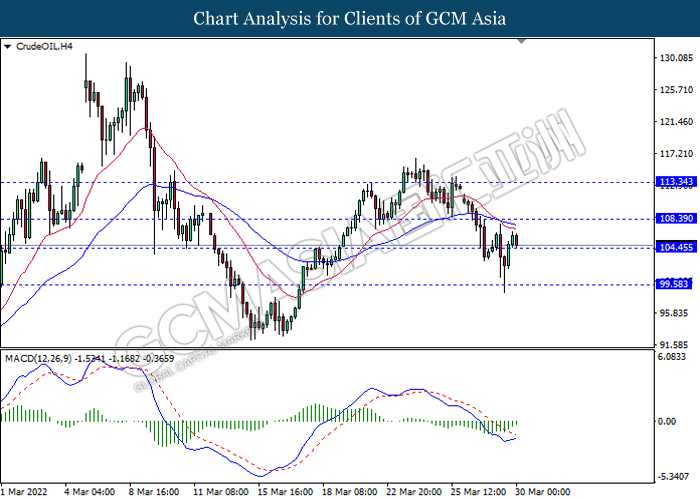

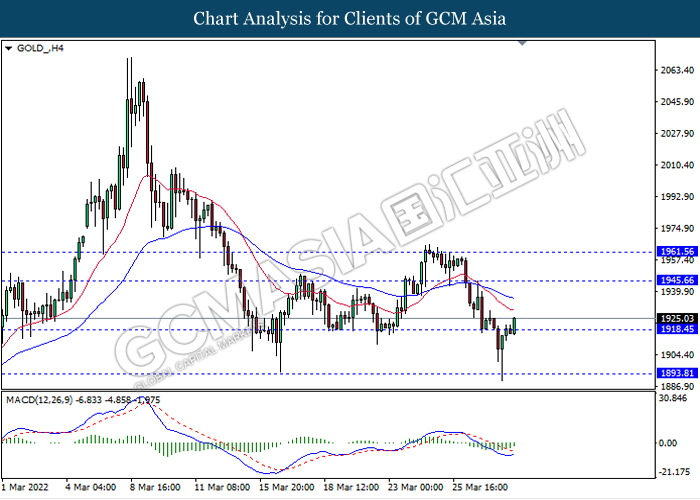

In commodities market, crude oil price appreciated by 0.58% to $104.84 per barrel as of writing. Nonetheless, oil price remained under pressure following Russia-Ukraine peace talks. Besides, gold appreciated 0.57% to 1923.15 per troy ounces as of writing. However, gold remained bearish amid the backdrop of peace negotiations between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Mar) | 475K | 438K | – |

| 20:30 | USD – GDP (QoQ) (Q4) | 2.30% | 7.10% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -2.508M | – | – |

Technical Analysis

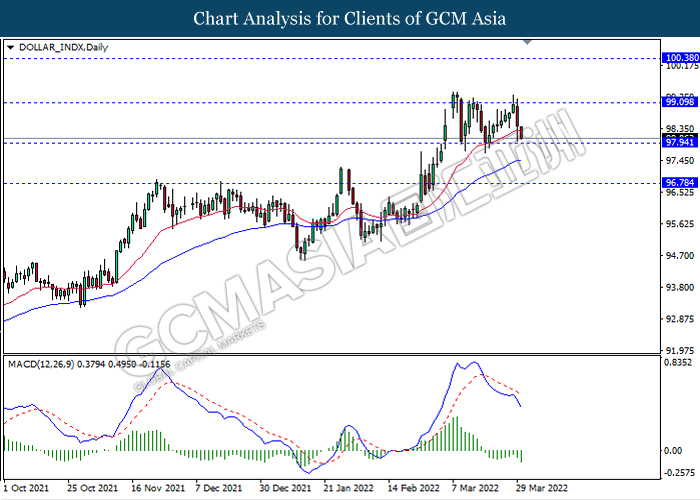

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 99.10, 100.40

Support level: 97.95, 96.80

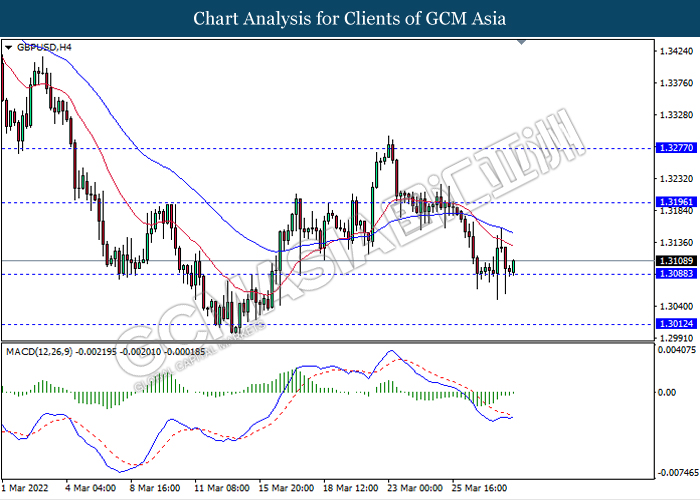

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1230, 1.1315

Support level: 1.1110, 1.1025

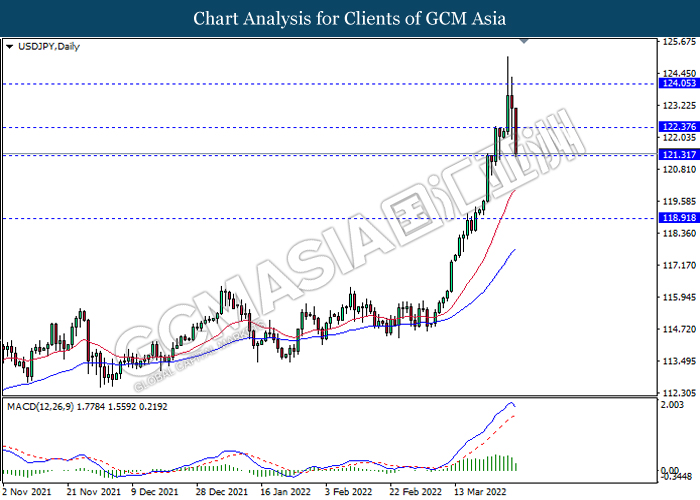

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 122.35, 124.05

Support level: 121.30, 118.90

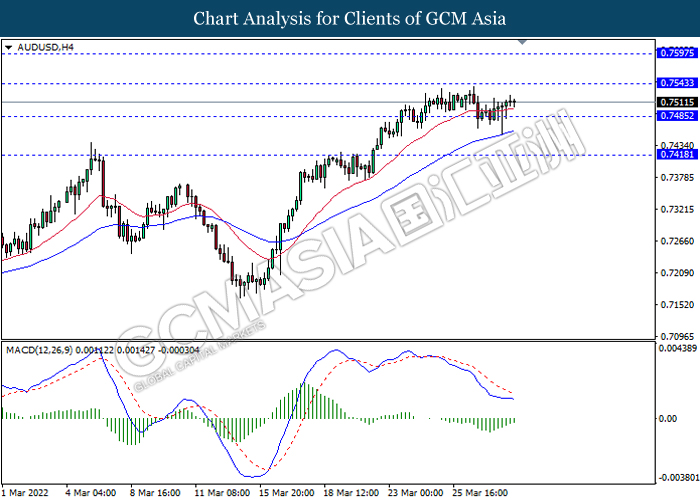

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7545, 0.7595

Support level: 0.7485, 0.7420

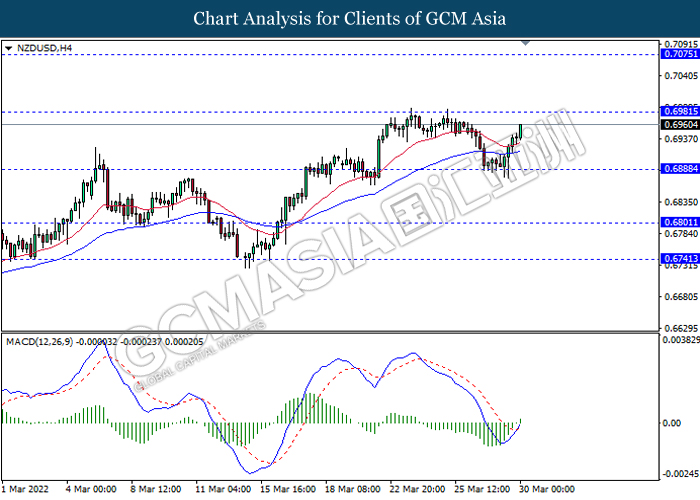

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

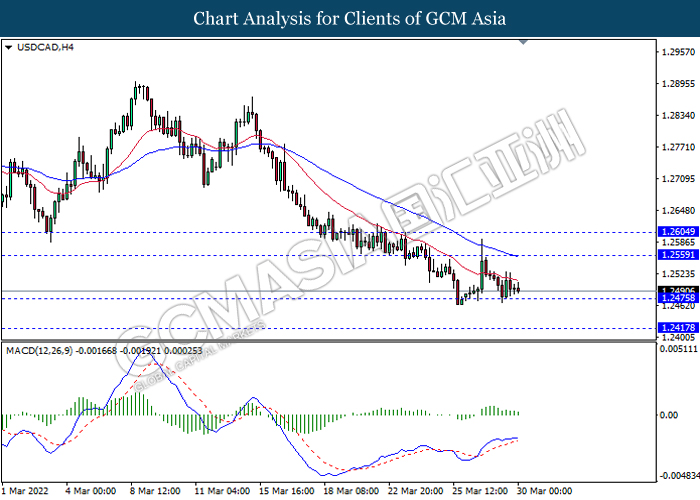

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

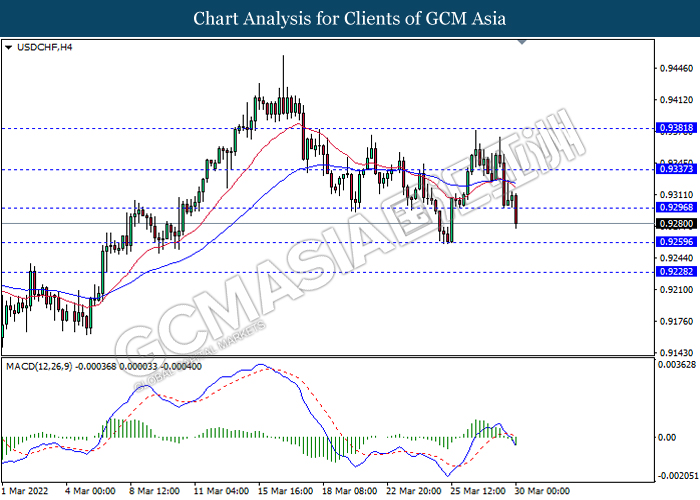

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9295, 0.9335

Support level: 0.9260, 0.9230

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 108.40, 113.35

Support level: 104.45, 99.60

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1945.65, 1961.55

Support level: 1918.45, 1893.81