4 April 2022 Afternoon Session Analysis

Euro slumped amid bearish economic data.

The Euro received significant bearish momentum last week over the backdrop of a string of bearish economic data. According to Market economics, Germany Manufacturing Purchasing Managers Index notched down significantly from the previous reading of 57.6 to 56.9, missing the market forecast at 57.6. The German factory activity slumped to an 18-month low amid the negative impact from Russia-Ukraine, heightened the inflation risk in future. Fresh supply disruption due to the implementation of sanctions had increase the price for raw materials while constraining the factory production. Besides, the rising tensions between Russia-Ukraine had sparked further uncertainty to the world economy while weighing down the export sales. On the other hand, the Pound Sterling slumped last Friday following the release of downbeat data. According to Markit/CIPS, UK Manufacturing Purchasing Managers Index (PMI) came in at 55.2, which also fared worse than market expectation at 55.5. As of writing, EUR/USD depreciated by 0.02% to 1.1050 while GBP/USD slumped 0.03% to 1.3115.

In the commodities market, the crude oil price slumped 0.84% to 98.55 per barrel as of writing. The oil market edged lower following the United Arab Emirates and the Iran-aligned Houthi group decided to halt military operations on Saudi-Yemeni border, alleviating some concerns toward the oil supply issues. On the other hand, the gold price depreciated by 0.08% to $1923.35 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:05 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

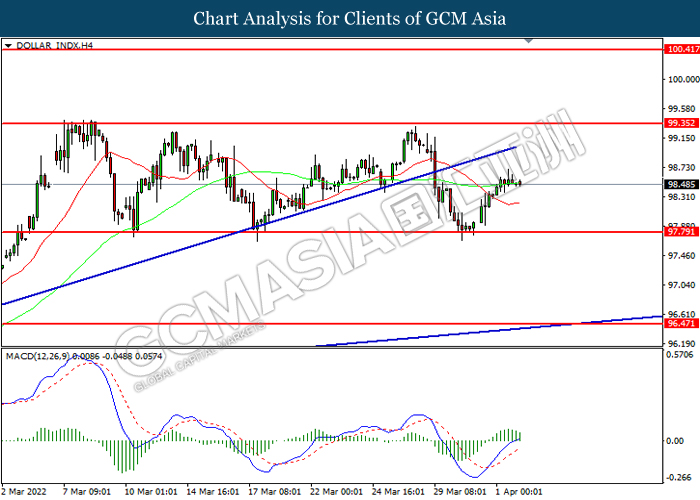

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

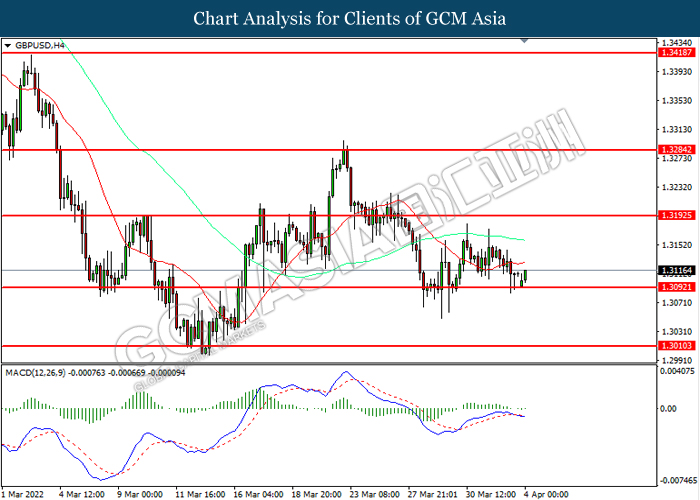

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

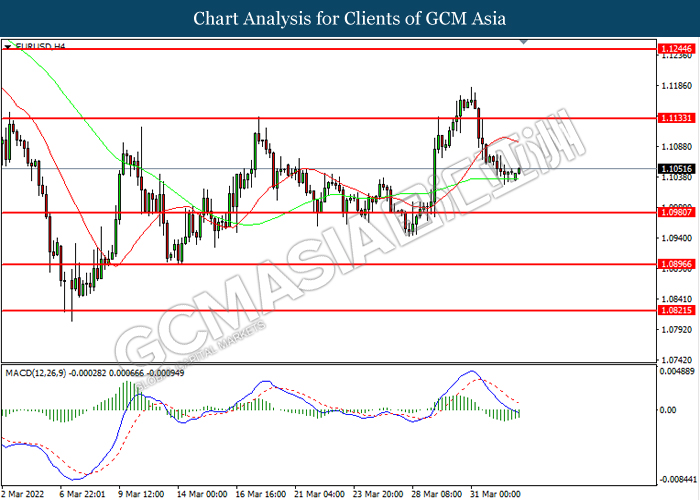

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0895

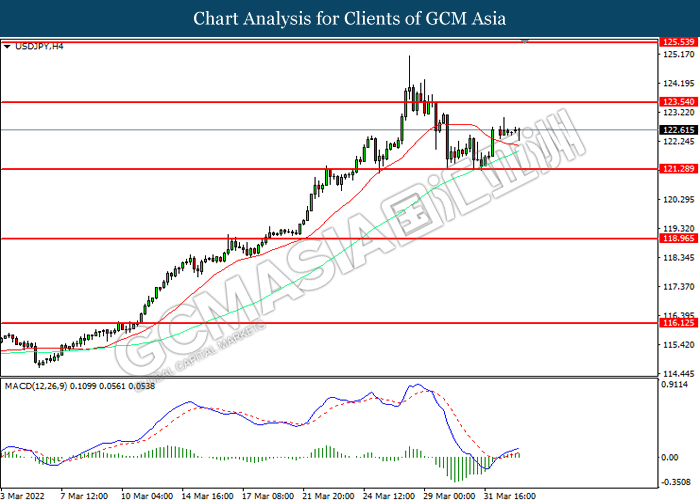

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

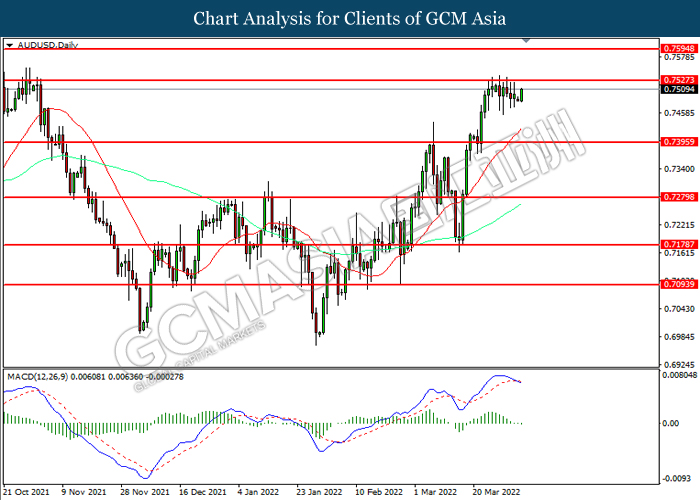

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7395, 0.7280

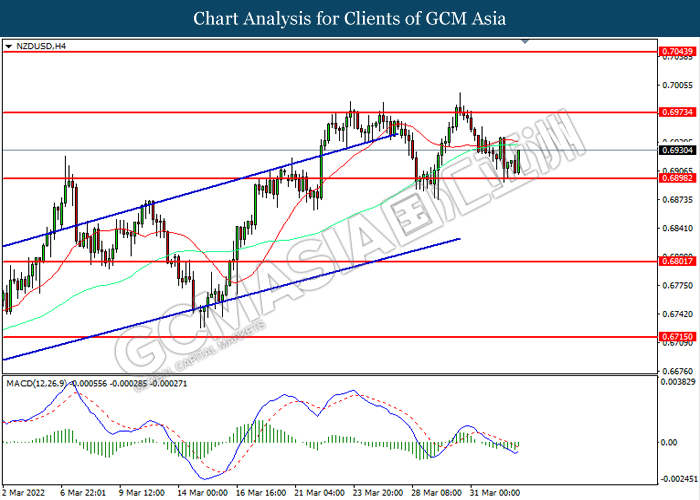

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6975, 0.7045

Support level: 0.6900, 0.6800

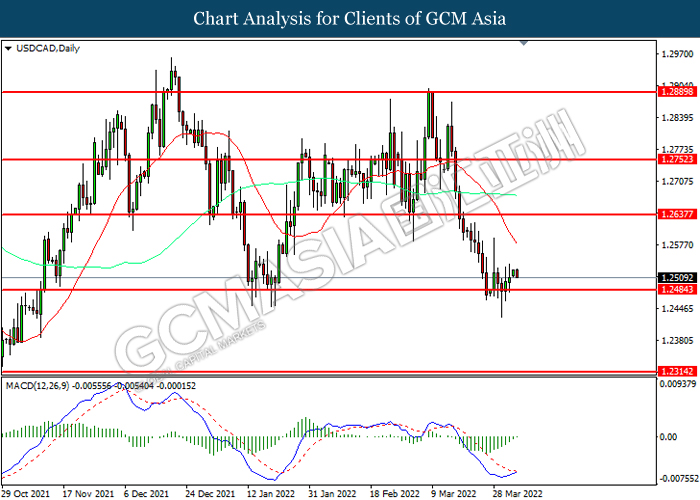

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

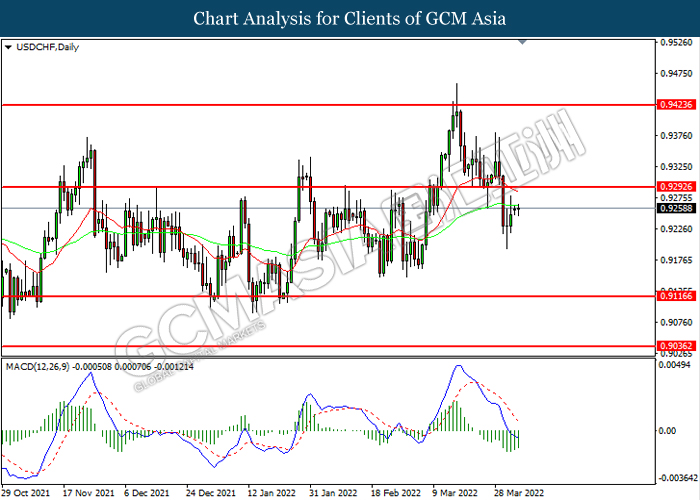

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

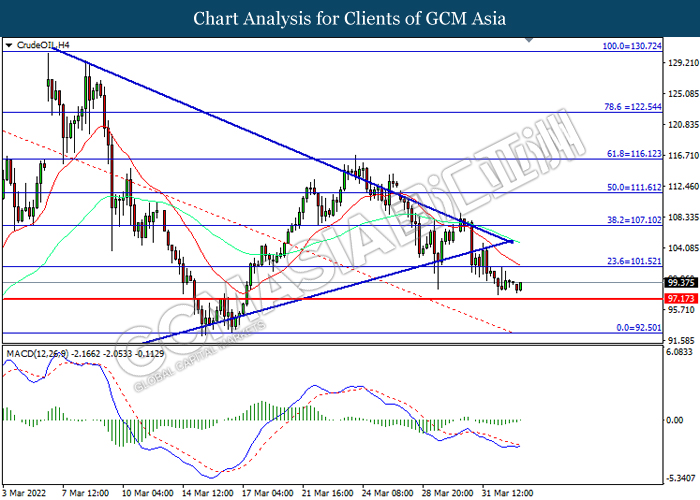

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 101.50, 107.10

Support level: 97.15, 92.50

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35