4 April 2022 Morning Session Analysis

US Dollar surged amid bullish job data, spurring rate hike expectation.

The Dollar index which traded against a basket of six major currencies extend its gains last week over the backdrop of a string of bullish unemployment data from United States. According to Bureau of Labor Statistics, the US Nonfarm Payrolls data showed that the employers added another 431,000 jobs in March and the US Unemployment rate fell to 3.5%, indicating a strong run of hiring and the positive economic recovery from the United States. With the robust economic growth as well as spiking numbers of inflation rate, investors are widely expecting a significant rate hike from Federal Reserve in the year of 2022. The US Treasury Yield inverted once more on signs of persistent inflation rate, with short-term yields rise above long-term yields. As of writing, the Dollar Index appreciated by 0.26% to 98.55.

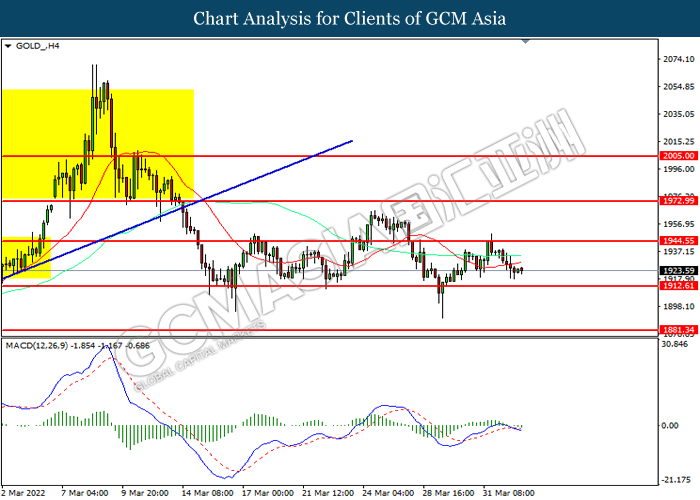

In the commodities market, the crude oil price extent its losses by 1.87% to 99.35 per barrel as of writing. The oil market continues to edge lower amid market participants remained concerns that the release of oil reserve from United States would likely to weigh down the crude oil price. On the other hand, the gold price depreciated by 0.63% to $1925.20 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:05 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

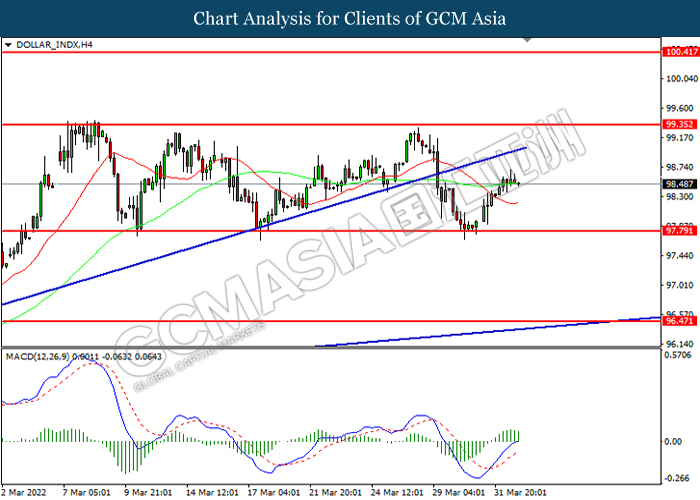

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

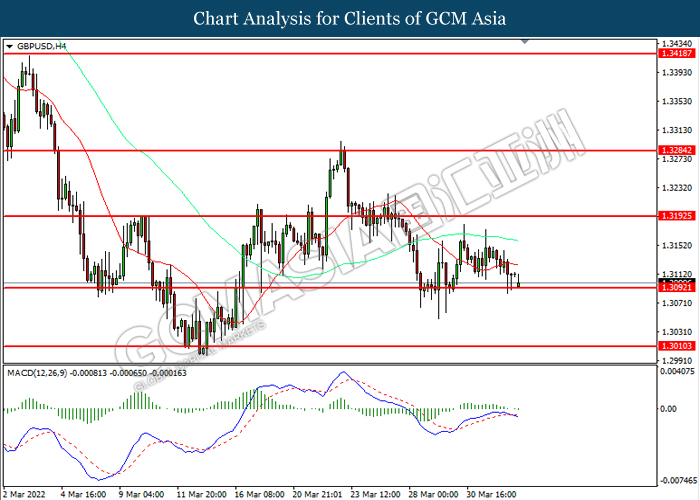

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

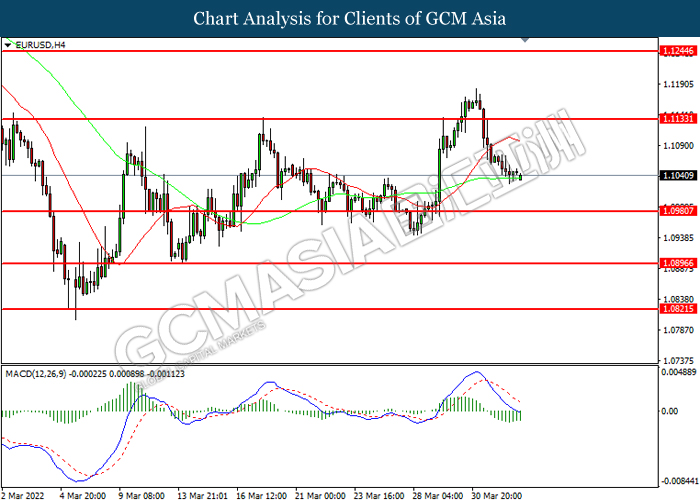

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0895

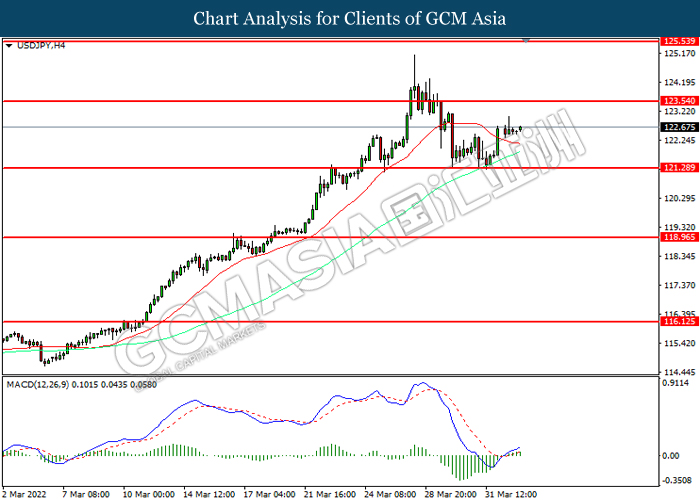

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

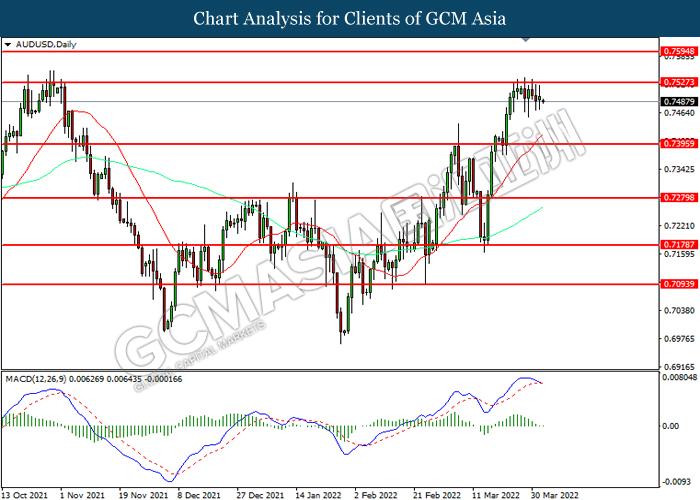

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7525, 0.7595

Support level: 0.7395, 0.7280

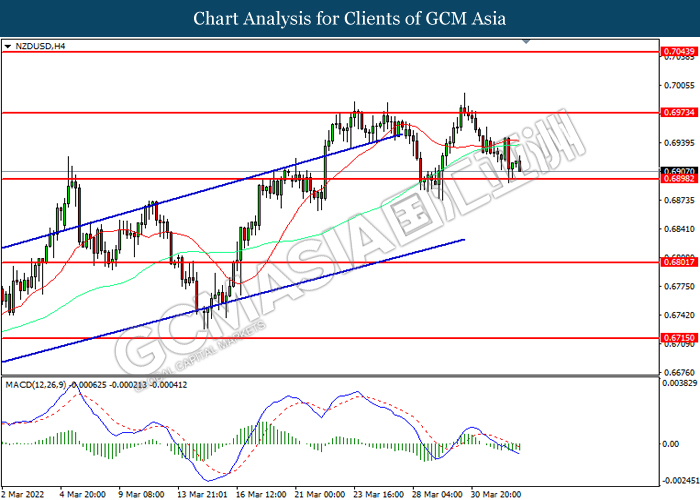

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6975, 0.7045

Support level: 0.6900, 0.6800

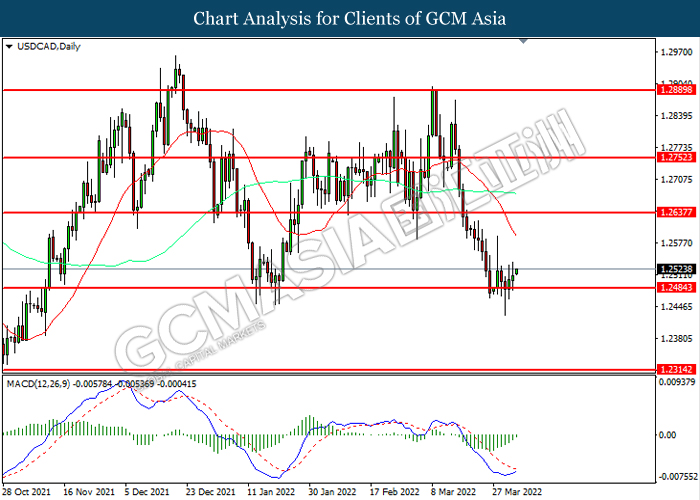

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 101.50, 107.10

Support level: 97.15, 92.50

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35