6 April 2022 Afternoon Session Analysis

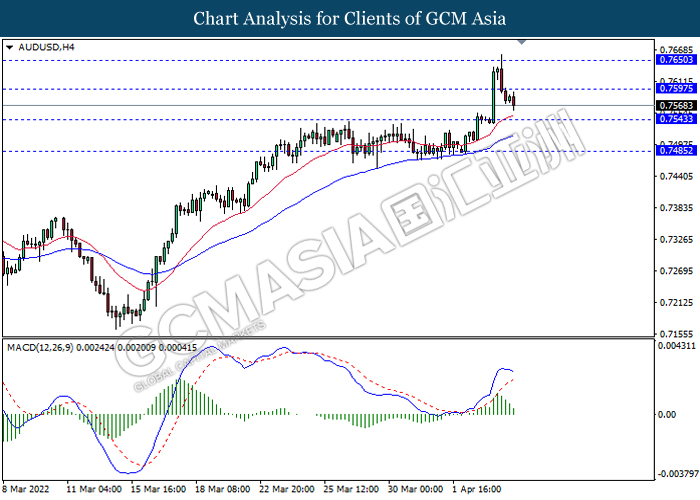

Australia Dollar spiked following tightening monetary policy.

The Australia Dollar surged on yesterday amid the backdrop of tightening monetary policy from Australia’s central bank. According to Reuters, Australia’s central bank had claimed on Tuesday that it opened the door to the first interest rate increase in more than a decade as it dropped a previous pledge to be “patient” on policy, a major surprise that sent the local dollar to nine-month highs. The rate hike decision from Australia’s central bank would likely to diminish the money circulation in the market, dialing up the market optimism toward Australia Dollar. Nonetheless, the gains of the pair was limited following whole of Shanghai entered lockdown. In a major test of China’s zero-tolerance strategy to eliminate the novel coronavirus, the government widened the lockdown to eastern parts of the city and extended until further notice restrictions in western districts, which had been due to expire on Tuesday. As China was the largest trading partner for Australia, lockdown of China region would likely to bring negative prospects toward economic progression in Australia, prompting investors to selloff Australia Dollar and purchase other currencies which having better prospects. As of writing, AUDUSD depreciated by 0.13% to 0.7570.

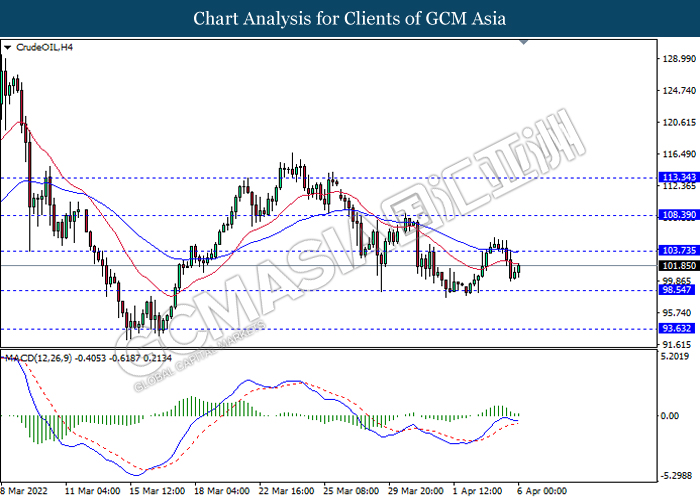

In commodities market, crude oil price depreciated by 0.26% to $101.69 per barrel as of writing. However, the overall trend for crude oil price was remained bullish over the backdrop of new sanction on Russia from US and Europe. On the other hand, gold price depreciated by 0.23% to $1923.00 per troy ounces as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Mar) | 59.1 | 57.3 | – |

| 22:00 | CAD – Ivey PMI (Mar) | 60.6 | – | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.449M | – | – |

Technical Analysis

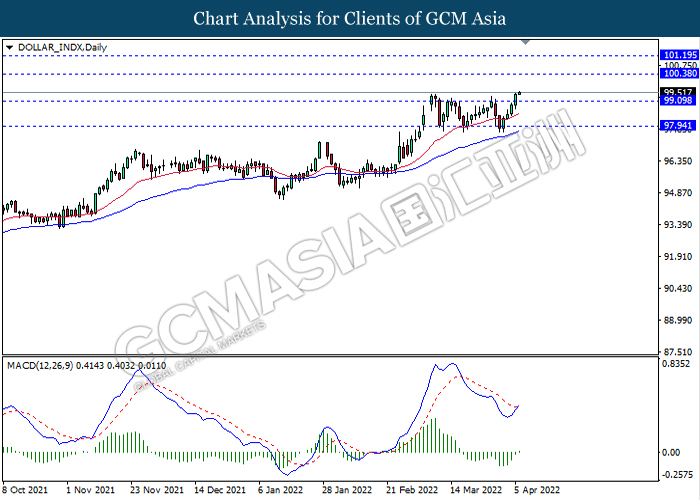

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 100.40, 101.20

Support level: 99.10, 97.95

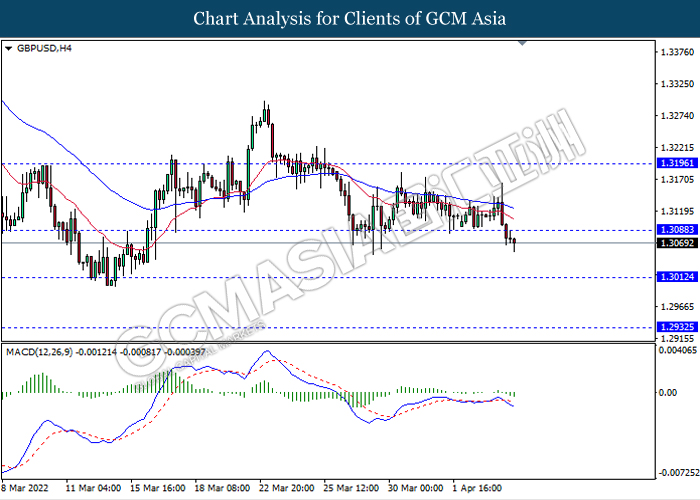

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3010, 1.2930

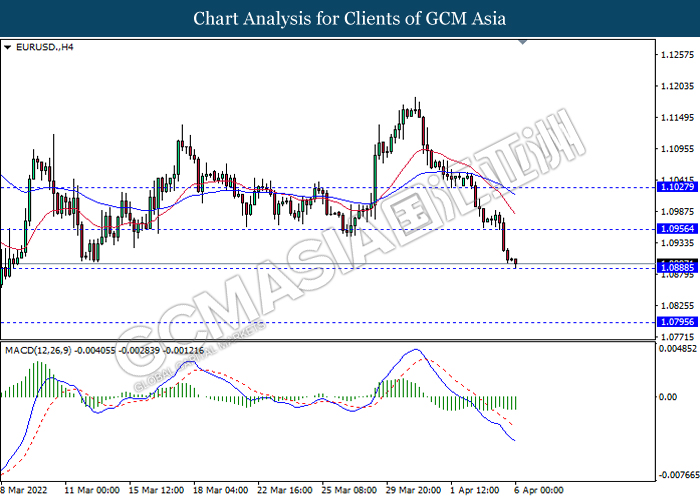

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0955, 1.1025

Support level: 1.0890, 1.0795

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resstance level.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7595, 0.7650

Support level: 0.7545, 0.7485

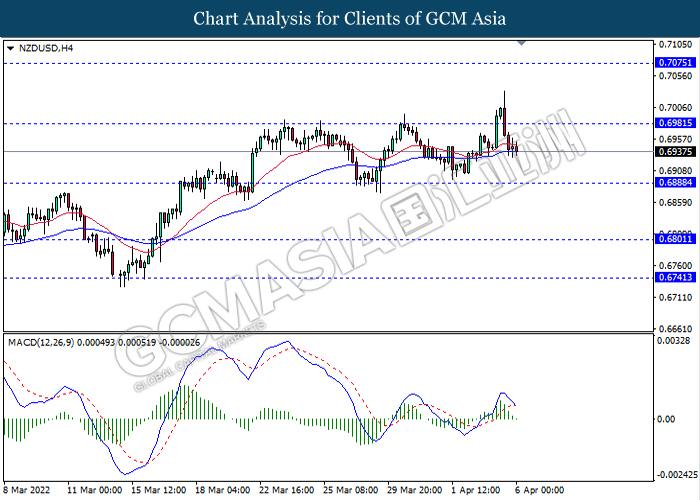

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

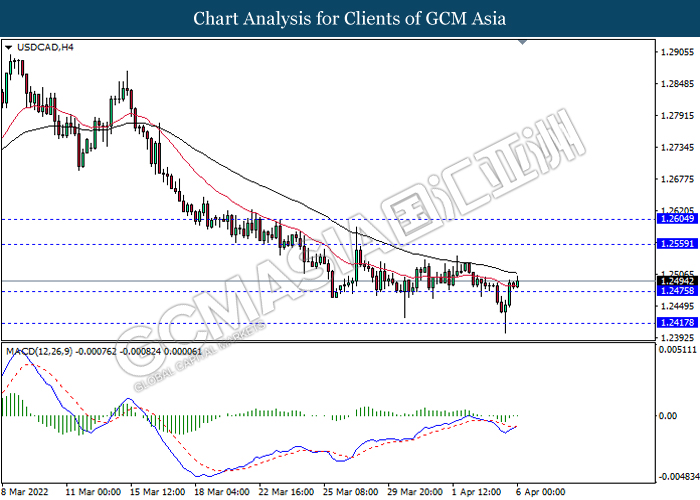

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

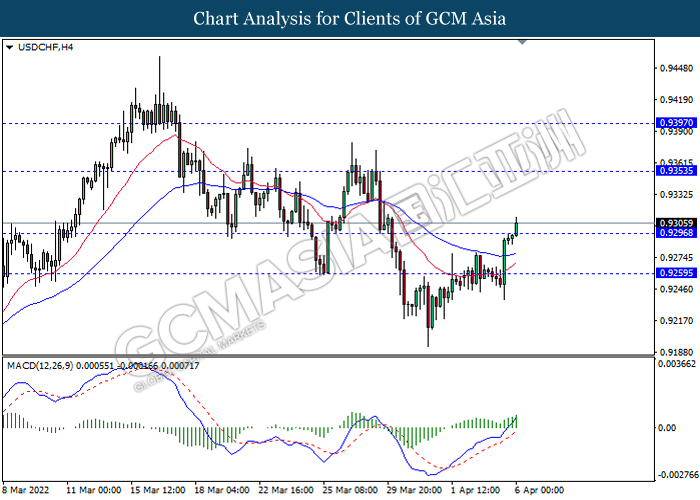

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9355, 0.9395

Support level: 0.9295, 0.9260

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 103.75, 108.40

Support level: 98.55, 93.65

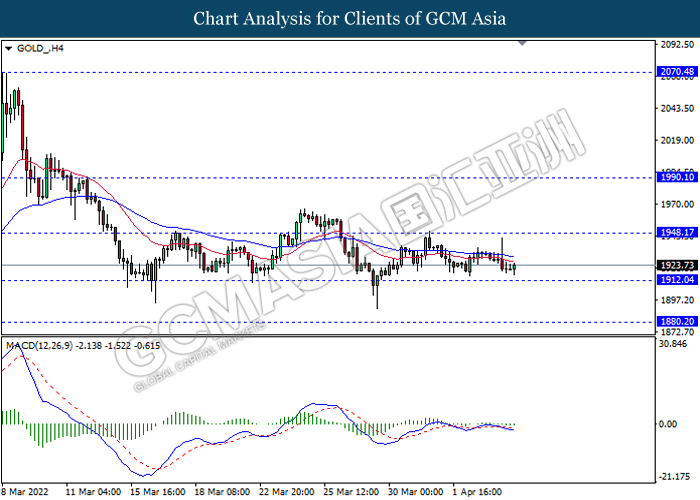

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1948.15, 1990.10

Support level: 1912.05, 1880.20